Nordroden/iStock via Getty Images

One of the larger industrial suppliers on the market today is a company called Ingersoll Rand (NYSE:IR). Operationally, the company focuses on what it calls mission-critical flow creation products and industrial solutions. These include products like compressors, pumps, vacuums, and blowers. In all, the company has claimed ownership over more than 40 major brands across the industrial space, with customers across a vast array of industries ranging from medical and laboratory sciences firms, to food and beverage companies, and more. Recent financial performance achieved by the company has been quite positive. At the same time, shares have taken a slight step back. To some investors, this may be a great time to consider buying in. But as a value investor, I do not think the stock is cheap enough quite yet.

Robust performance

Back in February of this year, I wrote an article wherein I described Ingersoll Rand as a difficult prospect to analyze. This difficulty came from a significant push management had made in recent years to truly transform the enterprise for the long haul. Ultimately, however, I said that while the firm was difficult to analyze, the cash flow picture for it was quite positive. Despite that, and despite the uncertainty associated with its transformation, I did also think that shares were fairly valued even though they were slightly lofty compared to similar businesses. At the end of the day, this led me to rate the business a ‘hold’. That rating, for me, signifies that Ingersoll Rand should generate upside or downside that is more or less along the lines of what the broader market should for the foreseeable future. Since then, the company has done just that. While the S&P 500 is down by 5.6%, its shares have declined in value by 5.2%. That’s about as close as you can hope for.

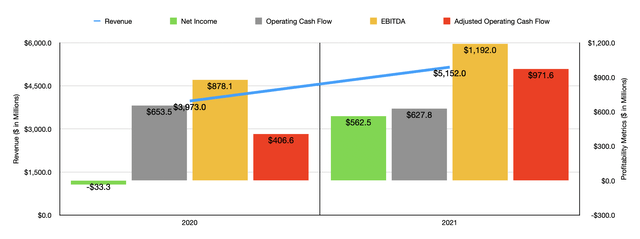

This decline should not be viewed in all that negative a light. The fact of the matter is that the fundamental performance of the business remains robust. Consider how the company ended its 2021 fiscal year. Sales came in at $5.15 billion. That’s up from the $3.97 billion generated in 2020. This 29.7% increase was driven largely by acquisitions, including of Ingersoll Rand Industrial. Total acquisition-related sales added $537.5 million to the company’s top line. But that’s not to say that the underlying core enterprise suffered any. Organic volume growth in its Industrial Technologies and Services segment accounted for $330.3 million of the increase in revenue for the year.

Thanks to this rise in revenue, profitability also improved. Net income for the company rose from negative $33.3 million in 2020 to a positive $562.5 million last year. Other profitability metrics also fared quite well. Operating cash flow, for starters, did decline, dropping from $653.5 million to $627.8 million. But if we adjust for changes in working capital, it would have risen from $406.6 million to $971.6 million. Meanwhile, EBITDA for the company also improved, jumping from $878.1 million in 2020 to $1.19 billion last year.

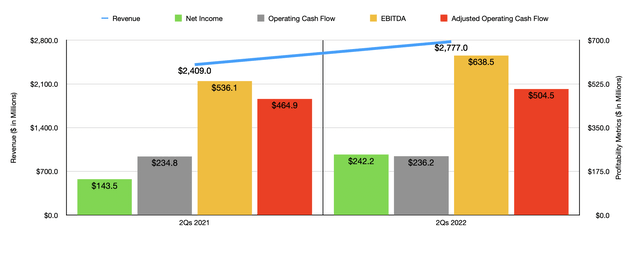

Growth for the company has continued into the 2022 fiscal year. Revenue in the first half of the year, for instance, came in at $2.78 billion. That compares to the $2.41 billion generated in the first half of 2021. This 15.3% increase was driven largely by higher pricing for its products that led to $169.3 million in increased sales. Higher organic volumes added $150.1 million, while acquisitions contributed $143.8 million to the company’s top line expansion. This is not to say that everything was great. In fact, foreign currency translation negatively impacted the business to the tune of $94.9 million. All things considered though, the picture was quite positive. Net income rose from $143.5 million in the first half of 2021 to $242.2 million the same time this year. Operating cash flow increased more modestly, inching up from $234.8 million to $236.2 million. If we adjust for changes in working capital, it would have risen from $464.9 million to $504.5 million. Meanwhile, EBITDA also increased, rising from $536.1 million to $638.5 million.

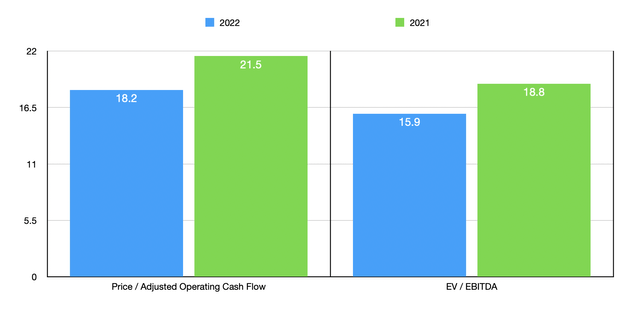

For the 2022 fiscal year as a whole, management has pretty high hopes for the business. Aided by higher pricing, strong organic growth, and the aforementioned acquisitions, overall sales for the year should climb by between 11% and 13%. At the midpoint, that would imply revenue of $5.77 billion. The company also expects EBITDA to come in at between $1.395 billion and $1.425 billion. If we apply growth from this to the other profitability metrics, then we should anticipate adjusted operating cash flow of roughly $1.15 billion. This would make shares a bit cheaper than they were last year. On a price to adjusted operating cash flow basis, the company is trading at a multiple of 18.2. Using 2021 results, this number would be higher at 21.5. Meanwhile, the EV to EBITDA Multiple for the firm should be around 15.9. That stacks up favorably against the 18.8 reading we get to using 2021 figures. As part of my analysis, I did compare the company to five similar businesses. On a price to operating cash flow basis, these companies range from a low of 15.1 to a high of 25.7. And when it comes to the EV to EBITDA approach, the range should be from 12.6 to 21.9. In both scenarios, only one of the five firms was cheaper than Ingersoll Rand.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Ingersoll Rand | 18.2 | 15.9 |

| Otis Worldwide (OTIS) | 20.4 | 16.6 |

| Fortive Corporation (FTV) | 19.2 | 18.2 |

| Dover Corporation (DOV) | 15.1 | 12.6 |

| Xylem (XYL) | 25.7 | 21.9 |

| IDEX Corporation (IEX) | 25.3 | 19.5 |

Takeaway

By pretty much every measure, Ingersoll Rand is doing well to deliver value for its investors. Long term, I don’t see that picture changing for the worse. If anything, that picture will probably only get better. On top of that, shares are declining in price and are looking cheaper from a valuation perspective. Add on to that the fact that management is actively reinvesting the cash into its investors, partially through share buybacks with the purchase of 3.5 million shares totaling $153 million in the latest quarter alone, and the overall trajectory for the company is definitely positive. Shares are also cheap relative to similar players, but they aren’t quite cheap enough for me to consider this a ‘buy’. This is not to say that the company is far off that mark. If shares fall just a bit further or fundamentals improve even more, I could see myself increasing my rating on the company. But for now, a ‘hold’ is what I feel most comfortable with.

Be the first to comment