8vFanI/iStock via Getty Images

We initially added FS KKR Capital Corp. II (FSKR) to the HDS+ portfolio back in late April 2021 as an undervalued play on its upcoming merger with sister BDC FS KKR Capital Corp. (NYSE:FSK) in Q2 2021.The merger was completed in mid June 2021, with the new entity trading under the FSK ticker. It has delivered a ~25% total return, with a roughly even split between price gains and distributions:

Hidden Dividend Stocks Plus

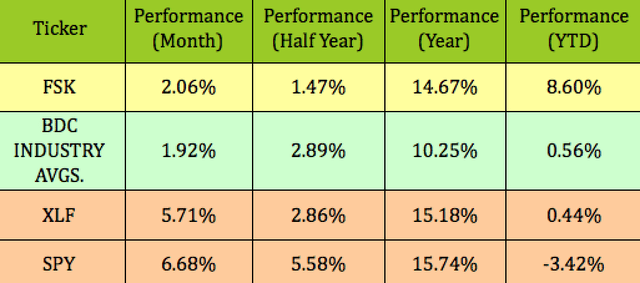

FSK has outperformed the S&P and the BDC industry so far in 2022. It trails the broad financial sector slightly over the past year, but has outperformed it in 2022. Over the past year, FSK has outperformed the BDC industry, while slightly trailing the financial sector and the S&P. However, if you add FSK’s 10% – 11% yield to the mix, it has provided a better return than the Financial sector and the S&P 500:

Hidden Dividend Stocks Plus

Profile:

FSK holds the #2 spot in the BDC industry, with a $6.5B market cap.

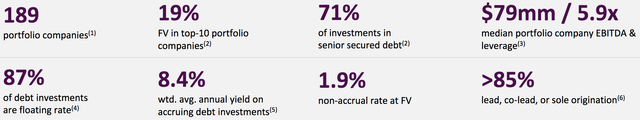

FSK has a $16.1B portfolio, of which 71% was invested in 1st and 2nd Lien senior secured securities, as of 12/31/22. The median portfolio company has $79M in EBITDA, with 5.9X leverage.

FSK’s non-accrual rate is 1.9%, favorably on the low side for the BDC industry. It improved in Q4 ’21, vs. a 3.7% figure in Q3 ’21. Two investments were restructured during Q4 ’21, and removed from non-accrual status.

FSK site

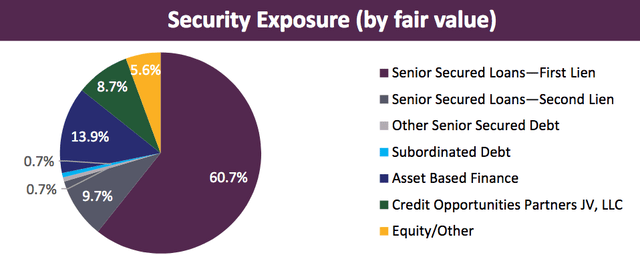

FSK also holds ~14% in Asset-based Finance investments, 5.6% in Equity holdings, and a JV, Credit Opportunities Partners.

FSK site

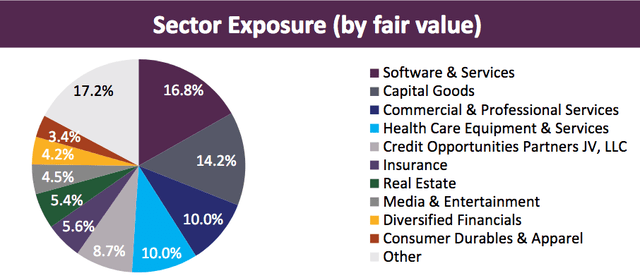

The JV comprises 17.2% of FSK’s sector exposure, followed by Software & Services, at 16.8%, Capital Goods, at 14.2%, Commercial & Professional, and Healthcare Equipment & Services, both at 10%, with the 32% remainder split between several sectors.

FSK site

JV:

The JV is a partnership with the South Carolina Retirement Systems Group Trust – SCRS, with Equity ownership of 87.5%, for which FSK provides day-to-day administrative oversight.

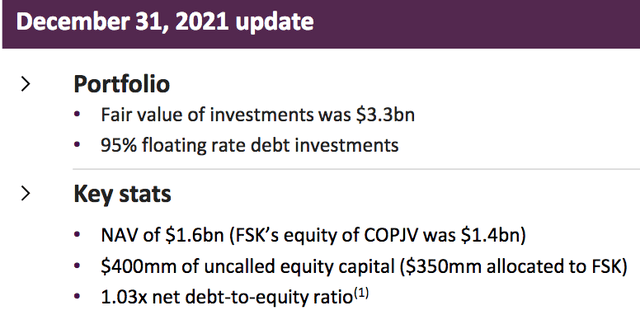

The Fair value of the JV’s investments was $3.3B, as of 12/31/21, with 95% floating rate investments. FSK had $1.4B in equity in the JV. The Net Debt/Equity ratio was 1.03X, as of 12/31/21:

FSK site

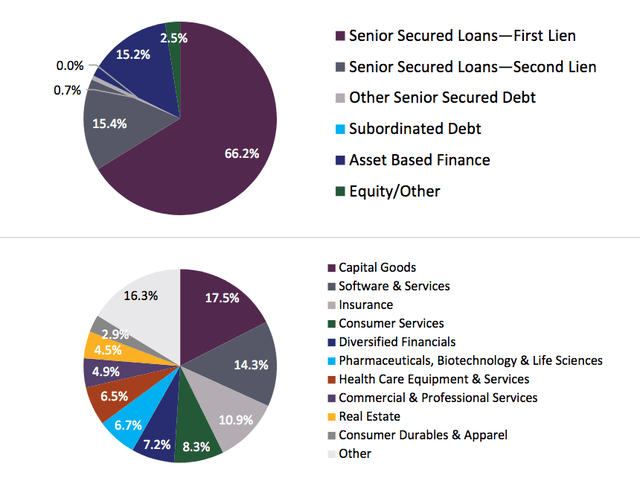

The JV holds ~66% in 1st Lien Senior Secured loans, 15.4% in 2nd Lien Senior Secured loans, and 15.2% in Asset-based Finance investments.

It looks well diversified – Capital Goods, Software & Services, and Insurance are its three biggest sector exposures, with seven other sectors comprising 41%, and 16.3% in other sectors.

FSK site

Earnings:

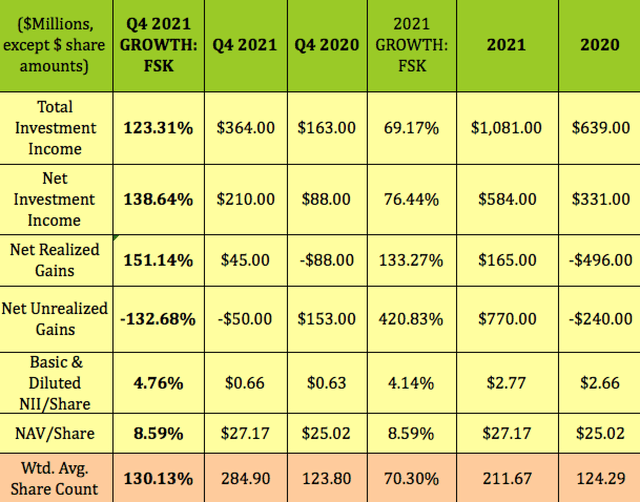

The Q4 2021 comps are quite robust, with triple-digit gains in total and net investment income. Net Realized Gains, which are lumpy on a quarterly basis, due to timing, were up 151%, while Unrealized Gains were -$50M, vs. $153M in Q4 ’20, as fair value rose big time at the end of 2020, with the economy improving. NII/Share rose 4.76% in Q4 ’21, as did NAV/Share, which rose 8.6%, to $27.17.

For full year 2021, Total Investment Income rose 69% and NII rose 76%, as the merged companies were able to ramp up income. NII/Share was up 4%, to $2.77, while Net and Unrealized Gains both had triple-digit gains, due to the easy comps from a pandemic-pressured economy in 2020:

Hidden Dividend Stocks Plus

New Business:

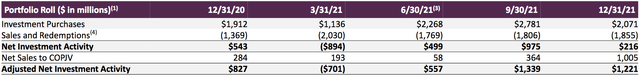

FSK’s Q4 ’21 investment purchases were $2.07B, the third straight quarter of $2B-plus activity, while its Net Investment Activity was $216M, lower than Q3 and Q2 ’21. However, there was $1B in sales to the COP JV, which raised the Adjusted Activity to $1.22B.

FSK site

Dividends:

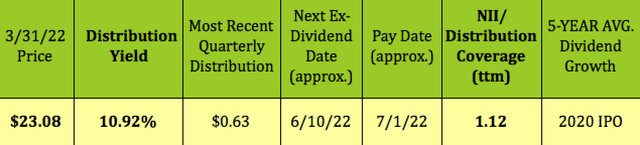

FSK pays a variable dividend. After its pre-announced Q3 ’21 dividend decline to $.62, (vs. $.65 in Q2 ’21), management raised it to $.63 in Q4 ’21.

At its intraday 3/31/22 price of $23.08, FSK yielded 10.92%. It should go ex-dividend next on ~6/10/22, with a ~ 7.1/22 pay date.

Hidden Dividend Stocks Plus

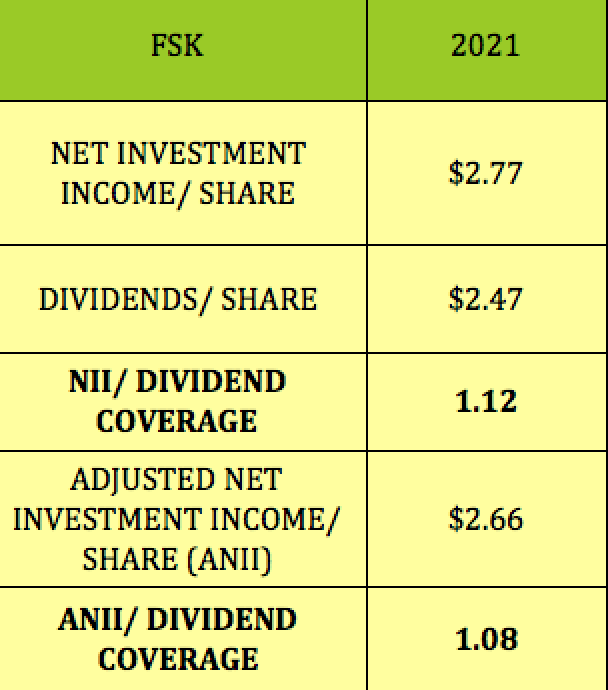

FSK’s NII/Distribution coverage was solid in 2021, at 1.12X. Adjusted NII coverage was a bit lower, at 1.08X, but still good for the BDC industry, where some BDC’s experience sub-1X coverage.

Hidden Dividend Stocks Plus

Valuations:

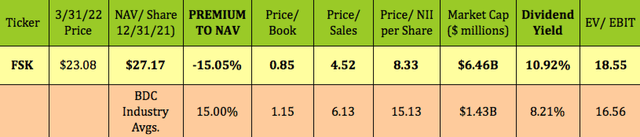

At $23.08, FSK is selling at 15% discount to its 12/31/21 NAV/Share of $27.17. Since NAV is diminished by distributions, we also track NII/Share valuations.

FSK is selling at a Price/NII of just 8.33X, a 45% discount vs. the BDC industry avg. of 15.13X. It’s also yielding much more, with a 10.92% yield, vs. 8.21% for the BDC industry.

Hidden Dividend Stocks Plus

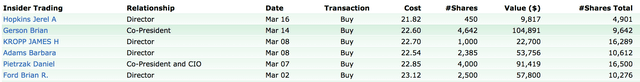

Insiders:

FSK’s insiders have continued their share-buying in March, snapping up ~15K in shares in March, after buying ~14K in November-December. Although this isn’t a big % of FSK’s share float, it’s good to see management with skin in the game.

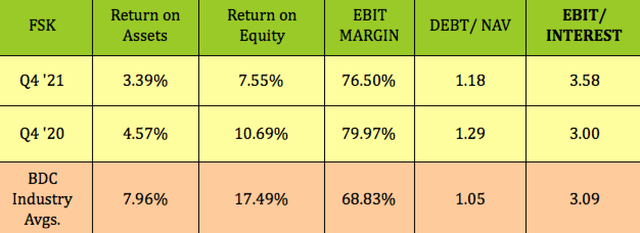

Profitability and Leverage:

FSK’s ROA and ROE both decreased in 2021, and were below BDC averages. Its EBIT Margin also declined somewhat, but remained above BDC averages. Debt leverage and Interest coverage both improved in 2021.

Hidden Dividend Stocks Plus

Debt and Liquidity:

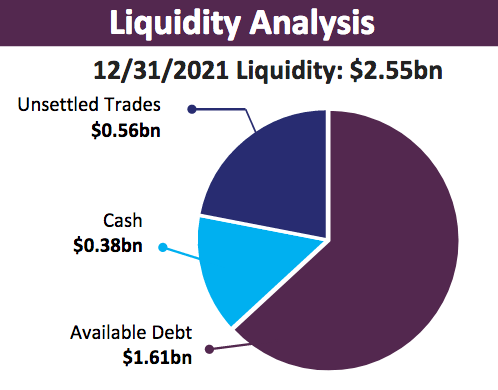

As of 12/31/21, FSK had ~$2B in available liquidity, with plenty of capital for future fundings.

FSK site

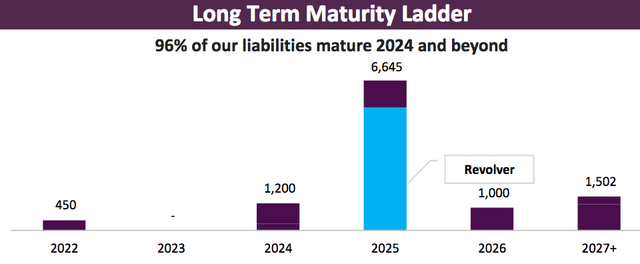

Its debt ladder looks good, with only 4% maturing in 2022, and 96% not maturing until 2024 and beyond.

FSK issued $1.65 billion of unsecured notes during 2021, with a blended coupon of 2.6% and closed on four amendments to approve the terms of various bilateral financing facilities. These activities contributed to a material decline in its weighted average cost of debt to ~3% at December 31, 2021.

Management began a $100 million share repurchase program in Q3 ’21. Through 2/25/22, FSK has repurchased ~$19 million of shares under the program.

FSK site

Analysts’ Price Targets and Upgrades:

On 3/2/22, FSK received an upgrade from Wells Fargo, which raised it from Under Weight to Equal Weight. The price target didn’t make sense though, since it was only $21.50, a 21% discount to FSK’s 12/31/21 NAV/share of $27.17.

The average and high target prices are also below the NAV/share, and appear to be lagging – they’re from Q1 and Q2 2021.

Hidden Dividend Stocks Plus

Parting Thoughts:

We rate FSK as a buy based upon its attractive, well-covered 10%-plus yield, its undervaluation on a Price/NII and Price/NAV basis, and its up-sized business scale.

All tables by Hidden Dividend Stocks Plus, except where noted.

Be the first to comment