Gustavo Caballero/Getty Images Entertainment

It is the 25th anniversary of female-powered Build-A-Bear Workshop, Inc. (NYSE:BBW), improving its top and bottom line since 2021. It ended its financial year of 2021 with its most profitable performance. The first half of this year has built on this success, and the financials indicate the company has a lot more upside potential and is on its way to bigger and better numbers. Sales are growing by targeting a wider audience, higher brand recognition through strategic licensing agreements, digitalisation and improved store locations. The price is currently trading at a very attractive valuation of $13.87, roughly 33% lower than at the start of the year.

Stock Activity over 5 Years (SeekingAlpha.com)

The Q2 2022 results have proven that the company has solid fundamentals, and Build-A-Bear has a historically high-performing Q4. Although cautious of above-average freight costs, cyclical sales cycles typically deliver weaker results in Q3 and very little insider buying activity in the past years. The company is on target to produce solid annual results, and there is confidence in the historically higher second half of the year results with sales driving anniversary events, momentum from the Honey Girls movie, and the benefits of coat-tailing much larger brands. Therefore, I recommend that investors take a bullish stance on this seemingly undervalued company.

Background

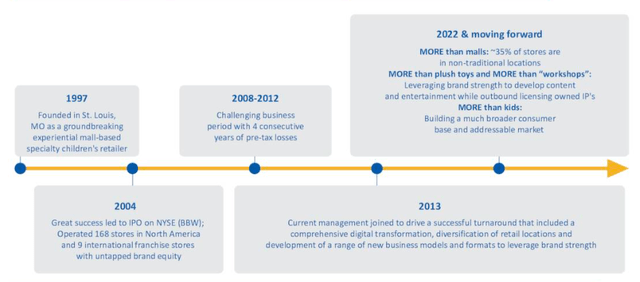

BBW was founded in 1997 by Maxine Clark in Missouri. It has grown from a brick-and-mortar, mall-based experience retailer that allowed children to make personalised stuffed animals to an international offering targeting adults and children through a diverse range of non-traditional locations, business models and expanding its digital presence. This year is a landmark year not only in performance but it’s also in the company’s 25th anniversary. Special events have been organised throughout the year to acknowledge the company’s growth, success and female-dominated workforce.

Company timeline (Investor Presentation 2022)

BBW has broadened its reach by opening locations in family-centric tourist sites, which now account for 35% and workshops within larger stores such as Walmart (WMT). Today there are near 500 store locations and over 3500 employees working for the company. It has made some significant changes to its core business, which is also why I believe there is considerable growth potential. As we can see in the image below, the company has severely broadened its reach locally and internationally through corporate, third-party and franchise store business models.

US and International Business Models (Investor Presentation 2022)

It has invested heavily in its digital capabilities, licensing agreements with many much larger and more established brands, and broadened its business model to increase the number of targeted customer segments and product categories on offer. Although economic uncertainty looms, toys and gifts have shown resilience through uncertain times.

Upgrading the digital platform in 2016 has significantly impacted the customer base. They have started entering the digital gaming world. Most recently, the BBW has signed an agreement with PetSmart store locations to introduce their pet toys at these locations.

Financials and Valuation

The company has just released a solid second quarterly performance and an impressive first half a year performance. It has record-setting numbers for total revenues and profitability. The company had total revenue of $218.3 million, an increase of 17% over the previous year, and the net income was $20 million, an increase of 16% versus the first half of 2021. EBITDA was $32.1 million, an increase of 11.46%

There has been an overall increase in sales and a higher number of retail visitors in 2022. Furthermore, online sales have increased by 180% since 2019. Twelve new retail workshops have opened since the start of the fiscal year. The company has a goal of 20 recent locations by year-end.

There are some key ratios to look at when considering a company in the retail sector. First, we will begin with the current and quick ratios, which should ideally be above one. Due to the seasonality of the business, it is always good to have cash and liquid assets available for unplanned events and cyclical fluctuations. BBW has solid short-term liquidity at a ratio of 1.31. However, it has a quick ratio of only 0.29, which is in line with the industry average of 0.3 but does indicate that the company would have to sell assets rather than use cash and accounts receivable for immediate liquidity.

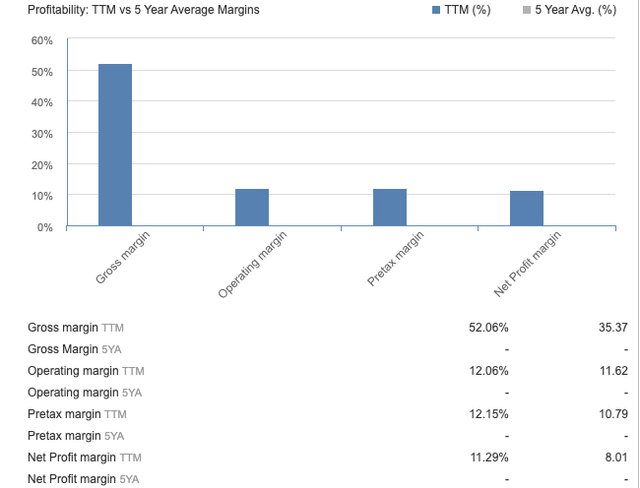

Next, we will look at the gross profit margin and the ROA. Retail companies are reliant on inventory to make money. All items in retail companies are inventory items. Thus gross profit margin and ROA relate to every item in the store. As shown below, BBW has a gross margin of 52.06%, well above the industry average of 35.37%. The company has a ROA of 18.98%, versus the industry average of 15.8%.

BBW versus Industry Average Margins (Investing.com)

Lastly, the valuation for BBW is very attractive. It is trading at a low forward price-to-earnings ratio of 4.95. Generating value for shareholders is one of the company’s key goals. The company has initiated a share repurchase program of up to $50 million by August 2025.

Risks and Uncertainties

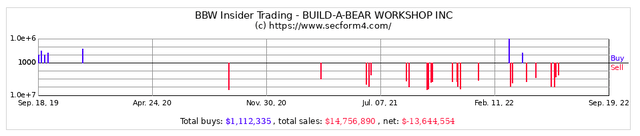

We cannot ignore some of the risks. One aspect of being cautious is the higher freight costs and other inflationary pressures that are expected to continue into the latter half of the year. The company has taken on these costs by increasing prices to maintain a respectable margin. However, this remains a challenge because of the competitive environment of the toy industry. Supply chain disruption has caused never before seen increases in costs, and the current geopolitical climate will not disappear shortly. Another aspect is that over the last three years, there has been very little buying activity within the company, especially compared to the high insider trading activities seen in the chart below. A small positive sign is that there has been some buying activity this year, for the first time since 2019.

BBW Insider Trading (Secform4.com)

Final Thoughts

BBW has strengthened its brand through some strategic alliances. Baby Yoda and Pokemon are two examples of products doing exceptionally well online and offline. The products are appealing to children but also adults as collectables. The products are available in a growing number of traditional and non-traditional locations. The company currently has a tiny market cap of $204.25 million but is riding on the coattails of much more extensive and well-recognised brands through its growing number of strategic alliances. With a solid financial first quarter and management confident about its performance for the rest of the year, I think there is a lot to be excited about for this undervalued stock and would recommend that investors take a bullish stance on this company.

Be the first to comment