JHVEPhoto

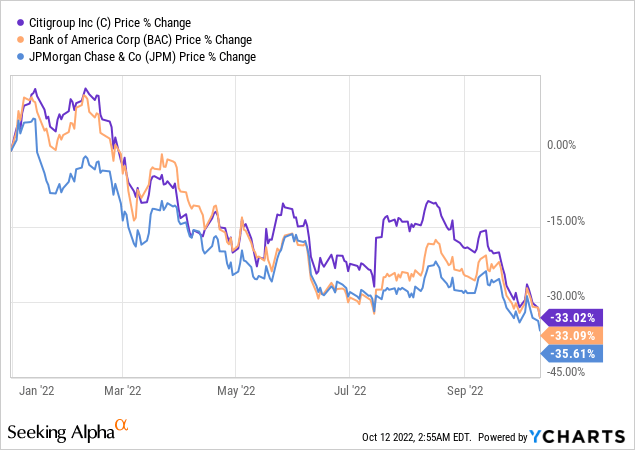

Citigroup (NYSE:C) and its large U.S. banks have sold off in recent weeks.

The culprit for the sell-off is primarily attributed to the fear of recession and more recently what appear to be potentially systemic matters relating to sovereign debt volatility in the UK.

In short, the large money-center banks are a proxy trade for such fears, even though the fundamental picture is still quite healthy and strong. Mr. Market is pricing in some serious damage to be absorbed by the financials in the short to medium term. These fears are grossly misplaced in my view, the banks are a bastion of stability in the post-GFC world, operate a low-risk business model (intermediaries mostly), and are highly capitalized and liquid. The Fed’s annual stress tests (otherwise known as CCAR) demonstrate that the banks will still have plenty of capital to spare even with a projected unemployment rate of>10% and a failure/insolvency of a major trading counterparty.

Valuation

Citigroup is the cheapest out of them all, trading at only 0.5x tangible book. The context is important as well. Citi is in the midst of a multi-year transformation where it is exiting its global consumer bank and seriously investing in its core businesses as well as in its infrastructure and controls. The strategy absolutely makes sense as Citi becomes a simpler, smaller bank without all the inefficient international baggage and should be operating in a much safer and more efficient way. Finally, it is also benefiting from strong tailwinds from interest rates whereas a 100bps parallel shift up in interest rates is forecasted to generate an incremental $2.5 billion of pre-tax income.

So in summary, there are many great things happening at Citigroup at the moment. The underlying performance and outlook remain strong, even though the share price is not reflecting this given the bear market and recessionary expectations currently.

Recession fears

This is probably the most anticipated and forecasted recession in the history of recessions. It is certainly the consensus call and the path to a soft landing seems elusive and narrowing by the day.

The main impact on Citi would likely be credit losses on the consumer Card’s unsecured lending portfolio.

How deep will the losses be in a recession?

This will largely hinge on the employment rate. If we end up at an unemployment rate of 5% to 6%, this will not have an outsized impact on Citi.

There are several reasons for this. Firstly, in the current period, Citi is running with portfolio loan losses which are at 50% of expected normalized losses. The consumer is still in a very healthy position, although a word of caution, more recent originations appear to generate a more normalized credit profile as they season. In any case, as required by the accounting standards (otherwise known as “CECL”), Citi is building up reserves upfront. I expect Citi to build some additional reserves in Q3 2022 as well.

So bottom line, if it is a garden variety recession, the financial impact from a consumer credit perspective is to a large extent already in the numbers (or shortly will be).

If however, it is a very deep and prolonged recession (say 8%+ unemployment rate), then Citi will need to build significantly more reserves. Even in that adverse scenario, Citi should remain profitable throughout and book value remains intact.

On the corporate and investment bank side (“ICG”), the business model is a low-risk one where 80% of clients are investment-grade large MNCs and much of the lending is collateralized. I expect Citi to also benefit from trading volatility as is usually the case in a downturn. Citi’s trading businesses are usefully counter-cyclical. Fortunately for Citi, unlike some of its peers such as Morgan Stanley (MS) and Barclays (BCS), it managed to side-step some of the riskier leveraged finance deals (e.g. Twitter buyout) and I don’t expect it to generate significant losses in that space either.

What to expect in Q3?

Citi’s CFO Mark Mason provided a useful update at a mid-September Barclays global financial conference.

The key takeaways for me are:

Trade and Treasury Solutions (“TTS”) is performing increasingly well and benefiting from active client engagement and most importantly from rising interest rates. Security Services should also similarly benefit from strong interest rate tailwinds. Both these businesses are accrual-like businesses that are delivering record quarterly revenues. TTS especially which is ranked the #1 global transaction bank is generating more than $3 billion of quarterly revenue and ROE approaching 30%.

The Markets business (FICC and equity trading) was forecasted to decline mid to high single-digit year on year, driven by lower equity trading. The last two weeks of the quarter were especially volatile, so Citi may perform slightly better than expected (although still very hard to predict).

The investment banking (equity and debt underwriting, M&A advisory) industry wallet is down ~50% and Citi should perform broadly in line.

On the consumer side, I expect wealth management revenue to be muted given the bear market. Whereas the cards lending portfolio has grown by a high single digit given customers’ appetite for unsecured lending has returned with a bang due to the inflationary environment. I expect Citi to build some reserves in the consumer portfolio given the uncertain macro environment.

Final thoughts

The consensus EPS for Q3 is currently $1.44.

My model suggests EPS will print in the range of $1.55-$1.60. The downside risk to my model is if Citi decides to over-build reserves ahead of the upcoming recession.

The other key metric to watch is Citi’s CET1 ratio. I expect it to end the quarter at around 12-12.2% and build towards the 13% target. The market will be very focused on the CET1 number.

If the Fed’s overnight rate will remain in the 2% to 5% range in the medium term, this provides huge tailwinds for banks like Citi. I suspect that we are not going to be back to a ZIRP anytime soon.

At 0.5x tangible book and a very sensible turnaround story, Citi remains a conviction buy.

Be the first to comment