keni1

Well-Performing Coal in the Commodity Market Also Creates an Opportunity for Investors in Coal Mines

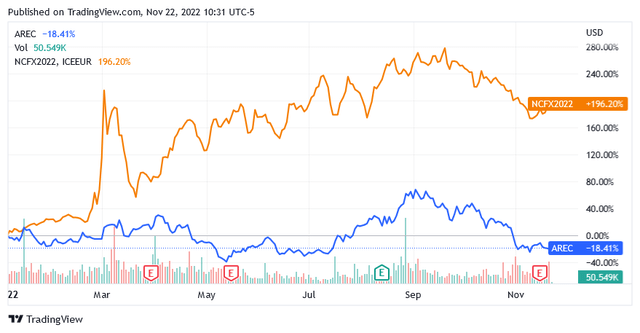

In the commodity market, coal is doing extremely well, with the price up almost 200% over the last 12 months as shown in the chart below.

As a benchmark index to show the development of the coal price, the chart shows the price development of Newcastle Coal Futures – Nov 22 (NCFMc1).

Due to the strong upward pressure on coal prices in the coming months, analysts have raised the 12-month price target to $403.46 per ton, up 15% from current levels.

To take advantage of rising coal prices, investors may be interested in increasing their exposure to coal companies. The increase in the price of coal should be reflected in higher sales and earnings and thus in an improvement in the share price of these producers.

Among coal stocks, American Resources Corporation (NASDAQ:AREC) appears well positioned with its core business as this should allow the company to offer more coal while market conditions are expected to be more benign than currently.

As can be seen from the chart above, there also seems to be a strong positive correlation between the American Resources Corporation stock price and the commodity.

Therefore, any rise in the price of coal should be reflected in a significant upward movement in American Resources Corporation’s stock price, helped by improved profitability of the operation.

American Resources Corporation

Based in Fishers, Indiana, American Resources Corporation is a producer of metallurgical coal that it supplies to steelmakers. Operating activities are located in the Appalachian basin between Kentucky and West Virginia.

The company is also a supplier of raw materials for the electrification market, as well as remanufactured metal that must then be recycled, and a supplier of coal for pulverized coal injection.

Pulverized Coal Injection (PCI) is a coal used in blast furnaces in combination with coke. In this way, manufacturers reduce the amount of coke needed during the manufacturing process of steel products.

McCoy Elkhorn Complex in Kentucky

In the coal mining industry, the complex is considered a high-quality mining facility by local and national market standards as it allows for a significant rise in coal production at a low cost and is expected to host coal production for several years.

The complex includes two ore processing plants and other infrastructure that allow the processing of more than 6 million tons of minerals per year.

Carbon metallurgical operations at the McCoy Elkhorn complex are developing well, partially thanks to the start of production at a series of greenfield projects called Carnegie 2 last August.

In the third quarter of 2022, the McCoy Elkhorn complex saw a stunning year-over-year increase in coal production, which accounted for almost all of the carbon sold during the period.

Perry County Complex in Kentucky

The Perry County Resources complex was idle during the third quarter of 2022 as the company was required to conduct various maintenance activities at the facility due to severe flooding that afflicted eastern Kentucky’s area in late July.

However, the company still sees an opportunity to capitalize on the next coal price hike by utilizing carbon resources from the Perry County resource complex.

The company believes there is even scope for value maximization, which should reassure shareholders.

ReElement Technologies Division

ReElement is a division focused on ramping up the production of lithium to be recovered from recycled materials and virgin ores, as well as the production of rare earth elements that will meet market demand for permanent magnets.

These rare earth elements are also used in the construction of electric vehicles, wind turbines, and defense technology.

According to the company, the ReElement Technologies division can achieve commercial production of earth elements such as neodymium, dysprosium, and praseodymium while maintaining a high purity level of 99.5%.

The division has good prospects as demand for lithium and rare earth elements will benefit from the global goal to go green and achieve decarbonization by gradually replacing fossil fuels with clean energy.

The production of lithium should reach 5,000 tons per year, while that of rare earth elements should hover at about 2,000 tons.

Unlike many operators who still use the traditional metallurgical process that involves the use of toxic solvents, ReElement uses technology that is environmentally and socially friendly. American Resources Corporation will have a significant advantage over many other operators who are instead facing costly green conversion efforts.

ReElement is poised to perform very well, but according to American Resources Corporation, it can fare much better in terms of long-term returns for the company’s shareholders if the division operates as a standalone company. So, American Resources Corporation plans to spin off the ReElement business and then make it a subsidiary by buying back about 7% of it.

American Resources Corporation expects to file within approximately 30 days a detailed SEC filing, a Form 10 Registration Statement, which will mark the beginning of the process of converting the ReElement business into a separate, designated entity.

Company Operational Targets

The company will expand in-house capabilities and partnerships with other companies across the supply chain for the lithium-ion battery recycling market as well as for rare earth metals and critical battery elements.

In addition, the company will also be working on other growth projects at its McCoy Elkhorn Complex, where operations are targeting to expand production, and at the Wyoming County Coal Mining Complex, a fully authorized complex in West Virginia, where the company plans to ramp up production. The West Virginia complex has access to high-grade metallurgical coal characterized by moderate volatile content. These reserves will be used for the expansion of the production from the complex, which will start with 55,000 tons of carbon per month. The processing plant will also have an expanded processing capacity of 700 tons per hour, approximately double its current level. The complex can count on the existence of transportation logistics connecting production to ports on the East Coast of the United States.

The Financial Results for the Third Quarter of 2022

For the third quarter of 2022, American Resources reported total revenue of $9.51 million, a 3.4x year-over-year jump on better coal prices and sales volumes. However, sales missed analysts’ median forecast by $14.4 million.

The bottom line of the income statement showed a net loss of $5.27 million, which was less bad than last year’s net loss of $8.91 million.

Net loss per share for the three months ended September 30, 2022, was $0.08, falling short of the median forecast of -$0.02.

The impact of increased coal prices and sales volumes due to the strong performance of production at the McCoy Elkhorn complex in Kentucky resulted in a positive turnaround in Adjusted EBITDA, which transitioned from a negative result of $1.4 million in the third quarter of 2021 to a positive result of $258 million in Q3 2022.

Coal Prices Outlook

Looking ahead to the remainder of 2022 and beyond, American Resources Corporation’s carbon asset portfolio should provide significant value to shareholders as there are strong catalysts for the coal. These mainly consist of the energy crisis in Europe, the geopolitical tensions between the countries, and other factors which are highlighted below.

For analysts, the increase in the price of the basic material is due to insufficient supply compared to demand. Following unfavorable weather phenomena in the Pacific Ocean, especially in Australia, where the world’s largest coal producers have plants, production had to be scaled back. As a result, the global coal supplies this year will be less equipped than usual to meet coal demand, which in contrast is expected to remain very resilient.

While Australia, one of the world’s largest coal exporters, is expected to ship less coal in the coming months, India, the second largest coal consumer (the largest is China), is expected to import more coal going forward as to meet its domestic needs.

Analyst Sales and Earnings Estimates

On a yearly basis, analysts are forecasting annual revenue growth of 725.24% to $64 million in 2022 and 138.59% to $152.7 million in 2023.

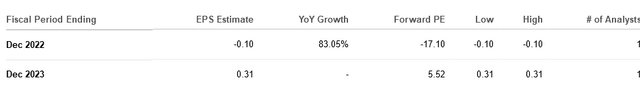

On an annual basis, analysts estimate an 83.05% improvement in the net loss to -$0.10 in 2022 and a positive switch to earnings per share of $0.31 in 2023.

These improvements could potentially generate strong upward pressure and propel the stock price to higher levels than today.

The Stock Price Looks Cheap Given the Likelihood of a Significant Rally

After falling more than 45% from early September levels, the stock price of $1.71 at the close of regular hours on Nov. 22 is now trading well below the long-term trend of the 200-day simple moving average line of $2.13.

Also, the stock has a market cap of $109.93 million and a 52-week range of $1.20 to $3.56. The stock price is in the lower half of the 52-week range.

The stock appears to be trading cheaply, not only because its share price is technically low compared to a few weeks ago, but also because it has strong upside potential given expectations of higher coal prices and the company’s sales volumes.

Given this positive outlook for American Resources Corporation, investors should consider adding to their positions in this US metallurgical coal stock.

The risk of American Resources Corporation stock trading lower can never be completely ruled out, but it is small, as the factors that analysts predict for a favorable environment for coal prices are solid and will therefore materialize over the long term.

Furthermore, not only the anticipated rise in production at the McCoy Elkhorn Complex in Kentucky, but also the ramp-up of production activities at the Wyoming County Coal Mining Complex in West Virginia and the resumption of operations at the Perry County Complex in Kentucky could provide an additional catalyst for growth.

Analyst Recommendation Rating and Price Target

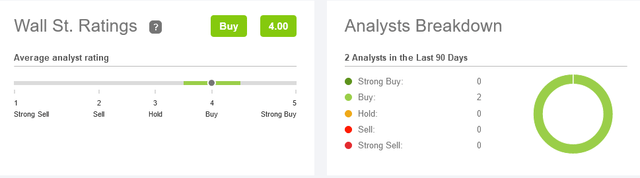

Analysts on Wall Street have issued 2 Buy recommendations.

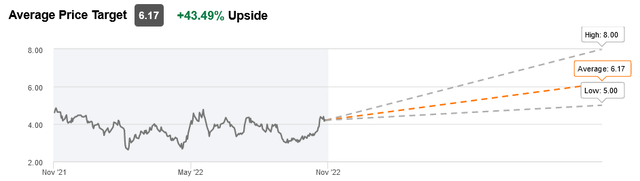

The stock has an average price target of $6.17, which suggests a nearly 44% upside potential compared to current levels.

Conclusion – A Buying Opportunity in the Coal Mining Industry

Coal is set to improve over the next several months on resilient demand versus expected constrained supply.

Shares in American Resources Corporation would allow the investor to benefit from coal price gains as this US producer plans to sell more metallurgical coal.

The impact of improved sales and earnings on the stock price may be amplified by the strong positive correlation between American Resources Corporation’s stock price and changes in the price of coal.

In the longer term, the company believes the transformation of the ReElement Technologies Division into a separate company, operating as a subsidiary of American Resources Corporation, will add value to shareholders.

Be the first to comment