Andrii Dodonov/iStock via Getty Images

Generating enough passive income to cover your living expenses can enable you to quit your 9-5 job and open up a world of possibilities to pursue with their newfound financial freedom.

Financial freedom looks different for everyone. For some, they may choose to truly retire early and travel the world, spend more time on a hobby, enjoy time with family, and/or pour yourself into a humanitarian, religious, philanthropic, or some other social cause that they are passionate about.

Alternatively, some may decide to continue to work. However money now is no longer a big motivator, so the nature of the work and how fulfilling and enjoyable it is rather than the compensation provided by the work is what will drive their decision process. It may even open the opportunity for some to pursue entrepreneurship for the first time with the safety net of having a passive income backstop. Perhaps they may decide to go back to school and get an advanced degree to satisfy their thirst for knowledge and position them to make a greater contribution to society.

Regardless of what course you choose to take, the bottom line is that when you no longer need a job to support yourself, you can live life on your own terms, thereby living it to the fullest.

What About Rental Property Investing?

Of course, the challenge is getting to that point. Many advocate investing in real estate rental properties as a proven method for getting there. However, after the recent run-up in real estate prices and with interest rates beginning to rise, it might be a bit late to get into the real estate game as you are taking on significant risk buying today. Additionally, rental real estate is not really passive income because you have to deal with the infamous “triple Ts” as a landlord:

- Tenants

- Toilets

- Trash

The only way to get around this is by hiring a property management company. However, even then you will still have some work to do to properly run your real estate rental business and property management companies are typically quite expensive – thereby reducing your returns – and may not always do a good job. After all, nobody cares about your investment as much as you do.

What About Index Fund Investing?

Still others advocate investing in S&P 500 index funds such as the SPDR S&P 500 Trust ETF (SPY) or the Vanguard S&P 500 ETF (VOO). While this is also a proven technique for compounding wealth over the long term and is truly passive, it also faces two key challenges in today’s environment:

1. The S&P 500 is trading near all-time highs and is at one of its most expensive valuations in history by virtually every metric. Similar to real estate, it might be a bit late in the game to get into index investing.

2. Planning for retirement and generating passive “income” from index investing is becoming increasingly challenging because funds like SPY and VOO generate very low dividend yields (currently ~1.3%). As a result, you either have to save over 75 times your annual expenses before you can safely retire off of dividend income (i.e., if you plan to spend $50,000 per year in retirement, you will need to save a whopping $3.75 million), or you will need to guess how much you can withdraw from your principal each year in a manner that stock market appreciation will offset it.

Traditionally, the 4% rule was employed by financial advisors as the standard retirement planning process. However, this is becoming increasingly impractical because the outlook for stock market real returns moving forward is very weak. This is because the stock market is currently trading at an elevated valuation level, so the prospects for multiple expansion for stocks are unlikely and multiple compression is increasingly likely as interest rates rise. Furthermore, inflation is soaring so the purchasing power of currency in today’s terms is likely to decline more rapidly than expected moving forward.

Why We Invest In High Yield Stocks

Given the numerous cons associated with both of these passive income methods, we have elected to pursue the third path to financial freedom: investing in dividend-paying stocks on a value basis.

This affords us numerous advantages:

1. It is far more passive than real estate rental property investing. In fact, we still invest in real estate rentals, just through truly passive publicly-traded REITs (VNQ) like W. P. Carey (WPC) and Realty Income (O) that offer high dividend yields and a superior risk-adjusted return profile over individual rental properties.

2. We are able to generate enough dividend income to be able to fully fund living expenses without having to save 75x our annual living expenses nor having to predict the annual performance of the overall stock market well out into the future.

3. It gives us the opportunity to continually deploy capital on a value basis, since we are picking and choosing individual securities rather than simply buying the entire market. We focus on finding a diversified array of quality businesses selling at clear discounts to intrinsic value that pay attractive dividends. As the market seesaws from geopolitical events and certain sectors come into favor while others fall out of favor, we will recycle capital accordingly to capitalize on Mr. Market’s moodiness.

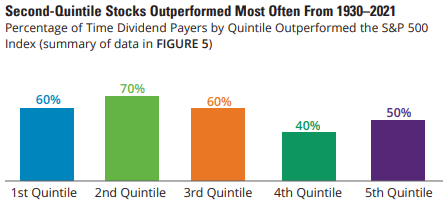

4. Ultimately, this strategy has proven to outperform on a risk-adjusted basis. As the chart below shows, high yielding stocks have outperformed the S&P 500 significantly more often than lower-yielding stocks over the past 9 decades:

High Yield Stocks Outperform (Hartford Funds)

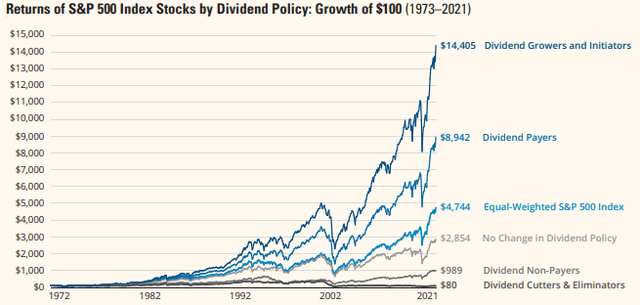

Furthermore, stocks that pay and grow dividends have absolutely crushed the market over the past five decades:

Dividend Stocks Outperform (Hartford Funds)

To give you a good start on your journey towards financial independence and – should you choose – retiring early, here are three of the best stocks with safe dividends that yield at least 7% right now:

#1. Ares Capital Corp. (ARCC) – 8.1% Yield

ARCC continues to serve as a best-of-breed BDC in our portfolio with a very liquid investment-grade balance sheet, strong growth numbers, and low non-accruals. It combines both balance sheet strength and underwriting excellence with more aggressive growth, that is translating into solid dividend growth.

We remain happily long after it reported its Q4 FY2021 results. ARCC increased its net asset value per share from $18.52 to $18.96, sequentially. Meanwhile, NAV per share has grown by a whopping 11.7% year over year. Combining with the hefty dividend payout over the past year, ARCC investors have enjoyed a ~20% return on NAV over the past year.

Meanwhile, net investment income rose by 5.6% year-over-year while core earnings per share increased by 7.4%, prompting management to hike the dividend by 2% sequentially and 9% year-over-year while also adding a $0.12 per share special dividend, making it a fantastic cash cow for investors.

On the other hand, the leverage ratio increased to 1.26x from 1.20x a year ago. While this increases the risk profile to some degree, ARCC maintains strong liquidity ($4.5 billion), a healthy debt maturity profile, and strong positioning to deal with rising interest rates.

Furthermore, the investment portfolio remains conservatively positioned with only 0.5% of loans on non-accrual status at fair value, down from 2.0% year-over-year.

#2. Enterprise Products Partners (EPD) – 7.4% Yield

EPD owns a best-of-breed midstream infrastructure portfolio that generates very stable cash flows from mostly fixed-fee contracts.

The vast majority (~80%) of its customers are investment grade or equivalent and its safety is further evidenced by its sector-leading BBB+ credit rating. On top of that, 100% of its pipeline revenues are linked to inflation, making it a good safe haven in these inflationary times.

The most attractive aspect of EPD is its well-covered (1.7x DCF coverage) distribution that yields 7.4% at the moment and is set to grow at a 3-5% CAGR moving forward as it seeks to add to its 23 consecutive years of distribution growth.

Last, but not least, it is also the cheapest BBB+ rated midstream business by a significant margin, trading at an EV/EBITDA multiple that is well below peers Magellan Midstream Partners (MMP) and Enbridge (ENB).

#3. TFS Financial Corp. (TFSL) – 7.0% Yield

The final stock we are presenting to you today is largely overlooked and misunderstood in today’s market. In fact, TFSL trades at a massive discount to book value, as the current share price is $16.41 and the book value per minority share is a whopping $32.63.

The main reason for this massive discount is that TFSL is a mutual holding company (i.e., MHC). This means that it is principally owned by its depositors, rather than the public shareholders. In 2007, TFSL sold a minority stake in the company to the public in order to raise capital and could at any time complete another partial or even a full sale of the remaining equity in the company to the public. As a result, ~81% of the company is currently owned by the Third Federal Savings and Loan Association of Cleveland, MHC and the remainder is owned by the public.

This puts the GAAP metrics on the company way out of whack because it is effectively the equivalent of a company buying back 81% of its shares, but the per-share metrics not changing. As a result, many stock screeners – and therefore investors – misunderstand the true intrinsic value of the business, leading to massive inefficiency.

Nevertheless, if the company were to get to a point where it did decide to issue some or all of its MHC shares to the public (at what would likely be at least close to book value per minority share), it could serve as a massive upside catalyst for the share price.

While some might wonder why the company doesn’t buy back shares aggressively if the discount is so huge, the reason is simply that the float is quite small given how few shares are public, so any more meaningful buybacks would likely push the float to such low levels that the liquidity of shares would be threatened. Instead, they pour their excess cash into their hefty dividend which is quite safe given the conservative positioning of the company (Tier 1 Capital to Average Assets ratio at 12.72% – vs. 5% required to be considered “well-capitalized” – and the Total Risk-Based Capital at 23.52% vs. the 10% required to be considered “well-capitalized”) and its 76% payout ratio.

Investor Takeaway

Achieving financial independence and the ability to be more selective about work – or even retire entirely – is an incredibly attractive proposition. However, the path there has probably never been more challenging given the elevated valuations and low yields offered by today’s rental properties and index funds.

However, as today’s article illustrates and past history has proven, the path via selective dividend stock value investing is still viable and leading to outsized risk-adjusted returns as well. We have implemented this strategy at High Yield Investor, and have been rewarded with returns that have more than doubled the S&P 500’s since the inception of our portfolio.

Should you decide to join us on this path, I hope these introductions to ARCC, EPD, and TFSL can give you a good starting point. It is also worth mentioning that both ARCC and TFSL are positioned to benefit from rising interest rates and EPD is positioned to benefit from rising inflation. When combined with their strong balance sheets and conservative business model posturing, they are relatively safe bets to ride out the current macroeconomic challenges facing us.

Be the first to comment