jbk_photography

By The Valuentum Team

Mastercard Incorporated (NYSE:MA) operates in an incredibly lucrative industry supported by secular tailwinds as the world shifts away from cash to card, seen through the proliferation of e-commerce (which is expected to continue in earnest over the long haul), the rollout of tap-to-pay options, and other contactless payment options, and the desire for certain governments to push societies to utilize more efficient payment methods.

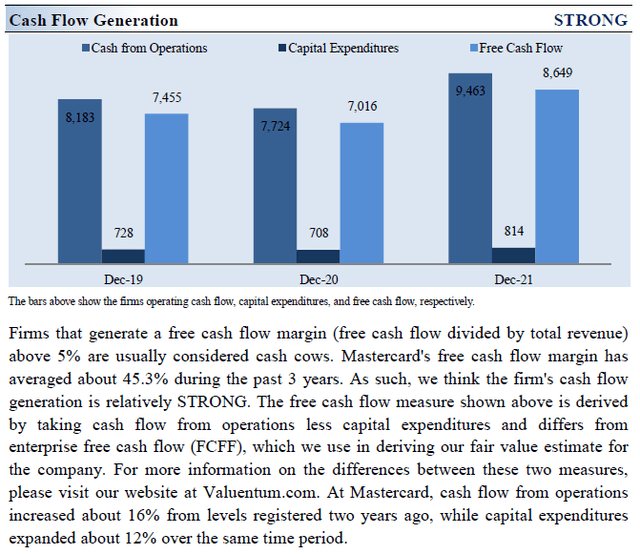

The company’s business model is asset-light, meaning it requires a relatively modest amount of capital expenditures to maintain a given level of revenues. In turn, that better allows Mastercard to generate substantial free cash flows (defined as net operating cash flows less capital expenditures). We view Mastercard’s capital appreciation upside quite favorably, with its dividend growth potential offering incremental upside.

Under our enterprise cash flow analysis process, which we will cover in detail in this article, we assign Mastercard a fair value estimate of $371 per share, well above where shares of MA are trading at as of this writing. Additionally, shares of MA yield a modest ~0.6% as of this writing. The stock trades at ~$330 per share at the time of this writing.

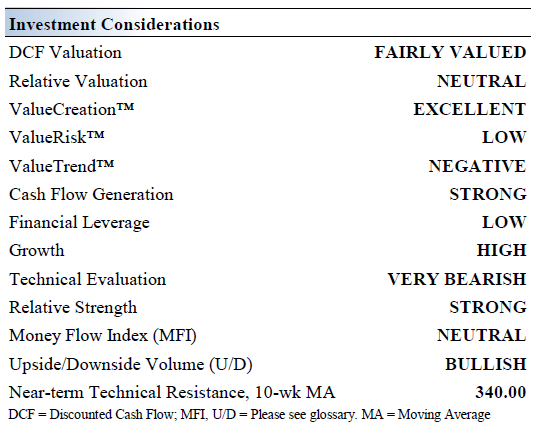

Mastercard’s Key Investment Considerations

Image Source: Valuentum

Mastercard is a payments industry leader. Every day, the firm’s network makes payments happen. It doesn’t issue cards, set interest rates or establish annual fees. Mastercard generates revenue by charging fees to issuers and acquirers for providing transaction processing and other payment-related services based on the gross dollar volume of activity.

Our cash flow model assumes Mastercard grows its revenues by double-digits annually and significantly expands its operating margins over the coming years. Should the firm stumble for any reason, its intrinsic value would face significant headwinds.

The larger secular trend moving society towards electronic payments accelerated during the COVID-19 pandemic due to surging e-commerce demand and the rise of contactless payment options (such as tap to pay). Going forward, technological advances and demand for adjacent services will continue to drive growth opportunities for MasterCard, and these secular growth tailwinds underpin the firm’s very promising outlook.

Mastercard benefits from one of the strongest competitive advantages out there – the network effect. As more consumers use credit/debit cards, more merchants accept them, thereby creating a virtuous cycle. Mastercard does not take on credit risk as it is not a bank, one of the reasons why we like the firm as this shields Mastercard from credit quality concerns. International travel activities are slowly recovering from the worst of the COVID-19 pandemic which supports Mastercard’s outlook.

Earnings Update

On July 28, Mastercard reported second quarter 2022 earnings that beat both consensus top- and bottom-line estimates. Additionally, the firm boosted its revenue growth guidance for 2022 during its latest earnings update, something we will cover later on in this article.

The firm’s GAAP revenues rose by 21% year-over-year in the second quarter to reach $5.5 billion as Mastercard benefited from robust consumer spending patterns and its GAAP operating income rose by 29% year-over-year as economies of scale drove Mastercard’s operating margins higher. Rising net income and a lower outstanding diluted share count offset a higher provision for corporate income taxes, which enabled Mastercard to grow its GAAP diluted EPS rose by 13% year-over-year in the second quarter. The company has been firing on all-cylinders of late.

Mastercard exited June 2022 with a net debt load of $8.1 billion on the books (inclusive of current investments and short-term debt, exclusive of restricted cash). However, its $6.4 billion in cash and cash-like assets on hand at the end of this period provides the firm with more than enough liquidity to meet its near term funding needs.

During the first half of 2022, Mastercard generated $3.8 billion in free cash flow (net operating cash flows less ‘purchases of property and equipment’ and “capitalized software” which are items that we consider to be the firm’s capital expenditures). Mastercard spent $1.0 billion covering its dividend obligations during this period along with $4.8 billion buying back its stock. As shares of MA are trading well below their intrinsic value and have been for some time, we view its share repurchases favorably, when done in moderation.

Guidance Update

Foreign currency headwinds, a product of the strong US dollar seen of late, has weighed negatively on Mastercard’s reported revenues. However, strong underlying demand for its offerings has enabled the firm to power through those hurdles with its growth runway solidly intact. During Mastercard’s latest earnings call, management had this to say on the company’s near term outlook and recent guidance boost:

Taking this all into account, including our well-diversified business model, we are increasing our expectations for net revenue growth for the full year 2022 to a low 20s rate on a currency-neutral basis, excluding acquisitions and special items. Acquisitions are forecasted to add about one ppt to this growth, while foreign exchange is expected to be a headwind of five to six ppt for the year, primarily due to the strengthening of the U.S. dollar versus the euro.

It is worth highlighting that this performance is despite the cessation of our Russia operations in Q1. For the year, we expect operating expenses to grow at the low end of a low-double-digit rate on a currency-neutral basis, excluding acquisitions and special items. This reflects continued investment in our people and strategic priorities, as well as impacts from FX-related expenses primarily due to a remeasurement of monetary assets and liabilities.

Acquisitions are forecasted to add about four ppt to this growth, while foreign exchange is expected to be a tailwind of approximately three to four ppt for the year. We are prepared to quickly adjust our operating expense base as we did in 2020 should circumstances dictate. — Sachin Mehra, CFO of Mastercard

We appreciate that Mastercard raised its full-year revenue guidance for 2022 during its second quarter earnings update. Previously, Mastercard was guiding for its “net revenues for full year 2022 to grow at the high end of a high teens rate on a currency-neutral basis, excluding acquisitions and special items” according to management commentary during the firm’s first quarter of 2022 earnings call.

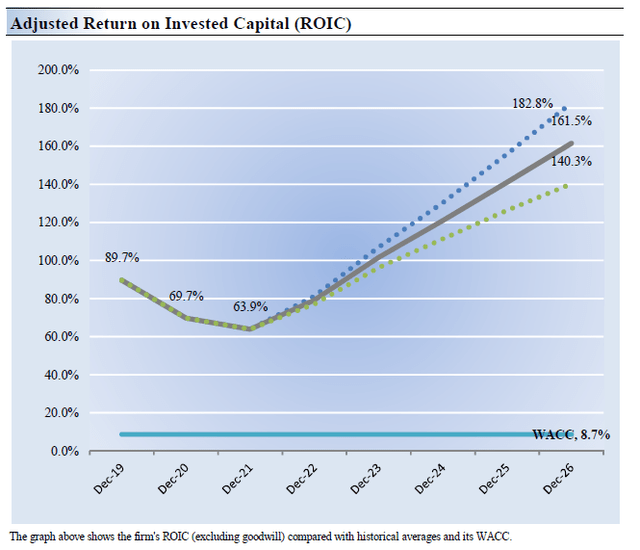

Mastercard’s Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Mastercard’s 3-year historical return on invested capital (without goodwill) is 74.4%, which is above the estimate of its cost of capital of 8.7%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Mastercard is a stellar generator of shareholder value.

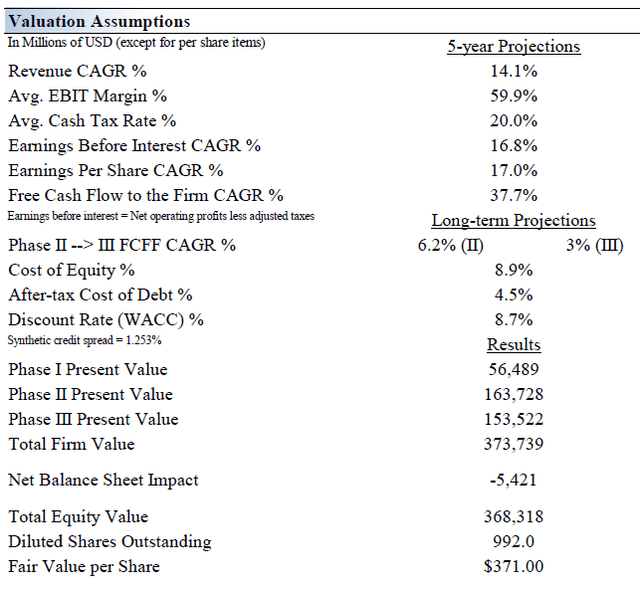

Mastercard’s Cash Flow Valuation Analysis

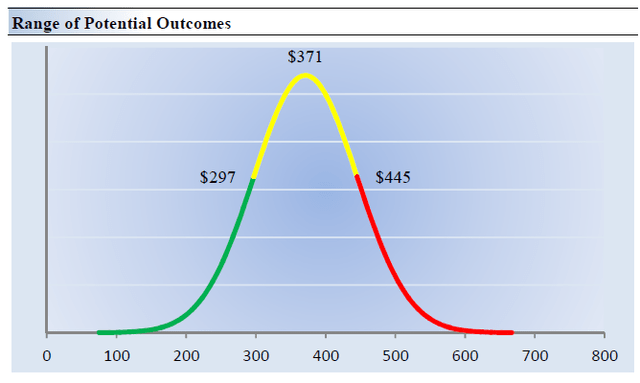

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of balance sheet considerations. We think Mastercard is worth $371 per share with a fair value range of $297-$445. Shares of MA are trading near the low end of our fair value estimate range as of this writing.

The near-term operating forecasts used in our enterprise cash flow model, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 14.1% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of 8.1%.

Our valuation model reflects a 5-year projected average operating margin of 59.9%, which is above Mastercard’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 6.2% for the next 15 years and 3% in perpetuity. For Mastercard, we use a 8.7% weighted average cost of capital to discount future free cash flows.

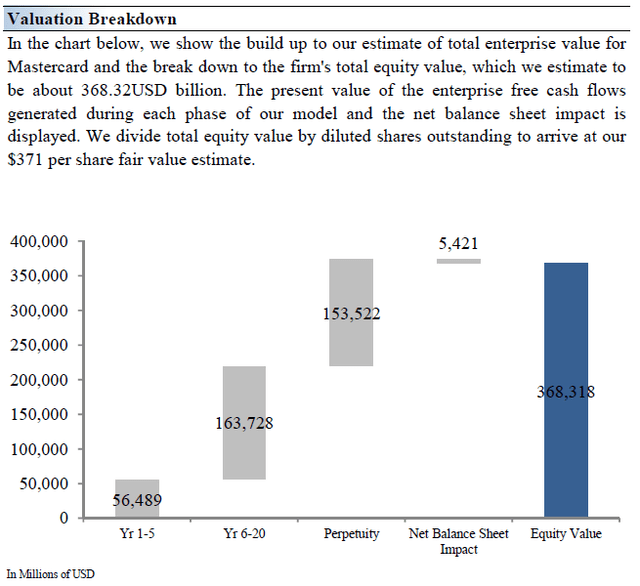

Image Source: Valuentum Image Source: Valuentum

Mastercard’s Margin of Safety Analysis

Although we estimate Mastercard’s fair value at about $371 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for Mastercard. We think the firm is attractive below $297 per share (the green line), but quite expensive above $445 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

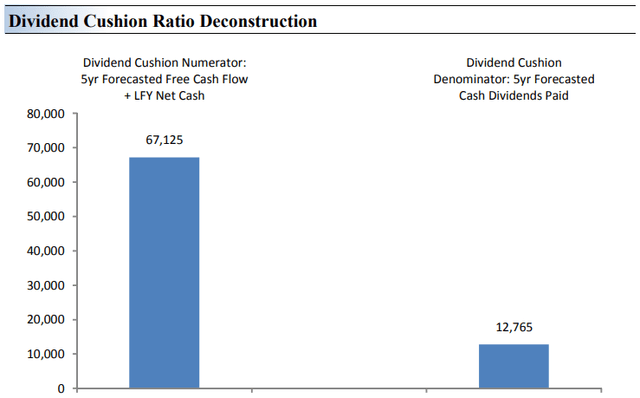

Dividend Analysis

Dividend Cushion Ratio Evaluation (Image Source: Valuentum)

The Dividend Cushion Ratio Deconstruction, shown in the image above, reveals the numerator and denominator of the Dividend Cushion ratio. At the core, the larger the numerator, or the healthier a company’s balance sheet and future free cash flow generation, relative to the denominator, or a company’s cash dividend obligations, the more durable the dividend.

The Dividend Cushion Ratio Deconstruction image puts sources of free cash in the context of financial obligations next to expected cash dividend payments over the next 5 years on a side-by-side comparison. Because the Dividend Cushion ratio and many of its components are forward-looking, our dividend evaluation may change upon subsequent updates as future forecasts are altered to reflect new information.

In the context of the Dividend Cushion ratio, Mastercard’s numerator is larger than its denominator suggesting strong dividend coverage in the future.

Concluding Thoughts

Mastercard’s cash-rich business model is one of the best in our coverage universe. The fact that it does not take on credit risk shields it from credit quality concerns. We like Mastercard’s solid capital planning priorities of maintaining a strong balance sheet with ample liquidity on hand while also distributing ample cash back to shareholders (via share repurchases and dividend increases).

The company will continue returning excess cash to shareholders, in our view, though existing plans are considerably biased toward share repurchases. Its current payout has an extremely long runway of safe growth potential ahead of it, should management choose to ramp up its dividend policy. We view Mastercard’s capital appreciation upside potential quite favorably as shares of MA are trading well below our fair value estimate as of this writing.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment