turk_stock_photographer

Patience is a virtue, but like many things in life, it’s easier said than done. While the recent market downturn has punished growth stocks, I believe it will pay to stick with moat-worthy names and wait for an eventual turnaround, as the market has proven to do throughout its history.

This brings me to Stryker Corporation (NYSE:SYK), which is a strong enterprise whose stock is now trading well below its recent high of $276 achieved as recently as April. In this article, I highlight what makes the current valuation attractive for long-term investors of this durable and growing enterprise, so let’s get started.

Why SYK?

Stryker is a leading medical technology company that designs and manufactures hospital equipment, instruments, consumable supplies, and implantable devices, for use in orthopedics, surgical, neurotechnology, and spine. Stryker holds a leadership position in operating room equipment, and is also the leader in reconstructive orthopedic implants, sitting above peers Johnson & Johnson (JNJ) and Zimmer Biomet (ZBH).

Stryker benefits from its standing with healthcare providers as a trusted partner, and from its over 4,000 device technology patents in the U.S. This makes it hard for new entrants and competitors to gain market share and forms a moat around its business. It also benefits from secular growth in the aging population, with the 65+ age group being the fastest growing age group. The U.S. Census Bureau projects 1 in 5 Americans to be in this category by the end of this decade.

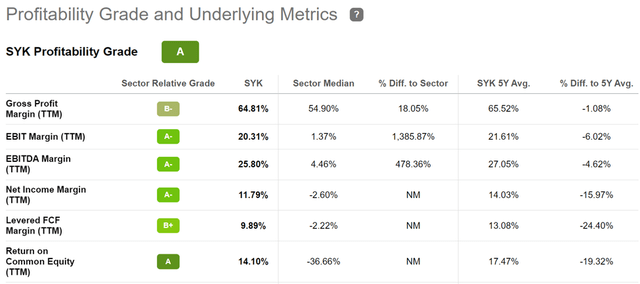

These factors, combined with SYK’s economics of scale result in industry-leading profitability. As shown below, SYK scores an A grade for profitability, with strong EBITDA and Net Income margins of 26% and 12%, respectively.

SYK Profitability (Seeking Alpha)

Stryker continues to grow well in the current macro environment, with 4.6% YoY sales growth (6.1% on an organic basis) to $4.5 billion in the second quarter. This was driven by robust Medical Surgical and Neurotechnology sales, with each growing by 8% and 10.6%, respectively. Also encouraging, SYK is growing its bottom line at a faster rate, with 11% YoY EPS growth over the same timeframe.

Headwinds to Stryker include ongoing supply chain challenges which has constrained SYK’s ability to deliver against its backlog and pressured sales growth. The problems, however, appear to be limited on the supply side, as SYK does not appear to be facing demand issues. This is reflected by its very strong order book, with the expectation of growth accelerating in the second half of the year, bringing full-year estimated sales growth to be in the 8-9% range.

Looking forward, SYK should see continued benefits from its diversified product mix, enabling it to meet growing demand in medical surgical and other emerging areas. This was noted by Morningstar in its recent analyst report:

In contrast to rival Zimmer Biomet, Stryker has diversified itself and eased its earlier reliance on large joint reconstruction. The benefit of this strategy became clear as the Great Recession pushed the orthopedic market into slow-growth mode, demonstrating that the historically recession-resistant business was indeed vulnerable when many uneasy patients deferred elective procedures.

Stryker is also relatively less vulnerable to the increased pricing pressure on hips and knees. We have always liked Stryker’s presence in the medical-surgical equipment area, as it offers a measure of stabilization and diminishes the impact of periodic economic downturns. The varied product lines also mean Stryker has more opportunities to engineer meaningful innovation, which is critical to gaining pricing advantages.

Stryker continues to pursue its strategy of augmenting internal innovation with acquisitions of specific technology, including Patient Safety Technologies, Small Bone Innovations, Sage, Mako, and K2M. This fits into the firm’s larger goal of partnering more closely with its hospital customers across multiple device and equipment categories.

Meanwhile, SYK maintains a strong BBB+ rated balance sheet, and while the dividend yield of 1.3% isn’t high, it appears to be very safe and covered by a low 29.7% payout ratio, a 10.4% 5-year CAGR, and an impressive growth streak of 28 consecutive years.

Admittedly, SYK still isn’t cheap on the surface at the current price of $213 with a forward PE of 22.7. However, I see this valuation as being justified considering the moat-worthy nature of the enterprise, and the 10% annual EPS growth rate that analysts expect over the next 2 years. Sell side analysts have a consensus Buy rating on the stock with an average price target of $238.48, implying a respectable one-year 13% total return potential.

Investor Takeaway

For investors looking for a defensive growth stock with a wide moat, Stryker Corporation appears to be an attractive option. The company’s industry-leading profitability, strong sales growth, and solid balance sheet make it a compelling investment at the current price. While the dividend yield isn’t high, it is very safe and has significant room for growth. I view SYK as being a decent buy at present for potentially strong total returns.

Be the first to comment