“TAIWAN”; Pro-independence candidates at 2016 campaign rally.

Ashley Pon/Getty Images News

The iShares MSCI Taiwan Capped ETF (NYSEARCA:EWT) is likely to perform poorly over both the long term, including relative to the S&P 500 and US Treasuries, and the short term. There are three reasons for this. First, the Taiwanese market is tech-heavy, and the sector is likely entering a long-term bear market. Second, a global cyclical bear market (a recession, if you like) is in its early innings. And third, geopolitical pressure on the Taiwanese economy is likely to increase. The technological component of the Taiwanese equity market alone would be enough to make me bearish on EWT, but China’s actions over the last week have shown that Taiwan and, most importantly, her allies do not have clear responses to China’s asymmetrical encroachments on the Indo-Pacific region.

Below, we are going review Taiwan’s role in the global semiconductor industry, the role that the tech sector plays in the EWT ETF, the geopolitical implications of Taiwan’s place in the global technology market, Taiwan’s place in Chinese ambitions, how China is squeezing the East Asia, and how these factors are likely to interact.

Taiwan’s global semiconductor

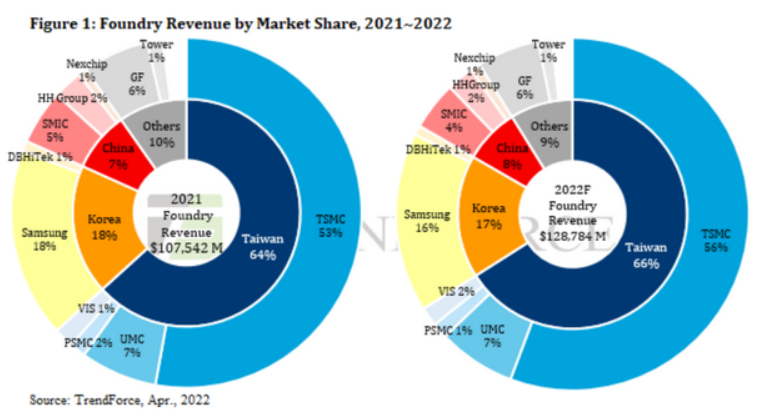

It is no longer a secret that Taiwan forms an integral component of the global semiconductor industry. According to TrendForce, Taiwan has two-thirds of the global foundry market, with Taiwan Semiconductor Manufacturing Company, or TSMC (TSM), making up the vast majority of that.

Chart A. Taiwan dominates the semiconductor foundry business. (TrendForce)

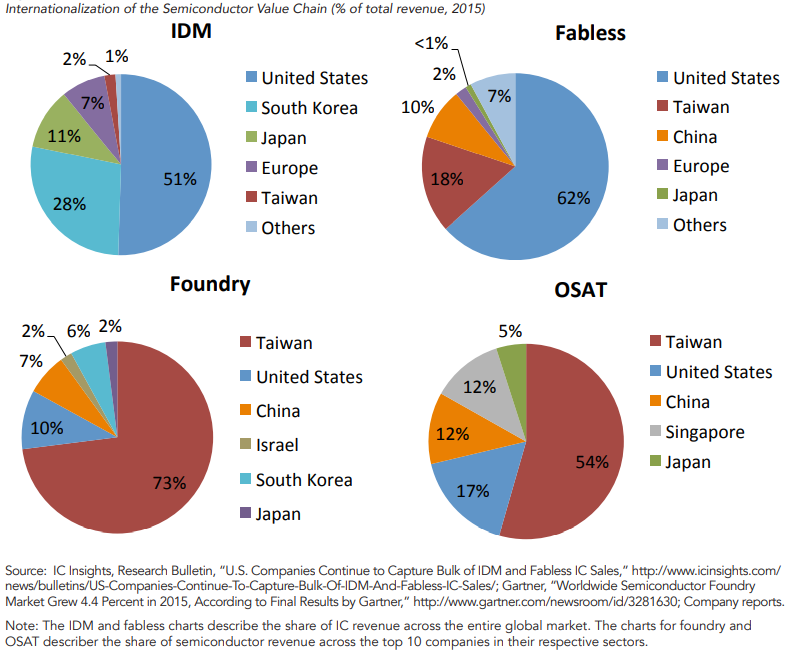

Taiwan holds strong positions in nearly every category of semiconductor manufacturing, as illustrated in the following chart. Taiwan’s strongest position is in the foundry business, which is effectively contract manufacturing for “fabless” chip designers and “integrated device manufacturers” (or IDM, companies whose efforts typically span design and manufacturing). Taiwan also has a strong position in “outsourced semiconductor assembly and test” (OSAT).

Chart B. Taiwan plays outsized roles in multiple layers of the semiconductor industry. (Boston Consulting Group/Semiconductor Industry Association)

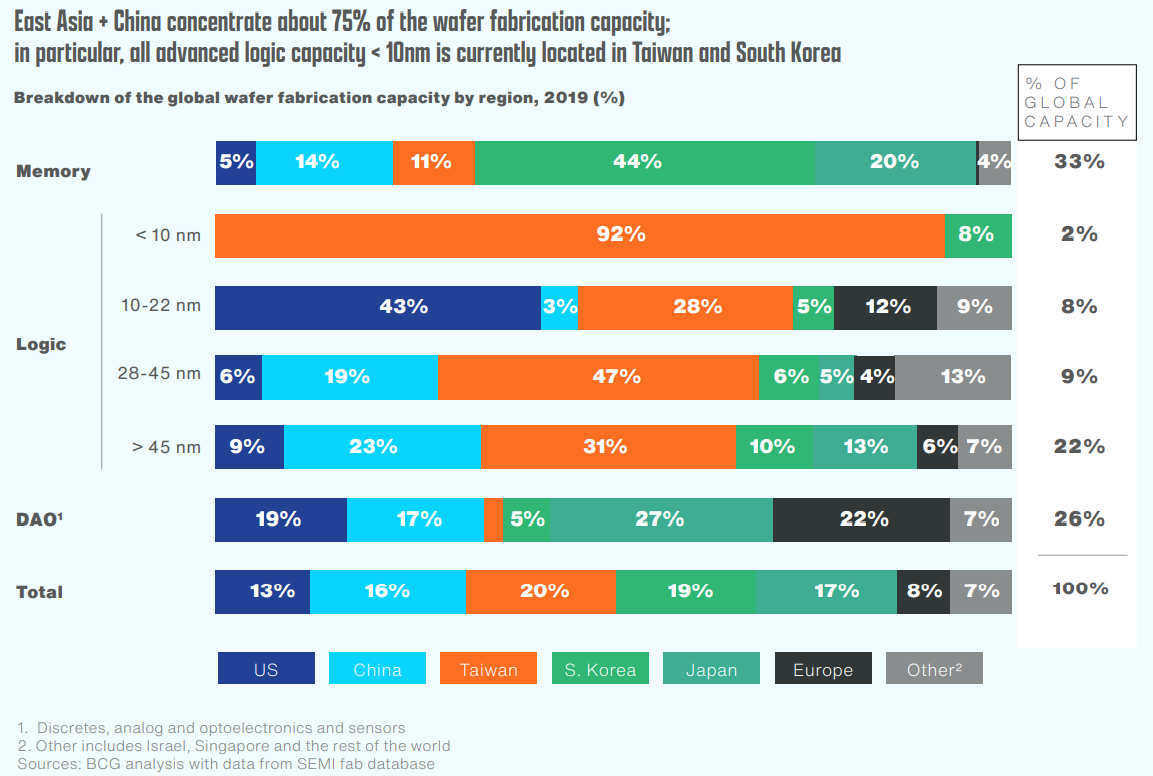

Taiwan holds a hegemonic position in the global manufacture of cutting edge logic chips and dominant positions in most other logic chip categories, as the chart below from a joint report by Boston Consulting Group (BCG) and the Semiconductor Industry Association (SIA) last year suggests.

Chart C. Taiwan has a hegemonic position in advanced logic chips. (Boston Consulting Group/Semiconductor Industry Association)

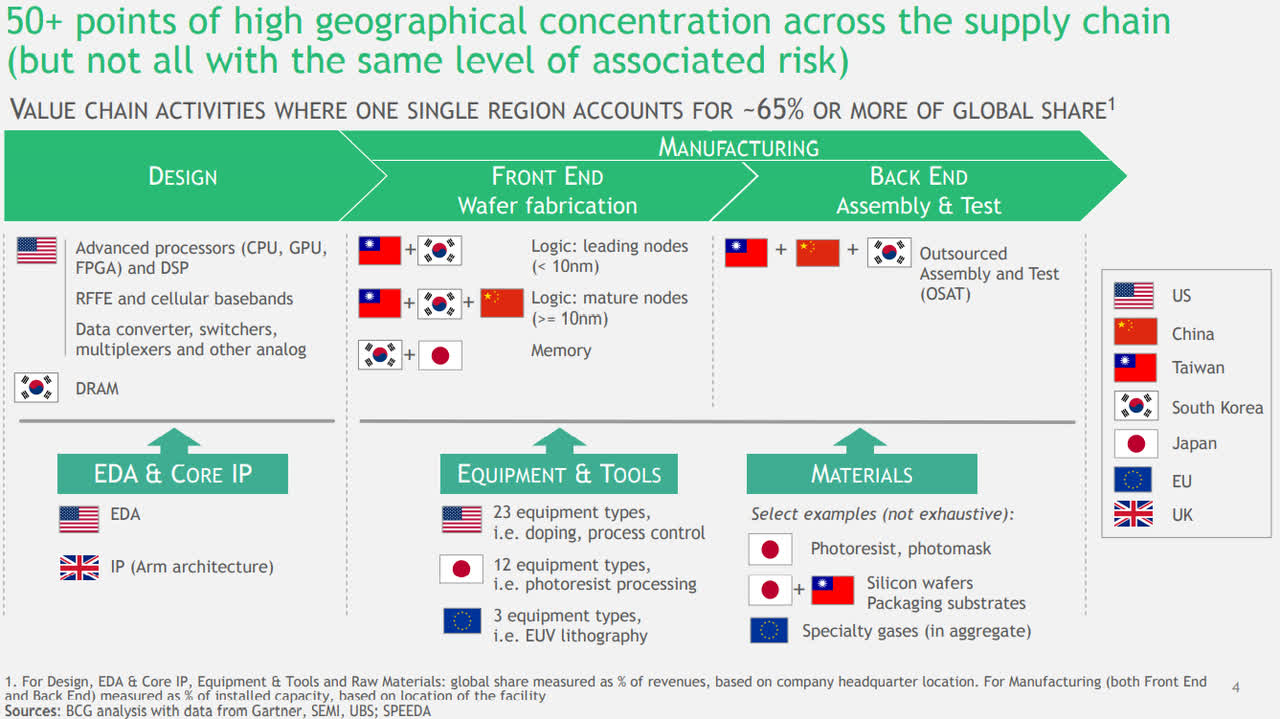

In another presentation, BCG and SIA list “geographical concentration”, a byproduct of intense globalization, as one of the “five key vulnerabilities” in the semiconductor supply chain. The second and third vulnerabilities are “geopolitical friction” and “national self-sufficiency policies”. In other words, geopolitical dangers constitute the primary risk. (The other two vulnerabilities are related to R&D constraints).

The chart below illustrates where the risk of geographical concentration is highest. Asia dominates CAPEX-heavy semiconductor manufacturing, while the West tends to dominate R&D-heavy chip design, as well as the manufacture of semiconductor equipment.

Chart D. Geographical concentration has been considered a risk to the globe but a shield for Taiwan. (Boston Consulting Group/Semiconductor Industry Association)

Logic chips are critical to defense and security, which is why the US pressured TSMC to shift production to Arizona while dangling subsidies (which the US might not deliver) despite the high costs.

“[A]bout a quarter of the US consumption of advanced logic chips is associated with critical infrastructure applications, including aerospace and defense systems, core telecommunications networks, supercomputers and data centers for essential sectors such as government, energy, transportation, healthcare and financial services”, according to BCG and SIA. An article in The Diplomat argues that, although the US has done a good job of maintaining production of highly specialized semiconductors at home, American weapons systems will also be increasingly dependent on advanced commercial off the shelf (COTS) logic chips, precisely the point along the semiconductor supply chain at which Taiwan holds such a powerful position.

The US, unsurprisingly, wants to secure its access to advanced chips while keeping them out of the hands of the People’s Republic of China, which has been expending great effort in creating its own semiconductor industry, albeit with somewhat disappointing results. In 2015, China set the goal of becoming 40% self-sufficient in semiconductors by 2020 and 70% by 2025, but as of 2020, had only reached a 16% level, according to Nikkei Asia. Nearly two-thirds of that 16% are produced by foreign companies operating in China. Meanwhile, the US continues to ramp up restrictions on China’s access to the equipment and technology it needs to develop its domestic semiconductor industry, with new restrictions being reported in just the last week.

What role does Taiwan’s semiconductor strength play in geopolitical tensions? It depends on who you ask.

Semiconductors and geopolitics

An article in Reuters suggested China was holding the US and Taiwan by the chips with this week’s blockade of sound and fury: “The People’s Republic has a trump card: threatening to cut off the island’s exports, which include products from pivotal chipmaker TSMC.” Mark Liu, the chairman of TSMC, said, however, “Because our interruption would create great economic turmoil in China—suddenly their most advanced component supply disappears….[P]eople will think twice on this.” The Hong Kong-based South China Morning Post seemed to share this opinion. China has banned certain Taiwanese imports and exports (most notably sand, some of which it allegedly steals from Taiwan), but it has steered clear of semiconductors.

Some have called the semiconductor industry in Taiwan the country’s “silicon shield”, and in this crisis, that seems to have been the case, but Taiwan’s geographical vulnerability combined with the US’s and China’s respective manufacturing vulnerabilities complicates things. If both the US and China feel exposed, they are more likely to (attempt to) reshore their critical semiconductor production, but the less dependent they are on Taiwan, the more vulnerable Taiwan becomes.

Others have argued that Taiwan’s dependence on its silicon shield is a gamble and thus provides a false sense of security. What if China is less deterred by the shield than Taiwan and the US think? This week’s crisis thus cuts both ways. It suggests that the semiconductor industry is a shield, but that it is not impenetrable. China has shown itself willing to materially escalate, and so far Taiwan and her allies have not demonstrated a way to prevent future blockades, harassment, and intimidation (nor, as I write this, a way to return the Taiwan Strait to its status quo ante). This may explain why, if TSMC’s founder has called the Taiwanese semiconductor industry “a holy mountain range protecting the country”, United Microelectronics Corporation’s (UMC) founder this week donated US$100 million to shore up Taiwan’s defense readiness. “The funds will support defense education for individuals or groups to help Taiwan resist Beijing’s cognitive and psychological warfare campaigns and also go toward countering Chinese Communist Party cyberattacks and hacking activities against Taiwan, he said.”

The PRC’s cognitive and psychological campaign lies at the heart of its strategy to take Taiwan. It gives China a greater ability to swallow Taiwan (and its industrial power) whole and without sacrificing its own power or resources in the process. It would also play into Chinese narratives of taming and subduing a wayward child. In short, it plays to China’s strengths. Taiwan is culturally Chinese, in some ways more Chinese than China: Taiwan’s religion and language are closer to Chinese tradition than China’s is (on the continent, many of the finest elements of Chinese culture were smashed during the worst excesses of the communist reign) while the traditional imperialism and Confucian dictatorship were shed in the transition from Taiwan’s KMT dictatorship to democracy (parallel with neighbors in South Korea and the Philippines).

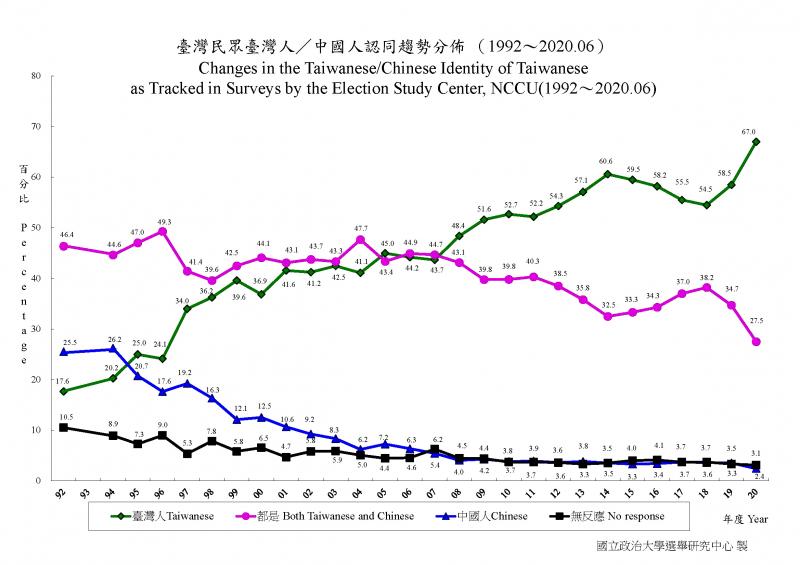

Taiwanese self-identification has shifted markedly over the last thirty years away from “Chinese” towards “Taiwanese”.

Chart E. Greater democracy has brought about a greater sense of Taiwanese identity. (Taipei Times/National Chengchi University)

It is not surprising, therefore, that representatives of the Chinese government have promised to “ reeducate” the Taiwanese upon annexation. This will be a process familiar to Taiwanese, not through their awareness of Chinese reeducation programs in China proper, as well as in Tibet, Xinjiang, Inner Mongolia, and most recently, Hong Kong, but in their own experience of Chinese indoctrination under the Chinese Nationalist Party (more commonly known as the KMT). In the gap between the continental (yellow) Chinese influence and the maritime (blue) international influence, a Taiwanese (green) identity repeatedly emerges that continental imperialists often find threatening.

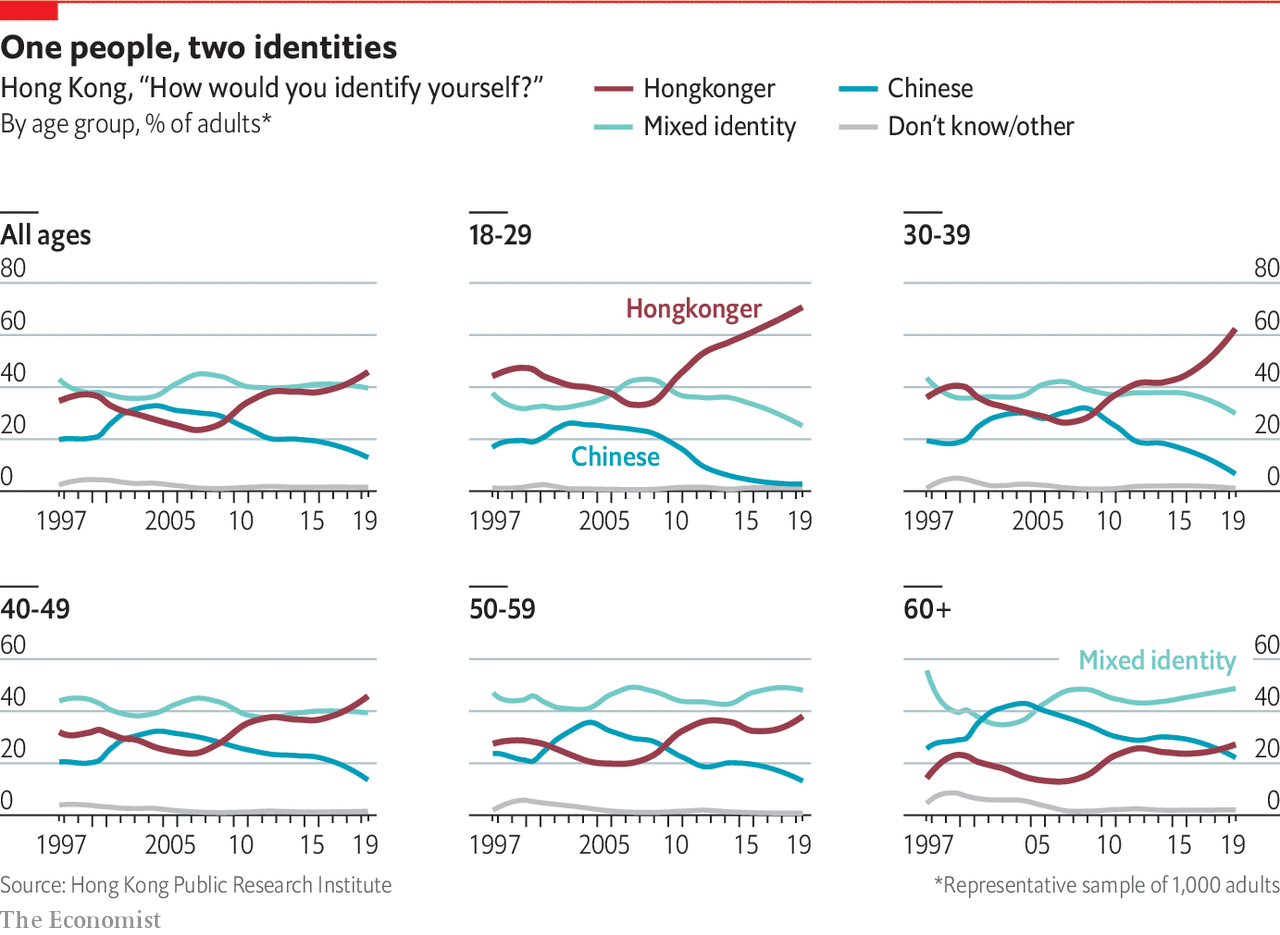

Hong Kong’s identity evolved in ways not dissimilar to Taiwan’s.

Chart F. The emergence of a Hong Kong identity in younger generations paralleled Taiwanese developments. (The Economist/Hong Kong Public Research Institute)

In both places, new national identities grew significantly from the late 2000s, especially in people under 50 years of age.

That new identity did not protect the city-state from a complete takeover by Beijing since the massive and sometimes violent protests of 2019, however. What began as a protest against an extradition law ultimately turned into a crackdown on any expression of a distinct Hong Kong identity or opposition to communist dictatorship. This was all done without the PLA ever having to leave its barracks.

One key difference between Taiwan’s situation and Hong Kong’s is that Hong Kong’s political institutions and police were loyal to Beijing whereas Taiwan has a democratically elected government that is fully committed to Taiwanese self-determination. There is a hardcore minority, however, that still believes that Taiwan is an inseparable part of China and would probably choose unification over democracy, and they may be over-represented in Taiwan’s officer corps.

Last year, a retired general publicly said the Taiwanese military “must respond by overthrowing this DPP scam ring in one fell swoop.” The DPP, or Democratic Progressive Party, is the main party of the pro-independence pan-green camp (as opposed to the blue KMT). As Reuters reported late last year:

“Taiwan’s spycatchers are battling a campaign that has compromised senior officers at the heart of the island’s armed forces and government agencies, a steady stream of convictions handed down in the courts shows….In November 2016, Beijing scored a dramatic propaganda victory when more than 30 retired Taiwanese generals were seen attending a speech by President Xi at Beijing’s Great Hall of the People. One of the retired generals in the audience was Wu Sz-huai, who is now a KMT lawmaker.”

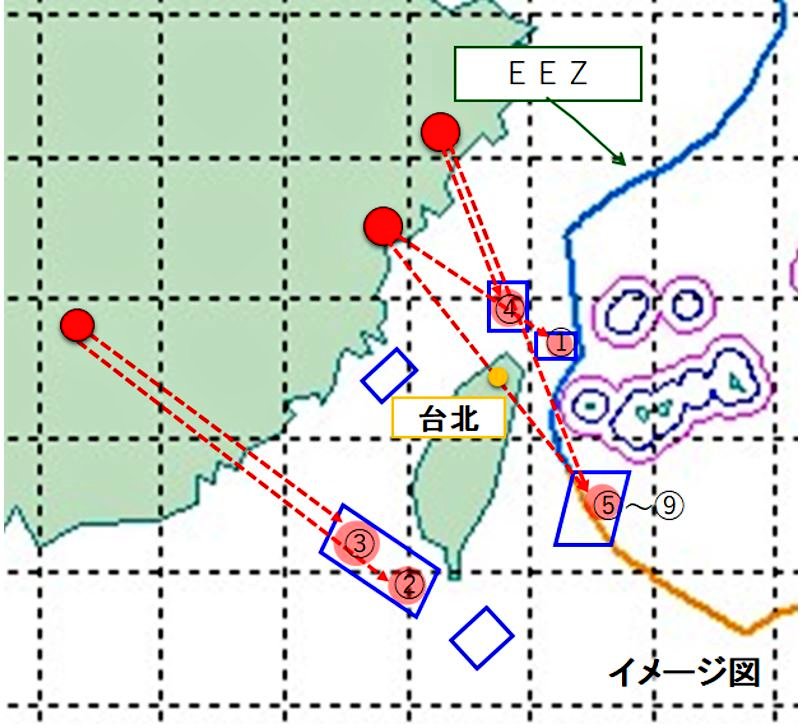

Massive and occasionally violent protests in Hong Kong were put down primarily through a campaign of intimidation. That is clearly the playbook China would like to use on Taiwan. On the map below, from the Japanese Ministry of Defense, the blue boxes mark the zones in which the PLA blocked air and sea traffic for three days. The numbers indicate the locations where Chinese missiles were fired into, including four over Taipei. Missiles 1 and 4 landed in zones outside of the main northern port, Keelong, while missiles 2 and 3 landed in zones outside of the main southern port of Kaohsiung (pronounced Gow-sheeong).

Chart G. China is isolating Taiwan. (Japan’s Ministry of Defense)

If the intimidation works, either by demoralizing the Taiwanese or by weakening the cohesion and determination of the Quad (Australia, India, Japan, and the US) and its allies in the Indo-Pacific (for example, South Korea, the Philippines, Vietnam, Singapore, Indonesia), tactics of intimidation can be transformed into direct military action, where deemed advantageous. (China may, for example, have determined the leaden response to last week’s “exercises” that it can effectively occupy the Taiwan Strait).

Indeed, it is primarily the collective resolve of the allies that China is primarily challenging in order to intimidate Taiwan. If neither the US nor the Japanese can assist in keeping Taiwan’s lines of communication open, the 23 million people of Taiwan will have virtually no choice but to surrender to a country of 1400 million. If China succeeds in cutting off Taiwan, Taiwan, for all practical purposes, becomes another Hong Kong.

The core of the alliance is the US-Japan axis. Numerous Japanese islands be under threat and ultimately Japan’s autonomy would be irrevocably crippled were China to absorb Taiwan. This logic holds too for South Korea, which I talked about in a previous article, but South Korea’s autonomy is already relatively constrained due to its geography, size, and relationship with North Korea. Japan has the capacity to challenge China, especially with the help of Taiwan, South Korea, the US and other members of the Indo-Pacific alliance. That is probably why China has tried to play on Japanese fears of nuclear war were they to come to Taiwan’s defense. Ultimately, both the attempt to intimidate Japan and the jubilation with which many Chinese greeted the news of the assassination of a former prime minister are projections of Chinese weakness.

Geopolitical prospects

The problem for Taiwan is that Japan and the US do not have their act together. While there seems to be a vague consensus that the two countries would help Taiwan repel a Chinese invasion, they do not appear to have articulated just what that means. In an interview with NPR, Yoji Koda, a retired Vice Admiral of Japan’s Maritime Self Defense Force, said, “Do the U.S. and Japan together have a joint or combined operational plan, the answer is no.” Assuming that is true, the most optimistic interpretation of that is that both Japan and the US are confident that China is not anywhere close to being in a position to launch an invasion of Taiwan out of the blue, which is probably true.

But, China’s actions this week suggest that nobody has a plan to deal with these “grayzone” tactics. The US has said that it will not “accept a new status quo” in cross-strait relations and will resume “standard air and maritime transits through the Taiwan Strait” in the ‘next few weeks’, but as the Wall Street Journal put it, “The problem is that these new exercises—surrounding the island and blocking main routes to key ports—are far more ambitious than anything China has tried before, and look like a trial run for a real blockade, either full or partial.”

The WSJ is not wrong, but the bigger problem is what to do about a series of sporadic, temporary blockades masquerading as “exercises” (and, as I write this, China’s apparent attempt to permanently occupy the Taiwan Strait). How frequent will US transits have to be to prevent these blockades from becoming indefinite? How much political will is there in the US to do this over the long term?

Part of the problem is that the doctrine of strategic ambiguity is starting to show its age; in the face of an aggressive China, it begins to look like strategic passivity. The US and Japan lack a long-term vision of East Asian order, and this is permitting interested parties (for example, Nancy Pelosi on one side and China on the other) to craft an order of their own. There is a lack of leadership in the region, and this is being exploited. Because of both North and South Korean uneasiness with Japan, it is difficult for Japan to take up a position of regional leadership, but the Taiwanese situation demands Japanese involvement (the Taiwanese have long had warm relations with Japan).

The next thing to watch out for, apart from the resumption of Taiwan Strait transits, is whether or not South Korea joins the Chip 4 alliance. The Chip 4 alliance is, according to the Hong Kong-based South China Morning Post (or, SCMP), “a US-led coalition aimed at partially decoupling China from a global tech cooperation”. The Chip 4 (also called the Fab 4) would include the US, Japan, South Korea, and Taiwan. Japan and Taiwan have needed little coaxing, but South Korea has been somewhat more hesitant.

Both the SCMP article and a recent piece in the Korean Herald suggest that the new government in Seoul, led by Yoon Suk-yeul, who has shown a greater willingness to improve relations with Japan and the US and take a harder line against China and the North, is positively disposed towards the Chip 4 proposal. The propaganda mouthpiece of China, the Global Times, has said, “Decoupling with such a large market is of no difference from commercial suicide. The US is now handing South Korea a knife and forcing it to do so.” A decision is expected by the end of the month. It seems unlikely that China will have helped its case much by attempting to intimidate Taiwan. But, perhaps China’s newly announced month-long exercises off the Korean peninsula will prove more persuasive.

The larger problem, as Pei Minxin alluded to in Bloomberg, is that a collective arrangement to help Taiwan bolster its defenses (for example, via its silicon-shield/holy-mountain strategy or to turn the island into a bristling “porcupine” that would be too hard to invade) is not enough. If China is not dissuaded from doing so, it is likely to continue grayzone blockades indefinitely. Pei suggests that a Strait transit might be effective, but a longer-term strategy includes giving Japan a more meaningful regional role while convincing South Koreans that, whatever misgivings they may have, their security is best served by a regional balance of power. This will mean a clear revision of the anachronistic Article 9 of Japan’s constitution, which says that Japan “renounce[s] war as a sovereign right of the nation and the threat or use of force as means of settling international disputes.”

China frequently points out that American hegemony is in decline. Insofar as that is true, Japan cannot be expected to continue to rely on American guarantees in the very long term. A regional alliance, backstopped by the US and supported by allies in the Indo-Pacific with a strong Japan at the center, is likely the only thing that can prevent China from cutting off Taiwan and ultimately East Asia entirely. Chip 4 is a small step in that direction, but this will ultimately have to expand beyond semiconductors.

Unfortunately, these kinds of transitions rarely occur smoothly and peacefully, and many things have to go right for Taiwan to not only survive but thrive. Insofar as this is likely to be a rocky road for Taiwan, I do not think Taiwanese equities are likely to outperform equities in the US until the East Asia as a whole can turn on the corner on the geopolitical challenge posed by China.

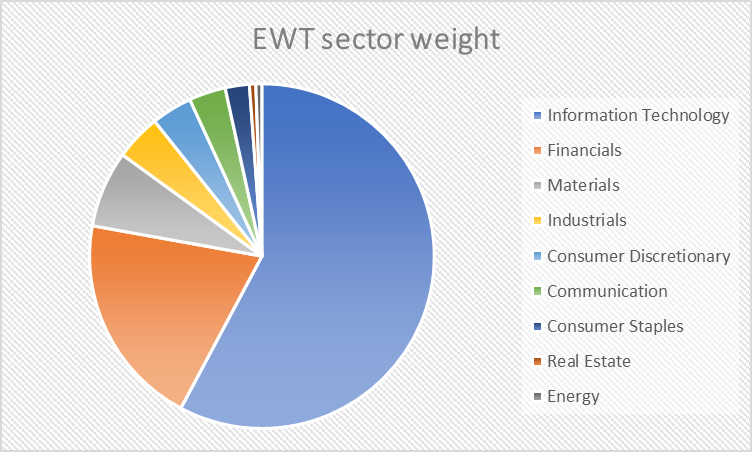

What is more, the technology sector is likely to underperform other sectors over the long term, and Taiwan is not only an important part of the tech sector, but the tech sector is the primary component of the Taiwanese market as it is reflected in the EWT ETF.

EWT’s composition

EWT is heavily tilted towards the tech sector. Indeed, whereas I described the Hong Kong market as effectively being a transportation index with a city built around it, EWT is a tech index with a country built around it.

Chart H. EWT is dominated by semiconductor and tech hardware stocks. (iShares)

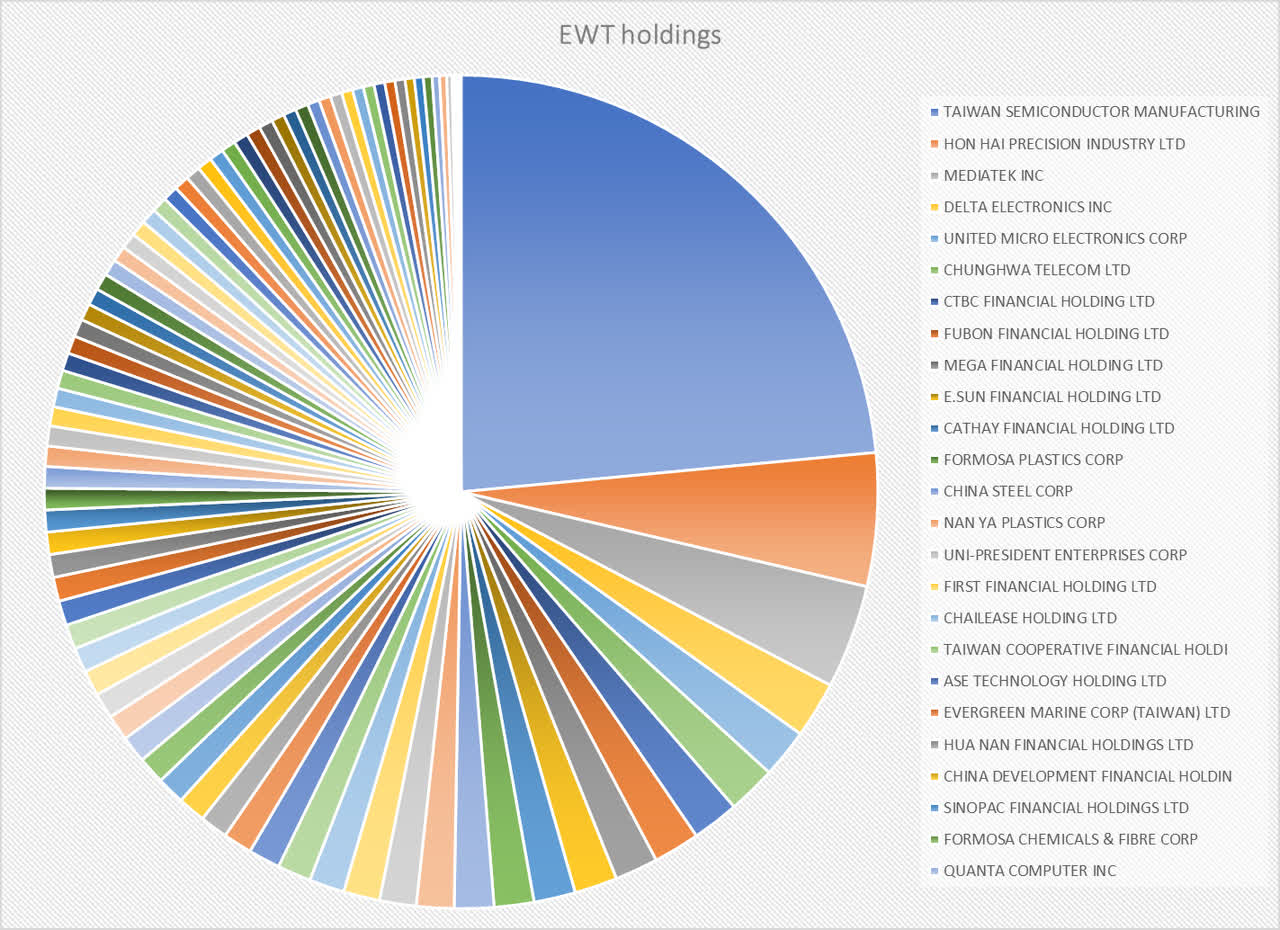

Fifty-seven percent of the index is devoted to tech, over half of which is in semiconductors and the rest in hardware. One quarter of the index’s market cap is made up of TSMC alone, with Hon Hai Precision (OTCPK:HNHAF) and MediaTek coming in a distant second and third, respectively. After that, the index is divided between the following 80+ companies in 1% or 2% slices.

Chart I. EWT is dominated by TSMC but is also composed of over 80 other stocks. (iShares)

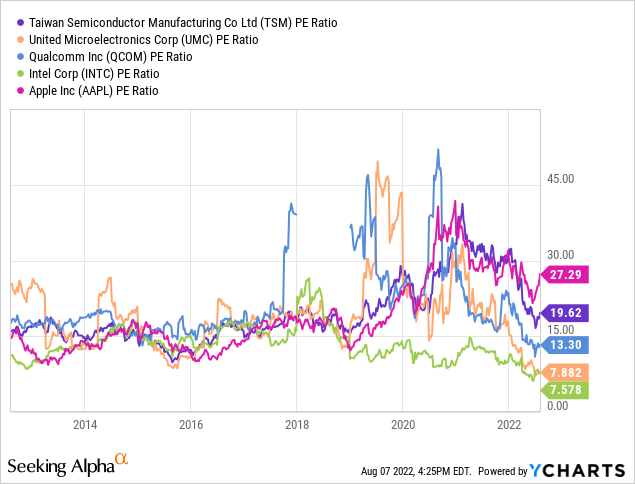

In the chart below, I plotted TSMC’s and UMC’s P/E ratios alongside those of select American tech companies.

Chart J. There is no clear indication of political risk having been priced in to Taiwanese equities. (YCharts/Seeking Alpha)

They generally seem to be within the range of US PEs, but YCharts lists EWT’s weighted P/E ratio at 10.2, roughly half that of the SPY, XLK, and XLI and 25% higher than that for the South Korean ETF EWY.

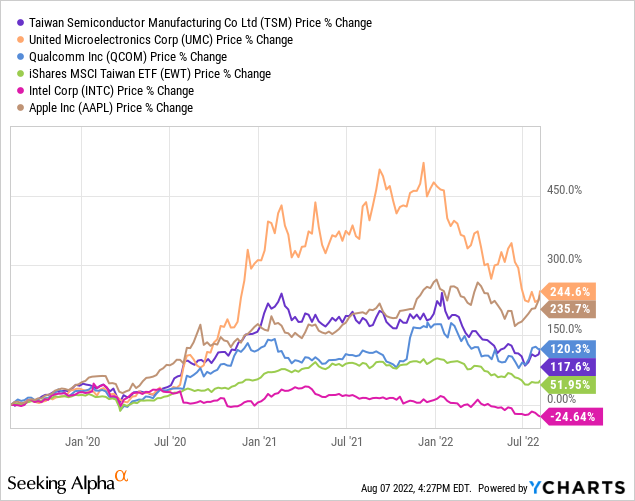

Chart K. EWT has generally tracked tech stocks. (YCharts/Seeking Alpha)

There is nothing that suggests to me that Taiwanese geopolitical risk is adequately priced in. Neither the geopolitical risk that could have direct, cataclysmic impacts on the Taiwanese market and society, nor the more indirect drag caused by continued geopolitical pressure forcing countries to reshore semiconductor production, thus adding potentially to competition with Taiwanese industry while removing the advantages that Taiwanese companies have accrued from low-cost, concentrated industry.

These risks overlap with a generally negative long-term outlook on tech and semiconductor stocks that I outlined in previous articles, for example in “A Primer on Long-Term Sector Rotations” a year ago and “Why I Think Semiconductors Are A Sell” in April. History suggests that in periods of extreme, long-term sectoral dispersion, subsequent long-term returns will have an inverted regime. That is to say, the leading sectors begin to lag, and the lagging lead. This is especially true when tech has done very well and energy very poorly, as has been the case over the last decade. This reversal of sectoral fortunes occurred after the 1920s and 1990s, for example. Tech booms tend to occur during the late stages of a general market boom, as well, so tech peaks tend to mark the beginning of “secular” bear markets in the overall index.

As I argued in a series tracing the history of the relationship between war, innovation, and asset prices, tech stocks do quite poorly during periods of rising geopolitical tension and, somewhat counterintuitively, explosions in disruptive innovations in the transportation and communication industries. As I argued there, history suggests that disruptive innovations are almost impossible to identify either in advance or in real time (even for those later credited with having been most responsible for realizing them). Stock returns, moreover, do not reflect this kind of technological progress until well into the period of mass diffusion and sometime around the period of product standardization (for example, when the iPhone set the standard for all subsequent smartphones).

For those who argue that technological progress will continue to propel tech stocks far into the future, I do not see much evidence to support that. Valuations are high, sectoral returns need to rebalance, there is no apparent mass diffusion curve lifting off in the durable goods sector, nor product standardization in a new communications or transportation sector, energy prices have halted their long-term decline, global geopolitical tensions are rising, and globalization is unravelling. If Taiwan and its tech-heavy index were located in the South Atlantic instead being off the coast of an aggrieved and sullen empire, there would still be good reason to be pessimistic about its returns over the remainder of the decade and perhaps beyond.

On top of these long-term headwinds, we have the short-term challenge of an inflationary shock compounded by a flattening yield curve. Flattening yield curves, especially when such flattening is caused by rising short-term rates, and energy shocks typically precede cyclical bear markets. Particularly in the context of a “secular” tech decline and overall bear market, these cyclical downturns tend to see deep cuts in all sectors, which is why in recent articles on defensive sectors like utilities, staples, and healthcare stocks, I have argued that they would likely underperform US Treasuries.

These cyclical and “secular” conditions create a number of challenges for a tech-heavy index like EWT. These problems are amplified by the accelerating breakdown in East Asian order that shows no hints of being halted.

Concluding observations

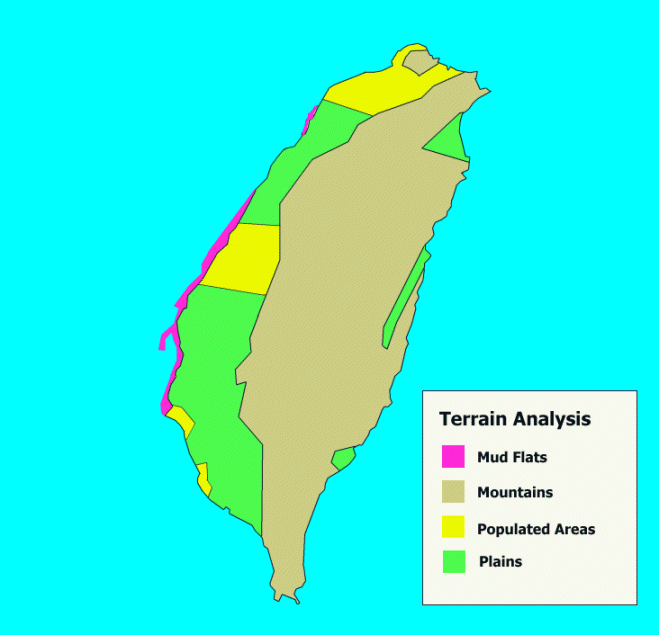

EWT is a tech index with a country built around it. Unfortunately, that country is located next to an empire that believes it has a duty to purge the island’s people of their democratic misgivings. A reasonable worst-case scenario could be catastrophic on multiple levels. We are talking about a population the size of Australia being jammed onto an island the size of the Donbas and with nowhere to escape to in the event of an invasion or blockade. Almost the entire population is located on the small plains of the west of the island facing China. One third of the landmass is mountains over 1000 meters, and the country has only attained a level of 35% food-sufficiency.

Chart L. Taiwan’s population is extremely concentrated along the coast facing China. (globalsecurity.org)

Whatever Nancy Pelosi was thinking when she decided to go to Taiwan, and whatever the Chinese leadership were thinking when they decided to choke the island off in response, the stakes have been raised and China continues to play its cards skillfully, exploiting gaps in the region’s security architecture and, most importantly, will. The nation of Taiwan is too small relative to China to have complete control of its destiny, as it may be forced to choose between annihilation and identity.

In order to merely stabilize Taiwan’s security situation, we will need to see unequivocal progress on at least four points in the coming weeks and months.

- Complete, sustained freedom of navigation in the Taiwan Strait

- Preventing grayzone blockades

- The establishment and expansion of the Chip 4 alliance

- The revocation of Article 9 of Japan’s constitution

The greater the failure to accomplish Points 1 and 2 in very short order, the greater will be the need for Japan to remilitarize.

The US has not wanted to provide Taiwan enough defensive support for fear that the island would unilaterally change the status quo (that is, so that Taiwan does not formally declare a Republic of Taiwan). That restraint has become the defining feature of the free world’s approach to Taiwan. China is now successfully exploiting US hesitancy towards Taiwan to change the status quo on its own terms. It will be difficult to dislodge the Chinese from the Strait now, but as the efforts to restore the status quo ante are nearly the same size of the commitment that would have been necessary to give Taiwan enough support for it to formally declare independence, the stakes are extremely high for all sides, but for Taiwan they are highest of all.

Whether the US chooses to take up this challenge is a political decision that the American people have to make for themselves, but it must be a decision made in the context of their wider interests in East Asia and the Indo-Pacific generally. From Taiwan’s perspective, the road ahead will be treacherous no matter what. The Taiwanese economy is being put on the frontline of the battle since a ‘straight’ invasion is not yet possible. Geopolitical risks combined with the global macro risks, both of which bisect with Taiwan’s semiconductor industry, make EWT a risky bet for investors.

Be the first to comment