bernie_photo

Earnings of Republic Bancorp, Inc. (NASDAQ:RBCAA) will most probably dip this year due to the normalization of provisioning for expected loan losses. On the other hand, subdued loan growth and slight margin expansion will likely offer some support to the bottom line. Overall, I’m expecting earnings to dip by 5% this year to $4.05 per share. For 2023, I’m expecting earnings to remain mostly flattish. The year-end target price suggests a high upside from the current market price. Therefore, I’m adopting a buy rating on Republic Bancorp.

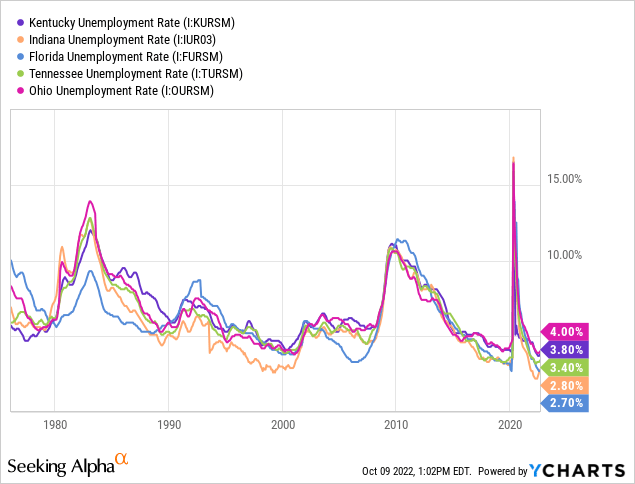

Strong Job Markets To Help Reverse The Declining Loan Trend

Republic Bancorp’s loan book declined by 0.5% in the second quarter of 2022. Except for 4Q 2021, the loan portfolio has declined sequentially in every quarter since June 2020. I believe the downtrend will reverse for good in the second half of this year due to the effect of favorable job markets. Republic Bancorp operates in five states, namely Kentucky, Indiana, Florida, Tennessee, and Ohio. All five states currently have strong job markets, with unemployment rates that are near record lows.

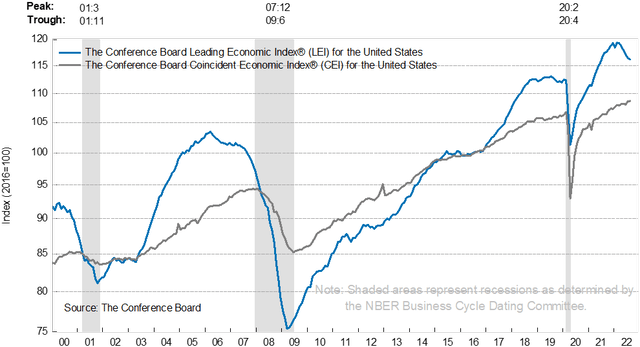

By asset subtype as well, the loan portfolio is well diversified. Loans range from credit cards and residential real estate to aircraft and commercial real estate. Therefore, the broad-based U.S. leading economic index is also a good gauge of credit demand in Republic Bancorp’s markets. As shown below, the leading index continues to be on a downtrend, but at least the slope is less steep than before.

Overall, I’m expecting loan growth to return to the pre-pandemic norm of low to mid-single digits in the coming quarters. I’m expecting the loan portfolio to grow by 0.75% every quarter till the end of 2023. Meanwhile, I’m expecting other balance sheet items to grow mostly in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 4,104 | 4,390 | 4,752 | 4,432 | 4,362 | 4,495 |

| Growth of Net Loans | 3.3% | 7.0% | 8.3% | (6.7)% | (1.6)% | 3.0% |

| Other Earning Assets | 566 | 569 | 632 | 594 | 705 | 727 |

| Deposits | 3,456 | 3,786 | 4,733 | 4,840 | 4,900 | 5,049 |

| Total Liabilities | 4,550 | 4,856 | 5,345 | 5,259 | 5,348 | 5,508 |

| Common equity | 690 | 764 | 823 | 834 | 828 | 883 |

| Book Value Per Share ($) | 32.8 | 36.2 | 39.6 | 40.9 | 41.1 | 43.8 |

| Tangible BVPS ($) | 32.0 | 35.4 | 38.9 | 40.1 | 40.3 | 43.0 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Net Interest Margin Is Only Slightly Rate-Sensitive

Republic Bancorp has significantly improved its deposit mix over the last two years. The proportion of non-interest-bearing deposits in total deposits has increased to 43% at the end of June 2022 from 27% at the end of December 2019 (before 2019 the non-interest-bearing deposit ratio hovered between 27% to 30%). As a result of this remarkable improvement, the current deposit cost is quite sticky. The stickiness will benefit the margin amid a rising rate environment.

At the same time, the earning-asset yield is not too rate sensitive because of the following two reasons.

- Residential real estate loans. Most of these loans are based on fixed rates. At the end of June 2022, residential loans made up 26% of total loans.

- Fixed-rate securities. At the end of June 2022, available-for-sale and held-to-maturity debt securities made up 13% of total earning assets.

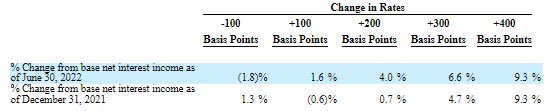

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing showed that a 200-basis point hike in interest rates could boost the net interest income by only 4% over twelve months.

2Q 2022 10-Q Filing

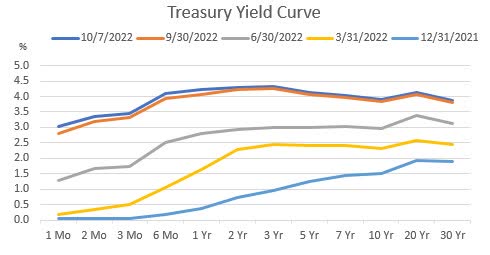

Republic Bancorp has a large cash balance that gives the company the flexibility to quickly shift its asset mix towards higher-yielding assets to benefit from the rising rate environment. At the end of June 2022, cash and cash equivalents made up 13% of total assets. Even if Republic Bancorp can’t shift its asset mix, it can still benefit from rising rates due to the upward shift in the short end of the treasury yield curve.

The U.S. Treasury Department

Considering these factors, I’m expecting the margin to grow by 20 basis points in the second half of 2022 and by 10 basis points in 2023.

Provisioning Normalization Likely

Republic Bancorp’s provisioning for expected loan losses reverted to the historical average in the first half of the year after remaining subdued last year. The non-performing loans made up 0.37% of total loans, while allowances made up 1.48% of total loans at the end of June 2022. As the allowance covered the credit risk well enough, I’m not worried that high inflation will substantially lift provisioning in the second half of the year.

However, some parts of the portfolio bear monitoring. Apart from traditional banking, Republic Bancorp has two other, smaller business segments: Republic Credit Solutions (“RCS”) and Tax Refund Solutions (“TRS”). Out of these two, RCS is a big source of credit risk because its clients are considered subprime or near-prime. At the end of June 2022, loans in the segment totaled $91.8 million, representing 2% of total loans.

Considering these factors, I’m expecting the net provision expense to average 0.62% of total loans every quarter till the end of 2023. In comparison, the net provision expense averaged 0.61% in the last five years.

Expecting Earnings To Dip In 2022 And Remain Flattish In 2023

The anticipated loan growth and slight margin expansion will likely support earnings this year. On the other hand, the normalization of provisioning this year after last year’s subdued provisioning will drag earnings. Overall, I’m expecting Republic Bancorp to report earnings of $4.05 per share for 2022, down 4.5% year-over-year. For 2023, I’m expecting earnings to grow by just 1.6% to $4.11 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 226 | 236 | 232 | 221 | 222 | 238 |

| Provision for loan losses | 31 | 26 | 31 | 15 | 27 | 28 |

| Non-interest income | 63 | 75 | 87 | 87 | 101 | 103 |

| Non-interest expense | 164 | 172 | 185 | 182 | 193 | 207 |

| Net income – Common Sh. | 78 | 92 | 83 | 87 | 82 | 83 |

| EPS – Diluted ($) | 3.74 | 4.41 | 3.99 | 4.24 | 4.05 | 4.11 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Adopting A Buy Rating

Republic Bancorp has a long-standing tradition of increasing its dividend every year. Therefore, I’m expecting the company to increase its dividend by $0.011 per share to $0.3520 per share in the fourth quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 34% for 2023, which is above the five-year average of 29% but still easily sustainable. Based on my dividend estimate, Republic Bancorp is offering a forward dividend yield of 3.6%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Republic Bancorp. The stock has traded at an average P/TB ratio of 1.17 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 32.0 | 35.4 | 38.9 | 40.1 | ||

| Average Market Price ($) | 43.4 | 45.1 | 34.2 | 47.4 | ||

| Historical P/TB | 1.36x | 1.27x | 0.88x | 1.18x | 1.17x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $40.3 gives a target price of $47.2 for the end of 2022. This price target implies a 21.4% upside from the October 7 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.97x | 1.07x | 1.17x | 1.27x | 1.37x |

| TBVPS – Dec 2022 ($) | 40.3 | 40.3 | 40.3 | 40.3 | 40.3 |

| Target Price ($) | 39.2 | 43.2 | 47.2 | 51.2 | 55.3 |

| Market Price ($) | 38.9 | 38.9 | 38.9 | 38.9 | 38.9 |

| Upside/(Downside) | 0.7% | 11.0% | 21.4% | 31.7% | 42.1% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.4x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.74 | 4.41 | 3.99 | 4.24 | ||

| Average Market Price ($) | 43.4 | 45.1 | 34.2 | 47.4 | ||

| Historical P/E | 11.6x | 10.2x | 8.6x | 11.2x | 10.4x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.05 gives a target price of $42.1 for the end of 2022. This price target implies an 8.2% upside from the October 7 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.4x | 9.4x | 10.4x | 11.4x | 12.4x |

| EPS – 2022 ($) | 4.05 | 4.05 | 4.05 | 4.05 | 4.05 |

| Target Price ($) | 34.0 | 38.0 | 42.1 | 46.1 | 50.2 |

| Market Price ($) | 38.9 | 38.9 | 38.9 | 38.9 | 38.9 |

| Upside/(Downside) | (12.7)% | (2.2)% | 8.2% | 18.6% | 29.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $44.6, which implies a 14.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 18.4%. Hence, I’m adopting a buy rating on Republic Bancorp.

However, I’m not enthusiastic about this company because it’s mediocre in many respects, especially rate sensitivity and organic loan growth. I am most dissuaded by the point that its earnings have been rangebound in the past and are likely to remain rangebound in the future. Unlike most other banks, there is no clear uptrend. Therefore, I wouldn’t want to buy and hold this stock for long. My strategy would be to buy and exit whenever its market price gets closer to its fair value.

Be the first to comment