metamorworks/iStock via Getty Images

Calix, Inc. (NYSE:CALX) has had a great run since I first covered the stock in 2020. The stock has risen from the single digits to the current price in the $70s since 2020. While I still think the company has multiple years of strong growth ahead, Calix’s high valuation and the overbought condition is cause for concern. Current investors should consider taking some off of the table to lock in profits, and potential investors should probably wait for a more attractive entry point.

Calix provides cloud and software platforms along with related services on a global basis. The company’s solutions enable broadband service providers (BSPs) to provide a range of services. In a nutshell, Calix’s offerings provide key analytics that allow BSPs to increase revenue by boosting the amount of subscribers and customer loyalty. This is something that is likely to be needed on a regular basis. So, I have a long-term bullish view for the company, but I’m cautious in the short term. The possibility of a recession over the next year adds to my concerns.

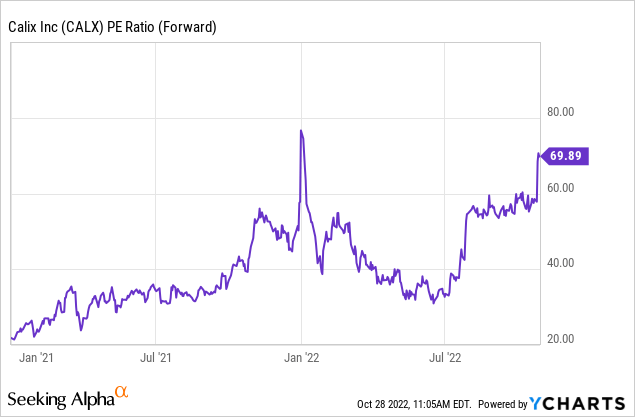

Valuation is Currently Too High

We can see from the chart above that the forward P/E ratio increased significantly above average into the 60s. The S&P 500 (SPY) has a forward P/E of 16.6. Calix’s stock may not drop down as low as SPY’s P/E ratio. However, I do think it is likely to drop from these valuation levels as higher interest rates lead to slower economic growth over the next year or so. The broader market may have its short-term rallies, but we are still in a bear market and could see lower overall prices for the major indexes over the next year. Higher interest rates could slow the economy to the point of recession.

We can see what happened to Calix’s valuation when the P/E increased to similar levels in January 2022 and then dropped to more reasonable levels in the summer of 2022. The stock price decreased from a 52-week high of $80 to a low of about $32 during this time. I think something similar is likely to occur over the next year.

Declining Economic Indicators

Declines in the key macroeconomic indicators increase the risk of recession over the next year. This is likely to lead to more stock market declines, which would likely lead to Calix’s stock to drop.

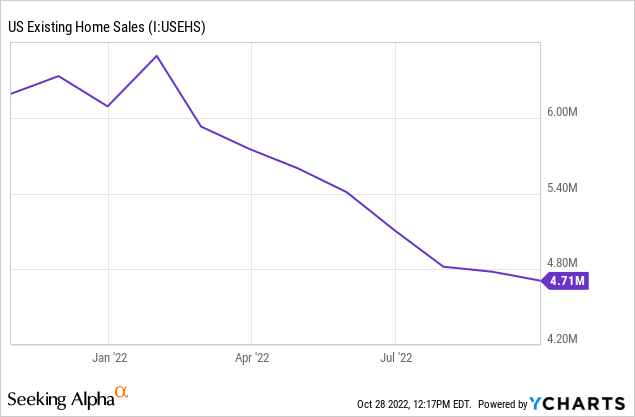

The housing market has been deteriorating, with higher interest rates making mortgages less attractive. The chart below shows existing home sales dropping in 2022.

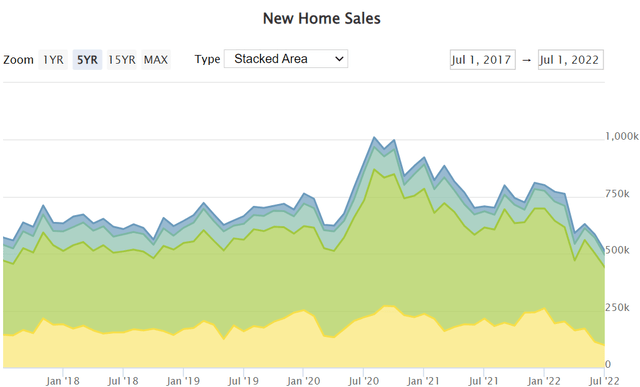

The next chart shows the decline in new home sales over the past 2 years.

Declines in the housing market tend to lead to a domino effect across the rest of the economy. Of course, this typically leads to declines in the stock market. Calix would likely be caught up in a market sell-off from this high valuation as we saw earlier in the year during the stock market drop.

Calix could also see a decline in business during a recession, as BSPs could cut back on investments/spending during uncertain economic times. The higher-than-average valuation puts the stock at a higher risk for steep declines.

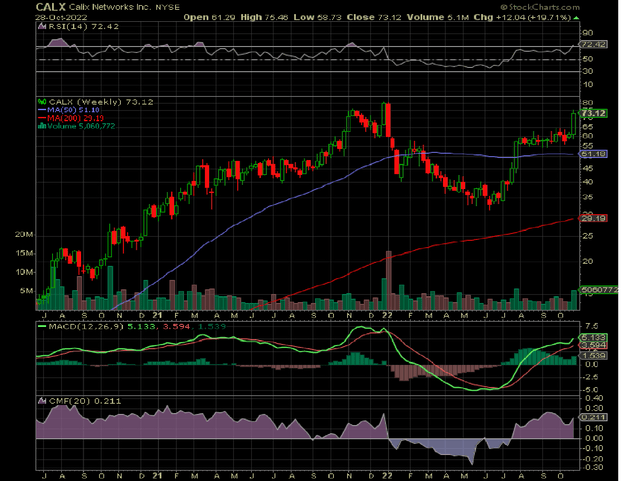

Overbought Condition

Calix’s weekly chart above shows the stock with positive momentum since July. However, the RSI indicator at the top of the chart increased to over 70, putting the stock in an overbought condition. Granted, the stock could still increase if the current rally continues. Since we are still in a bear market as recession risks remain, this rally will probably not be prolonged.

The last time Calix was overbought on the weekly chart, the stock lost more than half its value in the first half of 2022. So, it wouldn’t be unreasonable to think that something similar could happen soon, especially considering how volatile the broader market has been.

The Positives

Calix reported a positive quarter for Q3 2022. The company achieved a 37% increase in revenue and a 65% increase in RPOs. RPO stands for revenue allocated to remaining performance obligations, which is contract revenue that has not yet been recognized (deferred revenue which will be invoiced and recognized in future periods).

The company’s growth is being driven by BSPs that are providing broadband-as-a-service. This means that BSPs are providing more than just standard broadband service. These BSPs are also offering email, domain registration, web hosting, and browser/software packages. By offering these extras, BSPs can better grow and retain subscribers. Calix helps them do that through the company’s offerings.

Given the positive quarter and guidance for Q4, Calix is on track for their third consecutive year of 25% revenue growth. Calix is expected to grow earnings at 20% annually over the next 3 to 5 years. Revenue is expected to grow 22% over the next year. However, this positivity is probably mostly priced in given the company’s lofty valuation. The stock is at risk of dropping significantly if Calix falls short of expectations or reports news that is unexpectedly negative.

Calix’s Near and Long-Term Outlook

I have a positive view for Calix over the long term (looking 3 to 5 years ahead). BSPs are likely to use Calix’s offerings to help increase and retain subscribers. The company has strong, above-average expected revenue and earnings growth for the long term.

However, the stock’s overbought condition and overvaluation have me cautious over the next year. Experts are predicting a recession in 2023 as higher interest rates slow economic activity. If a recession does take place, it would likely lead to stock declines even for growing companies. Of course, it is possible that Calix’s business experiences a decline during a recession if BSPs cut spending.

I think most of the good news is priced in at this point. Personally, if I owned the stock, I would take some profits off of the table by selling about half of my position. If I was looking to start a position in the stock, I would wait for a more compelling entry point, which may present itself sometime in 2023.

Be the first to comment