stefanamer

Investment Summary

Here at HB Insights, a portion of our equity risk is concentrated in the incontinence segment of the health care market. We understand the causal relationship between various conditions pertaining to urinary and faecal incontinence, such as prostate disease, bladders cancers, post-pregnancy, etc.

We reaffirmed our ratings on key players in the benign prostatic hypertrophy (“BPH”) segments, Profound Medical (PROF) and Procept BioRobotics (PRCT) last week. Extending our reach to stress urinary incontinence, (“SUI”) we covered Axonics Inc (NASDAQ:AXNX) in detail last month, and we’re back to today to retain our buy rating on the stock.

You can check out our PROF and PRCT publications for a firmer grasp on the total addressable market:

- Profound Medical: Awaiting Positive Movement On TULSA-PRO Numbers

- Procept BioRobotics: Aquablation System Meaningful Insulator

Switching to AXNX, there’s a few things to unpack here. As a reminder, AXNX has expertise in treating bowel and bladder dysfunction. It’s sacro-neuromodulation (“SNM”) implant, coupled with its Bulkamid injection are key differentiators within the space that have potential to create a remedial breakthrough. It now has 330 personnel in the field [in the U.S].

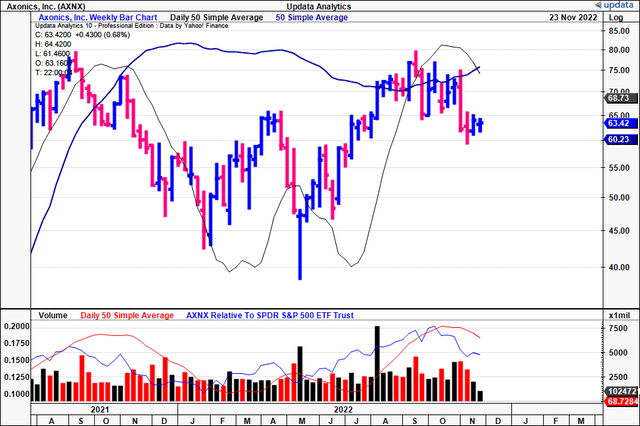

Following its Q3 FY23 financial results, management raised FY22 revenue guidance to $262mm, calling for a 45% YoY gain at the top, a clear indication of the end-market’s reception. Net-net, we reaffirm buy at a revised $86 target. AXNX’s weekly price action these past 18 months is summarized in Exhibit 1.

Exhibit 1. AXNX 18-month price evolution [weekly bars, log scale shown]. Key data points:

- Complete retracement of August 2021 high completed in Aug/September 2022.

- Sharp reversal of trend started in April 2022, despite strong quarterly financials, study data.

- No setbacks from growth route, in fact FY22 guidance upgraded [as mentioned] with delayed reaction in stock price.

- Volume trend still strong with no indication volume drying up.

- Investors now roughly in-line with price level of 18 months ago.

Q3 financials demonstrate AXNX’s market opportunity

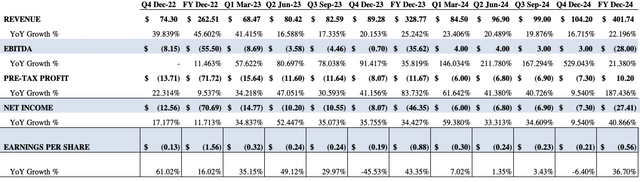

AXNX reported its Q3 results on Nov. 1st with several highlights. Revenue grew 50% YoY to $70.4mm, up from $46.9mm the year prior. It’s worth noting revenue grew by 50% in Q2 as well. The market’s uptake of AXNX’s systems is further indication of their effectiveness as a front-line and last-line therapy in our opinion. AXNX pulled turnover this down to a quarterly loss of $16.3m, a slight improvement from last year.

Turning to the divisional takeouts, there were many highlights. To name a few:

- SMN revenue grew 42% YoY to $56.9mm, a record quarterly result. That equals $147.8mm in SMN revenue for FY22 YTD, versus $110mm by this time last year. It supposedly sells each SMN unit for ~$16,000, implying ~3,555 implants during the period. For reference, the sacral nerve stimulation market was valued at $2.3Bn in 2022 and is expected to grow at CAGR 12.4% into 2028. The company expects to benefit from this, and expects a bold 15% annualized growth rate looking ahead. It’s above-market growth also suggest AXNX captured market additional market share.

- Bulkamid turnover also clipped $13.5mm, up from $6.8mm the year prior. Of that, $11mm or 81% was generated in the U.S, versus 57% a year ago. The upside stemmed from an acceleration in reorder rates in existing accounts and the pace of new accounts. Management forecast 50,000 global treatments via Bulkamid for FY22.

- The $11.6mm, or 41.4% YoY increase at the SG&A line stemmed from a $7.8mm gain in labor expense, 11% of turnover. Compared to some of the other names in our coverage, we feel this is reasonable, and that the company is well capitalized from a labor perspective looking ahead. Management note it has 330 personnel in the field, with 160 of these positioned for direct sales and clinical training.

Switching back to the P&L, Q3 gross profit margin was 72.8%, up from 66.5% last year. Obviously, this is a large upside, driven primarily from greater sales volume and manufacturing efficiencies. We’d also note, however, that inventory growth has been slow last 2 quarters, resulting in lower overhead into the margin.

Looking ahead, AXNX has its R20 unit coming online next year. Combined with the F15 volumes reported this quarter, this could impact gross-operating margins. Nevertheless, once these both pull through, we estimate AXNX’s gross profit margin to hold the 73-75% range in FY23 [see: Appendix 1].

One hurdle AXNX currently faces pertains to how its prescribers are handling the SMN units and Bulkamid. SMN has to overcome its status as a last-resort therapy, and thus AXNX is focusing intently on educating doctors, nursing staff etc., to have the confidence in communicating SMN as a first-line therapy vs. alternatives like Botox, for instance.

This could be timely and poses a risk in that fast-moving competitors could detract market share. Current growth rates in both segments suggest adoption rates are moving along nicely, however, and we’ll be tracking this closely in order to gauge market uptake.

Valuation and conclusion

Consensus values the AXNX at ~12x forward sales and the stock is currently priced at 5.7x book value. On that note, management updated FY22 guidance on the call. It now sees revenue of $262mm, calling for 45% growth at the top line. Specifically, it guides $212mm in SMN turnover with $50mm from Bulkamid sales. These are strong growth percentages representing 35% and 120% YoY growth in revenue respectively.

The company’s WACC is 9.22%. Think of this as the rate at which the company can turn capital into more capital. Therefore, whilst not a perfect comparison, we’re satisfied to see turnover potentially growing faster than the cost of capital.

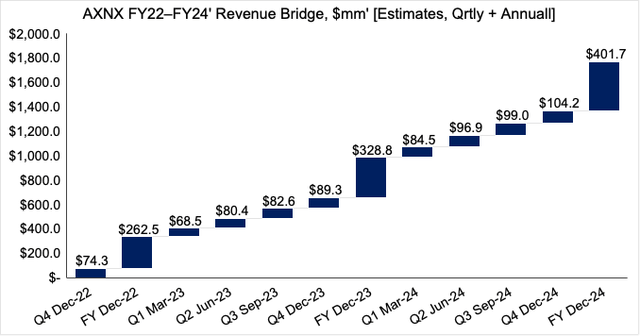

We believe the company is on track to print $262mm in FY22 and $328mm at the top in FY23 at its current run rate [Exhibit 2]. You can see our full projections into FY24 in Appendix 1.

Last time, we valued AXNS at 13x FY23 sales estimates of $317mm. We believe the company should trade at this forward multiple, ahead of consensus. Applying the 13x multiple to our revised FY23 sales estimates of $328 derives a price objective of $86. Therefore we reaffirm our buy thesis on an $84 price target.

Be the first to comment