yangna

Last week, NextEra (NYSE:NEE) published its three-month results. Here at Mare Evidence Lab, we provided a detailed comps analysis between the American energy giant versus Enel (OTCPK:ENLAY), prioritizing the Italian renewable operator. The European energy shocks coupled with the ongoing Italian government crisis have not played any favor towards Enel. At the stock price level, the European energy giant has tremendously suffered. Next week, we will provide an update with the half-year comment schedule for the 29th of July. In the meantime, we highlight that Enel is currently yielding more than 8%.

Regarding NextEra, our neutral rating recap was based on a higher interest rate forecast, future adverse climate conditions in Florida, and a lower geographical footprint in the renewable energy portfolio. Thanks to our stats team, we also provided a very useful tool to estimate future earnings growth. Looking at the previous analyses, we discovered that $1 billion in additional CAPEX has led to a 1.5% higher net income margin. Despite our preference for Enel, and after NextEra’s first quarter analysis, we confirmed our target price of $85 per share. Today, we provide the latest company news and our comment on the Q2 results.

Q2 Results

Starting with the analyst day presented in mid-June, the company raised the bar on future earnings growth. More in detail, NextEra provided the following:

- Confirmed a 6-8% long-term earnings per share growth rate (already at the top within the utility sector). The company also raised earnings per share in 2022/2023 as well as EPS forecast for the following year;

- Raised CAGR EBITDA growth by 15% until 2025;

- Confirmed order backlog despite the ongoing supply challenges and increased additional capacity in solar and wind production; the company is now targeting 18/24 GW over the 2024/2025 period and zero carbon emissions by 2045;

- Aside from the investor day, US President Biden has frozen solar import tariffs from China over the next two years. This was a positive upside for the renewable energy operators across the States.

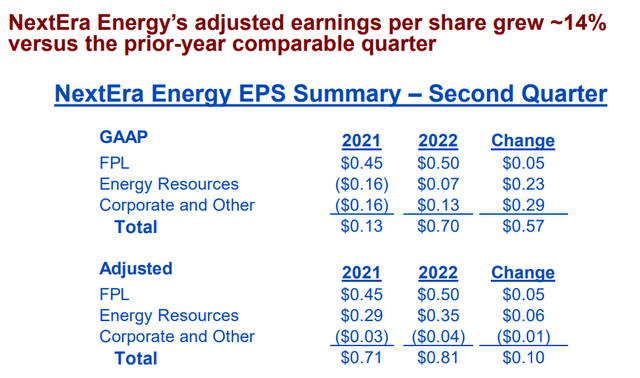

Regarding the second quarter results, NextEra delivered a good set of numbers. Indeed, top-line sales increased to $5,183 million compared to $3,927 million a year ago. This was driven by higher CAPEX and consequently higher regulated revenues. Net income also grew and stood at $1,380 million compared to the $256 million a year ago. This result was achieved thanks to NextEra Energy Resources, which delivered a strong performance in renewable energy generation and storage origination. Diluted EPS beats analyst consensus and all the financial metrics were confirmed from the analyst day.

Conclusion and Valuation

Our internal team has updated NextEra’s financial model with the latest company guidance, adding the additional renewable backlog and the further CAPEX requirements at the core utility level. Inflationary cost pressure and higher interest rate will weigh on the future earnings growth, and we believe this is not well priced in by the market. Despite the fact that the American energy giant will increase its DPS at a 10% rate per year, our internal team has a preference for European renewable energy operators such as Iberdrola (OTCPK:IBDSF) and Enel. Once again, we reaffirm our hold valuation at $85 per share.

Be the first to comment