Box company. It’s a box company.

Irina Gutyryak

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Box Is Dead, Long Live The Box!

As everyone knows, you don’t want to own hardware systems companies. Low levels of intellectual property, terrible balance sheets arising from inventory and all that old fashioned stuff, poor gross margins, no revenue visibility, and vulnerable to being eroded by the next box company that comes along with a sharp-looking case and a couple fancy ASICs in side.

We agree with this.

It’s just that the logic doesn’t apply to Palo Alto Networks, which is a box company. And that’s because the management team have worked very hard to scrub all trace of your regular box company economics from the financial statements. Not in an FTX/SB-F – kind of way; in a let’s-just-make-the-economics better kind of way.

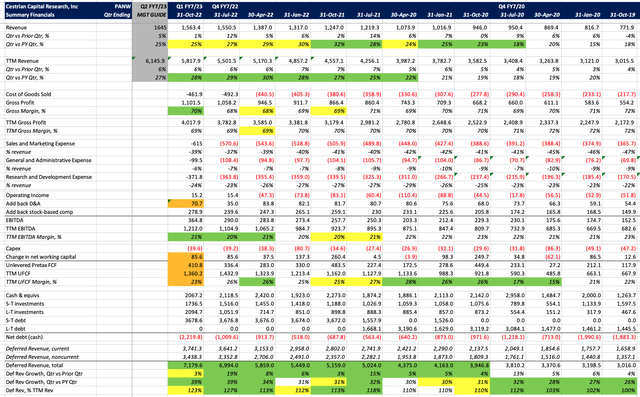

Here’s the numbers up to and including the quarter just reported (ending 31 October 2022), plus management’s guide for the next quarter (ending 31 Jan 2023).

PANW Financials (Company SEC filings)

This thing is a machine.

The company doesn’t publish all of its numbers until the 10-Q is out in a couple days (the orange cells above show where we have used trend-based estimates). We’ll update this article once the full set is available – they won’t change the story, which is:

- TTM revenue growth sits at 28% vs. peak TTM growth of 30% two quarters ago; quarter vs. PY quarter growth at 25% vs. peak of 32% this time last year. This is very strong compared to other tech companies – look at NVDA for instance (here).

- TTM EBITDA just hit an all time high of c.$1.2bn.

- TTM unlevered pretax cash flow was in the region of $1.3-1.4bn (will update once we have the true change in working capital and depreciation numbers) which is close to a record high.

- The company has >$2.2bn net cash on the balance sheet and has over $7bn of already-invoiced future revenue – that’s the deferred revenue element – on the books. Which means that something like 1.2x TTM revenue has already been sold. Nice.

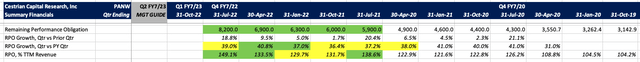

- The total book of signed contracts (RPO, = the deferred revenue plus contracts that have yet to be billed to customers) we don’t have yet but we expect will exceed $8bn, in the region of 1.5x TTM revenue.

Here’s that RPO data up to last quarter – again we’ll update when the full 10-Q is published.

Financial Table PANW (Company SEC filings)

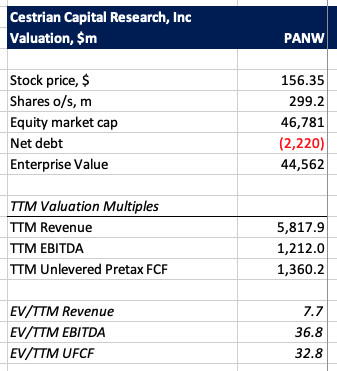

And here’s the valuation the market is asking you to pay.

PANW Valuation (Company SEC filings)

8x revenue and 33x cash flow in exchange for 28% growth and solid cash flow margins. That’s punchy but not terrible for buyers.

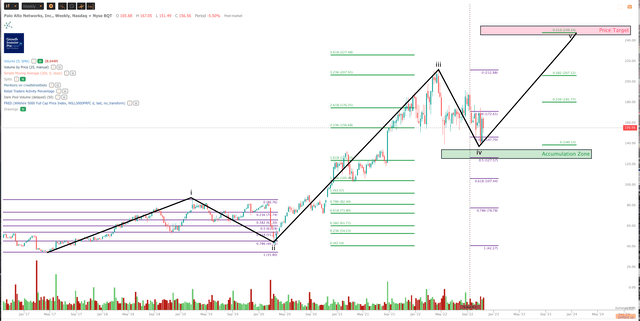

The stock offers a nice risk/reward setup if you don’t mind buying at Wave 4 lows (usually better to buy at Wave 2 lows because the risk/reward level is to your benefit).

You can open a full page version of this chart, here.

PANW Chart (TrendSpider)

We think a good way to play this name is to buy around here ($157ish) with a stop-loss-limit placed somewhere close below that W4 low, and to gun for a price target of $250 or so, which would mean the W5 target would be around the 0.618 extension of Waves 1+3 combined.

Just keep reminding yourself it’s a box company and that one day it will be devoured by software. Just not today.

Cestrian Capital Research, Inc – 17 November 2022.

Be the first to comment