Kevin Dietsch/Getty Images News

Thesis

I am excited to be back and writing articles again this off-season. For those who are new, I play for Major League Baseball in the World Baseball Classic and for a minor league team during the regular season. One thing we learn in baseball from a young age is, “it’s not how you start, it’s how you finish.”

With that in mind, Southwest Airlines (NYSE:LUV) got off to a rocky start in 2022, but through resiliency and swift action, the company has stabilized its operations and is now operating from a point of strength. In this article, I am going to discuss the state of the business, valuation, and risks.

My evaluation shows that Southwest Airlines is currently trading at a solid discount and could give double-digit returns over the long run.

Business Operations

Before we delve into specifics, it would be a good idea to understand the company. Southwest Airlines started in 1971 with three aircraft. Fifty-one years later and the company has 765 aircraft, 121 destinations (including ten international markets), and 42 states (along with DC and Puerto Rico).

Southwest Airlines operates via a “point-to-point” route structure rather than a “hub and spoke” structure. This enables the company to offer more nonstop flights at convenient hours with lower fares. Many air travelers think of Southwest as the “affordable and reliable airline.” The company’s low-cost strategy contains three major elements: (1) the use of a single type of aircraft, (2) the company’s point-to-point route structure, and (3) its highly productive employees.

Evolution of the Business in 2022

Southwest has significantly stabilized its operations when compared to the first two months of the year coming out of the pandemic. Let’s take a look at what has changed to give us a perspective on management’s actions.

Q1 2022

In January and February of this year, Southwest was operating at suboptimal levels: the company faced staffing constraints (including both a lack of staff and undertrained staff) which caused a significant number of delays and flight cancellations. The Omicron variant of COVID-19 also caused a reduction in travel demand, more specifically a softness in booking and increased passenger cancellations. As a result, Southwest actually produced a net loss in Q1 2022.

However, March told a vastly different story than the prior two months. The company had a significant ramp-up in travel demand during this month, which led to March being solidly profitable. In fact, March 2022 profitability was not far off from March 2019 profitability, before the effects of the pandemic. The company felt optimistic about booking demand for the remainder of the year.

Q2 2022

Revenue in Q2 increased 13.9% versus Q2 2019 to an all-time quarterly record of $6.7 billion, despite business revenue being down 24% and capacity down 7% in the quarter. The company also produced a record quarterly net income of $825 million.

The company made several key improvements to the problem areas present in Q1 (although none of the issues is 100% resolved):

- Southwest reached near pre-pandemic staffing levels in May 2022 and expects to add over 10,000 workers for the year.

- Operational reliability and efficiency reached near pre-pandemic levels. Flight cancellations in May and June were less than 1% and the company was on track with its cost-cutting measures (which included getting the staff trained so that the company is more efficient = more profitable).

Q3 2022

Revenue in Q3 increased 10.3% versus Q3 2019 to an all-time third quarter record of $6.2 billion.

The company guides for continued strong travel demand in both leisure and business and expects Q4 2022 revenues to be sequentially higher and comparatively to Q4 2019. The company has made strides in hiring enough pilots as they are on track to hire 1,200 this year and another 2,100 next year. Additionally, Southwest plans to add over 10,000 employees at the ground level.

Despite this progress, the company is still short on pilots and as a result, has excess fleets, which are not being utilized. Additionally, there is a shortage of staff on the ground level, which reduces the efficiency of the flight numbers, schedules, and reliability. Next, a significant portion of the company’s current staff is undertrained, which translates to taking a longer time to do tasks. Lastly, the company has experienced delays in receiving its fleet of new aircraft from Boeing, which results in issues with the modernization and reliability of operations.

Despite these headwinds (especially business travel being down), the company has managed to post record profits. Clearly, management has made significant progress in resuming normal operations and as they continue to do so, I expect the company’s profits to keep improving. Investors are in good hands and I believe that owning this stock could offer solid long-term returns.

And on that note, let’s shift to valuation.

Valuation

I am going to provide both my in-house discounted cash flow model and some technical analysis using FAST Graphs.

DCF Valuation

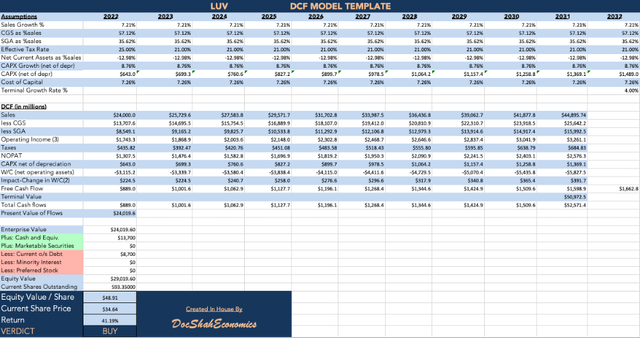

Discounted Cash Flow – LUV (DocShah Capital)

All assumptions are calculated using a combination of historical averages and company forward guidance with one caveat: I excluded all data from 2020 and 2021 in my averages. Both of these years would skew the data and make it completely unreliable as COVID-19 was a one-time event which does not reflect the operational capacity of the underlying business.

Sales growth, CGS, and SGA, NA as a % Sales, and CAPX/CAPX growth rate, were calculated using a decade’s worth of averages. The effective tax rate was taken from company guidance. The WACC was hand-calculated using market values for debt and equity. The terminal growth rate is set to 4% merely to keep up with inflation.

Lastly, I assumed a starting point of $24 billion for 2022 revenue based on sequential improvement throughout the year and comments from management in the last earnings call.

As a result, I calculate the fair share price of Southwest Airlines at about $49, which offers a 41% gain from current levels.

FAST Graphs Valuation

Let’s take a look at some technicals, earnings, forecasts, and additional valuations.

Consistent Record of Earnings

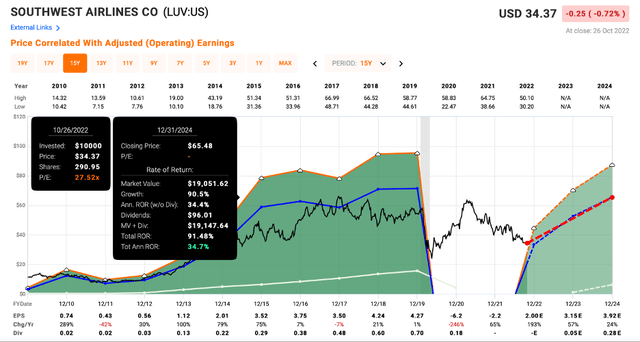

Adjusted Earnings (FAST Graphs)

Using a timeline of fifteen years, we can see that Southwest has produced consistently strong earnings over the long term, as evidenced by the shaded green area. The stock typically trades at a 17x normal P/E. We want businesses which produce consistent earnings and, if not for the pandemic, Southwest’s earnings graph would likely be uninterrupted. Extrapolating into the future, the stock could be trading at around $66, offering a two-bagger return.

Earnings Forecast

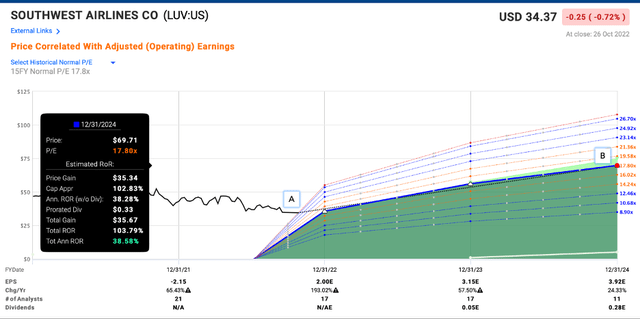

Earnings Forecast (FAST Graphs)

Analysts also believe the stock price has the ability to double if the company continues to execute. Using their earnings forecast, the stock would double under a 15FY, 17x normal P/E.

Historical Operating Earnings

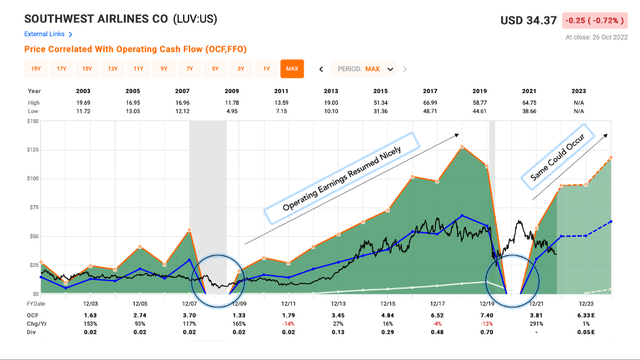

Operating Earnings (FAST Graphs)

It is important to understand that Southwest Airlines is a cyclical stock. These types of stocks are where a fool and his money are most easily parted because you have to look at things backwards. When times are great and the stock price has risen exponentially, it is likely preceding a downfall as the next recession approaches. And when times are bleak and the stock price has imploded, it is likely that the impending boom will send the stock price soaring.

Therefore, one has to buy a cyclical stock at its highest P/E in order to catch the stock at the right time in its cycle. It is counterintuitive and precisely why most investors get crushed in this category of stocks.

Keeping those thoughts in mind, we can see two points in time where the company did not produce any operating earnings, in 2008 and 2020. After the demand shock from financial crisis, Southwest’s operating income began a consistent and strong upward trend. Analysts expect a similar event to occur today, after the demand shock of COVID-19. If this materializes, the stock should have upward pressure as it will follow the trajectory of its earnings. To put things in perspective, the stock is essentially priced at the same level it was in 2014 when its revenue was $17.8 billion compared to the expected revenue of $23-24 billion for 2022.

Note: I know some readers are thinking we are in a recession now and by my own logic, I am advising to buy a cyclical stock at the exact wrong time. However, I do not believe consumer spending on travel will abate and management has confirmed this in their two most recent earnings calls by stating they “have not seen any noticeable impact in their booking and revenue trends.” I think there is a shift in consumer spending where discretionary income is being shifted towards travel and experience rather than things and materialism.

Liquidity

Southwest Airlines’ current liquidity profile is excellent. The company is the only major airline with an investment grade credit ratings from all three rating agencies. The company does not have significant debt maturing until 2025 (they paid off all $1.2 billion of 2023 debt in Q3 2022) and even that amount ($1.5 billion) is completely manageable given the strong balance sheet. The company has reiterated that reinstating its dividend is of high priority as well.

The company has a net positive cash position of $5 billion; $13.7 billion in cash and $8.7 billion in debt. As a result, the company’s cash/share is $8.43. This means that each share of stock an investor buys only costs $26.21 (current stock price minus cash/share). In other words, each share of stock is trading at nearly 25% off. Talk about Black Friday coming early this year.

Risks

As with any investment, there always lies risk. Let’s take a look at some important ones to consider with Southwest Airlines:

General Inflation Destroys Travel Demand:

In the short term, it is possible. In the long term, it will not matter. People will not stop flying because of a recession. Also, Southwest is the low cost airline… if anything I expect the company would get even more customers as the price of its competitors’ tickets become so expensive that it forces customers to book cheaper flights.

Higher Wages Will Destroy Margins:

It is true that staffing costs have risen and as such, will put downward pressure on margins. One has to trust a company can figure out ways to offset that by either cutting costs elsewhere or increasing its prices.

The Price of Gasoline Will Destroy Margins:

Higher gas prices reduce margins, which has a significant impact on the airline industry as its margins are already thin. However, Southwest (along with all other airlines) does have oil hedges which severely reduce the impact of higher oil market prices. An oil hedge is simply a fancy way of saying Southwest has a contract with an oil company which grants Southwest the right to purchase a pre-determined amount of oil at a pre-determined price, regardless of what the market price is on the day of execution.

Business Revenues May Not Recover

Business travel may be reduced due to the changes in work structure (more people working from home = less travel). If this is a permanent shift in society, then business travel might need to be reevaluated with lower expectations. Time will tell.

For a full set of risks, please click here.

Please Consider

Lastly, I want to leave all my readers with a piece of advice:

Do not choose to buy companies based on if it is a bull market or a bear market. It is important to understand when you buy a share of a stock you are a part-owner of that company; and as such, you have to make decisions as if you are the CEO, not a day trader.

Would Tim Cook sell his shares of Apple because there is a recession? Of course not. Would a day trader? Of course so. Be the former, not the latter. When you buy excellent companies at good or better prices, you will not have to worry about a recession. Consider it the blessing of making responsible investment choices.

Thousands of experts study every move the Fed makes, every macroeconomic data out there, every cup and handle pattern, and everything in between all to ultimately be wrong. If I had to buy stocks based on if the market is good or bad, I would have never made any money. And neither would have you nor any “expert.” Do not time the market. Make investment choices based on 90% fundamentals and 10% conviction.

Takeaway

Southwest Airlines is a solid pick for an investor looking to get in on a great company at a good price. I do not believe this stock is a “steal,” but it offers potential for a double-digit return.

According to my calculations, the stock is worth about $49, but there is potential for it to get into the upper $50s and even $60s according to FAST Graphs. It is worth considering in a well-balanced portfolio.

Be the first to comment