HJBC

Thesis

My last article on energy stocks was co-produced with Envision Research. It focused on the impact of the Russian/Ukraine war on oil supplies. It specially analyzed two leading energy stocks, Suncor Energy (SU) from Canadian and Exxon Mobil (NYSE:XOM) from the U.S., to provide ideas to hedge against geopolitical risks. As summer is more than half gone, this article will take a look at a different problem: the heating needs in the winter. More specifically, I anticipate a natural gas supply shortage and a further hike in its prices. And I will assess the impact on XOM and Chevron (NYSE:CVX), two leading natural gas suppliers.

The title of this article obviously is stolen from Game of Thrones, one of my favorite HBO shows. The title jumped out at me for two reasons. The first reason is obvious and is the main topic for today. As winter approaches, the world, especially European countries, will need to worry about heating problems. This article will focus on the heating issue and its impact on XOM and CVX, in particular from the natural gas supply shortage and the prices.

The second reason is less obvious. In the HBO show, the real threat to all the kingdoms is not who’s on the throne. Their little internal power struggle only serves to blind them from seeing the real threat: the approaching long winter and the undead army that comes with it. I see some similarities here for the energy sector in general. In the long term, I see the real opportunity and threat to the energy sector is not really in natural gas prices or oil prices. I see the real long-term challenges and opportunities coming from the outside. The recent societal shift toward a hybrid work-life mode caused by COVID serves a good example in point. If such a shift continues, it will eventually produce a large and irrevocable impact on our energy use (transportation, commute, home and office heating, et al). But we will save this topic for another today.

Here let’s get back to the near-term issues of natural gas supplies and prices.

Natural gas supply and price outlook

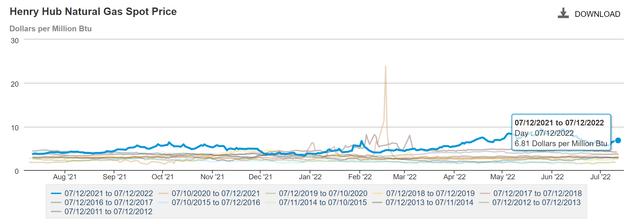

Natural gas prices are already at a high level currently. As you can see from the following chart (the thick blue line), the U.S. monthly average Henry Hub spot price nearly doubled in the past 12 months according to data from Refinitiv Eikon. The price was at $3.84 per million British thermal units (MMBtu) in July 2021, and it reached $7.70/MMBtu in June 2022, and now it came down slightly to $6.81/MMBtu.

the chart also put the current under a broader historical perspective. The thick blue line shows this year’s price, and the thinner lines with other colors show the 10-year seasonal analysis dating back to 2011. As seen, the current natural gas prices, after adjusting for seasonality, are far above the historical levels by a wide margin.

In my view, the current high price is not due to a random fluctuation or even the Russian/Ukraine situation. It is the result of years of underinvestment in our energy infrastructure as analyzed in our earlier articles. The Russian/Ukraine situation is only the trigger and catalyst to make it surface in a more dramatic way.

As a result, looking forward, I foresee the supply-demand imbalance and the high prices to persist (or even exacerbate depending on the weather condition in this coming winter). The following EIA report cited several factors that have contributed to the rising natural gas prices. A good portion of their assessments overlap with my view and I’ve highlighted them:

- Colder-than-normal temperatures resulted in total natural gas consumption exceeding the five-year (2017–21) average.

- The electric power sector had limitations with natural gas-to-coal switching.

- Growth in economies in Asia and constraints on liquefied natural gas (LNG) exports to Europe from Russia have contributed to strong international demand for natural gas, resulting in increased U.S. LNG exports.

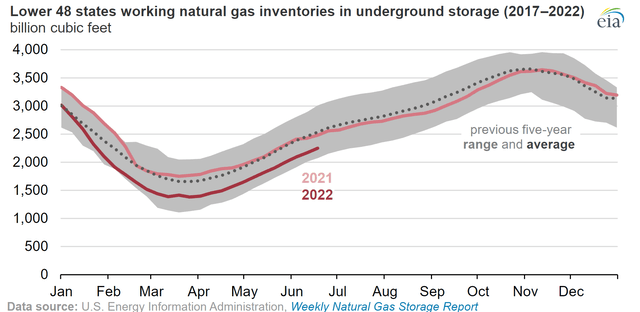

All these factors have kept inventory low as you can see from the chart below. The chart shows the working natural gas inventory in the lower 48 states in underground storages over the past five years in billion cubic feet. The gray area shows the previous five-year range and the dotted line the average. The current level (shown by the thick red line) is below the average. And what is really alarming is that it is toward the lower end of the range.

Next, we will see how this relates to XOM and CVX.

XOM, CVX, and natural gas

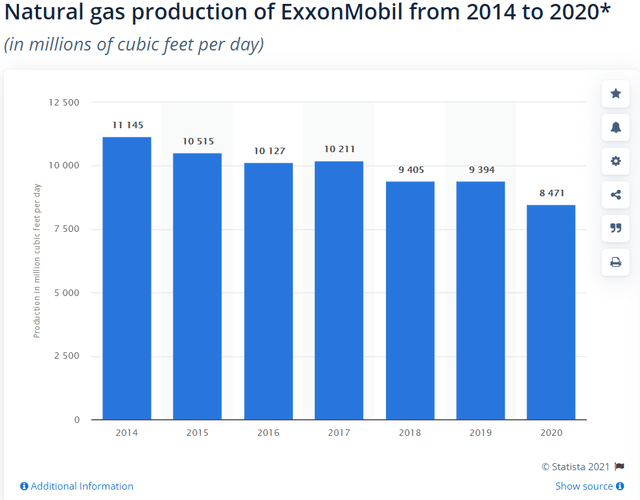

XOM and CVX are leading explorers, producers, and transporters of natural gas, not only in the U.S. but also globally. They employ advanced oil and natural gas technologies such as horizontal drilling and hydraulic fracturing at a scale unmatched by other energy players. Their scale and technological superiority help them to be more efficient and profitable. Let me cite a few numbers as examples. XOM produces approximately 8.5 billion cubic feet of natural gas production PER DAY in recent years. And CVX is not far behind. It produces about 7.3 billion cubic feet per day in recent years. Their natural gas production has been either declining or staying flat in recent years, exemplified by XOM’s output in the chart below between 2014 and 2020. As seen, its natural gas production has declined from more than 11 billion cubic feet in 2014 to 8.5 billion cubic feet in 2020 (which is approximately the level in recent years).

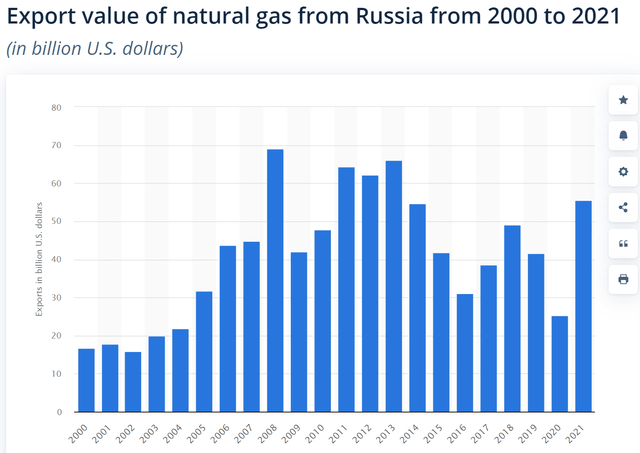

As aforementioned, I see the current supply-demand as the result of years of underinvestment, which has preceded the Russian/Ukraine situation. But the Russian/Ukraine situation does exacerbate it. As you can see from the second chart below, in 2021, Russia exported around 55.5 billion U.S. dollars’ worth of natural gas to other countries worldwide. Now with the western countries (especially European countries) imposing sanctions on Russian natural gas export, the $55B hole will have to be filled. And I see leading U.S. companies like XOM and CVX as the best candidates. First, the U.S. political and legal systems are more compatible with European countries. And second, XOM and CVX are the ones that have the resources and scale to meet demands at this scale, as detailed next.

XOM and CVX – impact of natural gas on profit

By this time, we have to overcome a bit of a math hurdle to proceed. You may find all the numbers quoted above confusing (production quote in billions of cubic feet, and price quote in MBTU, et al). You can find a detailed tutorial in our earlier article here for navigating math. A quick summary is provided below.

The Energy Information Administration measures the U.S. annual average heat content of natural gas at 1,037 British Thermal Units (“BTU”) per cubic foot (“CF”). And 1 million cubic feet of natural gas is equal to 172 oil-equivalent barrels.

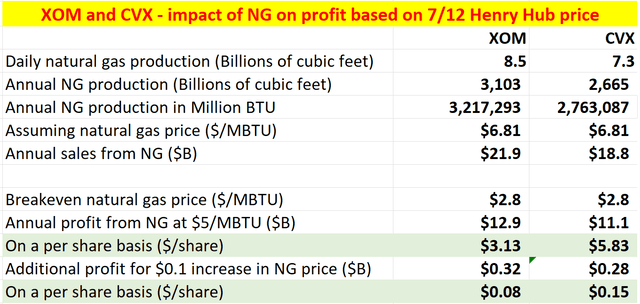

And the end results are summarized in the table below in case you trust my math skills. These calculations were made based on the 7/12 Henry Hub price from the EIA chart shown earlier. At a current NG price of $6.81/MBTU, natural gas contributes about $21.9B per year to the sales of XOM and about $18.8 for CVX. To put things under perspective, the NG sales are about 19.2% of the oil sales for them, a considerable segment. Next, I assumed a $2.80/MBTU breakeven price (estimated based on this McKinsey report) for both XOM and CVX. Under this assumption, for every $0.1 increase in NG prices, it will provide an additional $0.08 per share of profit for XOM and $0.15 for CVX.

And we will see the implications for the projected returns next.

Valuation and target prices

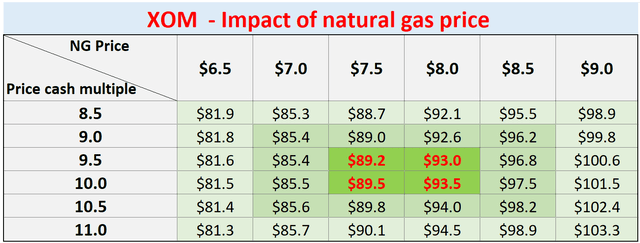

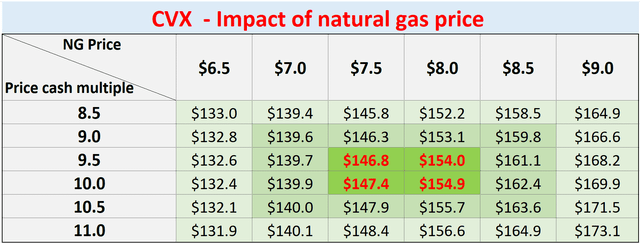

The next two charts show the impact of NG prices on XOM and CVX stocks prices under different valuation multiples. The numbers highlighted in red are the most likely scenario given the supply-demand imbalance I analyzed above. In particular, I see an NG price in the range of $7.5 to $8. And I also see a target price up to $93 for XOM and a target price around $155 for CVX to be supported by the NG price and valuation multiples.

Actually, I see my above projections on the conservative side because of the following factors:

- A valuation multiple of 9.5x to 10x cash flow is conservative both in absolute terms and relative terms.

- These projections only considered the impact of natural gas and excluded all other profit drivers such as their oil business and their chemical business.

- And lastly, even for natural gas, the above projections only considered the use of natural gas for heating. But as we will see in the next section, there is a multitude of other applications for natural gas besides heating as well.

Role of natural gas besides heating

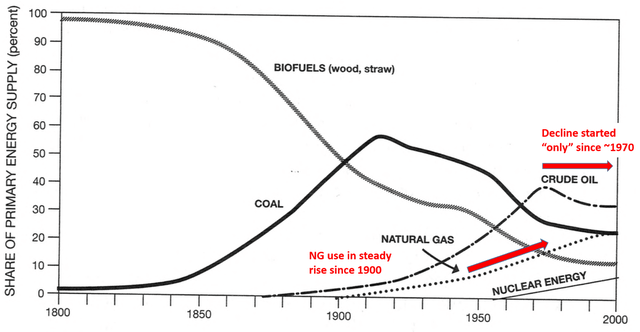

As also mentioned upfront, my thesis for the long-term transition of the “old energy” sources to the “new energy” is very likely to be catalyzed by factors outside of the energy sector. In the next 10 to 30 years or so, the “old energy” such as natural gas and oil will stay as our primary energy. And 10~30 years is a short time frame for energy transition as you can see from the chart below. We are still using some biofuels (wood and straw) after it has started their decline 200 years ago, and a significant amount of coal after it has started its decline almost 100 years ago. The US EIA projects a nearly 50% increase in world energy use by 2050 (i.e., in about 30 years), it projects that petroleum-based fuels will still remain the world’s largest energy source by that time. Renewable energy sources, which include solar and wind, will “only” grow to meet the increased demand.

Now specific to natural gas, our natural gas use is still on a steady rise as of this writing (and crude oil has “only” started its decline since around 1970). There is a multitude of other uses of natural gas besides heating. First, it takes energy to make energy. “New energy” has to be made from old energy sources as you can see from the chart below. Humans mined coals with the energy provided by biofuels and learned to produce oil using the energy provided by coal. And natural gas is one of the key components to producing new energy (plus being a major feedstock for the production of crucial chemicals). Secondly, natural gas enjoys far better energy return on energy investment (“EROEI”) than new energy. According to Energy and Civilization (A History) by Vaclav Smil (the emphasis was added by me):

For coal production, their EROEI range between 10 and 80. Oil and gas production has ranged from 10 to far above 100. In contrast, for large wind turbines, in the windiest locations, they may approach 20, but mostly they are lower than 10. For modern biofuels (ethanol, biodiesel) they are at best only 1.5. But their production has often entailed energy loss with no net gain at all (that is, with EROEI less than 1)

Source: Energy and Civilization – A History By Vaclav Smil

Final thoughts and risks

To sum up, I am really worried about the heating problem in the coming winter, especially for many of the European countries directly impacted by the Russian war. Some of them unfortunately are also geographically located in cold weather.

XOM and CVX will be the top candidates to fill the natural gas holes caused by the Russian/Ukraine war. But even at their scale, they may not be able to keep the world warm and at the same time meet the other demands for natural gas besides heating. If you recall from my estimate, under current conditions, natural gas contributes about $21.9B per year to the sales of XOM and about $18.8 for CVX. So the total is about $40B for these two giants combined. Recall that Russia alone exports about $50B of natural gas before the war started. So even if XOM and CVX export all their natural gas production, it won’t be sufficient to plug the hole, let alone the other needs for natural gas as analyzed above.

In my view, such a supply-demand imbalance is unfortunately very likely to persist and keep natural gas prices at a high level.

Finally, risks. There are both short-term and long-term risks to XOM and CVX, and here I will just focus on the natural gas aspect of their businesses. In the near term, obviously, the unpredictable weather condition in this coming winter is a big uncertainty. It could exacerbate the heating needs and drive up natural gas prices further if it turns out to be colder than normal. Or vice versa if milder. The duration and eventual outcomes of the Russian/Ukraine war are also unpredictable. But even if the war ends today, it will take some time for Russia to ramp up its production. Lastly, in the longer term, there could policies uncertainties for both of them. When fuel and heating prices become high enough, they will (are already to some degree) transition into political issues and not only be viewed as economic issues.

Be the first to comment