imaginima

Energy Transfer (NYSE:ET) is a popular dividend stock among retail investors, though I’d argue that has more to do with the company’s perennial undervaluation than strong execution. The stock is still yielding 7.8% as of recent prices and management has committed to growing the distribution by another 50%. However, management also seems unwilling to abandon its historically aggressive external expansion policies, even as many midstream peers are prioritizing debt reduction and share repurchases. This is one of those times where investors should pay up for higher quality and avoid reaching for yield.

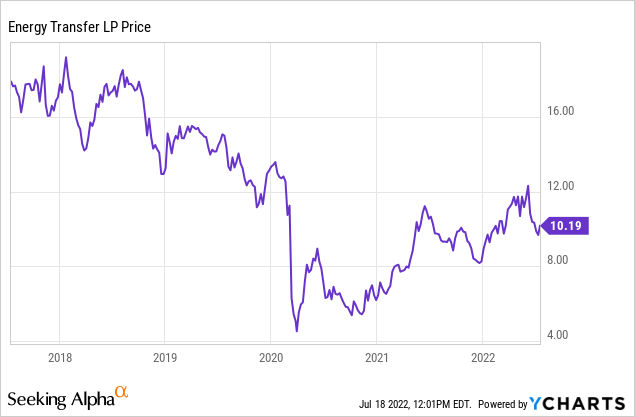

How Has Energy Transfer Performed in 2022?

ET has seen a substantial rally in 2022 as it benefitted from the positive sentiment of higher energy prices.

I last covered ET in April where I explained why I remained neutral on the stock in spite of having upgraded my views of peers Enterprise Products Partners (EPD) and Magellan Midstream Partners (MMP). The stock has since declined 11% since then, increasing the yield even further – but the issue is that valuation matters far less than execution.

ET Stock Key Metrics

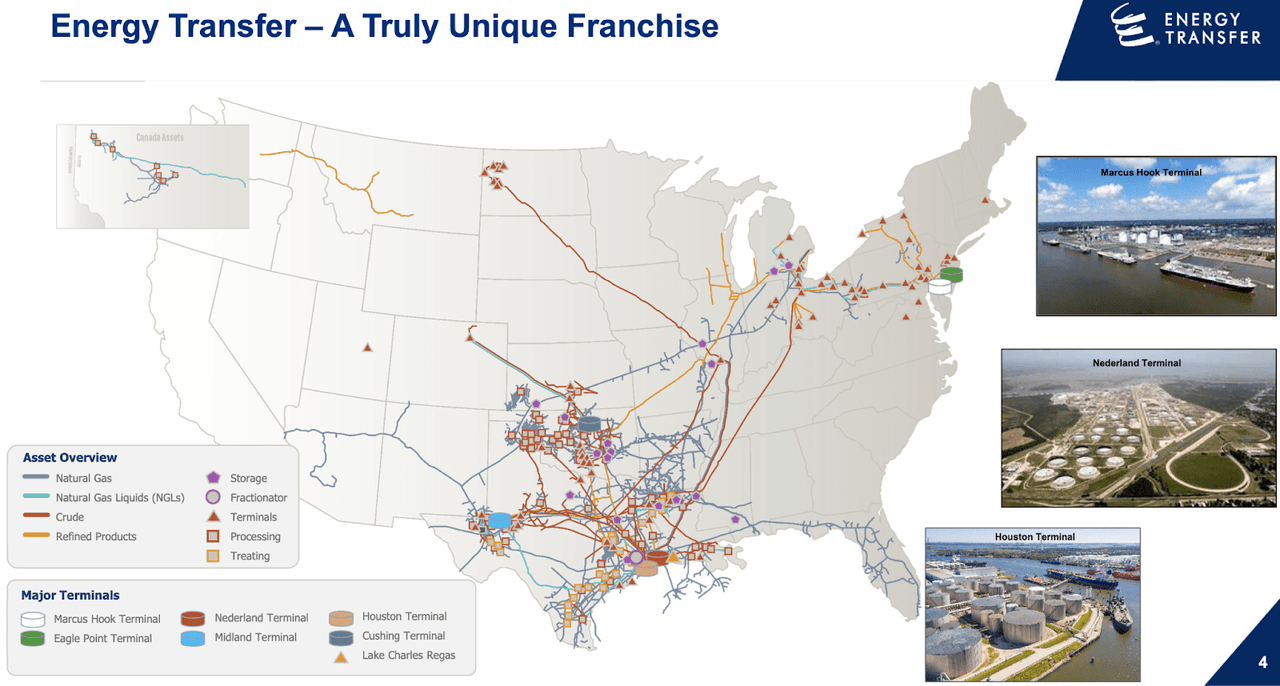

ET owns a dominant position in United States midstream infrastructure with a significant presence in the Texas region.

June 2022 Presentation

In the latest quarter, ET saw adjusted EBITDA decline from $5.04 billion to $3.34 billion. The decline was due to 2021 seeing a favorable impact from the winter storm Uri. This led to distributable cash flow (‘DCF’) to decline to $2.08 billion from $3.91 billion. Both of these represent significant growth from pre-pandemic levels.

ET also increased its distribution by 30% to $0.80 per unit annualized. The company reiterated its commitment to return the distribution to the previous level of $1.22 per unit annualized. At the current level, the distribution is covered by DCF by 3.36x.

ET reduced long-term debt by $6.3B in 2021 (and $290mm in Q1 2022), ending the quarter with $48.8 billion of long-term debt.

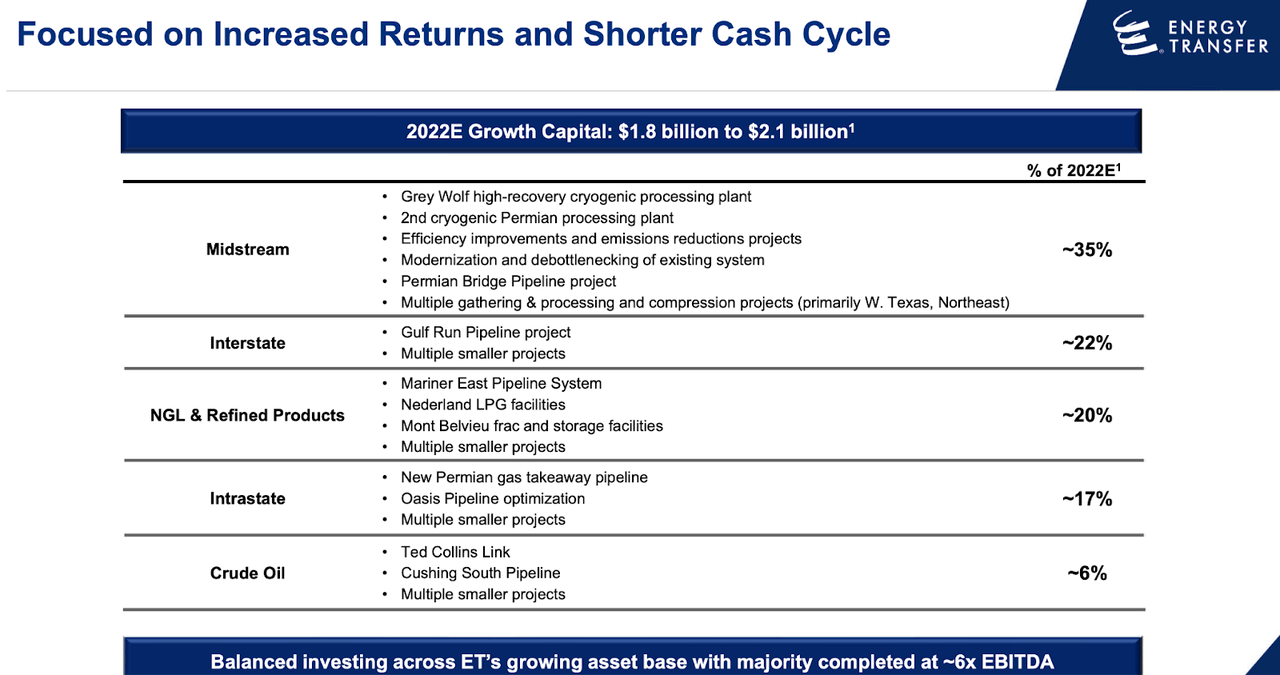

For 2022, the company has guided for up to $12.6 billion of adjusted EBITDA, implying debt to adjusted EBITDA of 3.9x, which remains elevated relative to peers. ET also gave guidance for growth capital of up to $2.1 billion. In 2020 the company had guided for $700 million of growth capital in 2022, and reiterated that guidance in 2021. But the company appears to have shifted gears after its $7 billion acquisition of Enable Midstream. I estimate that ET will generate around $9 billion of distributable cash flow this year. After accounting for $2.1 billion in projected growth capital spending and $2.5 billion in distributions (based on a $0.80 per share annualized payout), there remains $4.3 billion in excess free cash flow. Given the company’s elevated leverage position, I expect the company to prioritize using excess free cash flow to reduce leverage – in a couple of quarters debt to EBITDA might decline to the 3.5x range.

Is Energy Transfer Stock Undervalued?

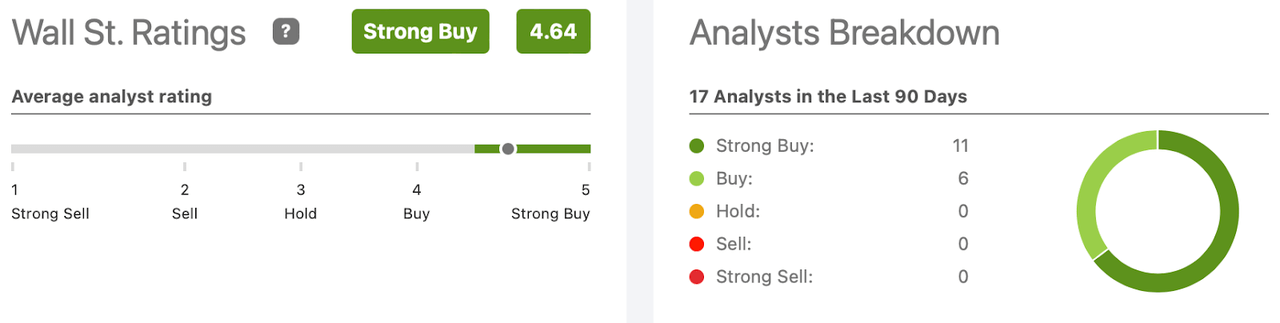

Wall Street finds the stock to be undervalued with an average 4.64 strong buy rating.

Seeking Alpha

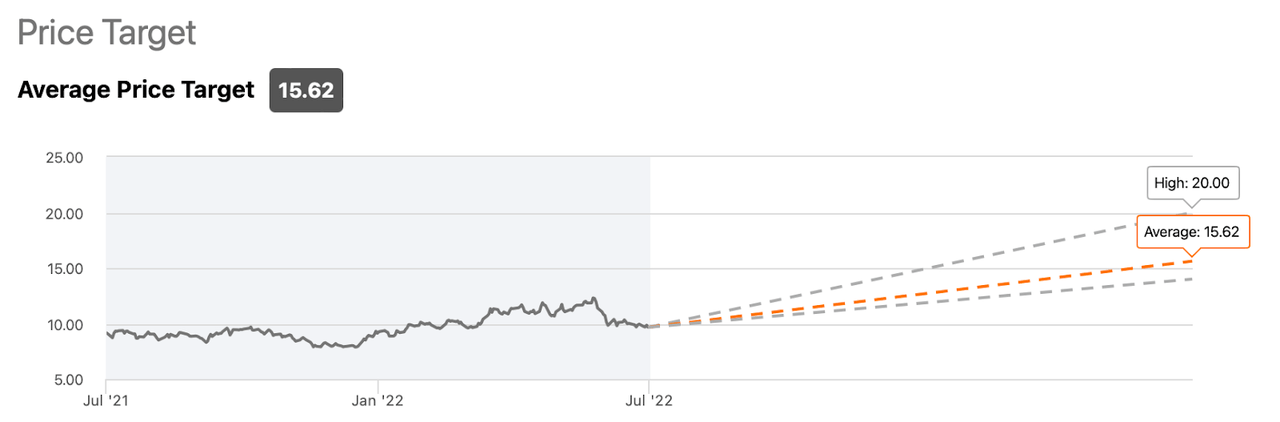

The average price target of $15.62 per unit represents 56% upside from price appreciation alone.

Seeking Alpha

Throw in the 7.8% yield and that price target represents 64% potential upside. At $15.62 per unit, ET would be yielding 5.1% based on the current distribution, or 7.8% based on the pre-pandemic $1.22 per unit distribution.

Is ET A Good Long-Term Investment?

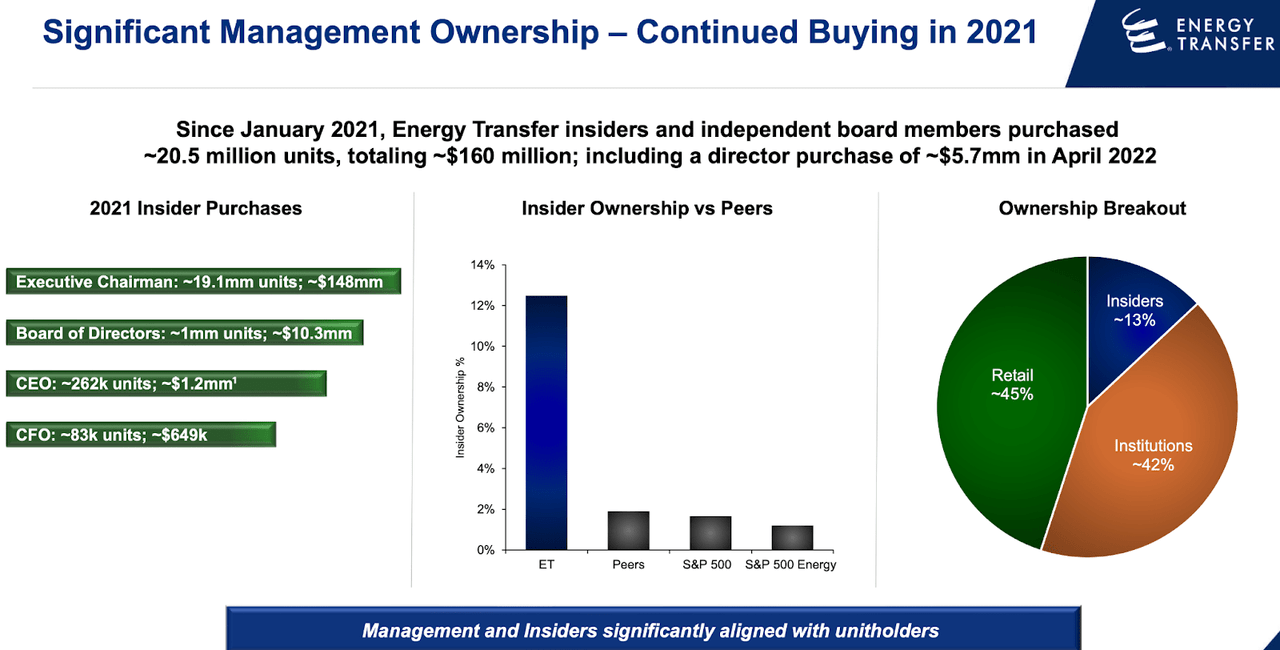

Unfortunately, I am not convinced that ET is a good long-term investment. My issue has been with management alignment with unitholders. At first glance, my reservations might seem misplaced considering the high insider ownership at the company.

June 2022 Presentation

However, management has seemingly taken a “grow at all cost” approach historically. As I stated in my prior article:

“As stated in its 10-K filing, ET rewards its executives a bonus payout based on adjusted EBITDA and distributable cash flow targets. MMP, on the other hand, uses distributable cash flow per share as the target for its equity plans. The absence of per-share metrics in the ET compensation plan may help explain why the company has historically been so set on increasing the asset base.”

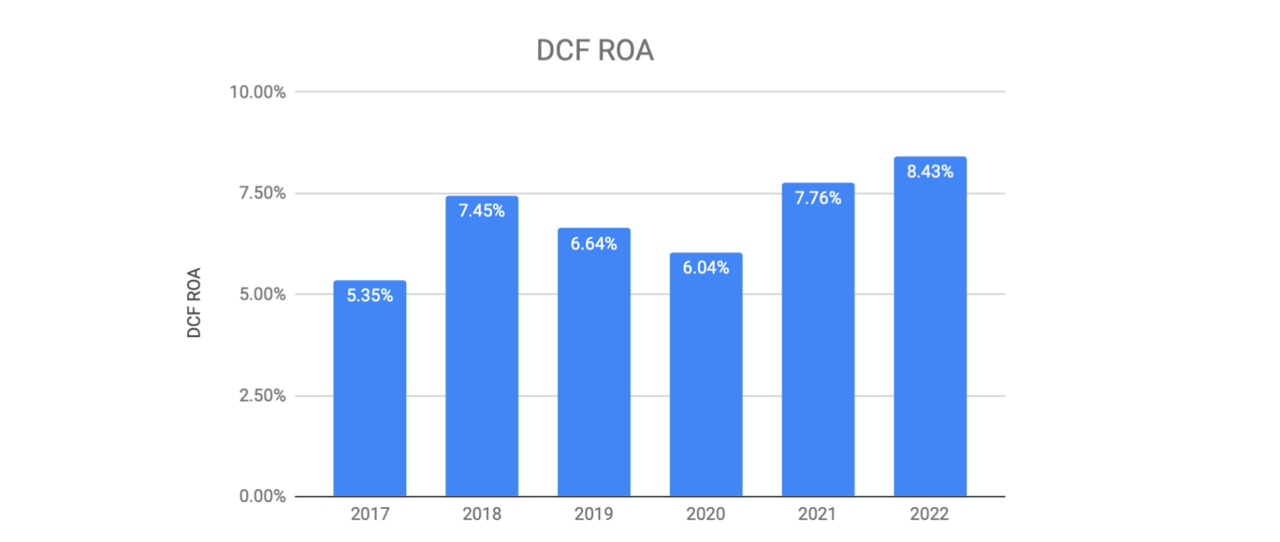

I measure the execution prowess of midstream companies by measuring return on assets based on distributable cash flow (mathematically that is computed as DCF divided by total asset value). We can see below that ET has grown its ROA over the past several years.

Best of Breed, data from company annual filings

Even so, ET’s ROA pales in comparison with peers like EPD or MMP, which post ROAs in the 11% to 15% range. I note that EPD and MMP also have less leverage than ET, further underscoring ET’s underperformance. The low ROA indicates that ET has historically executed poorly on its expansion projects.

We can see below a breakdown of ET’s planned projects in 2022.

June 2022 Presentation

As stated near the bottom, these projects are expected to be completed at around 6x EBITDA. The company is currently trading at around 6.4x EV to EBITDA. Considering the high level of execution risk in growth projects, one needs to wonder why ET is investing so much into expansion projects when it could instead repurchase units at a comparable return with absolutely zero execution risk. The answer in my view is due to the aforementioned compensation structure of the executive team, which is focused on growth in total cash flows and not on a per unit basis.

Is ET Stock A Buy, Sell, or Hold?

Therein lies the problem with ET. The stock is undeniably cheap – after accounting for growth capital expenditures, ET should produce around $6.9 billion of free cash flow this year. At recent prices, the stock trades at above a 20% free cash flow yield. The company could raise the distribution to $1.22 per unit – increasing the yield to over 12% – and still cover the distribution by free cash flow by 1.8x. But the issue is with management execution. I would not be surprised if management decides to increase growth capital spending further beyond 2022 due to the high energy prices. Considering the low ROA, I am skeptical that aggressive spending on expansion projects is the best allocation of unitholder dollars. I consider it to be a red flag that management continues to prioritize expensive expansion projects even though its units have consistently traded at low valuations. Furthermore, the high leverage ratio means that even if management decides to aggressively pay down debt, it will still take a couple of quarters to bring leverage in line with peers. Don’t get me wrong – the units are very cheap here, but if the company does not reward unitholders with aggressive unitholder returns (an increased distribution and unit repurchases), then this looks more like a value trap. While I could see ET delivering positive returns simply due to being too cheap, I cannot bring myself to recommend buying the units considering my skepticism of unitholder alignment and the fact that EPD and MMP trade at compelling valuations as well.

Be the first to comment