Ian Tuttle

Thesis

We urged investors in our pre-earnings article not to join the rally in Roblox Corporation (NYSE:RBLX) stock, despite its marked recovery from its May lows. We noted that RBLX rallied well into overbought zones and, therefore, was susceptible to selling pressure that could force it lower.

Accordingly, RBLX is down more than 16% since our article, underperforming the broad market. However, we gleaned that the post-earnings sell-off was well-supported before the recent pullback in the market led to further weakness in RBLX stock.

The company’s recent developer conference and investor day had also not piqued buying interest, as RBLX continues to consolidate. The company intends to make its forays into digital advertising through a new category of immersive ads that it believes is accretive to its business model. Furthermore, it has made headway into older cohorts (above 13 years old), broadening Roblox’s appeal to expand its brand advertising opportunity.

Notwithstanding, Roblox remains tentative over the accretion and timing of its revenue opportunity with its new immersive ads, given its nascent development. Therefore, we urge investors to stay focused on its core bookings.

Also, Roblox’s core Bookings metrics are expected to have bottomed out in Q2, with its profitability growth also estimated to recover through 2023. Coupled with its battered valuation and price action, we believe a speculative exposure at the current levels seems appropriate.

We revise our rating on RBLX from Sell to Speculative Buy.

Roblox Wants Immersive Ads To Diversify Its Revenue Growth

Investors should note that having ads on the Roblox platform is not a novel discussion. Street analysts have been clamoring for Roblox to develop a platform to generate sustainable ad revenue and diversify its revenue growth from its core bookings.

Therefore, we believe it’s reassuring to investors that management is ready to move into digital advertising through its immersive ads category. The company believes its unique offering could be used for the upper funnel (brand spend) or lower funnel (performance spend) for its creators.

We believe management has been holding off the ad revenue opportunity for a while, as it first needed to gain more sustainable traction with the older users’ cohort. Management alluded to it on its recent Investor Day:

Immersive ads are ads that are built natively from the ground up for 3D immersive shared experiences. We want this ads to be fun. We want this ads to be interactive. We want these ads, of course, to be safe. We want this ads to be nonobtrusive and we want to be privacy respecting. And one important thing about our ads is that we’re going to be honoring our safety, culture and DNA, and immersive ads are only going to target users above the age of 13. (Roblox Investor Day)

Also, Roblox was cautious not to telegraph the revenue potential of its immersive ads opportunity, given its nascent development. Hence, we urge investors to be careful in modeling its revenue model until we receive more guidance in its future commentary. Management accentuated:

[We are] optimistic long term, we’re going to be in really good shape all around the world, even without advertising. It’s very difficult to put financial projections around the brands. But we feel really comfortable that in 3 to 5 years, this is going to be a big part of our business. So things that can happen here [for immersive ads] haven’t happened anywhere else. That makes it inherently hard to forecast, but it also makes it inherently exciting about the long-term value of the business. (Investor Day)

So, Focus On Its Bookings For Now

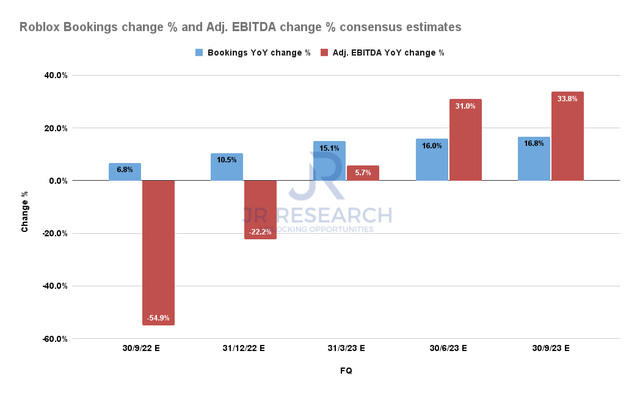

Roblox Bookings change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Accordingly, investors should remain focused on its core bookings growth to assess the company’s operating metrics.

The consensus estimates (bullish) suggest that its recent Q2 could have seen the nadir in its bookings growth, as it fell by 3.8% YoY, following Q1’s 3.2% decline.

However, Roblox’s bookings growth is projected to increase by 6.8% in Q3 and further accelerate through FY23. Moreover, its recent August metrics also corroborate a better H2, as bookings were expected to increase by 6% (midpoint). Therefore, it should also lift its adjusted EBITDA growth from its nadir through FY23 as Roblox recovers its operating leverage.

As such, we believe the lapping of challenging comps from 2021 should help RBLX’s buying sentiments to stabilize moving ahead, mitigating further downside volatility.

Is RBLX Stock A Buy, Sell, Or Hold?

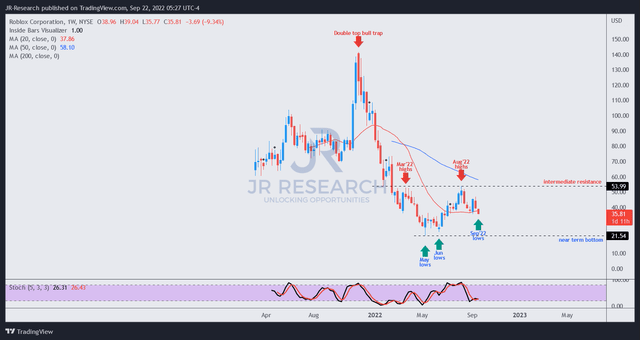

RBLX price chart (weekly) (TradingView)

RBLX last traded at an NTM bookings multiple of 6.6x, well below its mean of 13x. However, we believe the battering is justified as its valuation was unsustainable, given the decline in its bookings growth.

Notwithstanding, we gleaned that RBLX appears to have bottomed out in May. Moreover, its recent pullback also seems to find robust support at the 20-week moving average (red line), which could be instrumental in helping RBLX regain its bullish bias.

Hence, we believe the opportunity to add RBLX as a speculative position is appropriate.

We revise our rating from Sell to Speculative Buy, with a medium-term price target of $50 (implying a potential upside of 40%).

Be the first to comment