imaginima

The Health Care sector has been a mixed bag this year. There are major winners like Merck (MRK) and Eli Lilly (LLY) while the group’s cyclical niches have struggled. One equipment maker, Baxter International, reports Q3 results Thursday, and the stock has been among the losers. Let’s weigh the evidence to get clues on where it might be headed next.

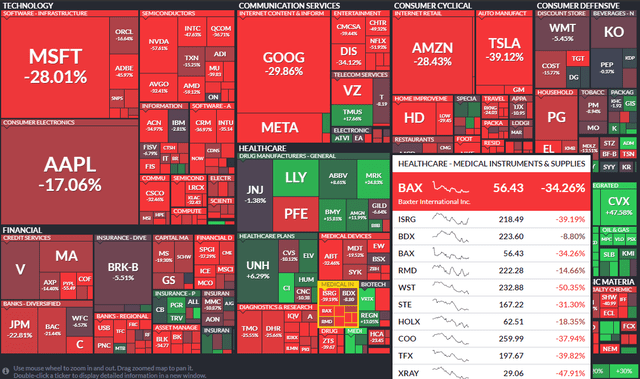

Year-to-Date Returns: BAX Sharply Lower

According to Bank of America Global Research, Baxter (NYSE:BAX) manufactures a broad range of essential healthcare products across the continuum of care including chronic dialysis therapies, premixed drugs, IV nutrition products, infusion pumps, inhalation anesthetics, patient monitoring devices, and care communications devices. The company acquired Hillrom in December 2021.

The Illinois-based $28.4 billion market cap Health Care Equipment & Supplies industry company within the Health Care sector trades at a high 28.3 trailing 12-month GAAP price-to-earnings ratio and pays a 2.1% dividend yield, according to The Wall Street Journal.

Baxter is one of several medtech firms that trade at a premium valuation to the market. With EPS growth somewhat slow over the coming quarters, investors might question how much to pay for the stock. Baxter has some uncertainty as to how some of its end markets might fare in the post-Covid environment. Lingering supply chain issues could lead to higher costs, pressuring margins while there is also a lack of clarity around its acquisition of Hillrom and how accretive to earnings that will be. Back in September, Bloomberg reported that Baxter was considering divesting two of its renal kidney businesses, which Wall Street took a brief shine to.

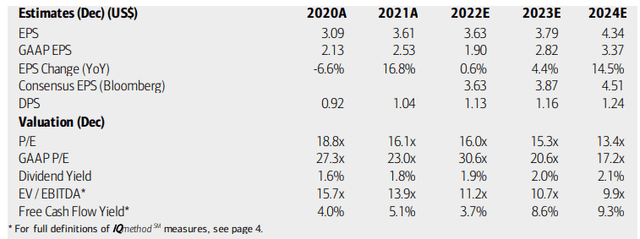

On valuation, BofA analysts see earnings growing just 0.6% in 2022, well below the inflation rate. EPS is seen as rising at a slightly faster rate next year before jumping in 2024. The Bloomberg consensus earnings outlook is a bit more optimistic. Dividends are seen as rising through the next two years, as well.

While Baxter’s operating P/E is decent, the GAAP multiple suggests it’s still an expensive stock. Moreover, the EV/EBITDA multiple is a big elevated while free cash flow is decent. Seeking Alpha rates BAX with a poor D- on valuation and an even worse F rating on growth. Overall, I am not excited about the price of BAX here.

Baxter: Earnings, Valuation, Dividend Forecasts

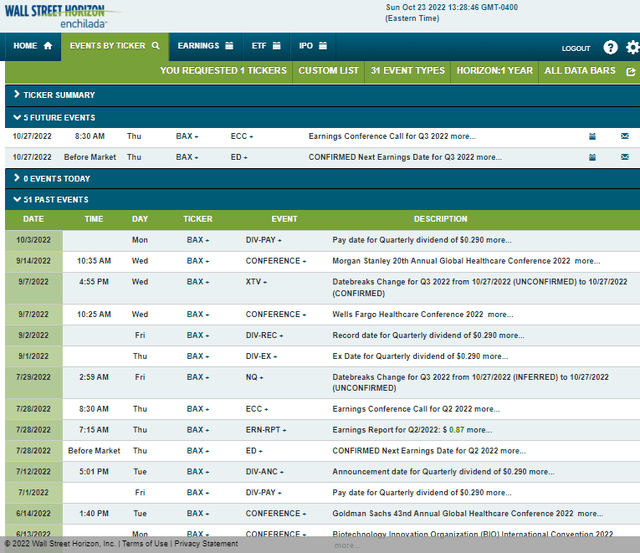

Looking ahead, BAX has a confirmed Q3 earnings date of Thursday, Oct. 27 BMO with a conference call immediately after results are released. You can listen live here. The corporate event calendar is light aside from the earnings date.

Baxter International Corporate Event Calendar

The Options Angle

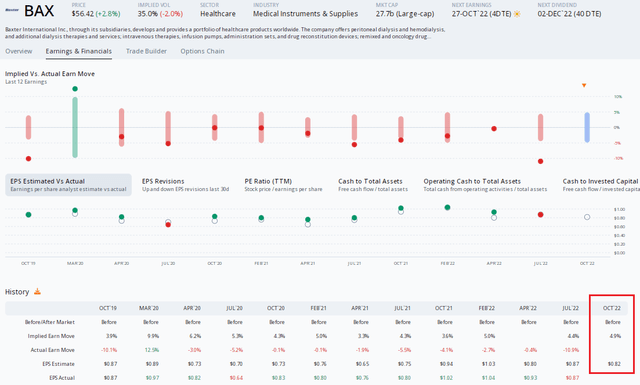

Digging into the upcoming report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.82 which would be a steep 20% drop from per-share profits earned in the same quarter a year ago. Moreover, despite a strong earnings beat rate history, the stock has traded down post-reporting in each of the last 10 quarters. That’s a bearish sign.

In terms of the expected stock price swing, the options market has priced in a 4.9% move up or down in shares after Wednesday morning’s announcement. That is roughly in line with previous implied moves using the nearest-expiring at-the-money straddle. There has been a single EPS downward revision since the July report.

Baxter: A Poor Track Record Post-Earnings

The Technical Take

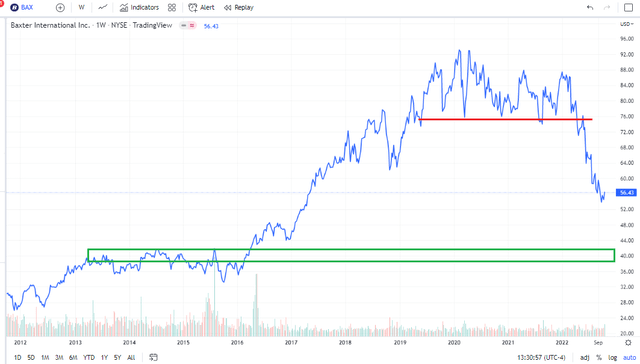

BAX has endured a sharp 40% drawdown off its early 2020 peak. Following a bearish break of support near the $75 mark, the stock has been on a steep slide. I don’t see much support until BAX approaches the low $40s – a key trading range from 2013 through much of 2015. The stock broke above that area in 2016 and it successfully tested it following the 2016 election.

Overall, I do not think it’s a favorable risk/reward setup until shares return to the low $40s.

BAX Shares Trending Lower, Eye A Test Of Support

The Bottom Line

With a very bearish earnings reaction history, an unattractive valuation, and a chart that suggests another 15% or so of additional downside, I am a seller of BAX here. If the stock dips further into the low $40s, it’s a buy.

Be the first to comment