Drew Angerer/Getty Images News

It is natural to give the CEO credit when the stock is soaring. It is equally easy to blame the current CEO for stock woes. The Walt Disney Company’s (NYSE:DIS) performance was no different in that regard.

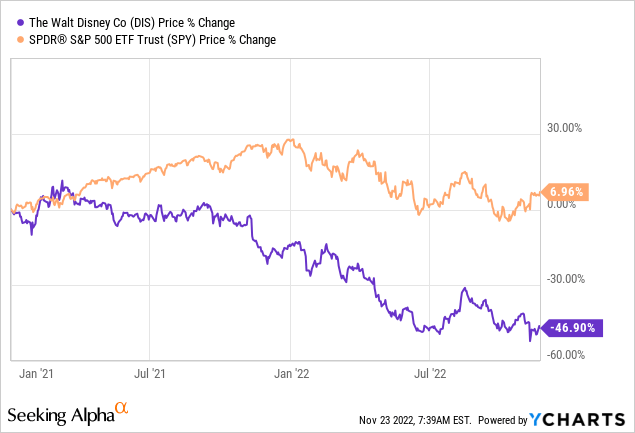

The 47% drop from January 2021 likely played a big role in the company bringing back Bog Iger to replace Bob Chapek. Iger was part of the leadership that saw Disney hit its stride and he wasted no time in reestablishing dominance.

Bob Iger, less than 24 hours after returning to the helm of Disney, told employees Monday that the company would be undergoing a restructuring in coming weeks.

Source: CNBC

While investors initially cheered the move the stock gave back half the peak gains as they absorbed new information. We go over why we think the Return Of The Jedi may not be as successful here as the movie was at the box office.

A Tale Of Good Performance & Valuation Expansion

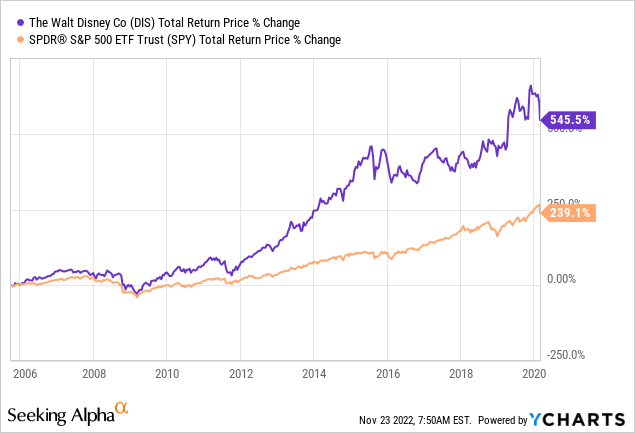

Iger’s claim to fame comes from the tremendous performance of the stock from September 30, 2005 to February 25, 2020. During the nearly 15-year tenure of Iger, DIS stock rallied more than 500% for an annualized gain of 13.9% including dividends. Total returns demolished that of the S&P (SPY) by a huge margin and investors could not say enough good things about the old guard.

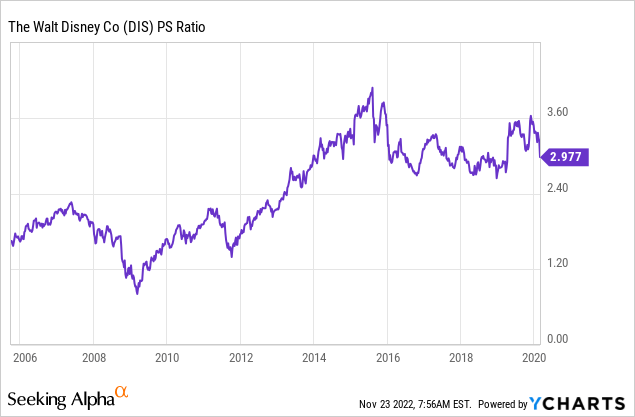

While the numbers appear spectacular and they were, a good deal of the return came from valuation expansion. Disney’s price-to-sales ratio more than doubled during Iger’s tenure.

By contrast, SPY’s price-to-sales ratio expanded less than 60% in the same time frame. Investors may object to using price to sales versus a P/E metric, but the latter is often distorted by a single point in time. Earnings tend to yoyo far more than revenues and it is hard to make comparisons on a single time point using the P/E ratio. Our point is that if you apply the price-to-sales ratio that was existing at the time of Bob Iger’s start, almost all the outperformance disappears.

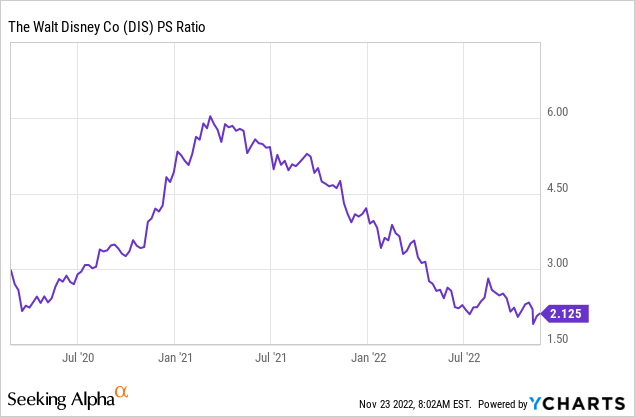

Chapek’s term was of course marked by the brutal COVID-19 induced recession, but more importantly, is a tale of excesses coming home to roost. After going briefly gaga at the thought that there was something known as “reopening” and paying insane multiples for that silly idea, things started normalizing.

The current 2.12X sales multiple for Disney is about as normal as one can get. In fact, it is more than 50% higher than where it was when Iger took office in 2005. Considering the high money losing propensity of streaming, coupled with an extremely high risk-free rate, one would expect price to sales to trend towards the low end of the spectrum. We see nothing wrong with valuing Disney even at less than 1.7X revenues and if that notion is correct, Disney stock could stay flat for the next 3 years.

What Can Be Changed?

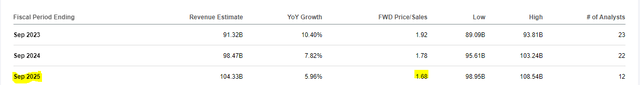

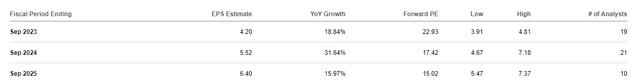

Considering the massive costs of streaming, the current profits are actually quite impressive. In fact, we think that the analyst community is wrong about the future profits by a wide margin.

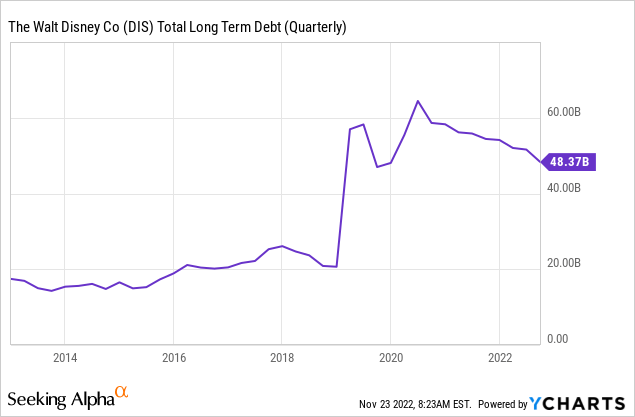

To grasp what we are referring to, examine the expected revenue growth from 2023 to 2025, which is about 14% versus the earnings growth of 52%. This is going to be incredibly hard to deliver. This is likely to be even harder if the current interest rates hold. Disney has over $48 billion in debt and paid interest at an annualized rate of $1.5 billion this quarter.

That works out to less than 3.2%. As the whole debt structure reprices higher over time, it will act as a headwind to earnings. So from our point of view, actually coming close to hitting those numbers would be the ultimate magic.

Verdict

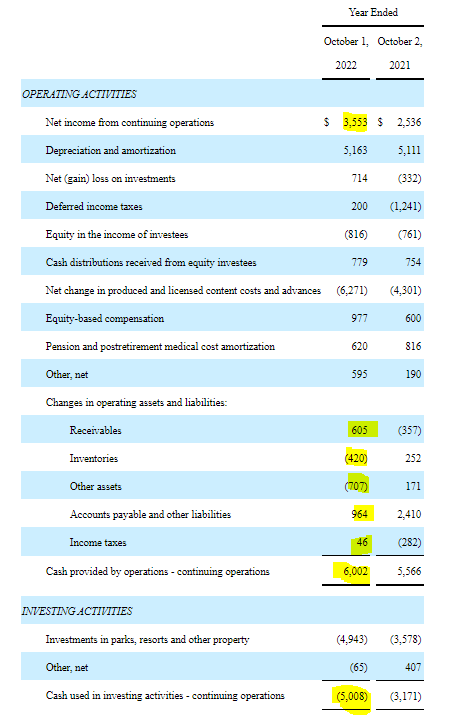

While Disney has got back to profitability quickly after COVID-19, investors are likely eyeing that cash flow statement with some concern. The company managed to generate free cash flow this year (8-K Link), but the amount trailed net income by more than $2.5 billion. Even the $1.0 billion of free cash flow was helped by $0.5 billion favorable net movement in working capital.

DIS Oct 2022 8-K

Streaming costs are exploding in the current high inflation environment and there are plenty of competitors that are spending without worrying about profits. This remains the biggest concern and all hopes of significant free cash flow and we might add those big earning numbers for future years, depend upon turning this around.

One of the first steps, Iger announced, would be the departure of Kareem Daniel, the company’s head of media and entertainment, and right hand to now-departed CEO Bob Chapek.

Iger announced Daniel’s departure in a memo to employees of the division, along with a “new structure that puts more decision-making back in the hands of our creative teams and rationalizes costs.”

“This will necessitate a reorganization of Disney Media & Entertainment Distribution. As a result, Kareem Daniel will be leaving the company,” Iger said in the memo, which was obtained by CNBC.

Source: CNBC (emphasis ours)

We will wager that this part will be very difficult and balancing the direct-to-consumer growth story while cutting costs is unlikely to succeed. As amazing as Iger’s performance was, this comeback story has more room for disappointment than for a heroic ending. Expect some restructuring charges and a lot of internal shuffles. Expect analyst downgrades as the operating margin expansion does not materialize. We would expect Disney to remain rangebound between $70 and $120. At the low end of the range, is where we would consider initiating a buy. Our thinking from when the stock traded at $200, still stands.

When investors get disenchanted with growth rates, Disney is likely to trade close to 1.5X revenues. Even using an optimistic $110 billion revenue outlook, the losses can be substantial.

Source: Best Short Hedge On The Market

We rate it at Neutral for now.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment