Skyhobo/E+ via Getty Images

Opendoor (NASDAQ:NASDAQ:OPEN) likely faces the most significant real estate crash since the global financial crisis of 2008. Rapidly rising inflation on the back of loose pandemic-era fiscal spending, supply chain disruptions, and a spike in energy due to Russia’s war has led to a series of interest rate hikes that now threatens to derail the US economy and make mortgages unaffordable for millions.

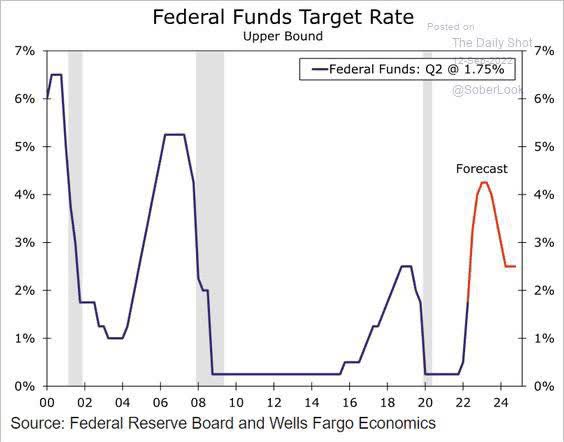

Federal Reserve Board

The Federal Funds rate, currently at 2.5%, is set to rise by a further 75 basis points to 3.25% when the Fed meets later this month. This is set to continue rising into 2023 and could peak at 4.25%. The winter ahead is set to be bleak as the yield curve inverts and broad household confidence continues to decline to new lows.

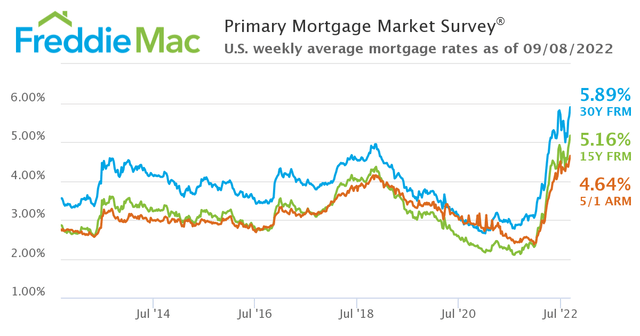

Fannie Mae’s Home Purchase Sentiment Index dropped to its lowest level since 2011 when it reached 62.0 in August, its sixth consecutive month-on-month decline as average rates of a 30-year fixed mortgage rose to 5.89%. This was significantly up from a year ago when rates hovered just above 3%.

Prices Are Falling. The Levered Business Model Is Exposed

House prices are forecast to fall by up to 20% next year and Opendoor is fully exposed to this. The company uses debt for its purchases at around an 80% to 90% LTV rate for any given home. These middle-market homes sit on the balance sheet until they are sold. Hence, movements in the market value of any such home would have a material impact on the company’s financial performance. The company’s business model fast disintegrates if its main source of revenue is continuously valued below book value. A slow consecutive retracement of house prices throughout 2023 would be the worst-case scenario especially as Opendoor currently holds total debt of $7.55 billion.

The most obvious impact on financials would be a non-cash reduction to the carrying value of inventory and the degradation of shareholders’ equity. The company last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $4.2 billion, up 250% year-over-year and a beat of $10 million on consensus estimates. Its inventory of homes reached 17,013, valued at $6.6 billion and up 143% versus the year-ago quarter. The company also reported Adjusted EBITDA of $218 million, up from $25 million in the year-ago quarter. This came as the EBITDA margin increased by 300 basis points year-over-year to reach 5.2%.

Most odd is that Opendoor’s management has actually sped up home buying activity. The company purchased 14,135 homes, up 66% versus the year-ago quarter and entered into a partnership with old rival Zillow (Z) to provide the option for home sellers on Zillow’s platform to request an Opendoor offer on their homes. The deal with Zillow, which itself exited the home buying business last year, will see a significant ramp in Opendoor’s home buying activity.

The company has accelerated their business activities.

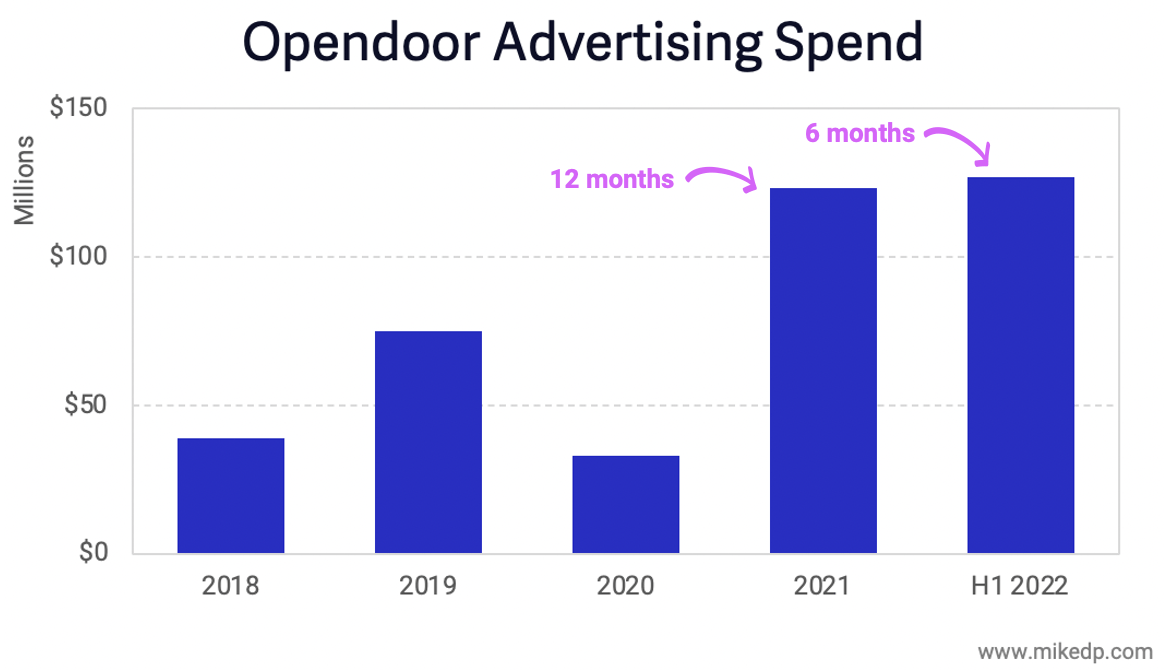

Mikedp.com

Advertising spending for the first half of 2022 is already more than the 2021 fiscal year. Extrapolating the current trajectory would see total advertising spend be greater than the previous four fiscal years combined.

Interest Rates Are Rising As The Housing Market Cools

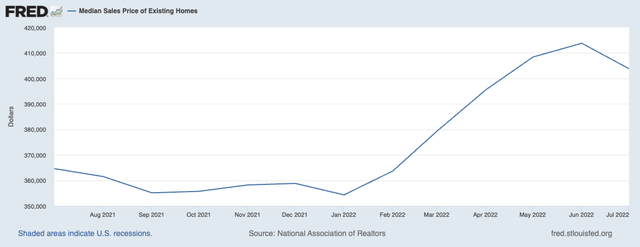

The median sales price of existing homes is already dropping, down 2.4% from their recent peak to $403,800.

St Louis Fed

With recent inflation figures coming in far hotter than expectations, the Fed will maintain its path of large interest rate hikes which will further increase the unaffordability of mortgages for plenty of prospective buyers. Demand for homes will likely be outstripped by available housing inventory even though there has been a failure to build enough homes for many years now. The environment is about to radically change.

FreddieMac

U.S. weekly average mortgage rates are already at a 10-year high and are set to reach levels not seen since the start of the new millennium. High rates in the latter half of the 20th century were palatable with house prices significantly lower than they are now. This new upward rise in mortgage rates is uncharted territory. High rates set against what remains a record high for property prices will end in disaster. A problem compounded by the spectre of a recession.

Opendoor’s ramp in operations is indeed odd when viewed through this lens. Management during the earnings call for their fiscal 2022 second quarter stated that they were moving to be more rigorous with managing risk and overall inventory health. They also stated that they are implementing price reductions in line with the speed at which the market is moving down and as a result expect lower EBITDA margins in the second half of the year. I see no near-term bullish catalyst to take a long position as real estate looks set to face its greatest test in decades.

Be the first to comment