Andreas Rentz/Getty Images Entertainment

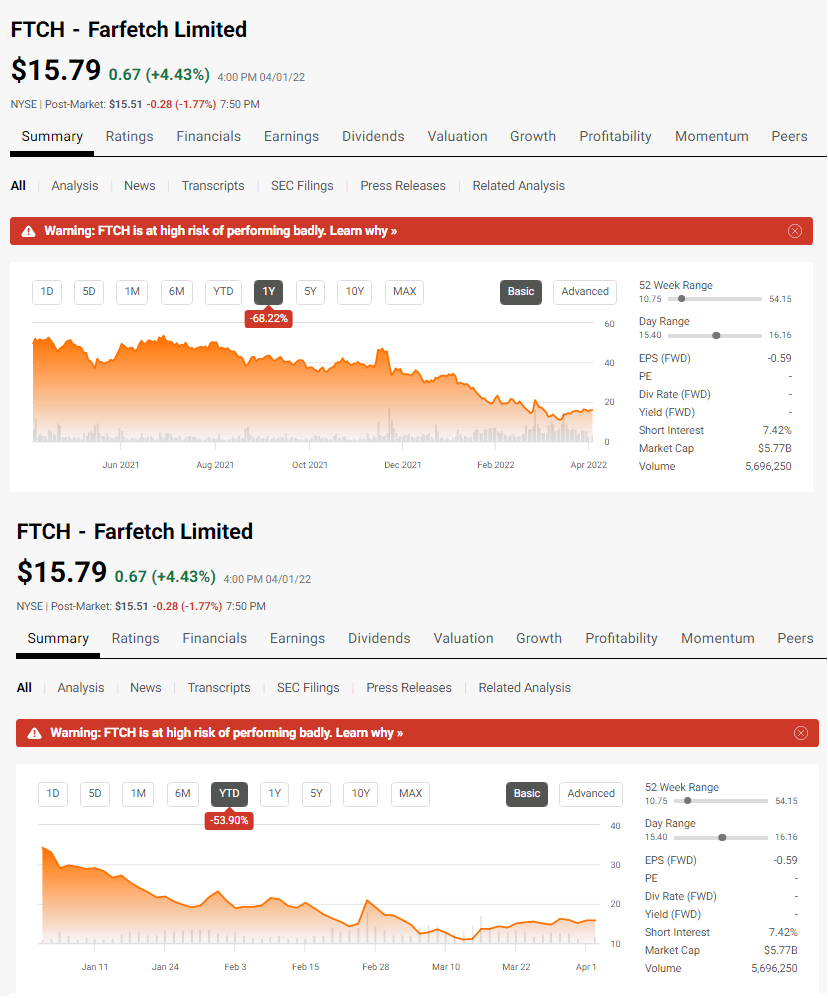

Online luxury eCommerce platform Farfetch (NYSE:FTCH) has seen its share price sink over the past year; Farfetch is down nearly 70% over the past year, and more than 50% year to date. The stock has been dropping over the past several months seemingly driven by a combination of factors including rising interest rates, the Russia-Ukraine war, and rising inflation.

Seeking Alpha

Despite these systemic challenges, Farfetch’s underlying business is still going strong. The company grew its active customer base from 3.024 million customers at the end of 2020 to 3.687 million customers at the end of 2021, up 21%. GMV rose 32% from USD 3.1 billion in 2020 to USD 4.22 billion in 2021 and revenues rose 34.8% from USD 1.67 billion in 2020 to USD 2.25 billion in 2021.

Going forward, while systemic risks may affect overall business conditions, in the longer term, there are multiple structural uptrends that could positively impact Farfetch.

Online luxury is a growth market.

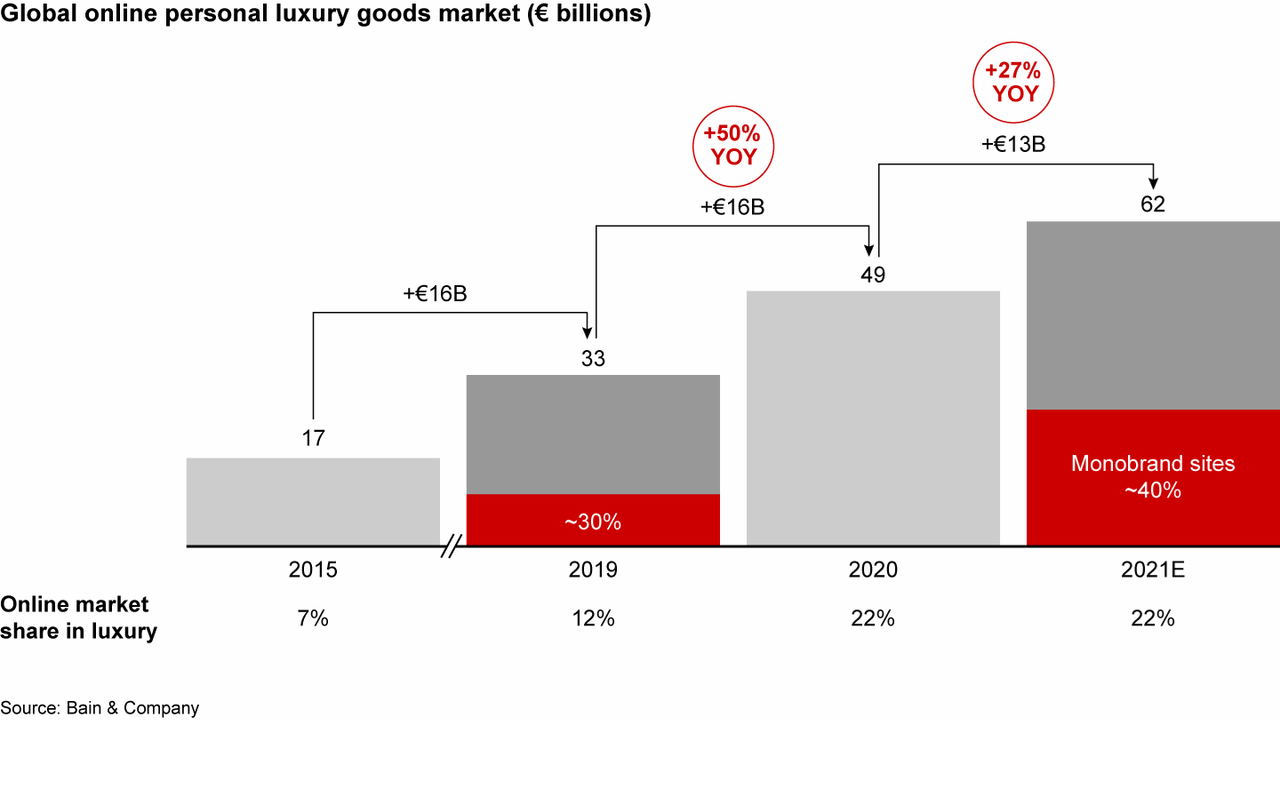

Luxury purchases are increasingly being made online, a trend accelerated by the Covid pandemic. Bain’s 2021 Luxury Report revealed that online luxury jumped 50% from 2019 to 2020, and rose 27% in 2020 to 2021.

Despite the growth, online luxury penetration lags far behind other retail goods and is estimated to be in the single digits, suggesting ample room for growth. The vast majority of online luxury shoppers are younger millennial generation consumers aged between 25-34 while the over-65s age bracket make up the smallest proportion of online luxury shoppers. This generation grew up in the ‘eCommerce’ era and are thus very accustomed to buying goods online. As they rise up the income ladder, this demographic could be a key driving force in the online luxury space going forward. The trend could benefit Farfetch, whose target customers are millennials (who make up nearly 60% of the platform’s customers).

Significant China exposure

China’s share of the global luxury market rose in 2021, with sales rising 36% in 2021 to CNY 471 billion, pushing China’s share of the global luxury market to about 21% in 2021, from 20% in 2020. Much of the growth was driven by well-heeled Chinese splurging on luxury goods at home as lockdowns and international border closures prevented overseas travel. Online luxury sales grew faster than offline, and online luxury penetration in the country reached about 19% not including duty-free shopping. Bain expects China to emerge as the world’s biggest luxury market by 2025, and with China being Farfetch’s second-biggest market by gross merchandise value (GMV), the company is poised to benefit.

Expansion into other luxury segments (such as beauty and hard luxury)

Farfetch is increasingly broadening its reach in the luxury market, expanding beyond apparel and accessories and into other areas such as beauty and luxury resale.

In January this year, Farfetch acquired luxury beauty platform Violet Grey as part of the company’s effort to crack into the luxury beauty industry which is expected to reach USD 69 billion by 2025, according to the Bain Altagamma 2021 luxury study. Farfetch beauty is set to launch on the Farfetch Marketplace later this year.

The luxury resale market is expected to reach USD 68.5 billion by 2026, from USD 16.2 billion in 2018, representing a CAGR of nearly 20%. Farfetch appears to be positioning itself to capture this opportunity with the company acquiring LUXCLUSIF, a luxury resale platform that enables the acquisition, authentication and sale of second hand luxury goods to and from auctions, retailers, e-commerce platforms, and stores worldwide.

Much more than just an online luxury marketplace; Farfetch is aiming to be the “Netflix of Fashion”

Like Netflix, Farfetch started out compiling catalogs of brands and products owned by third parties, however both are now increasingly moving to create their own original content. In addition to peddling other people’s brands, Farfetch has evolved to include its own portfolio of brands which are being supported by Farfetch’s expanding brand development infrastructure which includes its own marketplace (Farfetch Marketplace), a network of boutiques, a brand accelerator, and luxury production and distribution arm (New Guards Group which Farfetch acquired in 2019). The idea is to identify and invest in creative talent and disruptors early, and offer support services such as marketing, sourcing, merchandising and other resources to help them blossom into profitable brands.

In 2019, Farfetch paid USD 675 million to acquire luxury brand development and distribution platform New Guards Group and its portfolio of brands including Off-White, Palm Angels, Marcelo Burlon County of Milan, Heron Preston, Alanui, Unravel Project and Kirin Peggy Gou. With the acquisition, Farfetch aimed to develop and introduce new brands to its platform to boost customer engagement. Not only could this build brand equity, and revenues, but these new brands are margin accretive.

While margins at Farfetch’s Digital Platform business (which includes Farfetch’s online sales channels such as Farfetch Marketplace, BrownsFashion.com, StadiumGoods.com, and Farfetch New Retail, and online websites for New Guards brands) have been flat over the past few years, margins at Farfetch’s Brand Platform (which includes the production and wholesale distribution of New Guards brands’ merchandise to selected third-party distributors) has steadily increased.

|

Digital Platform |

Brand Platform |

|

|

2021 |

52.7% |

51.7% |

|

2020 |

54.2% |

48.9% |

|

2019 |

53% |

45.7% |

Brand Platform accounts for just 20.7% of Farfetch’s total revenues and as this business segment grows, it could help support margin expansion. Farfetch launched its first private label brand – There Was One – together with New Guards Group late last year, and the company says it has more brands under development with New Guards Group. Margins are likely to be considerably higher than Farfetch’s take rate from third party retailers and brands.

Luxury brands likely to opt for mono-brand online channels

Luxury brands have long been laggards in terms of eCommerce adoption, partly due to their fear that moving online would destroy their elite, exclusive status. However, the demand for online luxury is clear, and luxury brands are stepping up their digital presence to meet that demand. However, rather than opting for a multi-brand marketplace platform, they may opt to go direct to the consumer, similar to a strategy employed by Nike (NKE), to capture advantages associated with the mono-brand model such as better control over presentation, customer service, exclusivity, pricing consistency etc, which better enables them to offer a unique luxury brand experience that reflects their brand story, and build a loyal, engaged community. A notable example is Kering who withdrew from YNAP in 2018 to manage their online sales operations in-house. Bain’s Luxury Report 2021 noted that online luxury nearly doubled during the past two years, a surge led by mono-brand stores which gained ground on other types of online platforms and now make up an estimated 40% of the online segment, up from 30% in 2019.

Bain & Company

Source: Bain & Company

While luxury giants such as LVMH (OTCPK:LVMHF) and Kering (OTCPK:PPRUF) may have the scale and resources to maintain and operate in-house luxury online retail websites, boutique luxury brands are more likely to partner with technology platform providers such as Farfetch or YNAP. The trend could be a boon for Farfetch Platform Solutions – Farfetch’s white-label ecommerce platform service that offers luxury brands an array of ecommerce services from powering mono-brand online retail sites and fulfillment operations, to providing first party data to identify marketing opportunities on the Farfetch Marketplace. The opportunity is particularly compelling in China, where Gen-Z luxury consumers are increasingly looking for niche luxury brands, but such niche luxury brands often struggle to crack the Chinese market due to resource constraints and limited experience in navigating China’s vast and complex market. Farfetch through its tie-up with Chinese e-commerce giant Alibaba last year, is nicely positioned to capitalize on this opportunity by offering boutique luxury brands the necessary technology platform, expertise, and sales channels to access China’s fiercely competitive and lucrative market, and in turn satisfying Chinese Gen-Z shopper demand for niche brands from Farfetch’s growing selection of niche luxury brands from around the world.

Risks

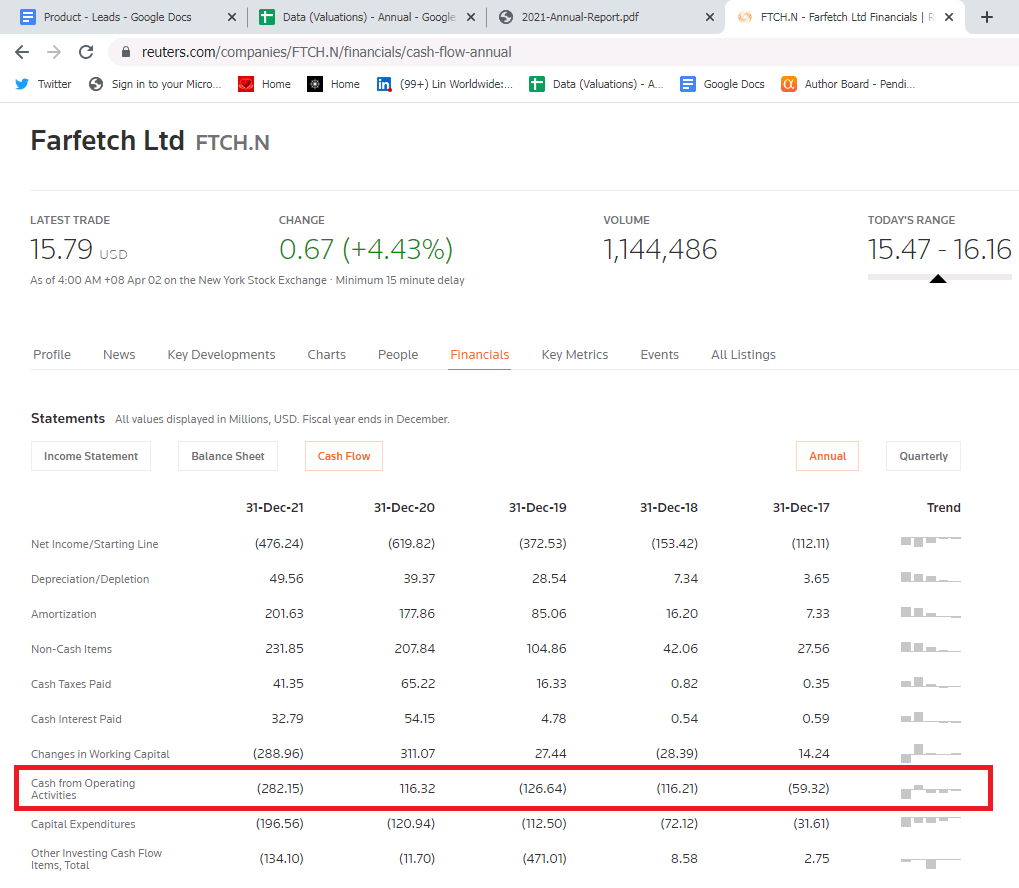

Negative operating cash flows, heavy debt burden

Since 2017, Farfetch has generated negative operating cash flows in all but one year.

Reuters

Source: Reuters

This means the company will have to keep turning to outside sources to plug the shortfall, as well as to fund capital expenditures and acquisitions, which could either mean increasing debt, or raising cash from equity sales such as private placements (which could dilute existing shareholders’ stake in the company) or if Farfetch fails to do any of those, the company could run into liquidity problems. With a total debt to equity of more than 8 times, Farfetch is quite heavily leveraged and with the company on an aggressive growth path, Farfetch’s debt burden could potentially continue increasing if negative operating cash flows continue.

Heavy promotional activity weighing on margins

With competitors being just a “click away”, there has been a trend of heavy promotions in the online luxury space, with Farfetch noting that the “industry experienced a trend toward promotional activity over the last few years”. This trend leaves Farfetch in a relatively unpalatable situation – cut demand generation expenses to focus on profit at the expense of market share and revenue growth, or match competitors’ promotional activity to retain market share and revenue growth at the expense of profit. Heavy promotions are weighing on Farfetch’s margins; the company’s gross margins have remained unchanged over the past three years, and if Farfetch is compelled to spend heavily to match competitor marketing spend, the company’s path to profitability could be an uphill climb.

Farfetch Ltd gross margins

|

2021 |

45% |

|

2020 |

46% |

|

2019 |

45% |

|

2018 |

50% |

|

2017 |

53% |

Luxury shoppers switch to offline retail store purchases as lockdown measures ease, borders open and international travel resumes

Given their high price points, shoppers may prefer to hold, examine, and try luxury products before buying them, something online luxury platforms simply cannot offer. In addition, shoppers have to wait for the goods to be delivered as well as bear the potential inconvenience of goods arriving damaged, or lost in transit. After being forced to satisfy their luxury desires online due to pandemic-induced lockdowns, luxury shoppers may skip shopping for luxury goods on online marketplace platforms or on mono-brand websites and instead gradually visit brick-and-mortar stores again as lockdown restrictions ease, putting a lid on online luxury sales growth.

Meanwhile, Chinese luxury shoppers – the growth engine of global luxury sales – who are expected to drive two thirds of growth in luxury spending through to 2025, made 73% of their purchases overseas prior to the pandemic. That trend reversed during the pandemic, but this key group of luxury consumers may revert back to in-store luxury shopping when borders reopen and international travel resumes. International tourism increased 4% in 2021, but international arrivals were still 72% below the pre-pandemic year of 2019.

Rising competition

Farfetch already sells through Tmall in China and now smaller rivals are entering the scene. MyTheresa is dipping its toes into the Chinese online luxury market with the platform quietly launching on JD.com (JD). Richemont (OTCPK:CFRHF), under pressure from activist investors, is turning YNAP into a hybrid marketplace model, which means shoppers will have access to a wider variety of brands. The bigger competitor to watch however is Amazon (AMZN), who launched Amazon Luxury Stores in 2020, which was built similar to Alibaba’s widely successful Tmall Luxury Pavilion (BABA). Although Amazon is a latecomer, and their luxury brand selection is underwhelming, the company nevertheless has considerable advantages, notably big pockets which could allow them to make the necessary investments to build or acquire a business if they choose to.

Summary

Farfetch’s financials are not exciting with debt increasing, operating cash flows persistently negative, and gross margins flat however, this is not uncommon for young companies (Farfetch was founded in 2007 compared with Alibaba which was founded in 1999 and Amazon which was founded in 1994) operating in very early-stage industries.

Online luxury penetration has ample room for growth and the market is still at early stages. While there are a number of online luxury retailers jostling for a share of the growth opportunity, Farfetch stands out as being much more than just a retailer with the company wielding a proprietary technology platform that offers end-to-end ecommerce services for third-party luxury brands, as well as an in-house brand development platform to identify fashion trends, and rapidly build and develop higher-margin private label luxury brands to capitalize on those trends. YNAP, arguably Farfetch’s closest competitor in the online luxury space has been struggling and YNAP parent – luxury powerhouse Richemont – is increasingly cozying up to Farfetch; the duo are in discussions for a potential partnership, part of which includes Richemont Maisons joining the Farfetch Marketplace. If successful, that could be a major win for Farfetch as smaller luxury marketplace rivals may struggle to secure a similar deal with top luxury brands who are known to be ecommerce-averse and extremely selective with their online activities. Farfetch has already secured a combined investment of USD 1.15 billion from Alibaba and Richemont, which may be early signs of more to come.

With Farfetch appearing to a likely winner in an early stage industry that has ample room for growth, there is reason to be optimistic on Farfetch’s prospects of reaching critical mass as the market grows, the company matures, and industry consolidates to just a few players (Morgan Stanley believes Farfetch is at the early innings of a winner-take most marketplace model). As with any early stage business there is the risk Farfetch’s ambitions may never realize, but if it does, the upside could be significant.

Be the first to comment