XiXinXing/iStock via Getty Images

Industrial Logistics Properties Trust (NASDAQ:ILPT) has a net asset value of $29.63 per share. It is now trading at $10.44. That is a 65% discount to NAV and it’s still not cheap enough to be worth buying.

As a value investor, I am used to dealing with companies that have problems. For any given problem, there is an appropriate amount of discount for that problem to be priced in. If the magnitude of discount is greater than the appropriate discount, the company is opportunistic and should outperform.

The market likes pretty, shiny things and consistently attributes too deep of a discount to companies with problems. Stocks that should trade at 20% to 30% discounts often trade at 30% to 40% discounts. This is why value outperforms over long stretches of time. The bigger than appropriate discounts consistently give value investors opportunistic entry points.

In a world of over-discounting, there is one problem that the market rarely discounts enough: Bad management.

The Value Trap Thesis

ILPT’s external manager, RMR Group (RMR), is so incredibly misaligned with shareholder interest that over time it will erode enough value so as to overcome the discount.

The primary buffer for shareholders against long term value destruction was the large dividend. Once shareholders receive the cash, that cash retains its value. However, now that the dividend has been essentially eliminated, the erosion is no longer mitigated.

Perhaps there will be a small bounce after the initial reaction to the dividend cut which knocked the stock down 25%, but long term I do suspect ILPT’s market price will continue to decline. NAV/share and FFO/share will also tend to go down over time.

Misaligned Management Structure

ILPT does not have any employees. It is fully operated through an external management agreement with RMR LLC. There is nothing inherently wrong with external management with some externally managed REITs such as Gladstone Commercial (GOOD) and NexPoint Residential (NXRT) generating excellent long term shareholder returns.

However, there is a big difference between external management that is executed well and that which is executed for the purpose of enriching management. I believe that ILPT falls into the latter category.

Here is a pertinent statement in ILPT’s 10-K in which they basically admit management is not aligned with shareholders:

“Our management agreements with RMR LLC were not negotiated on an arm’s length basis and their fee and expense structure may not create proper incentives for RMR LLC, which may increase the risk of an investment in our common shares.”

While I believe most people are inherently good, we as a species are also inherently self-interested. There is a reason that most employment is set up in such a way that it is in the employee’s best interest to perform well at their job.

The most basic performance feedback mechanism present at most employment is the ability to be fired. Someone who wants to retain their income is incented to perform well so as to retain their job.

Even this most basic alignment mechanism is not present in the RMR management contract. As noted in the 10-K, RMR’s management contract automatically renews such that it is perpetually 20 years in remaining duration.

“The terms of our management agreements with RMR LLC automatically extend on December 31 of each year so that such terms thereafter end on the 20th anniversary of the date of the extension.”

Not only is RMR perpetually rehired, but they are also virtually unfirable. Again from the 10-K:

“The termination of our management agreements with RMR LLC may require us to pay a substantial termination fee, including in the case of a termination for unsatisfactory performance, which may limit our ability to end our relationship with RMR LLC.“

How much is this break-up fee?

It is the entire 20 years of payments. Imagine canceling your internet service because it doesn’t work and still having to pay the bill for another 20 years. Well, that’s what you get with RMR as per the 10-K:

“we are obligated to pay RMR LLC a termination fee in an amount equal to the sum of the present values of the monthly future fees, as defined in the applicable agreement, payable to RMR LLC for the term that was remaining before such termination, which, depending on the time of termination, would be between 19 and 20 years.”

This fee is also triggered by a change in control, not just a firing. That makes it prohibitively expensive for another entity to rescue shareholders by buying ILPT.

Given the contractual language, it would appear as though ILPT is stuck with RMR as its manager for a very long time. Thus, in valuing ILTP we must take into account the implications.

Buying for the sake of buying

To understand the incentives, we can look at the terms of RMR’s compensation. RMR gets paid a base management fee equal to the lesser of:

- 0.5% of the real estate assets acquired by or transferred to the REIT

- 0.7% the market capitalization of common equity, preferred equity and principal value of debt.

Note that each of these has nothing related to per share. It is just about size. Bigger equals more compensation.

Simply by issuing debt or equity and buying stuff with it, RMR can give itself a raise.

I believe this is exactly what happened when ILPT decided to buy Monmouth (MNR).

ILPT’s doomed transaction

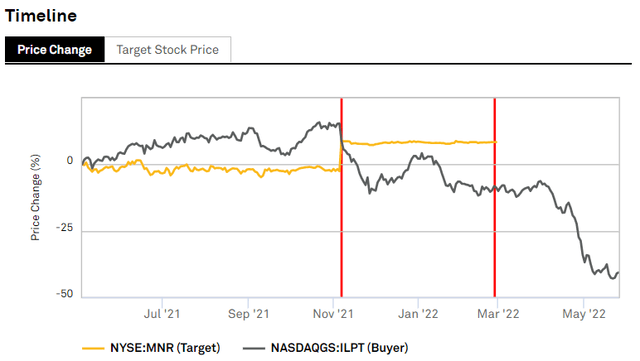

On 11/5/21, ILPT announced its intent to buy Monmouth for total consideration of $3.73B. It was a fairly normal premium and MNR has great assets, but the transaction resulted in massive value destruction for ILPT shareholders.

S&P Global Market Intelligence

Usually in real estate, the larger and higher valuation company will buy a smaller and cheaper company.

It allows the expensive REIT to use its stock as currency to buy the cheaper REIT. Both REITs win because the target gets the takeout premium and the buyer gets accretion by buying at a cap rate north of its cost of capital.

RMR did it backward. It was the smaller and cheaper REIT trying to gobble up the bigger and more expensive REIT. That flips the math on its head.

It was simply doomed from the start. Even though MNR’s portfolio of assets was great, ILPT was buying them at a very low cap rate and using expensive capital to do so.

But the deal was announced as accretive?

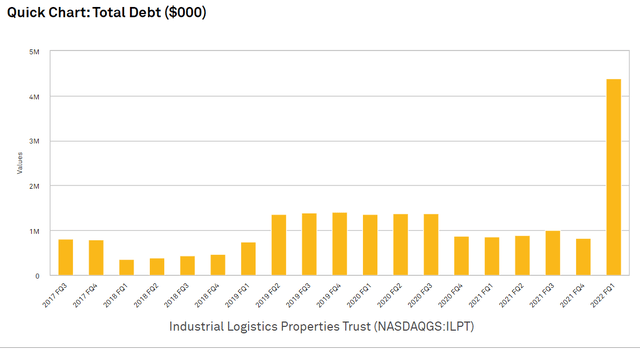

Well, technically, it is accretive in year one because the cost of capital used for that calculation is not the stabilized cost of capital, but rather the short term debt cost of capital. See, in executing the deal, MNR did not establish long term financing. They just bought it with debt causing an astronomical spike in its leverage.

S&P Global Market Intelligence

So now ILPT has over $4B of debt sitting on its balance sheet and an equity market cap of just $700 million.

Much of the financing is floating rate which can be quite dangerous given the Fed action. The failure to properly finance the massive purchase with equity has resulted in a July 14th announcement of cutting the dividend to a meaningless $0.01 per share. From the press release:

“ILPT’s Board of Trustees has reduced ILPT’s regular quarterly cash distribution on its common shares for the second quarter to $0.01 per share. This dividend will be paid to ILPT’s common shareholders of record as of the close of business on July 25, 2022 and distributed on or about August 18, 2022.”

It will be a mad scramble to try to get permanent financing in place and the options available to ILPT are not good.

- Asset sales

- Equity issuance

- Preferred equity issuance

Asset sales are probably the least dilutive option but even that is not good. Rushed sales in this rising interest rate environment would be at cap rates north of 6%. Given that MNR was purchased at a significantly lower cap rate, the round trip would be dilutive.

With how discounted ILPT is trading, common equity has a dilutive cost of capital of 16.1% (FFO of $1.66 and share price of $10.44).

With rates rising rapidly, preferreds of strong REITs come at an 8% cost, but given ILPT’s upside down capital structure, it would be at least a 10% coupon.

Regardless of which path ILPT takes to finance the acquisition, the result is substantial dilution to FFO/share and NAV/share.

With the upcoming capital crunch, ILPT was forced to cut its dividend to close to zero and this is the move that will really limit the ability for shareholders to ever get a return on ILPT.

Without cash flows out to shareholders, they have the capital in perpetuity, and after enough rotations of turning a dollar into three quarters, there won’t be much value left for shareholders.

Industrial Logistics has great assets in the best ever environment and still struggling

ILPT has a strong portfolio of Hawaiian land and industrial assets. It has now added the mainland logistics assets of MNR.

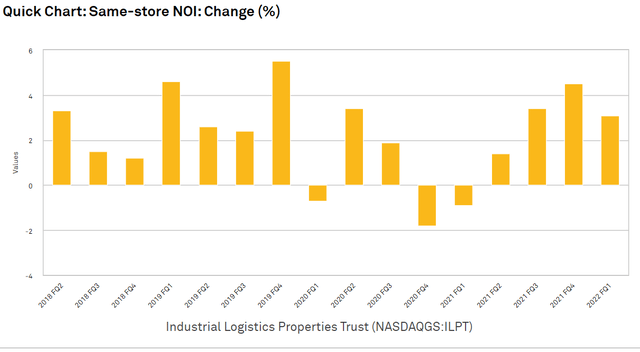

These properties have increased in value considerably and rental rates have increased nicely.

S&P Global Market Intelligence

ILPT wasn’t doing anything special to make this happen, it has just been the nature of the industrial real estate market.

It was a rising tide lifting all boats. The difference is what ILPT did with it compared to what other REITs did with it.

A properly managed REIT would allow the organic growth to translate to the bottom line. With rents up, property values up and NOI up, it doesn’t take much to get FFO/share growth.

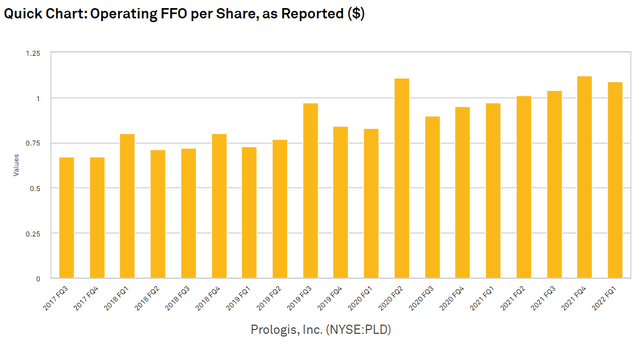

Below is the chart of Prologis’ (PLD) FFO/share over the past few years, but the same pattern would show up with just about any industrial REIT.

S&P Global Market Intelligence

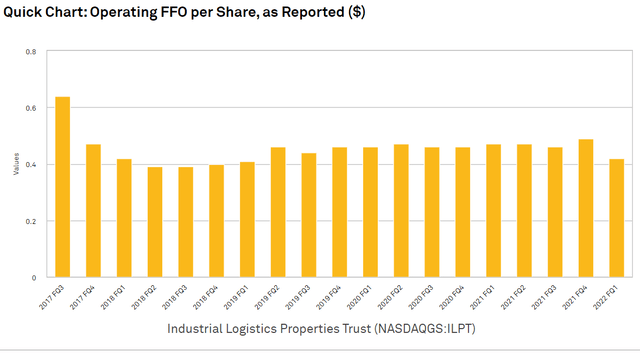

ILPT somehow managed to take great assets in the best ever industrial organic rent growth environment and somehow lose FFO/share.

S&P Global Market Intelligence

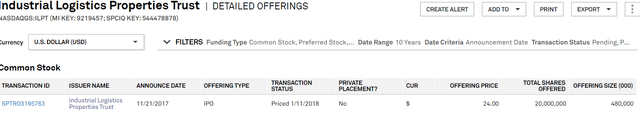

It was just a matter of too many transactions like the MNR purchase. Continually matching expensive cost of capital with low IRRs. ILPT IPO’d in early 2018 at $24 a share.

S&P Global Market Intelligence

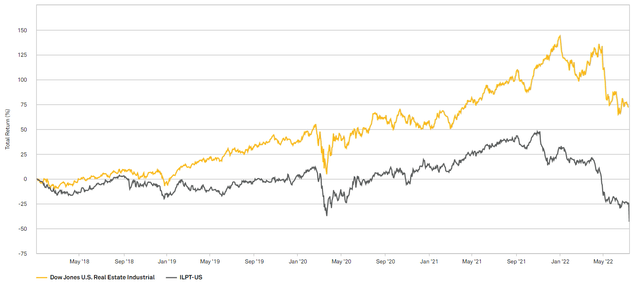

It trades today at less than half of that. In comparing ILPT to the industrial REIT index, it is just an astounding magnitude of underperformance.

S&P Global Market Intelligence

RMR’s past has been obfuscated by continual spin-offs, conglomeration, name changes and other actions that make it hard to track the history, but if you can dig up the record books, you will see similar levels of underperformance at each of their vehicles.

Those who have been around REITs for a while might remember their former vehicles

- HRPT properties

- Commonwealth

- Select Income REIT (formerly SIR)

- Government Properties (formerly GOV)

- Hospitality Properties Trust (used to be HPT)

- Senior Housing Properties Trust (SNH was the old ticker)

Commonwealth was lucky enough to be rescued through buyout and is now Equity Commonwealth (EQC).

Since then, however, RMR has further entrenched itself, making similar buyouts in the future fairly unlikely.

Summary of value trap thesis

At $10.44, ILPT is tantalizingly cheap. I know the assets to be worth substantially more than that, but it still is too risky to buy.

With the dividend obliterated, there is no longer a mechanism for shareholders to actually get the value of the properties. Instead, they will be subject to round after round of management turning $1.00 into 75 cents.

Is ILPT worth shorting?

I don’t think shorting would be wise here given the magnitude of discount. The downside to ILPT shares, in my opinion, will be a very slow bleed that takes place over decades. Thus, I don’t see much opportunity for shorting.

It is also exceedingly risky to short a company trading at such a wide discount to NAV. Even though RMR has layers of protection in place against a buyout, there is some possibility that an outside entity would bite the bullet and just pay RMR the 20 years of break-up fees in order to buy out ILPT.

My base case outlook for ILPT is that it continues to slowly erode value over time, but because there is some possibility of a buyout or other similar event, I don’t think it is wise to short.

For me, ILPT is a no-touch.

Be the first to comment