guvendemir/E+ via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on April 1st.

Real Estate Weekly Outlook

U.S. equity markets advanced for the third-straight week as solid employment data relieved some immediate recession concerns, but kept the pressure on the Federal Reserve to maintain its hawkish pivot toward more restrictive monetary policy. Bond investors were sounding the growth alarm, however, suggesting that the Fed may be so far “behind the curve” that it effectively missed the economic cycle entirely. Calling to mind the famous “Because I Was Inverted” scene from Top Gun, all were on the yield curve following a rare inversion of the 10-2 Treasury yield spread – a dynamic that has historically occurred in the final stages of an economic and Fed rate hike cycle.

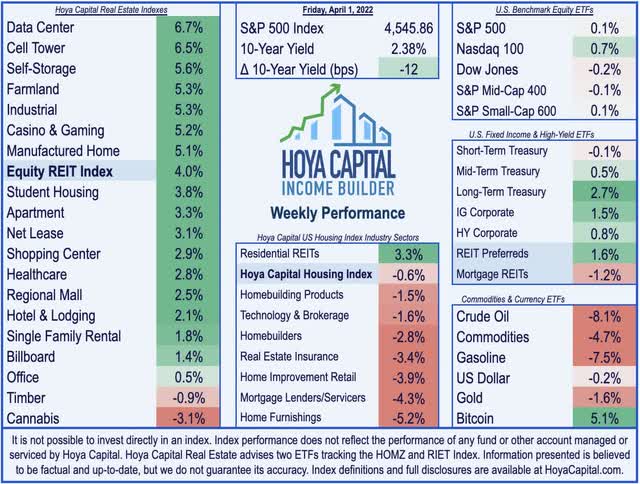

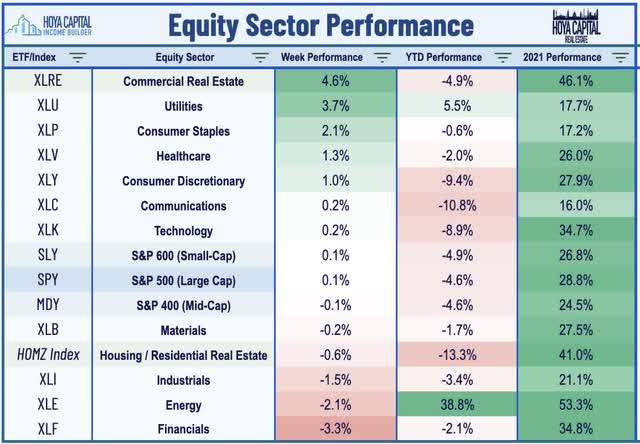

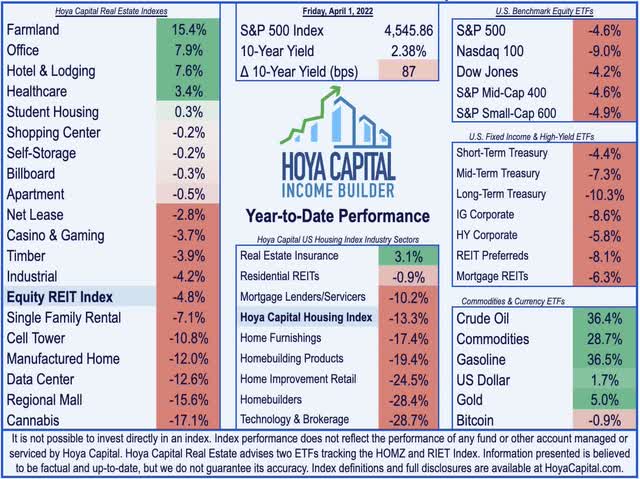

Gaining for the third-straight week – but still positing its worst quarterly performance since April 2020 – the S&P 500 edged higher by 0.1% on the week and the tech-heavy Nasdaq 100 gained 0.7%, but the gains were “top-heavy” once again as the Mid-Cap 400 slipped 0.1%. Buoyed by moderating rates at the long-end of the curve, real estate equities posted their best week in over a year as the Equity REIT Index rallied 4.0% with 17-of-19 property sectors in positive territory while Mortgage REITs slipped 1.2%.

Commodities were under pressure following reports of mild progress on peace talks between Russia and Ukraine, renewed COVID concerns in China and domestically, and plans to release 1 million barrels of oil per day from the strategic oil reserve. Crude Oil (CL1:COM) prices plunged by more than 8% to below $99/barrel while the broader Commodities (DJP) index slipped by nearly 5%. After briefly climbing above 2.50% earlier in the week, the 10-Year Treasury Yield closed the week at 2.38% while the 2-Year Treasury Yield closed at 2.46% resulting in the lowest spread on the 10-2 yield curve since early 2007 when the curve bottomed at negative 19 basis points.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

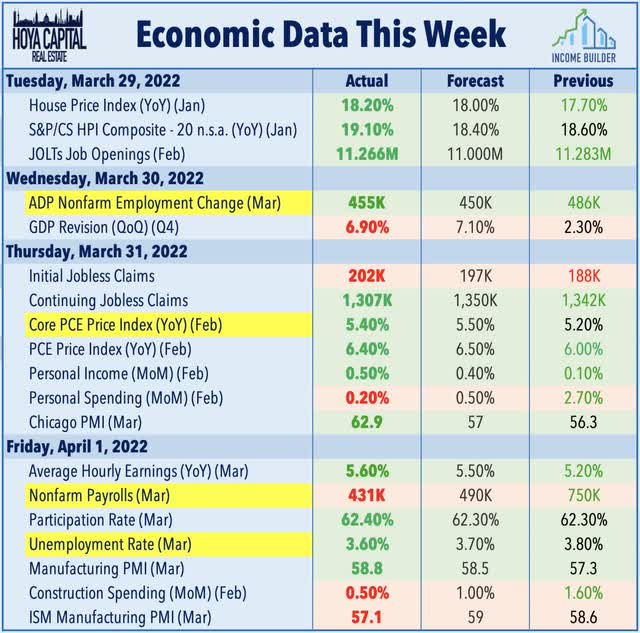

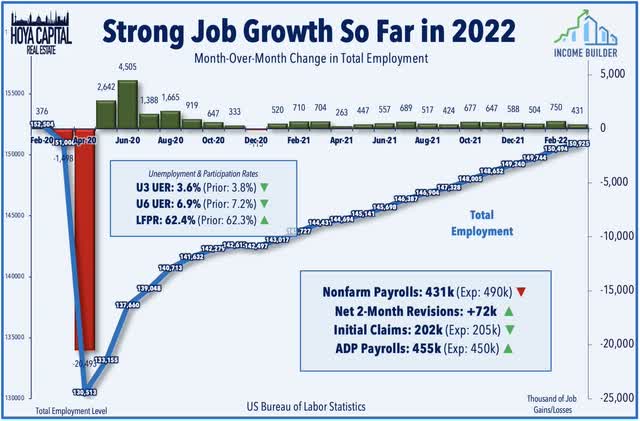

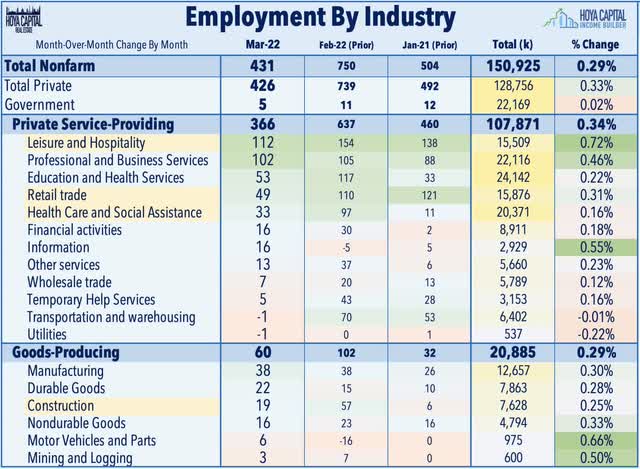

The Bureau of Labor Statistics reported this week that the U.S. economy added 431k jobs in March – slightly below expectations of roughly 490k – but nevertheless, a very solid report which indicated the U.S. labor market remains a notable source of strength amid a myriad of concerns over inflation and geopolitics. The solid report followed a stronger-than-expected ADP Payrolls report earlier in the week which showed job gains of 455k in March and strong Initial Jobless Claims data, which remained near the lowest level of 2022. Average hourly earnings rose $0.13/hour in March or 0.4%, roughly in line with estimates, but less than half of the 0.8% rise in inflation last month.

In March, the unemployment rate edged down to 3.6%, and the number of unemployed persons decreased by 318,000 to 6.0 million. In March 2020, prior to the coronavirus (COVID-19) pandemic, the unemployment rate was 3.5%, and the number of unemployed persons was 5.7 million. Notable job gains continued in leisure and hospitality, professional and business services, retail trade, and manufacturing. Employment in construction continued to trend up in March (+19,000) and has returned to its February 2020 level. Also notable – 10.0% of employed persons teleworked because of the coronavirus pandemic, down from 13.0% in the prior month as the long-awaited “return to the office” appears to be picking up some steam in recent weeks.

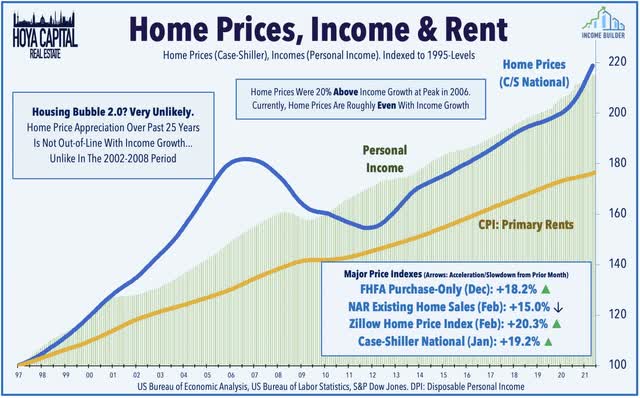

After cooling off slightly at the end of last year, home values continued rising at robust rates in early 2022 as the effects of tight supply and strong demand – and the “staggering” surge in rental rates – are counteracting the headwinds from rising mortgage rates. Home prices nationally rose 19.2% year over year in January, up from 18.9% in December. Similar to the trends seen in 2018 when rising mortgage rates resulted in a notable near-term slowdown in buying activity which was followed by a robust recovery, the longer-term outlook for the housing industry remains highly promising as demographic-driven growth in household formations, combined with the lingering housing shortage resulting from a decade of underbuilding, remain long-term tailwinds for the housing industry. We commented on the effects of rising mortgage rates on the U.S. housing market in an article published on Forbes this week.

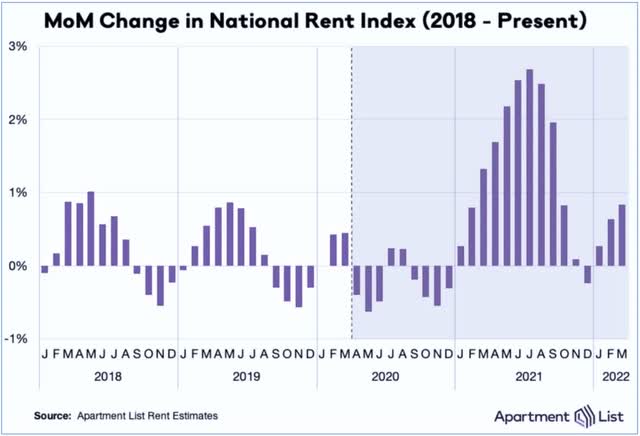

Equity REIT & Homebuilder Week In Review

Apartments: S&P announced that Camden Property (CPT) – which we own in the Income Builder REIT Portfolio – rallied 4% after S&P announced that CPT will be added to the S&P 500 on April 4th, becoming the 29th REIT included in the large-cap benchmark. We also saw fresh rent data from Apartment List which showed an acceleration in rents following a brief seasonal cooldown. Year-over-year rent growth currently stands at a “staggering” 17.1%. Zumper’s National Rent Report, meanwhile, showed that through the first three months of the year, 2022’s national rent growth is outpacing 2021’s rent growth with an annualized growth rate of 10% in Q1.

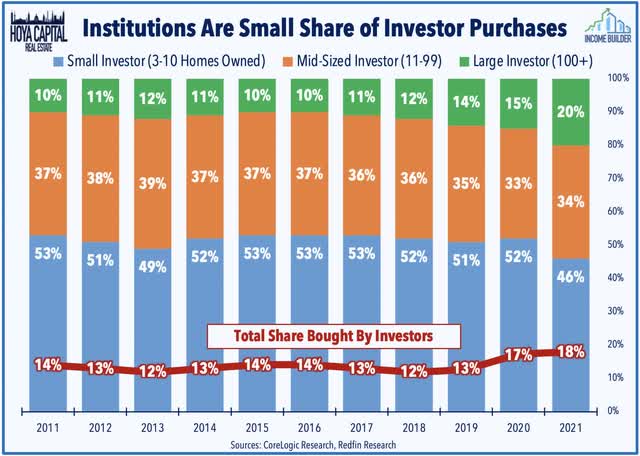

Single-Family Rental: Speaking of soaring rents, this week we published Renting The American Dream. Single-Family Rental REITs have been one of the best performing property sectors since their emergence onto the scene in the mid-2010s, outperforming the REIT Index for three straight years entering 2022. Too much demand, and not enough housing supply: Powered by the historic surge in rents, SFR REITs reported earnings growth of nearly 20% last year and have delivered dividend growth of over 30% per year since 2019. We believe that the three SFR REITs – Invitation Homes (INVH), American Homes (AMH), and Tricon (TCN) are uniquely positioned to benefit from the broader trend of “institutionalization” in the single-family housing industry and one that we see as a positive development for both renters and investors alike.

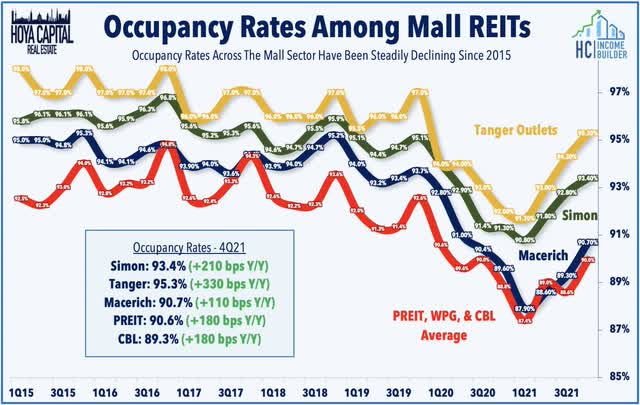

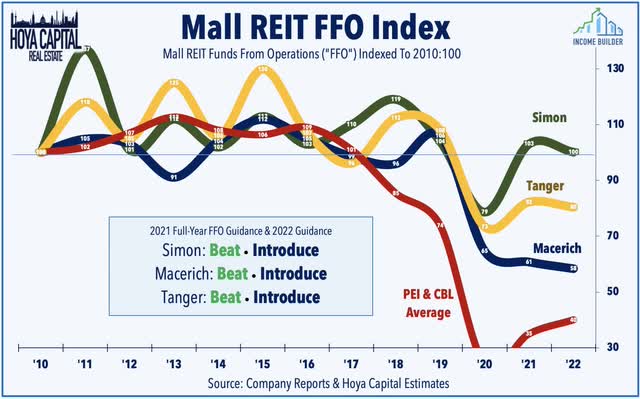

Malls: Troubled mall REIT CBL & Associates Properties (CBL) – which emerged from bankruptcy last November – advanced 6% on the week after reporting Q4 results which included a couple of encouraging indicators as occupancy and leasing metrics both showed notable signs of improvement. Total portfolio occupancy increased for the third-straight quarter to just shy of 90%. Leasing spread on renewals improved from -12.2% in Q3 to -1.5%, but was still lower by more than 12% for the year, indicating that it’s still too soon to call a bottom to the steep decline in Class B & C mall rental rates. As discussed in Last Mall Standing, the mall sector continues to be bifurcated between the Class A malls – which have performed decently well – and then everyone else.

On that note, Seritage Growth (SRG) – which emerged from the Sears bankruptcy and now owns 170 properties in primarily Class B and C mall locations – announced it will no longer be a REIT, effective immediately. Seritage is more than 65% below its IPO price in 2015 but has rallied more than 12% over the past month after announcing that it’s pursuing a potential sale of the company. Pennsylvania Real Estate (PEI) dipped another 8% this week and is now lower by nearly 40% on the year despite providing a fairly upbeat update on the performance of its portfolio. For PEI, investors wonder if it’s “too little too late” as interest expenses on debt service accounted for 43% of revenues in 2021, up from 32% in 2020 and the firm reiterated in its Q4 report that its credit facility prevents the payment of dividends with the exception of those needed to maintain its REIT status.

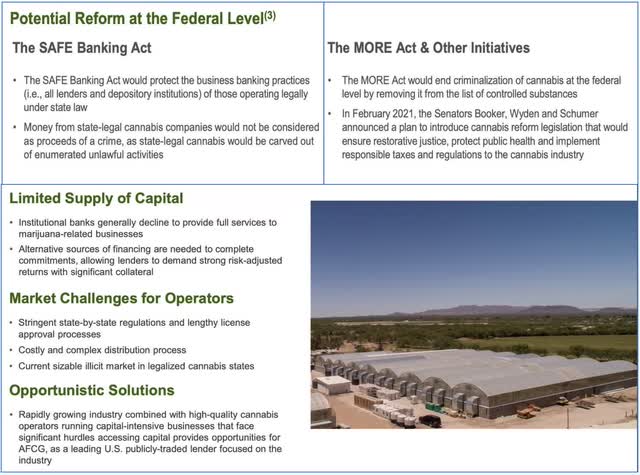

Cannabis: Power REIT (PW) dipped more than 10% on the week after reporting a significant miss on Core FFO at $0.35 versus $0.82 estimated in its February 2022 Investor Deck last month due to “one-time” write-offs. Fellow cannabis REIT Innovative Industrial (IIPR) gained 1% on the week despite launching a secondary equity offering of 1,000,000 common shares to fund future acquisitions. Sticking in the cannabis sector, as anticipated in our Cannabis REIT report published last week, the U.S. House of Representatives passed legislation on Friday to legalize marijuana nationwide, but the bill is widely expected to fail to clear the 60 vote threshold to pass through the Senate. In a vote seen as more political than practical, cannabis industry executives have expressed frustration with Congressional Democrats for failing to act on measures with bipartisan support such as the SAFE Banking Act.

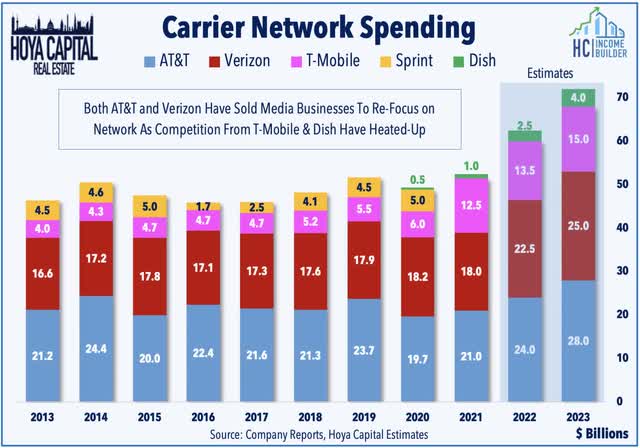

Cell Tower: This week, we also published Cell Tower REITs: 5G Is Coming, But Not That Fast. A perennial performance leader in the real estate sector, cell tower REITs have uncharacteristically lagged this year, dipping into “bear market” territory for just the second time in history. Several factors are behind the recent cell tower slump including potential competition from Low-Earth-Orbit satellite networks, delays in 5G deployment related to airline interference, rising rates, and broader tech-related weakness. 5G build-outs have so far focused on equipment upgrades at macro towers for broad mobile coverage, but small-cell deployment – necessary for “true” 5G speeds” has lagged amid local regulatory challenges and challenging unit economics.

Mortgage REIT Week in Review

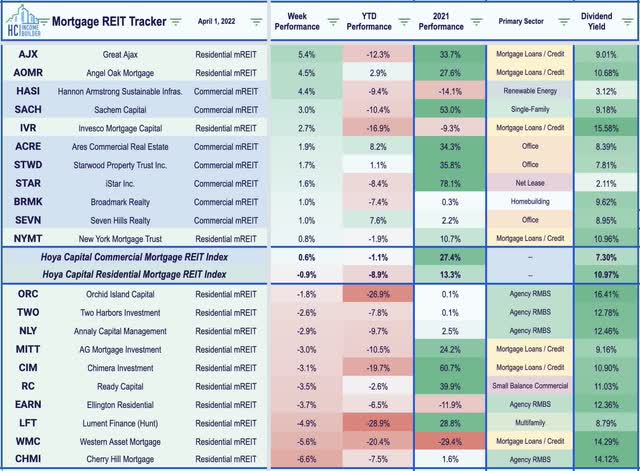

Mortgage REITs were mixed on the week despite the yield curve inversion as commercial mREITs advanced 0.6% while residential mREITs slipped 0.9%. On the upside this week, Sachem Capital (SACH) advanced 3% after reporting solid Q4 results and keeping its quarterly dividend steady at $0.12/share, representing a forward yield of 9.4%. Invesco Mortgage (IVR) was also among the leaders after holding its quarterly dividend steady at $0.09/share, representing a forward yield of 15.8%. The average residential mREIT pays a dividend yield of 10.97% while the average commercial mREIT pays a dividend yield of 7.30%.

REIT Preferreds & Capital Raising

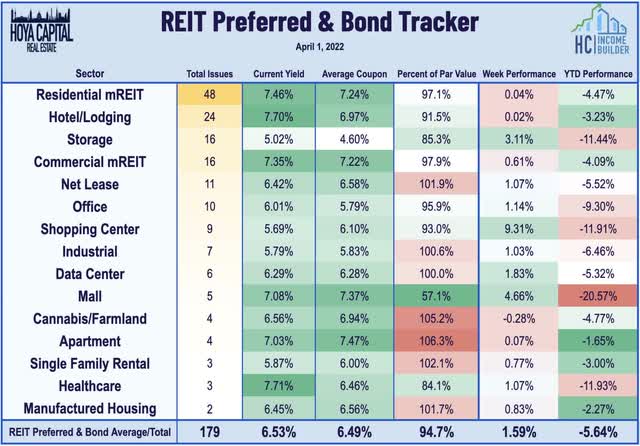

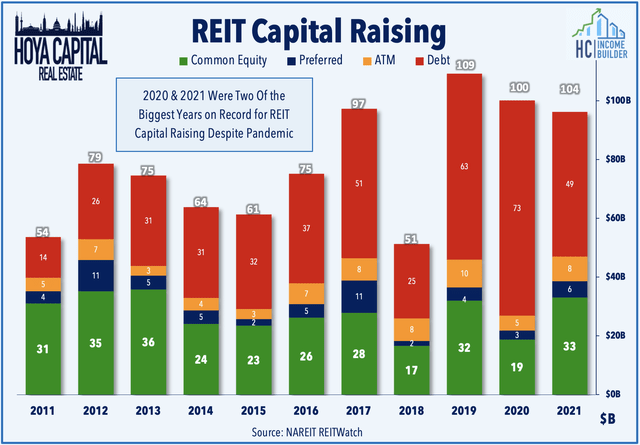

REIT Preferred stocks advanced 1.59% this week and are now off by 5.6% on the year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. This week, American Homes (AMH) priced $600M of 3.625% senior notes due 2032 and $300M of 4.30% senior notes due 2052 and noted that it intends to use the proceeds, in part, to redeem its Series F (AMH.PF) preferred shares and/or other preferred shares. Per our Income Builder Preferred Tracker, its Series F Preferred has an initial call date of April 24th while it’s Series G Preferred (AMH.PG) has a call date of July 17th.

REITs were active in the capital markets this week. A pair of REITs broke the $1B mark as American Tower (AMT) priced $650M of 3.65% senior notes due 2027 and $650M of 4.05% senior notes due 2032 while Equinix (EQIX) priced $1.2B of 3.90% senior notes due 2032. Elsewhere, Welltower (WELL) priced $550M of 3.85% notes due 2032. A pair of REITs launched foreign bond offerings – Digital Realty (DLR) closed on a $108M offering of 0.600% Swiss bonds due 2023 and $162M of 1.700% Swiss bonds due 2027 while Realty Income (O) priced a private placement of £140M senior notes due 2030, £345M senior notes due 2032, and £115M senior notes due 2037

2022 Performance Check-Up & 2021 Review

Through thirteen weeks of 2022, Equity REITs are now lower by 4.8% this year on a price return basis while Mortgage REITs have slipped 6.3%. This compares with the 4.6% decline on the S&P 500 and the 4.6% decline on the S&P Mid-Cap 400. Dragged on the downside by the regional mall and data center sectors, 14-of-19 REIT sectors are now in negative territory for the year. At 2.38%, the 10-Year Treasury Yield has climbed 87 basis points since the start of the year and is now closer to its post-Great Financial Crisis peak of 3.25% reached in October 2018 than its August 2020 low of 0.52%.

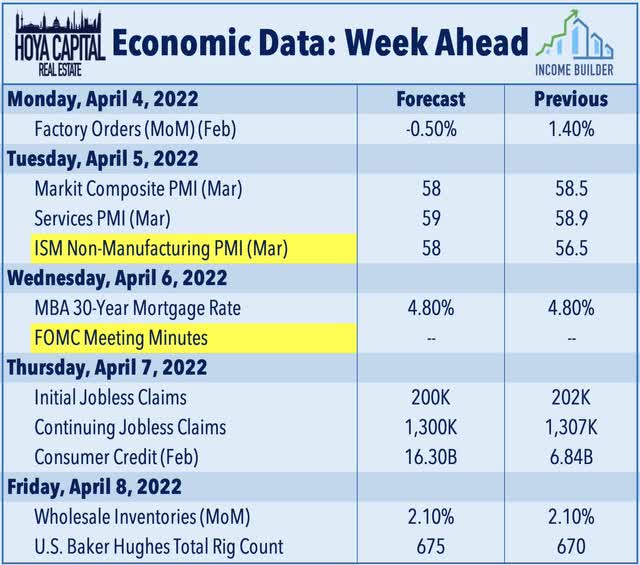

Economic Calendar In The Week Ahead

The economic calendar slows down in the week ahead. We’ll be watching Purchasing Managers’ Index (“PMI”) data throughout the week and the Baker Hughes Rig Count on Friday for indications on whether U.S. oil and gas production is accelerating to address the surge in global energy prices. Investors will also be reviewing the minute from the Federal Open Market Committee meeting from the March 16th policy decision in which the FOMC raised the Fed Funds rate for the first time since 2018.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment