Aja Koska/E+ via Getty Images

Investment Summary

There are numerous selective opportunities that are positioned with the ‘beaten-down’ corner of medical technology (“medtech”). Investors have been quick to punish names based on a single set of earnings, if not for this, then in response to wider systematic risks impacting the entire market. Case in point is Patterson Companies, Inc. (NASDAQ:PDCO) came in with a weaker-than-expected earnings last quarter and was dealt with a swift response. Note, from here on I will refer to the calendar year 2022 as “2022”, and PDCO’s financial years as “FY22”, “FY23”, etc. from hereon in.

The stock hit a 52-week low in September 2022 and has drifted sideways since, however, here I illustrate not much changed fundamentally for the company from Q2. In particular, the company’s return on capital invested, and the trajectory of earnings growth are still on par with recent growth trends.

These two levers are integral to the PDCO share price appreciating into a weakening global economy, marred by higher costs of capital and illiquidity. In effect, PDCO is compounding return on its invested capital at greater than 10% on a TTM basis. This is the kind of equity premia I am seeking to position against in 2022. Plain and simple, those companies who have a return on investment that outpaces the WACC hurdle, are growing earnings, and are trading at discounted multiples present with a compelling investment case that I believe will outperform into the coming years.

Therefore, with strong return on its investments and resilient, quality earnings to boast about, PDCO overcomes the surface-level headwinds of factors like slower revenue growth, or negative FCF. Shares are also trading at a deep discount to peers. Net-net, I rate PDCO a buy with a $33 valuation.

Valuation- priced at a deep discount

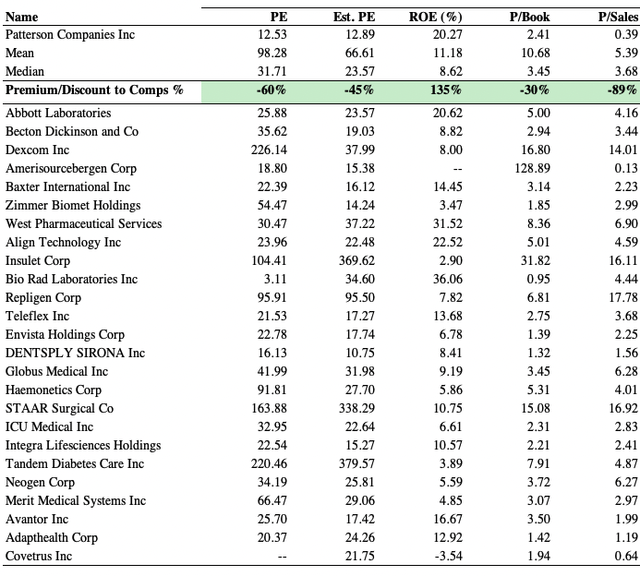

As seen in Exhibit 1, shares are trading at a respective discount to GICS industry peers across multiples used in this analysis. Trading at 12.5x trailing P/E and 2.4x book value represent double-digit discounts in their own right. Even at this multiple to book value, the company’s return on equity of 20.27% gives the investor an 8.4% ROE – in-line with the peer median. The market has also priced the stock at 12.9x forward earnings. We’ve got PDCO to print $2.51 in earnings per share for FY24 – ahead of the consensus’ $2.43 – and at 13x this figure sets a price target of $33, implying there’s upside to be realized from the current market price.

Whilst it is trading at a respective discount, the question immediately turns to why, and if the discount is in fact warranted.

Exhibit 1. Multiples and comps – suggests there’s relative value on offer.

Question is – is this warranted?

Data: HB Insights, Refinitiv Datastream

The two ways in which I primarily examine corporate value is in terms of a company’s return on its ongoing investment (“ROIC”) and current investments/assets (“ROA”) and the quality of its earnings growth.

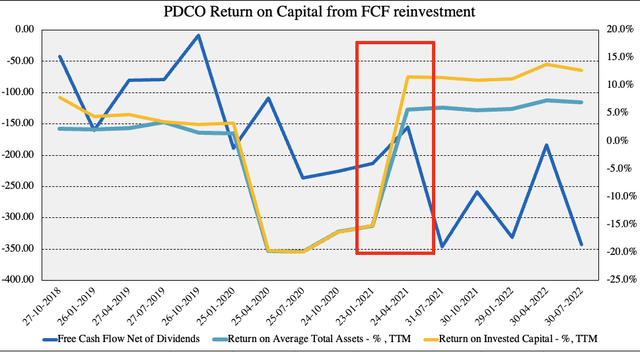

As seen in Exhibit 2, whilst free cash flow (“FCF”) has been narrowing on a sequential basis for PDCO, this has been accompanied by an uptick in ROIC and ROA since the key inflection point shown below in FY21.It also has a TTM asset turnover of 2.33 meaning it generates $2.23 for every $1 invested into its asset base. Therefore, whilst FCF has pushed into the red, the ROIC from the FCF reinvestment returned 7% and 12.8% in TTM ROA and ROIC respectively last quarter.

Exhibit 2. Whilst FCF has printed negative, since 2021, the FCF reinvestment has yielded double-digit return on capital

- This is desirable, and indicates the company compounds capital at a rate that outpaces the WACC hurdle of 9%.

- This also suggests the discount to peers is unwarranted and presents a mispricing opportunity.

Note: All figures in $mm or [%]. Free cash flow calculated as [NOPAT – investments – dividend payout]. FCF calculated net of dividends to reflect true cash availability to shareholders net-net. All figures calculated using GAAP earnings with no reconciliations. (Image: HB Insights, PDCO SEC Filings)

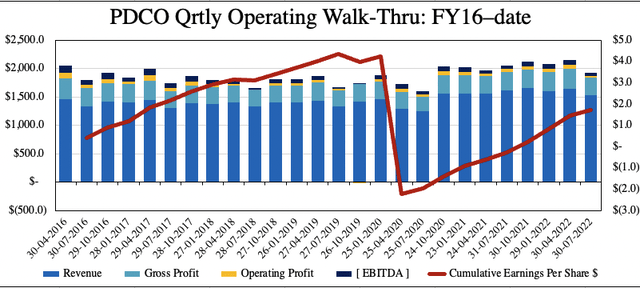

So it’s a plus 1 for the investment pile. In terms of the earnings pile, there’s equally as favourable numbers to sink the fangs into. After a large step-back in earnings during the pandemic, earnings have begun to shift upwards once again on a cumulative, sequential basis. As seen in Exhibit 3, this has occurred whilst the company’s turnover and operating profit has remained resilient across this time, and shown signs of swift recovery. PDCO now prints its highest levels of gross profit as well, and this is the kind of earnings quality I’d like to see in the forward looking climate. As a result, I reiterate my posture that PDCO’s discount seems to be unwarranted and this could create an opportunity for it to re-rate back to the upside.

Exhibit 3. The earnings pile is equally as supportive of the view that the deep discount to peers shown above is unjustified

This creates a solid bedrock for the stock to re-rate to the upside.

Data: HB insights, PDCO SEC Filings

PDCO Q1 earnings give insights for full-year results

The company also came in with a fairly strong set of numbers. Whilst revenue came in ~570bps behind Q1 FY22 at $1.52 Billion, this was expected, and last year’s result was also skewed by an extra week of sales. Removing the week of sales on a comparable basis and turnover increased 320bps on the same quarter last year. Gross margins decompressed ~25bps YoY to 20.5% helped by greater COGS efficiencies in both operating segments. Meanwhile, OPEX came in with a 90bps higher expense margin YoY to 17.6% of sales, resulting in an operating margin of c.3%.

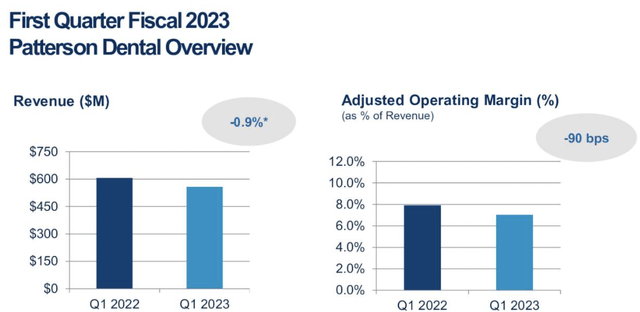

Segmentally, results were mixed across dental and animal health. Dental sales came in ~90bps YoY decline in internal sales, accompanies by a 270bps YoY decline in dental consumables. This is partially due to the deflationary effect of infection control products on the previous comparable period. Management anticipate this deflationary impact to continue throughout the remainder of FY23.

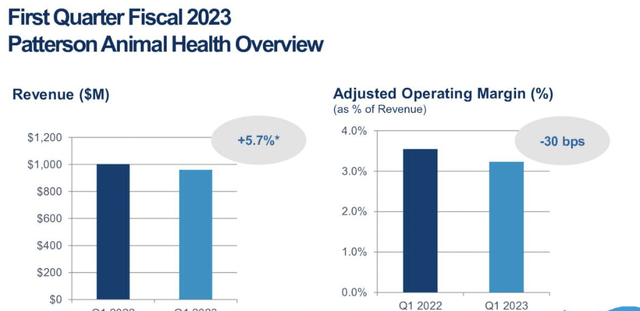

Meanwhile, the animal health segment saw upside and grew 570bps YoY compared to Q1 FY22. This was underpinned by strength in the production animal business, itself growing 760bps YoY. A consolidated view of the company’s segment performance is observed in Exhibits 4 and 5.

Exhibit 4.

Exhibit 5.

From its performance last quarter, PDCO reaffirmed its FY23 bottom-line forecasts. Guidance now calls for GAAP earnings of $1.96-$2.35 per share and this seems fairly reasonable by my estimate and aligns with our own forecasts for the company in FY23 and beyond.

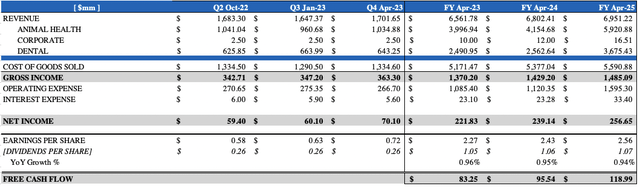

We forecast $2.27 in EPS for FY23, as seen in Exhibit 6, with this stretching up to $2.56 per share by FY25. In addition, we also project PDCO to convert $83mm in FCF this year and estimate this to grow at a CAGR of 12.6% into FY25 and reach $118mm. With the company’s recent growth in earnings, and, in particular it’s substantial ROIC, there is clarity on the pathway PDCO will take to reach these numbers in my estimation.

These forecasts are supportive of a bullish view on the company, and I believe the earnings and FCF growth will inflect positively on the PDCO share price across this time.

Exhibit 6. PDCO Forward estimates, FY23 quarterly; FY23-FY25 annual

Conclusion

From my examination the market has unfairly punished PDOC in Q1 FY23 and only looked at 1 set of quarterly earnings to discount the stock to its 52-week lows. Whilst this has been a constant thematic in equities this year, it also widens up the gate of opportunity for those investors looking to step up in the quality spectrum.

Here we have in PDOC a company that consistently generates ROIC that outpaces the WACC hurdle and sees its reinvestment of FCF pull through in ROIC as well. Shares are also heavily discounted to peers and at 12.9x forward earnings I’ve priced PCOD and believe we are paying fair and reasonable value to obtain exposure to these quality features.

There are some risks to consider in this debate, however. Should the company miss guidance or consensus estimates at its next report, it’s likely the market will punish PDCO and this could result in downside on the chart. There’s also a risk that multiples won’t re-rate to the upside, and that the discount to peers could remain in situ for some time. These risks need to be considered heavily along with the growth catalysts described.

Net-net, I continue to see compelling value in the name, and on this basis, I rate PDCO a buy on a $33 price target.

Be the first to comment