wildpixel

Shares of 2seventy bio (NASDAQ:TSVT) have lost over 40% of their value since the company was spun off from Bluebird Bio (BLUE) in November of 2021.

Recently I listened to the Canaccord Growth Conference presentation, which convinced me this one has potential as a Core Biotech pick given sales growth for autologous BCMA-targeted CAR-T treatment Abecma with an eye toward expanding into earlier lines of therapy.

Traditionally, I have not been a fan of the auto CAR-T space, but sales growth of lead approved drugs including CD19 class of agents along with a deep pipeline and validation via big pharmaceutical partners has me optimistic that we will continue to see commercial acceleration in coming years. Additionally, 2seventy bio is pursuing more lucrative solid tumor targets with partner Regeneron (REGN) offering us multiple shots on goal.

Let’s dig deeper to better understand the degree of upside we can expect in coming years.

Chart

Figure 1: TSVT daily chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the daily chart above, we can see the ensuing decline from highs and shares trading in the $15 to $20 range since the spinoff took place in November of 2021. There is a spot of strength following the promising Q2 report, and my initial take is that readers who like the story would do well to accumulate dips in the near term.

Overview

2seventy bio is an immuno-oncology company with a focus on autologous cell therapies. They are pioneers in the space and have a first-in-class therapy (Abecma) in BCMA for treating patients with multiple myeloma.

Sales continue to ramp up thanks to partner Bristol Myers Squibb (BMY) doing the heavy lifting. 2seventy has multiple products in clinical development, each with modifications to address complex biological challenges endemic to various forms of cancer.

They were founded at the end of 2021 and are nearing the 1-year market, spun out of struggling rare disease player Bluebird Bio (BLUE) and with a sole focus on the oncology space (autologous cell therapy).

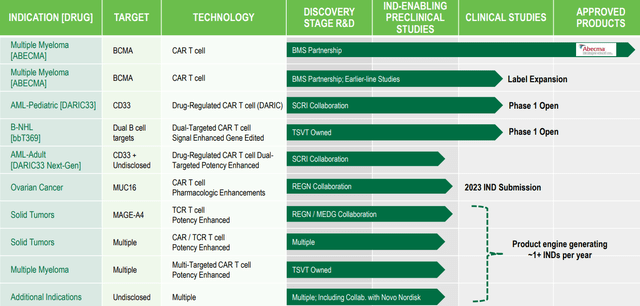

Figure 2: Pipeline (Source: corporate presentation)

Management including CEO Nick Leschly are excited about commercial momentum for Abecma, with a singular focus on getting after cancer and getting more time for patients (cultural and mission level statement for the company).

Recent news was very good with partners at BMY, as interim analysis of KARMA-3 phase 3 study in multiple myeloma (‘MM’) achieved its primary endpoint. They were able to declare success and that accelerates the program into the next steps by about a year versus what the final readout would have been (exciting for broader MM community.

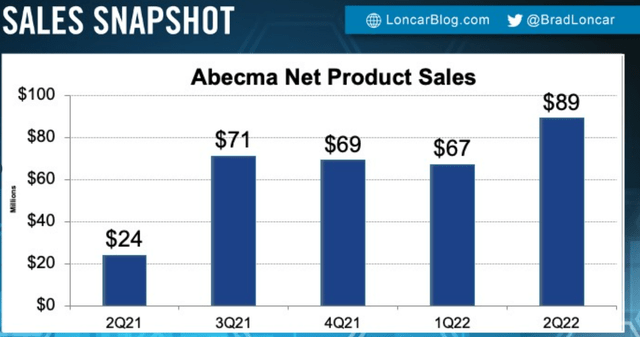

Q2 earnings showed revenue of $72M, representing 23% growth and continued demand for the product (“patients out the door”). They are investing heavily in manufacturing to increase vector capacity as well as the drug product side with partners at BMY.

The manufacturing ramp up will be key catalyst for long term growth and is an area of hyper focus for 2seventy and their partners at BMY (providing an end-to-end supply chain). The two biggest components of note are vector manufacturing and drug product manufacturing. For the vector side, they used an adherent process to generate the data that led to regulatory approval. Over time, they are migrating to a suspension process that gives them even more scale and lower cost of goods sold (COGS). Today they are an adherent system working with a third party CMO (contract manufacturing organization) and the second suite is coming online shortly. Revenue guidance this year in the US is $250M to $300M revenue (contrast that to current $600 million market capitalization). On the drug product side, that’s internal and BMY has a plant in New Jersey with multiple suites and fully trained operators making end drug product for patients. They have made step ups in terms of weekly capacity, but these are governed by the FDA so it takes time. Demand for Abecma continues to be incredibly strong and they want to get to every patient they can.

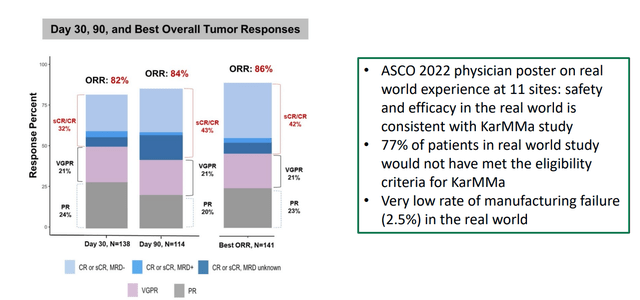

Figure 3: Abecma real-world data (Source: corporate presentation)

As for KARMA-2 and KARMA-3 studies, KARMA-3 is registration-directed and would give broad approval to 3rd-line MM (triple exposed refractory patients who are refractory to most recent treatment within the last 60 days and thus have a pretty aggressive form of the disease). Interestingly, this is the first randomized study with a control arm for a BCMA CAR-T.

For KARMA-3, they have not shared specific data yet and are reserving it for a medical meeting later this year. Next steps are to get the complete data set, share with regulators and seek approval to broaden the label.

KARMA-2 is not a registration-directed study and takes place in earlier line patients with multiple arms looking at different combinations to inform potential for earlier-line studies. Data is also coming later this year and they have conviction that the value proposition for Abecma and its role to play in MM is strengthened after the KARMA-3 data (started in 5th line disease with potential to expand into earlier lines of therapy). They are ready to commit additional capital and time to investing here. While manufacturing is very complex, over the years they expect to shave minutes, hours and eventually days off the process over time.

Moving on to the more difficult indication of pediatric and adult AML, they are pursuing the target CD33. This target has been attempted by lots of people and the DARIC approach aims to overcome prior challenges. Simply explained, CD33 is also present on normal healthy myeloid cells and thus elimination of all myeloid cells is not something patients would tolerate for long. To solve that problem they designed regulated CAR-Ts that allow them to turn it on in the presence of drug, CAR-T attacks and eliminates CD33+ cells on both the tumor and normal cells. From there, they can withdraw drug to allow the myeloid cell compartment to be reconstituted from the bone marrow (this occurs much faster in pediatric patients). They started first with pediatric AML to evaluate if they can turn the system on, withdraw drug and see whether myeloid cell compartment truly returns. These kids have more vigorous hematopoietic systems and thus this is ideal as opposed to starting in adults. The study uses a standard dose-escalation design with respect to cells and fixed dose with respect to rapamycin. The schedule will incorporate conditioning, they provide the cells and wait 48 hours before providing rapamycin to allow the cells to distribute around the body appropriately prior to initiation of CAR-T activation. Then, they keep T-cells on for 3 weeks (period chosen because literature shows 3 weeks is as long as you get that rapid CAR-T proliferation, starts to peak then). At 3 weeks they withdraw rapamycin, allowing the physician the opportunity 2 weeks later to choose whether to reinitiate rapamycin or not. This is a late-line approach to patients who have run out of options and the standard course is to get them to transplant as they hopefully see reconstitution of myeloid component). Principal objectives of the trial are safety and efficacy and again they leave the decision to the physician of what to do after the initial course of drug (on/off). As for enrollment criteria, they are allowing for patients previously exposed to a CD33 agent. This is because their binder recognizes the C2 domain of CD33, an invariant region to genotype of patient whereas other approved binders recognize a different epitope of CD33 that is dependent on the genotype (in other words, the genotype 2seventy has chosen should be present in every patient). Initial data is expected by the end of the year, but beware this will be in a low number of patients as the study uses a classic 3+3 design. The goal is to accumulate enough evidence to show that the DARIC system can be consistently and predictably turned on and off and this will take time. It sounds to me that this data set could be postponed to 2023, as they wish to wait until they have a meaningful block of data.

Moving on to bbT369 targeting CD79A and CD20, they are pursuing B-NHL which is an area where CD19 CAR-T cells have been playing for some time. They are not targeting CD19 because patients exposed to these CD19-targeted CAR-Ts experience loss of antigen on those T cells. Management is realistic that they are coming into a patient population very likely to be exposed to at least one CD19-directed treatment, and thus they need a therapy that is immune to changes that could occur relative to CD19. One mode of failure is loss or reduction in expression of one antigen, so the solution is to get deeper and more consistent responses via a dual-targeted CAR-T. They chose antigens that have an identical expression profile of CD19, expressed on almost every B cell and the construct is designed to be an oragate binding to either CD79A or CD20 which should be sufficient for T-cell to kill. They used gene editing as well to knock out the SYBL B gene, an intrinsic checkpoint inhibitor that reduces the ability of the cell to get angry when it sees the antigen. This also has a beneficial impact on durability and persistence of functional T-cells, allowing them to maintain functional T-cell response for longer. Essentially, this candidate is designed to address known mechanisms of failure of the current CD19 CAR-Ts. Commercially, it’s not supposed to fit in at the end and hopefully data will be robust enough to displace other approaches and head into earlier lines of therapy (I remain skeptical as the competitive landscape is quite crowded).

The company also has other programs in the clinic and they recognize the need for flexibility early on in the development process. They continue to build out phase 1 manufacturing capability designed to support early-stage studies and give them maximum control, which will be important to build on in the future. Longer term, as the pipeline matures and advances into registration, they are big believers in “captive manufacturing” whether going it solo or with a big pharma partner.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $398M as compared to a net loss of $77M. Research and development expenses rose slightly to $68M, while SG&A fell to $17M. BMS reported $72M of total US revenues for Abecma in Q2, with collaboration loss for 2seventy of $4.3M. They are guiding for US Abecma revenues for full year 2022 of $250M to $300M. Additionally, the company is increasing net cash spend guidance for the full year to $245M to $265M (1.5 years operational runway by my estimation, on the conservative side). Management, on the other hand, is guiding for cash runway into 2025.

Figure 4: Abecma net product sales chart (Source: Brad Loncar)

As for institutional investors of note, this one seems under owned by well known funds we follow and I like the contrarian potential that this implies. CEO Nick Leschly has some skin in the game with over 550,000 shares owned.

As for the management team, several members have highly significant and relevant prior experience in the cell therapy space. Chief Technology & Manufacturing Officer Susan Abu-Absi served prior in Global Product Development & Supply at Bristol-Myers Squibb. Chief Medical Officer Steven Berstein served prior as Chair Immuno-Oncology Translational Research and Development at BMY as well. Head of Clinical Development Kevin Chin served at BMY with development of ipilimumab and nivolumab in the immuno-oncology space. Chief Operating Officer Nicola Heffron served prior on the Global Myeloid Commercial Team at Celgene.

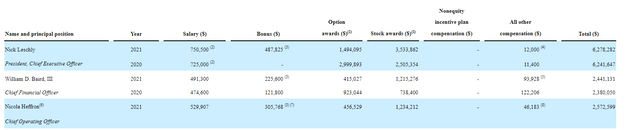

As for executive compensation, cash component seems a tad excessive for a company this small, but on the other hand stock awards compensate for this by being reasonably-sized.

Figure 5: Executive compensation table (Source: corporate presentation)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

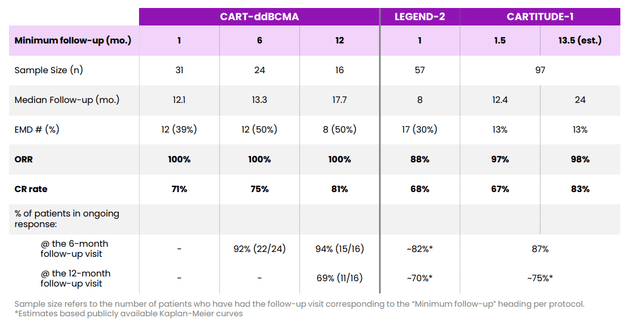

As for competition, I note that versus Johnson & Johnson’s (JNJ) BCMA CAR-T Carvykti there is a point of differentiation in manufacturing failure rate (1.5% for Abecma versus 18% for Carvykti). Projected sales for Carvykti by 2026 are thought to be in excess of $1.5 billion and I imagine Abecma can do similar. I also think that Arcellx’s (ACLX) CART-ddBCMA appears to be the “best-in-class” BCMA-targeted CART in multiple myeloma (see my August 24 article), but again they are a number of years behind in the race.

Figure 6: CART-ddBCMA versus LEGEND response over time (Source: corporate presentation)

There are also quite a few bispecific antibodies targeting BCMA (and other novel targets in MM) in development that have posted respectable response rates and are much easier to manufacture (teclistimab, REGN-5458, elranatamab, talquetamab, cevostamab and TNB-383B come to mind initially).

As for IP, the company has a vigorous position with 11 patent families including two issued US patents, 13 pending US patent applications and 62 corresponding foreign patent applications related to their gene-editing platform. They expect the issued composition of matter patent to expire in 2038 (excluding possible patent term extensions). They expect any composition of matter or methods patents, if issued, to expire in 2041.

As for other nuggets, while I did not spend much time on solid tumor efforts the MUC1 CAR-T has potential to address 80% of ovarian cancers and is part of the strategic collaboration with Regeneron designed to minimize off-target toxicity and incorporates a proprietary binder from the larger partner.

Final Thoughts

To conclude, at enterprise value of $200M this autologous CAR-T player looks attractive and appears to fit our criteria for Core Biotech. I see analyst price targets in the $38 to $41 range, implying multi-fold upside from present levels based on growth in the multiple myeloma space aided by first-to-market advantage with ability for Abecma to expand into earlier lines of therapy. Investors also receive significant optionality via the company’s multi-faceted pipeline targeting additional heme indications as well as the solid tumor collaboration with Regeneron.

For readers who are interested in the story and have done their due diligence, TSVT is a Buy and I suggest accumulating a full-size position in the near term.

From a Core Biotech perspective (emphasis on next 3 to 5 years), I can see the rationale for accumulating a position in Q3 or Q4 if cash is freed up from the portfolio (whether another company gets bought out as was the case with previous winner CCXI or we could take partial profits in multiple names to free up space). On the other hand, I already have exposure to the cell therapy space via allogeneic competitor Fate Therapeutics (FATE) (still 3-5+ years away from market), so I am not likely to sell current holdings to make room in the meantime.

As for risks, my key concern is growing competition in the autologous CAR-T space as well as within the target BCMA. Novel approaches and targets, including bispecifics and allogeneic CAR-T, are doing their best to supplant autologous BCMA CAR-Ts and that’s something to keep an eye on in coming years. Given current cash burn I would expect additional dilution by year end or Q1 2023 at the earliest. Manufacturing and supply challenges are a cause for concern or at least a risk factor worth considering as well.

Be the first to comment