Francesco Scatena/iStock via Getty Images

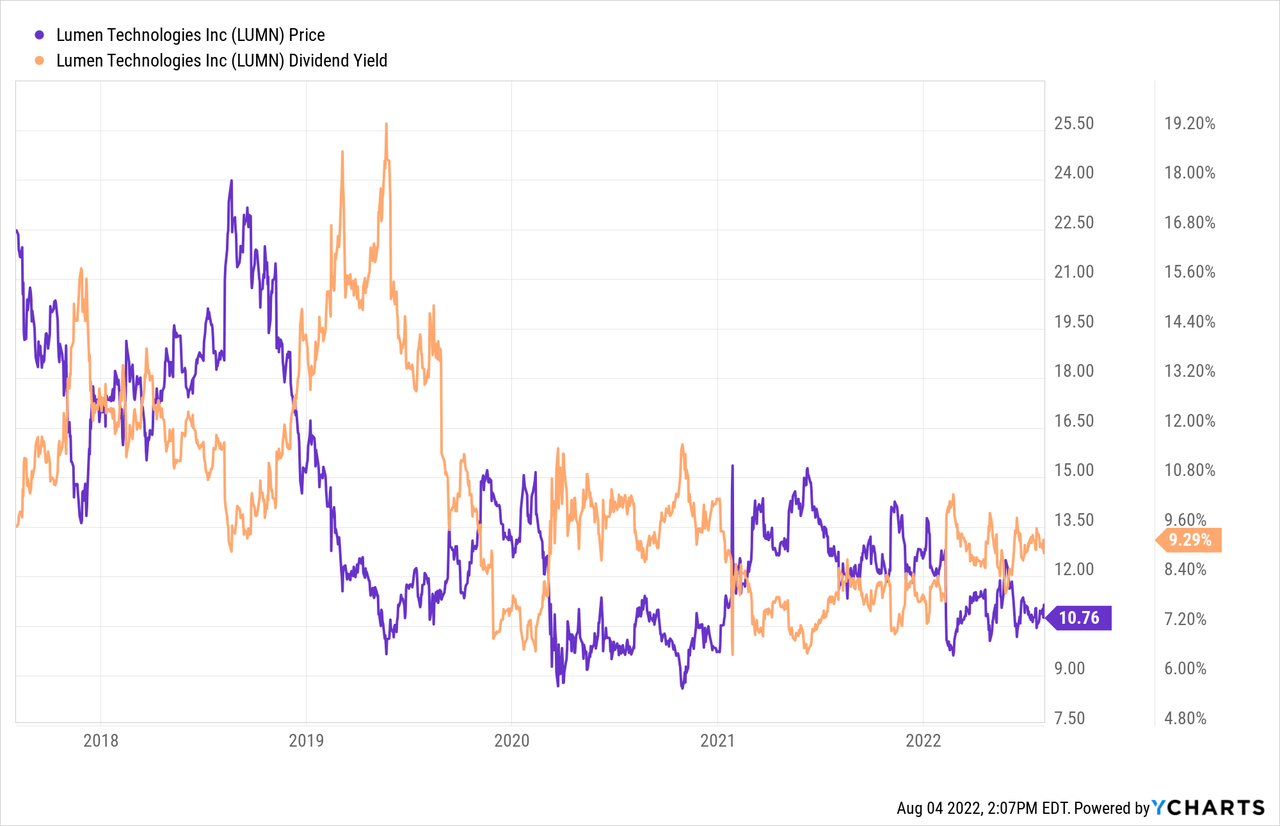

Perhaps no stock has had such a long saga with dividend investors as Lumen Technologies, Inc. (NYSE:LUMN). The company paid a hefty 54 cents a quarter between 2013 and 2018 and after a few rather incredulous denials on the dividend cut, the axe fell. The new dividend looked awesome. It was well covered and LUMN had a clear runway to deleveraging. This attracted a new set of dividend investors and things looked right for a while.

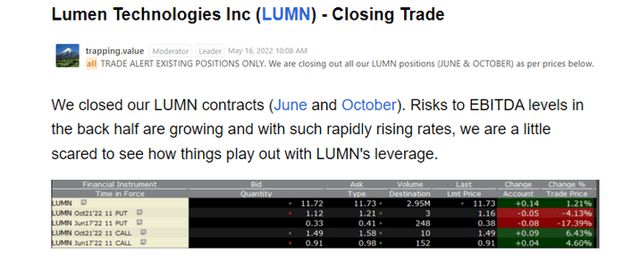

Like any good series, the sequel is where the real money is made, and LUMN did not disappoint on that front. The last 18 months have once again got the vultures circling and speculating on a dividend cut. While we have played LUMN successfully a few times via covered calls, we have been out since May 16, 2022.

Our rationale was that things are just looking too dicey for a long position, and we thought it’s best to lock in gains. That was a good choice in hindsight, and the stock is now significantly cheaper. With Q2-2022 results out, we decided to see if we could actually make another play for this.

Q2-2022

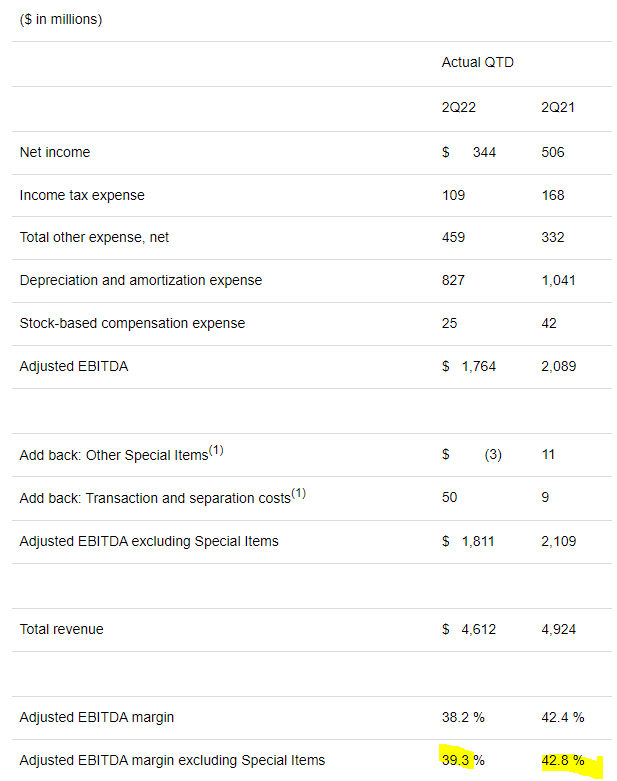

Lumen’s Q2-2022 numbers were more or less in line on revenues, but the margin performance was ghastly.

LUMN Q2-2022 Results

Non-GAAP adjusted EPS missed by 11 cents, and that is no mean feat when analysts were busy taking the numbers lower. Lumen faced pressures from forex movements and also from the loss of Connect America Fund Phase II revenue. Margin pressures were further exacerbated by inflationary headwinds and even supply chain issues. The company did hold the guidance for the year, something we attribute to aiming low in the earlier part of the year, but nonetheless, this prevented the stock from going into single digits.

Are Things Really That Bad?

You generally don’t see 9% plus yields on stocks that you can safely put into your mother’s retirement fund.

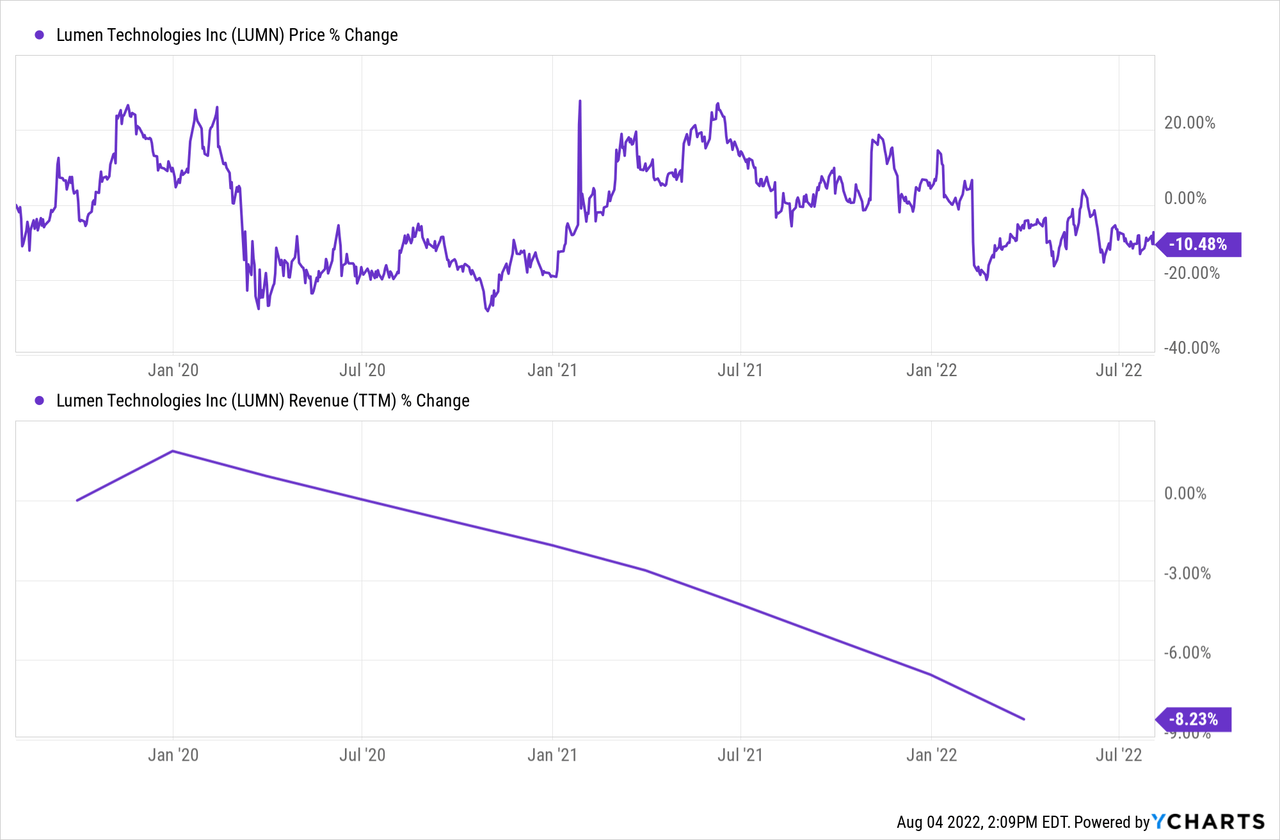

We get that. The concern the market has over declining revenues is also legitimate.

Adjusted earnings don’t appear to be bottoming out this year either. But are we all ignoring the massive free cash flow generation? The free cash flow (which is of course after capex) is supposed to be almost exactly 2X that of the dividend. 2X. How many 9% yields are covered at 2X? It is a pink unicorn for sure. This free cash flow is also not based on faith. The first half has already seen about $1.5 billion generated, and that is about 50% higher than the whole year’s dividend.

Bull Mode

The positive argument for the company comes from the fiber assets being far more valuable at a time of data explosion. The added benefit here is that LUMN has moved away from the consumer and is now courting enterprises for revenues. Perhaps we could see growth down the line. Deleveraging helps LUMN more than most similar companies, as some of its debt coupons are humongous.

Bear Mode

The bear arguments stem from the constant hemorrhage of revenues, and now we can add the margin pressures to that as well. Capex is likely to go up in the coming years as LUMN tries to bring about a fundamental shift in its business. The pace of deleveraging will slow and we could see serious problems in the next recession.

Our Outlook & Choice Of Play

It is tough to get in front of what is essentially a liquidating business sale. EBITDA of $8.7 billion in 2020 will decline to $5.7 billion in 2023. Looking out to the same 2023 year, analysts think the dividend coverage will look poor from an earnings perspective. The mean estimate is 98 cents, and we can bet that no one has modeled an outright recession or capex contraction from enterprises in their equation. The risks remain high in our view and the dividend is not guaranteed, if we get a recession.

The valuation is compelling from a different standpoint. LUMN’s major divestitures would easily rank among the worst of its assets (when we account for how fast the revenues were declining on them). We are also counting the ILEC sale slated for later this year for $7.5 billion in this equation. Yet, each fetched (or will fetch) a higher multiple than the company as a whole. We are looking at close to 5.5X EV to EBITDA as the company valuation when we move into 2023. That seems wrong, and perhaps a hill worth fighting for.

So investors can look at the 9.4% yield and perhaps “yield” to the temptation. From a risk-adjusted standpoint, though, we see some rather lucrative value in the company bonds. We have highlighted just 4 below and would note that the two longer-dated bonds have yields to maturity that exceed that on the common stock.

Interactive Brokers Aug 4, 2022

These are very interesting deals in relation to the market value of the company. With a debt to EBITDA of close to 3.2X, when all the smoke has cleared, you have to only believe that the entire company is worth more than 3.2X EBITDA to consider these bonds. We think that is an extraordinarily low hurdle to clear. Interest coverage should be close to 5X and if you like the 2X dividend coverage, you should love the 5X interest coverage. We rate the bonds a buy (yes, the 2042 bonds with a 10% YTM was what the title was referencing) and have a hold rating on the stock.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment