Ian Tuttle/Getty Images Entertainment

Thesis

Roblox (NYSE:RBLX) is my favorite gaming stock. Perhaps even may favorite growth stock in general. Although, the company is uniquely positioned to capture a large slice of the enormous metaverse market, in my opinion, the stock is trading cheap-now being down approximately 65% from all-time-highs and 56% YTD.

When the market sell-off is over, RBLX is the one stock that I definitely want to have in my portfolio and hold for the long-term. I initiate with a strong buy recommendation and a target price of $50.3/share.

About Roblox

Roblox is one of the world’s most popular gaming/entertainment companies with a global daily active user base of more than 50 million. With over 10 million developers and 25 million interactive experiences (games), the company operates a digital platform where people create and play games in a highly interactive ecosystem.

Roblox describes itself as follows:

Roblox’s mission is to build a human co-experience platform that enables billions of users to come together to play, learn, communicate, explore and expand their friendships.

Social Media, Entertainment, and Gaming

Personally, although this might not be the correct official classification, I see Roblox as a Social Media company where the medium of connection and communication is not text, picture or video, but truly interactive social interaction based on games. Arguably, this is the essence of the metaverse appeal that captured the market’s speculative fever ever since Mark Zuckerberg has presented his metaverse vision. Given Roblox’ value proposition it is no surprise that Roblox is frequently, or perhaps always, ranked among the top 3 stocks with strong metaverse appeal. To put things into perspective, the metaverse is expected to be a 13 trillion market opportunity–according to Citi analysts

We could also consider Roblox as an entertainment company. And thus, although this is a stretched argument, compare it with Netflix (NFLX). Notably, according to data by Similarweb, as of July 2022 Roblox has approximately 3 billion monthly site visits (total traffic/all devices), which is approximately half of Netflix’ 6.6 billion visits. But Roblox’ visitors are much more engaged, with 15 minutes time spent per site visit and a <20% bounce rate versus Netflix’ 9 minutes time spent per site visit and >40% bounce rate.

Supported by powerful network effects

As big platform companies such as Google, Amazon and Facebook have proven, network effects are incredibly powerful in the digital age and might be one of the major driving factors to support a company’s rapid growth and industry leading positioning. That said, Roblox enjoys two powerful network effects: First, there is the interaction between gamers and players. The more players on the platform the more are game developers enticed to produce games. And the more games are on the platform, the more gamers are attracted. Second, there is the interaction between gamers and friends. The more engaged a gamer with Roblox, the more likely it is that the gamer will persuade friends to join the platform-so they can enjoy playing together. In my opinion, these two powerful and mutually supporting network effects have fueled Roblox’ rapid industry growth and will continue doing so.

Still lots of potential

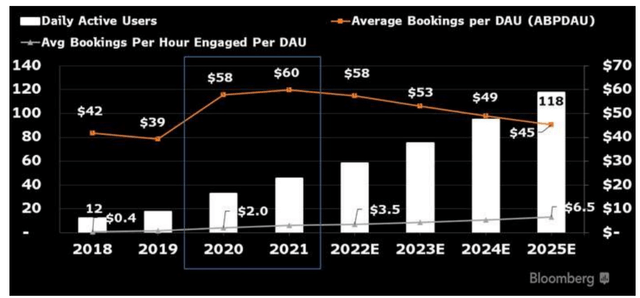

Although highly popular already, I argue the full potential of Roblox interactive experience must yet to be developed, as investments in metaverse technologies such as 5G and VR/AR hardware accelerate. That said, Roblox’ founder and CEO David Baszucki is aiming for a 1 billion global user base-which I think could be possible within a 10-year time horizon. If this metric were to be achieved, Roblox could arguably be valued at >$500 billion based on a $150 annual revenue per user valuation. Because Baszucki’s target might seem too ambitious, I advise to use an independent source when estimating Roblox future growth. That said, Bloomberg Intelligence Primer (Data as of 30 July) sees Roblox achieving 115 million users by 2025.

Valuation

Today, I feel it is difficult to value Roblox-as the company is writing losses and analysts will have a difficult time quantifying the company’s enormous potential. For reference, in the most recent financial year 2021, Roblox recorded a net-loss of $492 million, or -$0.92 per share. I believe, however, an equity valuation of $25 billion and (< $22 billion enterprise value) is definitely too low for such a high growth asset.

To give readers an anchor, I would suggest using a x20 EBIT/EV multiple based on Roblox’ 2025 analyst consensus EBIT-and discounting the valuation with an 8% WACC. That said, analyst consensus estimates Roblox 2025 EBIT at $1.3 billion (Source: Bloomberg Terminal, June 2022). This would imply a discounted valuation of approximately $26 billion for the company, or $50.3/share.

Downside Risks

Although I strongly believe in Roblox’ undervaluation, I would like to highlight four major risks that could prevent the stock company’s stock valuation to materially differ from my target price.

First, Roblox has a history of writing losses-and still is. That said, there is no guarantee that the company will reach operating profitability as expected for late 2023-or ever. Second, Roblox’ value thesis is in the future, which is speculative. Estimating a company’s operations and business fundamentals for multiple years is highly difficult and imprecise.

Third, Roblox appeal is supported by the hype surrounding the metaverse. That said, the metaverse might develop at a much slower pace than expected, as VR/AR and 5G development and adoption slows. Or in general, the metaverse (the VR digital experience) might turn out less impressive than expected.

Fourth, much of Roblox’ current share price volatility is driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though Roblox’s business outlook remains unchanged.

Conclusion

Roblox operates a highly attractive business model which has exposure to strong growth potential. While the stock has definitely traded at rich valuations in the past, the stock is now down more than 65% from ATH and arguably undervalued. I am a buyer at current levels as RBLX is a stock that I do not want to miss for my long-term holdings. As it is difficult to put a price on the company’s long-term potential, I anchor on a pro-forma x20 EBIT/EV multiple based on Roblox’ 2025 analyst consensus and calculate a target price of $50.3/share. I initiate with a Buy recommendation.

Be the first to comment