kupicoo

Given these difficult times, you might think that value retailers would be thriving. But not every company is built the same and the economic picture is more complicated than that. To see what I mean, we need only look at Ollie’s Bargain Outlet Holdings (NASDAQ:OLLI), an extreme value retailer of brand name merchandise that focuses on a variety of products ranging from housewares, to bed and bath products, to food, to floorcoverings, and so much more. Even though management continues to add physical locations, comparable store sales have taken a beating. Profits have declined significantly and the price at which shares are trading, from the perspective of a valuation, has increased. Eventually, the picture for the business will likely improve. But in the near term, the company could experience additional pain. Once we return to the kind of profitability the business experienced back in 2020, upside potential for investors could be decent. But given recent changes, I cannot yet upgrade the company from a ‘hold’ to a ‘buy’.

Difficult times

Back in February of 2021, I wrote an article that took somewhat of a neutral stance on Ollie’s Bargain Outlet. At that time, I acknowledged that the company had proven itself to be a quality retailer for investors to consider. I recognized that its historical performance had been attractive and that the future for the company was likely bright. However, I could not yet bring myself to rate the company a ‘buy’ because of the firm’s historical volatility and the multiples at which it was trading. At the end of the day, I ended up rating it a ‘hold’, reflecting my belief that it would likely perform similarly to what the market would perform for the foreseeable future. Since then, a great deal has changed. Although the COVID-19 pandemic has largely wound down, high inflation, rising interest rates, and other economic concerns, have all caused uncertainty and have impacted many companies in a negative way. Even though the S&P 500 is up by 8% since the time of that article’s publication, shares of Ollie’s Bargain Outlet have generated a loss for investors of 30.8%.

Sometimes, a decline in share price is completely unwarranted or only partially warranted. This is not one of those times. The fact of the matter is that the fundamental picture for the company has worsened over the past year and a half. Consider, for instance, how the company ended its 2021 fiscal year. Revenue for that year came in at $1.75 billion. That represents a modest decline of 3.1% over the $1.81 billion generated just one year earlier. It’s not so much the decline that matters as it is where the decline came from. Comparable store sales for the company declined by 11.1% in 2021. Management said that this decline came in part because of a decrease in the number of transactions. At the same time, however, the average transaction size for the company increased, with sales of the health and beauty aids, housewares, and bed and bath departments significantly declining due to the prior year’s surge of COVID-related personal protective equipment, cleaning supplies, and home-related sales. Meanwhile, the number of stores the company had in operation increased from 388 to 431. Although the increase in store count is an indicator of the company’s long-term potential, the drop in comparable store sales will negatively affect any retailer’s margins rather considerably.

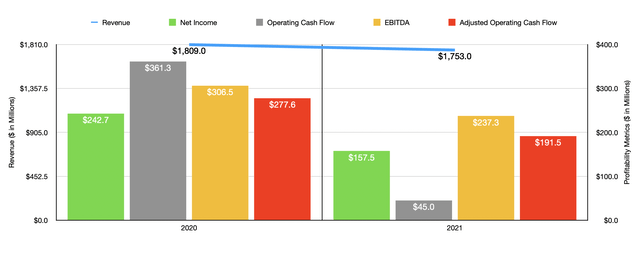

As a result of this modest decline in revenue, net income fell 35.1% from $242.7 million to $157.5 million. Operating cash flow fared even worse, plunging from $361.3 million to $45 million. If we adjust for changes in working capital, the picture was only slightly better, with the metric falling from $277.6 million to $191.5 million. Finally, we have EBITDA. According to management, this metric ended the year in 2021 at $237.3 million. That’s down from the $306.5 million generated just one year earlier.

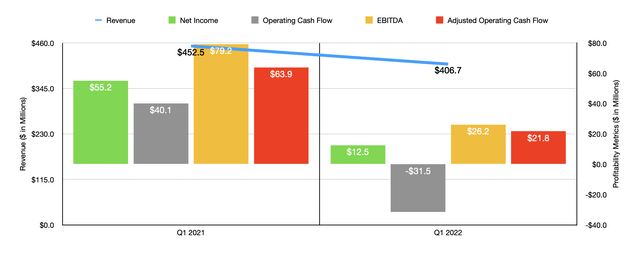

As bad as the weakness in 2021 was, the 2022 fiscal year has proven to be even worse. Revenue in the first quarter of the year, for instance, has come in at $406.7 million. That’s 10.1% lower than the $452.5 million generated one year earlier. Once again, comparable store sales took a beating, plunging by 17.3% year over year even as the number of stores rose from 397 to 493. Thanks to this pain on the top line, profitability contracted severely, with net income plunging from $55.2 million to $12.5 million. Operating cash flow turned from a positive $40.1 million to a negative $31.5 million. If we adjust for changes in working capital, it would have dropped from $63.9 million to $21.8 million. And over that same window of time, EBITDA also dropped, declining from $79.2 million to $26.2 million.

When it comes to the 2022 fiscal year, management now expects revenue to be between $1.87 billion and $1.90 billion. Although this does represent an increase over what the company achieved in 2021, it will only be because of an increase in store count of between 46 and 48 locations, including two that are relocations. Interestingly, it should also come at a time when management is forecasting some improvement, year over year, in comparable store sales. I say this because, if all goes well, comparable store sales should drop by no more than 2% and may even come in flat. Of course, that does seem difficult to believe in the current environment. But it’s also true that management knows their business better than we do. In terms of profitability, the company expects adjusted net income of between $115 million and $125 million. No guidance was given when it came to other profitability metrics. But if we assume that they will change at the same rate that net income should, then we should anticipate adjusted operating cash flow of $145.9 million and EBITDA of $180.8 million.

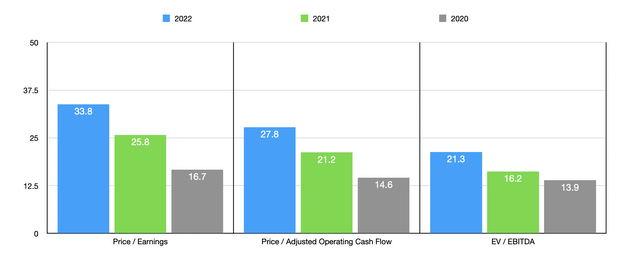

Using these estimates, we can calculate that the company is trading at a forward price-to-earnings multiple of 33.8. This is up from the 25.8 reading that we get using 2021 results and compares unfavorably to the 16.7 multiple that we get using 2020’s results. The price to adjusted operating cash flow multiple, meanwhile, should come in at around 27.8. That stacks up against the 21.2 reading we get when it comes to 2021 and the 14.6 reading we get using data from 2020. Meanwhile, the EV to EBITDA multiple should come in at around 21.3. Using 2021 figures, that reading would be 16.2, while using the 2020 figures it would be 13.9. As part of my analysis, I also compared the company to five similar firms. On a forward basis, these companies saw their price-to-earnings multiples at between 10.5 and 20.7. In this case, Ollie’s Bargain Outlet was the most expensive of the group. The price to operating cash flow multiples for these firms should range between 4.5 and 29.4, with three of the four businesses with positive results cheaper than our prospect. And finally, using the EV to EBITDA approach, the range should be between 6.7 and 38.6. In this scenario, four of the companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Ollie’s Bargain Outlet Holdings | 33.8 | 27.8 | 21.3 |

| B&M European Value Retail S.A. (OTCPK:BMRRY) | 11.0 | 4.5 | 7.8 |

| Ryohin Keikaku (OTCPK:RYKKY) | 16.7 | N/A | 6.7 |

| MINISO Group Holding Limited (MNSO) | 20.7 | 14.9 | 6.9 |

| Franchise Group (FRG) | 15.1 | 29.4 | 9.9 |

| Big Lots (BIG) | 10.5 | 7.4 | 38.6 |

Takeaway

Based on all the data provided, it seems to me as though Ollie’s Bargain Outlet is having a difficult time but that the rest of this year should show some signs of improvement. Having said that, the company will have to make a full recovery to at least 2020 levels of bottom line results before shares really look attractive. Long term, with the company expected to add between 50 and 55 new stores each year, with the ultimate goal of rising to 1,050 locations, I have no doubt that this will eventually come to pass. But given how the company is priced both on an absolute basis and relative to similar firms, and the uncertainty about the near term, I feel a ‘hold’ rating is more appropriate at this time.

Be the first to comment