Angel Di Bilio/iStock Editorial via Getty Images

Several months ago, we recommended investing in Rio Tinto Group (NYSE:RIO). Since then, the company’s stock price has recovered significantly, driving roughly 40% total returns. As we’ll see throughout this article, given continued market growth, we see strong potential for increased Rio Tinto returns.

Rio Tinto Strong Results

The company has continued to achieve incredibly strong results, highlighting the strength of the overall commodities market.

Rio Tinto Investor Presentation

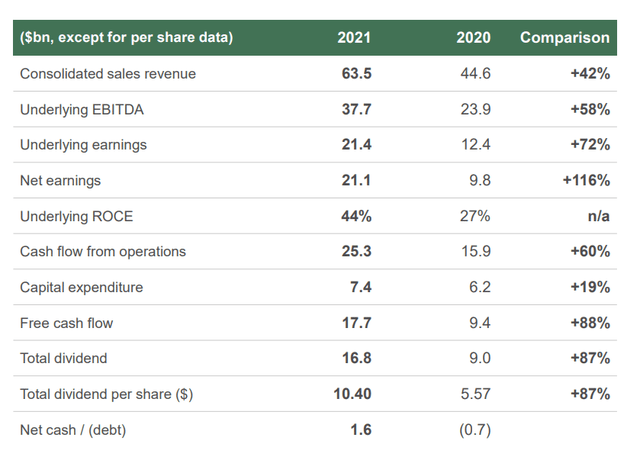

Rio Tinto Strong Results – Rio Tinto Investor Presentation

Rio Tinto managed to earn $63.5 billion in consolidated sales revenue, up 42% YoY. Underlying EBITDA increased 58% and net earnings by a more significant 116%. The company is modestly expanding capital expenditures (19%) and FCF by a very substantial 88%. That’s enabled the company to pay out a near double-digit total dividend, while having additional cash.

Commodity Market Strength

Supporting the company’s continued performance is strength in the commodity markets.

Rio Tinto Investor Presentation

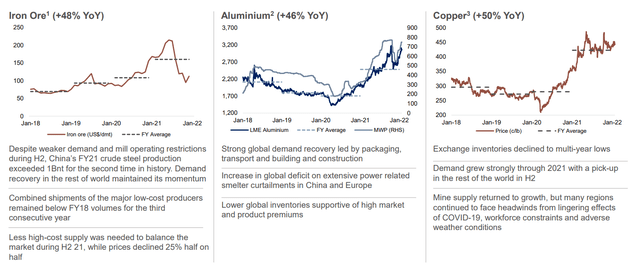

Commodity Market Strength – Rio Tinto Investor Presentation

Rio Tinto is, fundamentally, a commodity producer. It’s outperformed from Iron Ore, Aluminum, and Copper price growth. All of these commodities have performed well going into 2022. Iron Ore, Copper, and Aluminum account for $16.5 billion of the company’s $17.5 billion increase in EBITDA. Despite some costs, the company has continued to outperform.

Rio Tinto De-Carbonization

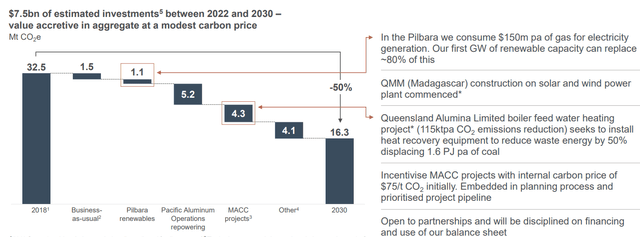

De-carbonization is no longer a “hip” culture. Globally, the risks of climate change have been recognized, and companies are beginning to meaningfully change their emissions. Fortunately, there’s a surprising amount of low hanging fruit, and as evidenced with the Pilbara gas-to-renewable replacement, emissions reduction and cost saving go hand in hand.

Rio Tinto Investor Presentation

Rio Tinto De-Carbonization – Rio Tinto Investor Presentation

The company expects emissions to drop roughly 50% from 2018 until 2030 through a variety of significant projects. The company is spending $7.5 billion on these projects, or a fairly modest 10% of its capital spending until 2030. Many of these projects such as Pilbara renewables and Queensland Alumina projects will save the company costs.

We expect the company will continue to opportunistically take advantage of de-carbonization projects.

Rio Tinto Growth

Rio Tinto is continuing to chase reasonable growth in its business, modestly increasing capital spending.

Rio Tinto Investor Presentation

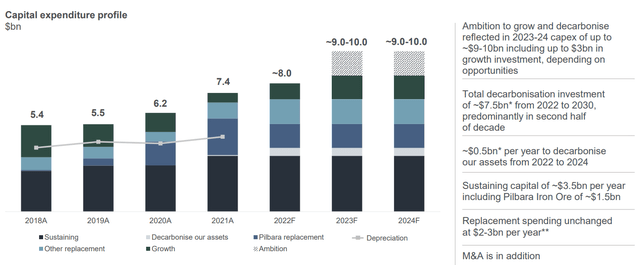

Rio Tinto Growth – Rio Tinto Investor Presentation

Rio Tinto spent $7.4 billion in 2021 capital spending. That’s ramping up to $8 billion in 2022 with “Other replacement” consuming the company’s more expensive “Pilbara replacement”. Sustaining capital is expected to increase moderately but remain modest, with Pilbara Iron Ore still representing the largest share here.

Specifically in 2023-2024 the company is looking at roughly $3 billion in potential growth projects. These growth projects could enable the company to increase its long-term earnings, and highlight how there’s continued opportunities available to the company.

Rio Tinto Financial Strength and Returns

Putting this all together, Rio Tinto has significant financial strength and the ability to drive substantial returns.

Rio Tinto Investor Presentation

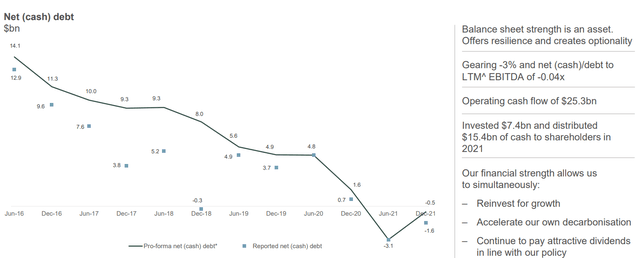

Rio Tinto Debt – Rio Tinto Investor Presentation

Rio Tinto’s impressive cash flow has enabled the company to move towards a net cash position. The company’s steady reduction in net debt means it now has a subtle cash position. If anything else it means that interest and debt paydown isn’t a concern for the company, so it can utilize its cash flow completely towards shareholder returns.

The company distributed substantial dividend in 2021 while saving some cash. Going into 2022 and onwards, with continued price strength, we see the potential for continued double-digit dividends along with other opportunistic forms of shareholder returns. The company hasn’t participated in a buyback in several years, however, with dividends, it’s not necessary in our view.

Thesis Risk

The largest risk to the thesis in our view is commodity prices. While global demand for commodities is going up, prices in the industry tend to be incredibly volatile. Rio Tinto’s cash flow has improved significantly over the past 1-2 years, however, there’s no guarantee that it’ll continue. That’s a risk worth paying close attention to.

Conclusion

Rio Tino has seen its share price improve significantly since we last recommended investing in the company. We expect that performance to continue. The company has a unique portfolio of assets and on top of opportunistically investing in replacement, the company is expecting to start investing in growth as well.

The company has no net debt. It’s focusing primarily on dividends enabling the potential for a double-digit dividend yield. As long as prices remain strong, which we expect, we expect a continued double-digit dividend yield. That reliable yield and the company’s strong financial position helps to reveal the company as a valuable investment.

Be the first to comment