Torsten Asmus

Article Thesis

Arbor Realty Trust (NYSE:ABR) is a well-managed and successful mortgage REIT that has delivered very reliable and attractive dividend growth in the past, even during the pandemic. With a hefty 9.5% dividend yield, Arbor Realty Trust offers massive income potential to investors today. Shares are not looking too expensive, which is why I do believe that ABR is still an attractive investment, despite the fact that shares are up from the lows that were hit a couple of weeks ago.

Arbor Realty Overview

Arbor Realty Trust invests in a wide range of loans, but around 90% of the company’s assets are bridge loans for multifamily properties, with bridge loans overall making up around 95% of Arbor Realty Trust’s assets. The rest consists of mezzanine loans and preferred equity investments, but the focus is clearly on (multifamily) bridge loans.

Arbor Realty Trust has a loan portfolio from which it generates interest income, but the company has some additional income streams on top of that. Its loan origination business has originated $1.27 billion of agency loans in the second quarter, and Arbor Realty Trust’s agency servicing portfolio has grown to $27 billion as of the end of the quarter. Its structured portfolio, meanwhile, has benefited from $2.1 billion of loan originations during the second quarter, which has lifted Arbor Realty Trust’s overall assets to more than $14 billion as of the end of the quarter.

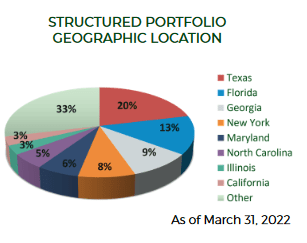

Arbor Realty Trust’s structured portfolio has exposure to different geographic markets, but the largest ones are Southern states such as Texas, Florida, and Georgia:

Arbor Realty Trust presentation

That’s positive for investors, as these states are exhibiting healthy growth both when it comes to overall GDP, but also when it comes to people moving there. With recent migratory trends suggesting that people are increasingly moving from NY, California, etc. to Texas, Florida, and so on, demand for housing in these Southern states will remain healthy. That, in turn, means that developers will likely be successful, which reduces the default risk for the loans that Arbor Realty Trust owns. This is one of the reasons why Arbor Realty Trust operates with a pretty low-risk profile. The company recorded $4.9 million of provision for loan losses during the second quarter, which is a pretty low amount for a company holding assets of $14 billion. On an annualized basis, that’s around 0.14% — which is pretty low, relative to the compelling average interest yield the company receives. That interest yield has risen from 4.86% in the first quarter to 5.26% during the second quarter, which makes for a 40 base point increase in a single quarter. Both the increase in Arbor Realty Trust’s portfolio yield as well as the absolute size of the yield are compelling. With a yield this high, the 0.1%-0.2% provisioning pace isn’t very high at all. The company would remain quite profitable even if it were to double its provisions compared to the current level.

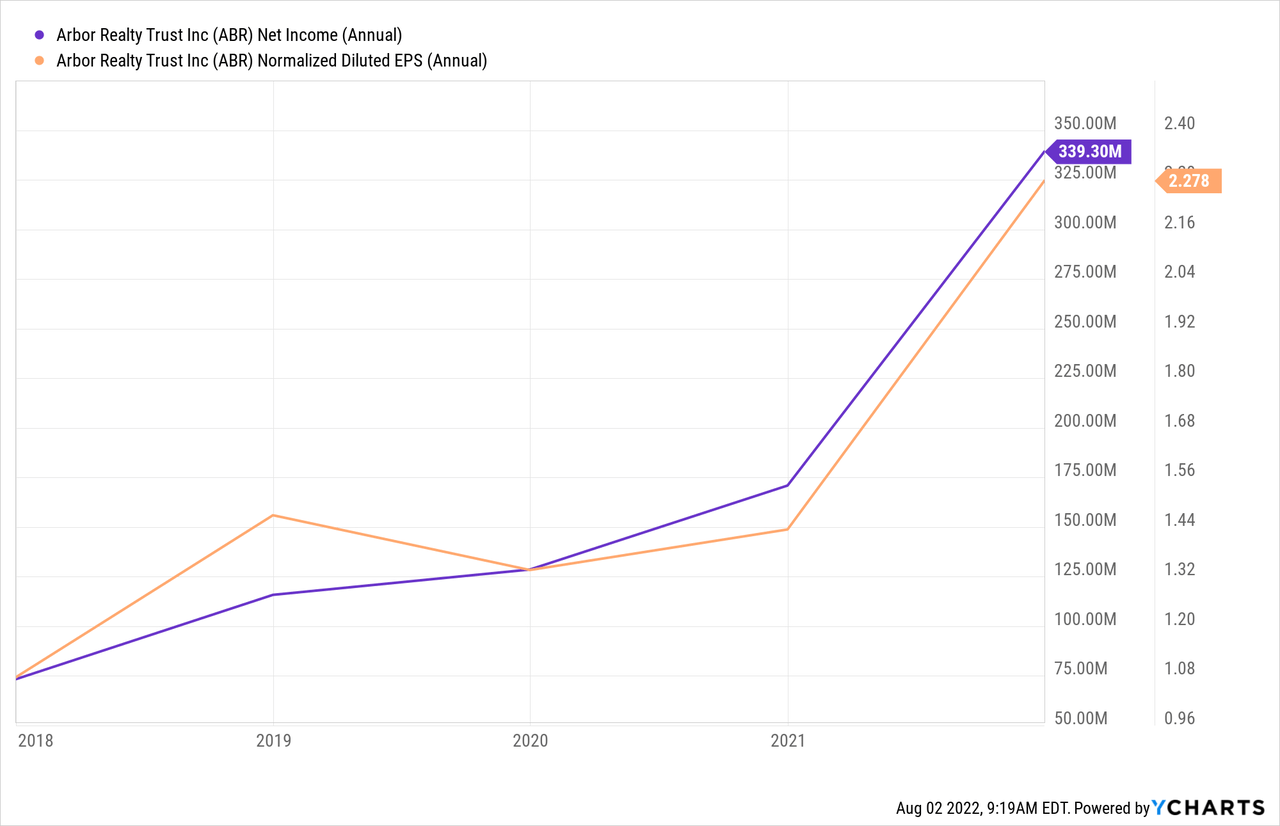

Arbor Realty Trust’s profitability is well-established and has been maintained in different market environments, including quite difficult ones such as during the initial phase of the pandemic. When many other mortgage REITs saw their book values drop and when some of them suffered from margin calls that eventually led to dividend cuts, Arbor Realty continued to perform well. The company’s profits hit new record levels in 2019, 2020, and 2021, as we can see in the following chart:

Net income and earnings per share are not moving 100% in line with each other, as Arbor Realty Trust’s share count keeps climbing. That explains why earnings per share were down in 2019, although only slightly, while net income still rose during the same year. Share issuance by the company dilutes shareholders, but Arbor Realty generally manages to put the funds it generates from share issuance to work in a profitable manner. As long as that remains the case, share issuance and a rising share count are not a problem. Many other REITs operate with a similar business model, including stalwarts such as Realty Income (O). Since Arbor Realty grew its earnings per share to new record levels in both 2020 and 2021, the model seems to be working well and is clearly creating value for shareholders, despite the fact that each individual share’s portion of the company as a whole is slowly declining — as long as the overall company-wide growth rate is high enough, which is the case here, the dilutive impact of share issuance is not a problem.

During the most recent quarter, Arbor Realty was pretty successful again. The company grew its revenue by 60% year over year and beat estimates on both lines. Earnings per share came in a whopping 20% ahead of estimates, which means that Arbor Realty’s track record of beating estimates reliably was maintained. The company has beaten EPS estimates in nine out of the last ten quarters, which suggests that Wall Street somehow perpetually underestimates Arbor Realty’s ability to earn money. That is somehow surprising, but a good thing for shareholders — after all, who wouldn’t want to own a company that reliably outperforms expectations? With Arbor Realty growing its distributable earnings per share by 16% year over year, the company’s compelling growth record continues. Once again, management was able to use the funds it generated from equity sales in a very accretive manner, boosting shareholder value. Since Arbor Realty Trust is internally managed, investors do not have to worry about a situation where managers are chasing growth at all costs — that’s mainly a problem one sees at externally managed REITs, where management interests and shareholder interests aren’t well-aligned.

ABR Is A Great Income Play

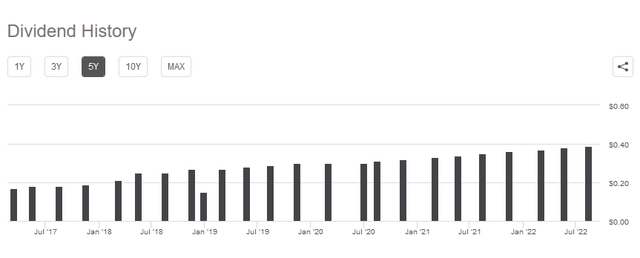

Arbor Realty’s shareholder-friendly management has a great track record of returning cash to the company’s owners. Not only does Arbor Realty Trust offer a hefty dividend yield of 10.3% at current prices, but the company has been able to offer reliable and fast dividend growth on top of that.

The following chart shows how Arbor Realty’s dividend has changed over the last couple of years:

Seeking Alpha

We see that the company’s payout has grown very consistently over time. Over the last five years, Arbor Realty’s dividend more than doubled, rising from $0.17 per share per quarter to $0.39 per share per quarter. Over the last two years, Arbor Realty has increased its dividend by $0.01 in each quarter. This has resulted in a 26% increase over those two years, which makes for an annual growth rate of 12%. Arbor Realty thus combines a double-digit dividend yield with a double-digit dividend growth rate — that’s a very rare and very attractive combination.

Importantly, Arbor Realty’s dividend growth was not driven by an increase in its payout ratio. The opposite is true: The company was able to grow its dividend meaningfully while also reducing its dividend payout ratio at the same time, meaning that its dividend has risen and become safer at the same time — which is great for investors. Based on H1’s annualized earnings per share of $2.14 and Arbor Realty’s current dividend of $1.56 per share per year (likely to be increased again later this year), Arbor Realty’s dividend payout ratio is 73% right now. That is not too high for a REIT in general. For a mortgage REIT, that’s an especially non-aggressive payout ratio — many of Arbor Realty’s peers pay out larger portions of their profits.

Looking at Arbor Realty Trust’s valuation, we see that shares are trading for around 7x this year’s profits, assuming H2 will be more or less in line with H1. That is a pretty inexpensive valuation as this lowish earnings multiple equates to a ~14% earnings yield.

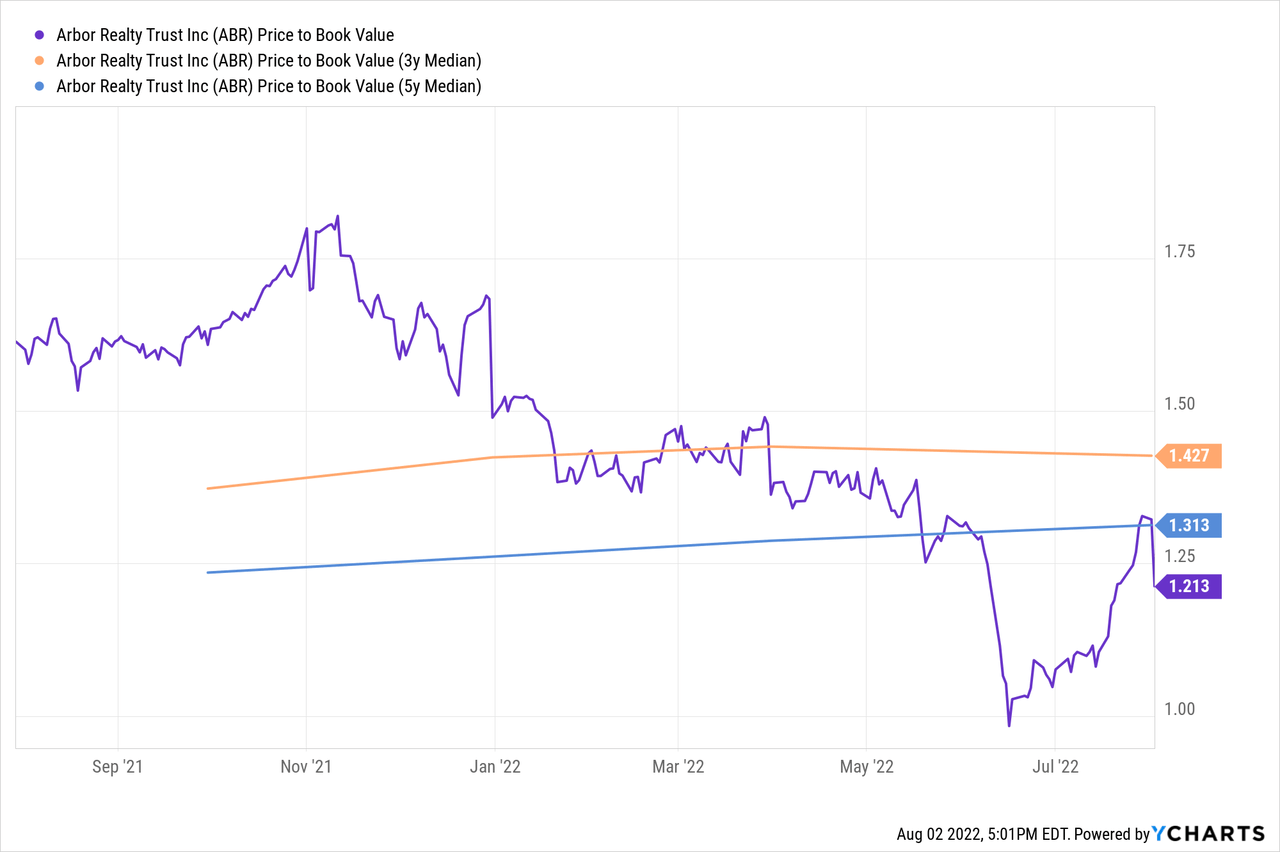

Mortgage REITs are not only valued based on their profits, but one can also look at their book value, as mortgage REITs generally own assets that can be easily liquidated.

Arbor Realty trades at 1.21x its book value today. A price-to-book ratio of more than 1 seems justified due to the company’s strong track record and high profitability — management is employing money in a great way, which is why paying slightly more than book value does not seem like an outrageous idea at all. Compared to how Arbor Realty was valued in the past, shares are slightly undervalued today. ABR has an upside potential of 10%/20% to the 5-year and 3-year median book value multiples, respectively.

Takeaway

Arbor Realty Trust looks like a very solid income investment today. The company has experienced management, a strong track record, and has performed well in the recent past.

Arbor Realty offers a hefty dividend yield, sizeable dividend increases, the payout ratio isn’t high which means that the risk of a dividend cut isn’t especially high and last but not least, shares are trading at a discount compared to how ABR was valued in the past. It would have been an even better idea to buy Arbor Realty at $12-$13 in June, but at $15 the stock still looks pretty attractive to me.

Be the first to comment