Hispanolistic/E+ via Getty Images

Co-produced with Hidden Opportunities

In 2007, Consumer Reports wrote an article about the 1st generation Apple iPhone, describing it as “The world in the palm of your hands.” 15 years later, technology has dramatically improved interconnectivity. 2020 proved just how much we could do from our homes, that would have been unthinkable 20 years ago.

An entire sector of companies in the financial market, the technology sector, provides fabulous growth opportunities for investors. However, these companies generally opt to redirect profits back into the company for growth and expansion instead of paying dividends to shareholders. This makes them a non-starter for income investors.

Broadband and wireless internet are modern utilities – an essential requirement in our daily lives and the basis of our interaction with most technology. Fortunately for income investors, internet connectivity providers are great dividend payers.

This industry in the U.S. has significant competitive advantages, mainly due to its high barrier to entry for new players. Significant capital is required to set up, maintain, and upgrade the necessary infrastructure to provide coverage, quality, and reliability.

We love dividends, and we like these wide-moat businesses that have inelastic demand for their services. So today, we discuss two picks with yields up to 6.2%* from the telecom industry. Without further ado, let us now review these picks.

Pick #1: AT&T, Yield 6.2%*

In the 1950s, Marjorie Bradt’s father gifted her around $6000 (~$57,572 today) worth of stock in a company. She never added anything to this position through the years nor made any withdrawals. All she did was enable dividend reinvestment with her broker and let time and the company management do their job (source: “The Ultimate Dividend Investor” – Josh Peters)

By 1999, this position blossomed into equity within ten companies worth over $1 million (~$1,711,187 today), an impressive 8% CAGR over 40 years (adjusted for inflation). The company, you guessed it, was AT&T (T).

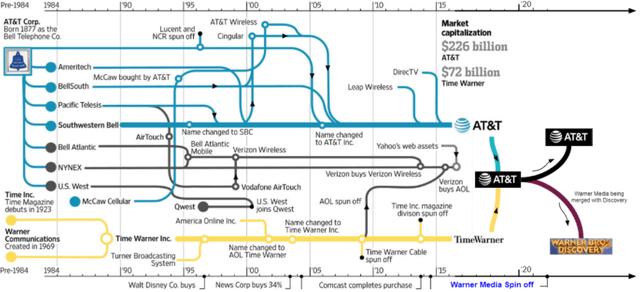

For over a century, AT&T has made acquisitions to grow, and divestitures to regain focus on the core offerings. (Source: theverge & modified by author)

The organization’s logo, business approach, revenue composition, and leadership have changed with time, but one thing has remained constant – its value creation for shareholders.

If you had purchased $10,000 worth of T stock in September 2007 (unfortunate timing, right?), you would have collected $7,815 in dividend payments to date ($12,341 if you reinvested the dividends). Not so unfortunate!

Interestingly, many T investors would have felt like they have been left holding the bag on several occasions in its 136-year history. When you invest in a quality dividend stock, you are rarely left holding the bag. Those consistent dividend payments improve your financial flexibility during challenging market conditions.

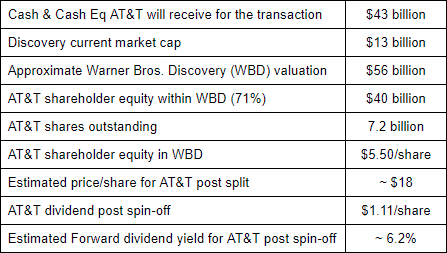

Mr. Market doesn’t like change, and this isn’t the first time he is reacting negatively to a transaction announcement from AT&T. The company is pursuing a significant change, a $43 billion transaction involving the sale of Warner Media to Discovery (DISCA), and the stock has been down 28% since the announcement. There is a severe negative perception due to its transaction-related dividend reduction. While that sounds bad on the surface, let us do a back-of-the-napkin valuation of this deal to demonstrate how undervalued the company is today.

Author Calculations

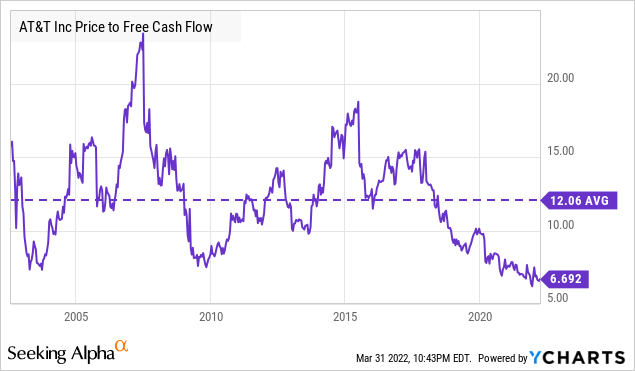

AT&T projects $16 billion FCF in 2022. At the estimated $17.70/share (current T price minus 0.24x DISCA price), the post-spin-off company has an 8x price/FCF valuation. This is significantly lower than T’s 20-year average multiple.

As with most spin-offs, the value-unlock opportunity is massively misunderstood, and the company is significantly undervalued. Many investors sold off when it was announced the dividend would be reduced. Many others are simply sitting on the sidelines, waiting to buy after the spin-off.

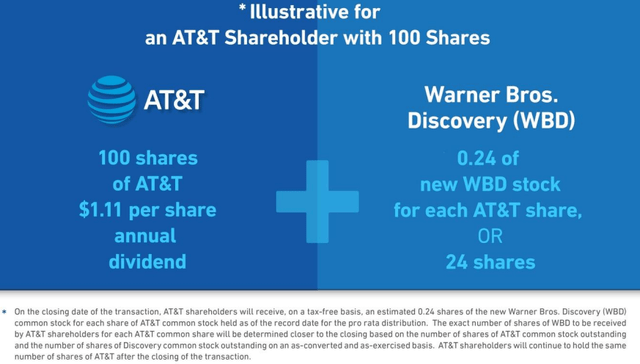

Discovery doesn’t currently pay dividends, and we don’t expect WBD to be a dividend-payer either. Post-split, T shareholders will receive 24 WBD shares for every 100 T shares. (Source: AT&T shareholder letter)

As a long-term investor, you have two options.

1. The income method: Sell WBD shares and deploy the proceeds into T or another dividend-paying security to preserve the income from your existing T position.

Our experience with special situations like this tells us that WBD shares are likely to experience a sharp sell-off when they become available for trading. This is because AT&T is a highly popular stock for most pension plans and fixed-income funds. As such, several funds that receive WBD shares will dispose of them immediately since the non-dividend-paying security does not fit in their portfolio. If you plan to sell WBD shares following the spin-off, you may have to wait for a favorable opportunity to avoid losing too much value.

2. The income-growth hybrid: Keep T shares for dividend income and retain WBD, one of the largest global media companies with a strong portfolio of entertainment, sports, and news assets.

Spin-offs present terrific value-unlock opportunities because a high-growth entity may get neither the leadership’s focus nor the respect from Mr. Market for a premium valuation. As a separate company, WBD will be a $56 billion company and is expected to have $52 billion in revenue in 2023. Using a very conservative 20% EBITDA margin (lower than CMCSA, PARAA, and DIS), we estimate WBD to have ~$10 billion EBITDA. WBD could present a significantly underpriced opportunity.

AT&T projects that they will eliminate ~$48 billion in net debt by the end of 2023, bringing their net debt to EBITDA ratio to around 2.5x. This will make the wireless company the least leveraged compared with T-Mobile (TMUS) and Verizon (VZ). This financial improvement positions T well to invest in its cash-producing, moat-expanding 5G and fiber assets. T will continue to be a business with significant cash-flow. Selling off WBD will provide cash upfront to deleverage, while also allowing T to focus more on its core business. We expect the dividend will grow with FCF.

“Two Way” Trading

April 4th is the “ex-dividend” date when T shareholders become entitled to the new WBD shares, although the exact date of the transaction closing isn’t known yet.

Starting on April 4th, T shares will have “two-way trading”, meaning that there will be temporary tickers allowing investors to buy or sell T with or without the spin-off shares. If you trade T on April 4th or later, up to the closing date, you will have three ticker options:

- T: Under the regular ticker, you are buying or selling both the original T plus the right to receive 0.24 shares of WBD.

- T WI: Shareholders who sell this ticker are selling only a share of the original T, and are maintaining ownership of the right to receive 0.24 shares of WBD.

- WBDWV: Shareholders who sell this ticker are selling only the right to receive the shares of WBD. They will retain shares of the original T.

Note that trades of T WI, and WBDWV will not settle until after the deal closes. If the deal doesn’t close for any reason, these trades will be reversed.

Telecom is a cash-rich business to own and take advantage of widening tech adoption among American consumers. The Warner Media spin-off introduces lucrative opportunities for long-term investors. Being income investors, we prefer to stick with T. We expect annual dividend growth and a valuation recovery after the spin-off.

If you wish to avoid the drama associated with this transaction (or already have a full allocation to T, there are other methods to take advantage of this wide-moat sector. We recently wrote an article outlining a bullish outlook for Verizon Wireless. Our next pick is a safe, income-oriented pick from the Canadian market.

Pick #2 BCE, Yield 5.3%

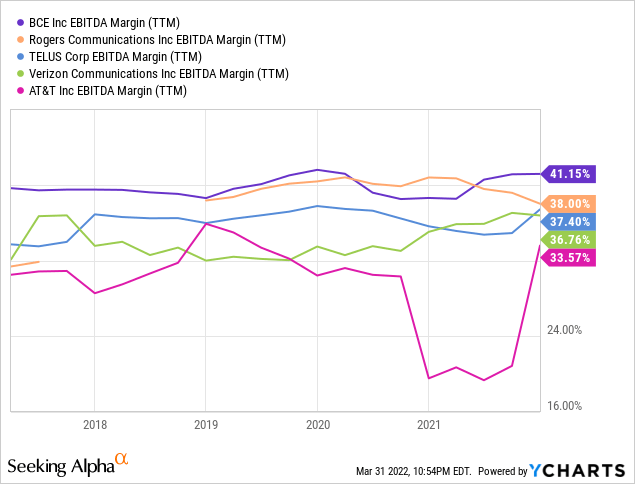

Telecom is one of the most dependable sectors in Canada, and the major companies’ stocks are safe buys in a market correction. The telecom oligopoly created in Canada by BCE Inc. (BCE), Rogers Communications (RCI), and TELUS (TU) has allowed the companies to consistently maintain higher EBITDA margins when compared to peers in the U.S.

U.S. Consumers seeking simple wireless services without fancy bells and whistles often choose Mobile Virtual Network Operators (‘MVNO’) like Boost Mobile, Google Fi (GOOG), Lycamobile, etc. These MVNOs can purchase wireless connectivity at wholesale rates from more prominent companies that own, operate, and maintain this expensive infrastructure. MVNOs thus offer highly competitive pricing to customers. But our neighbor to the north has tight restrictions on who can be an MVNO, effectively limiting the entry of smaller players. Big three telecoms thus have a strong oligopoly in Canada with the federal government’s backing.

BCE is Canada’s largest communications company and the leader in 5G coverage and speeds. Canada is in the process of relaxing COVID-19 travel requirements and restrictions. BCE reported higher Q4 roaming revenues in its wireless segment, and we expect the Average Revenue Per Unit (‘ARPU’) to improve in 2022 as more Canadians pursue international travel. Another high-growth segment is Bell Media. The company reported 35% higher YoY digital revenues in 2021, representing 20% of total Bell Media revenue. BCE holds exclusive licensing to air all original content from HBO Max through its Crave streaming platform and FibeTV which are spearheading Bell Media’s growth.

BCE paid its first dividend in 1881 and has maintained a phenomenal streak with no missed dividend payments for over 140 years. BCE has sustained 14 years of consecutive dividend increases of at least 5%, meaning your annual income grows comfortably and automatically. BCE currently yields above its 10-year average, and this opportunity won’t last.

Dividend Note:

-

This quarter BCE announced a 5.1% increase in the quarterly dividend to C$0.92/share (equivalent to US$0.736 as of 3/1). This means, for a US$55.46 stock price, the yield calculates to 5.3%

-

BCE pays dividends in Canadian Dollars, and the dividend payment to U.S. investors is subject to variation due to USD-CAD conversion rates.

-

The US-Canada tax treaty allows U.S. investors to collect dividend payments from Canadian securities within IRAs without withholding taxes.

BCE represents the best in Canadian telecom, a highly defensive segment to seek shelter in a volatile market.

Conclusion

Technology is constantly changing, and our dependence on it is growing. Today, on average, global smartphone users consume ~11 G.B./month. In North America, it is forecast to reach 53 G.B./month by the end of 2027. We may all be working, shopping, traveling, and dining in the metaverse. I don’t know which companies will be leading in delivering those services and experiences. What I do know, is that the need for reliable internet is set to grow, and the companies providing this have a significant competitive advantage.

Telecom is the means to connect users with technology and is the backbone of the digital ecosystem. The good news for us is that telecom is a dividend-friendly sector. These companies are often seen as a bastion for conservative investors because of their comparatively high dividends and stable businesses. This article discusses two powerful dividend payers from the telecom sector with yields up to 6.2%. With such picks in your portfolio, you can collect income from the growing tech adoption without worrying about picking the right company that will dominate in the next best thing ever. The world is indeed in the palm of your hands – only if there is internet!

Be the first to comment