Justin Sullivan

VMware (NYSE:VMW) just reported quarterly results. As they transition from license to a subscription model, things are evolving much in the way you’d expect. Some service revenue is folding into being part of the subscriptions, obviously license revenue is falling, and the subscription revenue is growing, but behind ARR which annualizes those subs, so revenue looks a little weak despite still roaring end-markets of cloud software and infrastructure. Earnings are weak though as costs are getting high, but Broadcom (AVGO) will certainly have to say about that as their serial acquiring puts their focus on VMware in the minimum $61 billion acquisition deal. We think antitrust is less likely to be an issue, and that the deal will proceed, but Broadcom’s plans with it, which will likely include raising prices, may generate some controversy even if it wins some earnings short term.

VMware Q3 Earnings Results

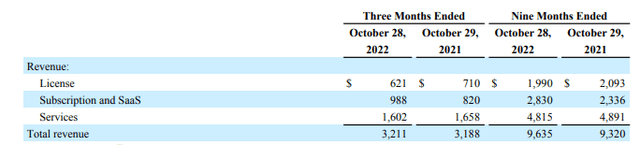

The quarterly revenue growth was fairly limited of only 1% YoY, but this always happens when companies shift from license to subscription revenue. ARRs are growing quite well in the subscription segment, which now accounts for 31% of the revenue. The ARR growth which was 24% looks at the total billings growth, and therefore the total growth may lag that as subscription revenue recognition happens over time and not upfront like with licenses. Still the total growth in subscription revenue was 20%. But again, this is coming from the subscriptions earned from prior wins in business, not from the new subscriptions billed this quarter in ARR. The delta of ARR this quarter barely feeds into revenue growth, since on average these new wins have only gone a month of being recognized as revenue, so maybe 10% of the ARR delta ends up in the revenue growth. In other words, growth trajectory while shifting from license to subscription and subscription growth relative to ARR both look weak. They will slow burn into steady revenue growth even a while after new business wins slow, which they’re not.

At any rate, the license revenue to subscription revenue shift typically see erosion in services revenue as well even though it’s recurring as things get folded into subscriptions. The wins in subscription over license aren’t fully evident in revenues figures yet.

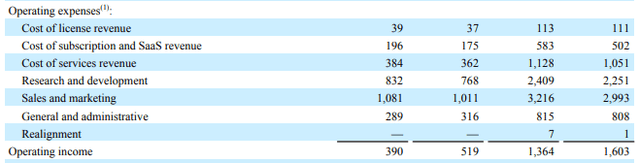

Operating income declined quite a lot YoY. A lot of this is coming from growth in general COGS costs, say about 20% of the OPEX growth, but a lot is coming from higher R&D growth (33% of the delta) and marketing covers the rest.

This is a relatively good sign and could be a catalyst for investors who want to be railroaded through the acquisition by Broadcom. With their history from their serial acquisitions being quite a clear precedent, these discretionary costs are going to come down quite hard. Moreover, pricing is likely to improve. VMware is a massive enterprise player and is quite embedded in cloud operations of major companies, playing in a lot of the same arenas as Red Hat with virtualization, cloud middleware and cloud management. When Broadcom likely gets regulatory approval and acquired VMware, this pricing power might get flexed. Customers could push back and this may create controversy around the direction Broadcom will take with the business, but it also could be a good commercial opportunity to flex pricing power.

Regulatory Approvals

The regulatory approval and acquisitions are important to review. VMware have the option of taking cash or stock for their shares, and the deal values them at a minimum of $61 billion or $142 per share. VMware trades at a pretty reasonable discount from that, which is owed to speculation over the deal going through. The upside is still about 20% on the deal going through.

The EU antitrust authorities but now also other authorities like the British CMA are picking up the matter and beginning their review of the transaction. As it stands, there isn’t way too much overlap between the companies, but Broadcom gets way further into the enterprise backend of lots of major companies beyond its previous acquisition in the software space of Symantec and others. There are still other cloud middleware, cloud management, and cloud software players out there. Red Hat and IBM (IBM) have a fair bit of competitive overlap with VMware, and we don’t think the competitive integrity of markets for cloud management, infrastructure and software products are majorly threatened by this deal.

Bottom Line

VMware is a decent company, and the current valuation, which doesn’t take into account fully the deal value, is not overly high at 10x EV/EBITDA, and there might even be an opportunity at this price, deal or not, to make money as the license to subscription revenue continues to take hold, and the subscription wins continue to bleed into revenues. Moreover, we think the deal has no major reason to go through. While there’s some overlap with Symantec properties and some of the other things Broadcom does with VMware, they don’t get to corner the market after this. I think Broadcom is mainly in it for the pricing power, the successful VMware cloud product franchise, and the greater mix it will give Broadcom in software revenue. There’s some immediate upside likely over the next few months as regulatory approvals conclude on likely a more positive note than not. Overall, VMware is a pretty interesting prospect right now.

Be the first to comment