luismmolina/iStock via Getty Images

Ionis Pharmaceuticals (NASDAQ:IONS) is a pharmaceutical company best known for developing Spinraza, which is licensed to Biogen (BIIB), producing $60 million in royalty revenue in Q2 2022. Ionis specializes in a type of RNAi therapy known as antisense. It has two approved, commercial drugs beyond Spinraza, though they are not very significant sources of income. The real prize for investors is Ionis’s extensive pipeline. In this article I will argue that given the pipeline and current price of the stock, Ionis is a strong candidate for long-term investors. I will also review the possible downsides to the rosy scenario. First, I will ground the reader in the financial picture at the end of Q2 2022.

Q2 2022 Results

Ionis reported Q2 results on August 9. In Q2 revenue from Spinraza royalties, Tegsedi and Waylivra were all down y/y. Licensing and R&D collaboration revenues were up significantly y/y. Total revenue was $134 million, up 6% y/y. GAAP net loss was $105 million or $0.74 per share. The non-GAAP net loss was smaller at $80 million. The primary reason for the loss was a high level of R&D spending at $220 million. This is driven not just by the desire to move pipeline therapies to commercial success, but because Ionis competes with other RNAi and mRNA companies, sometimes tackling the same diseases.

|

Ionis sales and royalties$ millions |

||||

|

therapy |

Q2 2022 |

Q1 2021 |

Q2 2021 |

y/y |

|

Spinraza royalty |

$60 |

$54 |

$72 |

-17% |

|

Tegsedi + Waylivra |

10 |

6 |

12 |

-17% |

|

licensing and royalty |

8 |

12 |

2 |

300% |

|

R&D collaboration |

56 |

70 |

40 |

40% |

Source: Ionis, compiled by author

Ionis ended the quarter with a cash and equivalents balance of $2.0 billion. Its debt consists of $1.16 billion in convertible notes. Even at the current spend rate Ionis should be able to continue developing its commercial pipeline until it reaches profitability.

Tofersen for ALS

In addition to Spinraza, Biogen has licensed tofersen for ALS (amyotrophic lateral sclerosis) from Ionis, and it may be the next big stock price driver. On October 17 Biogen announced a three month delay in the tofersen decision by the FDA. The new decision, or PDUFA, date is April 25, 2023. The delay was caused by Biogen submitting responses to FDA questions. The responses were considered a major amendment to the original application, requiring further time for review. Tofersen has shown clinically meaningful benefit in patients with SOD1-ALS. However, there are not many potential patients, less than 2,000, as the SOD1 version occurs in only about 2% of ALS patients. The two companies have a collaborative development and license agreement for tofersen. I see the potential approval of tofersen not as a significant revenue generator, but as further proof of concept for higher revenue potential drugs in the pipeline, particularly neurology drugs. Biogen and Ionis are partnered for several other disease indications.

Eplontersen for ATTR neuropathy

Ionis reported positive Phase 3 data for eplontersen for hereditary ATTR polyneuropathy and is on track to file for commercial approval with the FDA before the end of 2022. For the global launch Ionis is partnered with AstraZeneca (AZN). The drug has orphan drug status in the U.S. It is also in a Phase 3 trial for ATTR-CM, cardiomyopathy. Eplontersen is an improvement on Tegsedi and would also be competing with Onpattro from Alnylam (ALNY). Alnylam also has a novel drug, Vutrisiran, for hATTR polyneuropathy which gained FDA approval in June 2022 and EU approval in September 2022. Since Ionis is the latecomer to this indication, I would not count on a very significant revenue boost unless it materializes.

Pelacarsen

Pelacarsen Lp(A) recently completed enrollment in a Phase 3 trial. This is partnered with Novartis, which is conducting the trial, and could be a multi-billion-dollar revenue opportunity. Pelacarsen is intended to control Lipoprotein(A) and help prevent cardiovascular disease including heart attacks and strokes. However, investors need to be patient: data from the trial will be reported in 2025.

Olezarsen

Familial chylomicronemia syndrome, or FCS, is a rare genetic disorder that causes extremely elevated triglyceride levels. It currently has no approved medications. Enrollment of the Phase 3 olezarsen trial has been completed. Data is expected in 2023. While there will not be very many patients, if approved it will likely carry a high price tag.

Rest of Pipeline

There are too many possible therapies under development to detail them all here, so I recommend taking a look at the Ionis Pipeline page. In many cases Ionis has partnered with larger companies to develop the potential therapies. Partners not mentioned above include Roche (OTCQX:RHHBY), GSK (GSK), and Bayer (OTCPK:BAYRY). The biggest chunk of therapies is in the cardio-renal category. Neurological disease indications are numerous, with a majority partnered with Biogen. Metabolic diseases, hematology, a Hepatitis C candidate, and an eye therapy round out the lot. The most advanced therapy not mentioned above, in a Phase 3 trial, and so most likely to generate new revenue in the next few years, is donidalorsen for hereditary angioedema. Positive Phase 2 results were announced and a Phase 3 donidalorsen trial started in November 2021.

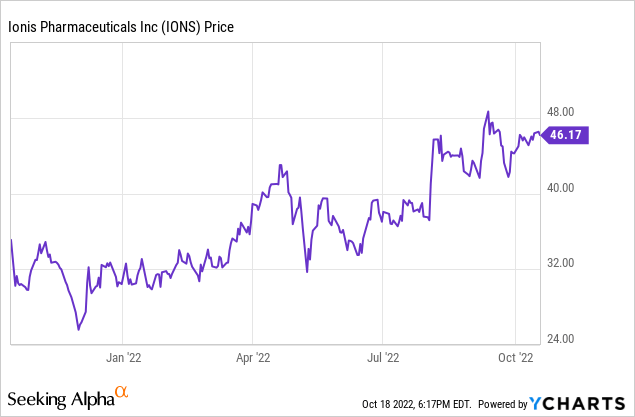

Stock price

When most revenue is in the future, and losses fluctuate, and some data comes in positive and some negative, a stock price can show a lot of volatility. The trend for Ionis was downward with much of the biotech sector in 2021, but has done better in 2022, though getting nowhere near its 2019 peak above $80 per share. The 52-week low was $25.04, the 52-week high was $48.79, and Ionis stock closed on October 18, 2022, at $46.20, close to the top of the 52-week range.

The potential downsides for the stock price are reporting bad trial data; low sales of commercial therapies; and competition in disease target areas. Many of the disease areas tackled by the Ionis pipeline are notoriously difficult to treat. There is no guaranty the Ionis’s antisense RNAi therapies will succeed where other modalities have failed.

Conclusion

Ionis Pharmaceuticals is about the future of RNA therapy. It has proven itself already with 3 approved medications. It is likely to add more in 2023, but I do not see a substantial acceleration of revenue until 2025-2026. In the meantime, incremental approvals of orphan drugs may push Ionis closer to profitability and keep the large cash balance from dwindling too much. I like Ionis for the long run, so long as the price remains reasonable, but expect volatility along the way.

Be the first to comment