jetcityimage

Introduction

As a dividend growth investor, I constantly seek additional opportunities to increase my income stream. Sometimes I add to existing positions, and on other occasions, I start new positions to expose myself to new industries or diversify further. The current market volatility may be an excellent opportunity to find attractively valued companies.

I lack exposure to consumer staples companies in my dividend growth portfolio. I own shares in several large retailers, including Walmart (WMT) and Target (TGT). In this article, I will analyze another retailer I have followed for some time, Kroger (NYSE:KR). Consumer staples seem like a haven for investors in volatile times due to their low volatility and steady execution.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

The Kroger operates as a retailer in the United States. The company operates combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses. Its combination food and drug stores offer natural food and organic sections, pharmacies, general merchandise, pet centers, fresh seafood, and organic produce, and multi-department stores provide apparel, home fashion and furnishings, outdoor living, electronics, automotive products, and toys.

Fundamentals

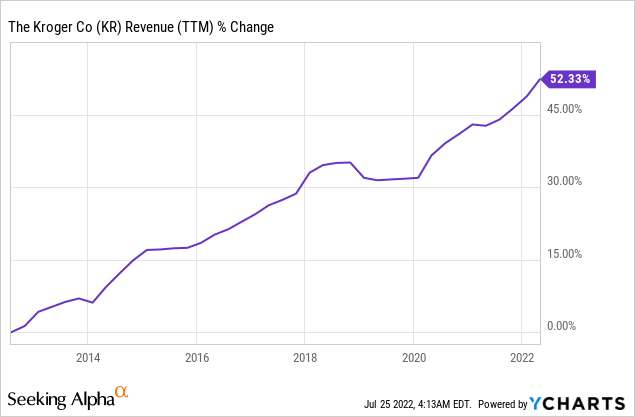

The company’s revenues have increased by more than 50% over the last decade. It is a compound annual growth rate of ~4%. The company grows as it opens stores and expands its digital offering. While the growth rate is not extraordinary, the graph below shows how consistent the growth is, and that’s why investors flock to consumer staples during downturns. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Kroger to keep growing sales at an annual rate of ~4% in the medium term.

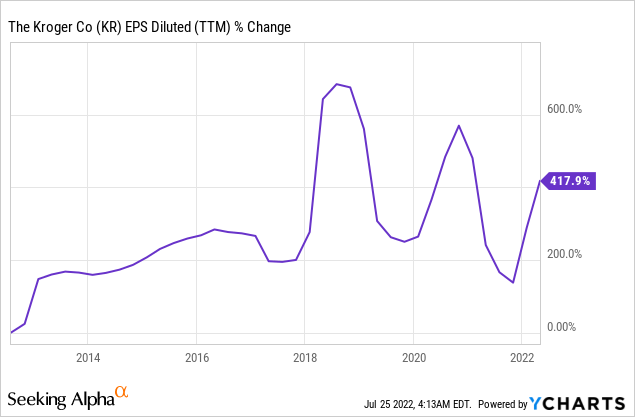

The EPS (earnings per share) increased much faster during the past decade. The EPS has increased by over 400% in 10 years. EPS growth was achieved by increasing sales, aggressively buying back shares, and improving margins. Margins are improved using private labels and lowering costs. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Kroger to keep growing EPS at an annual rate of ~3% in the medium term.

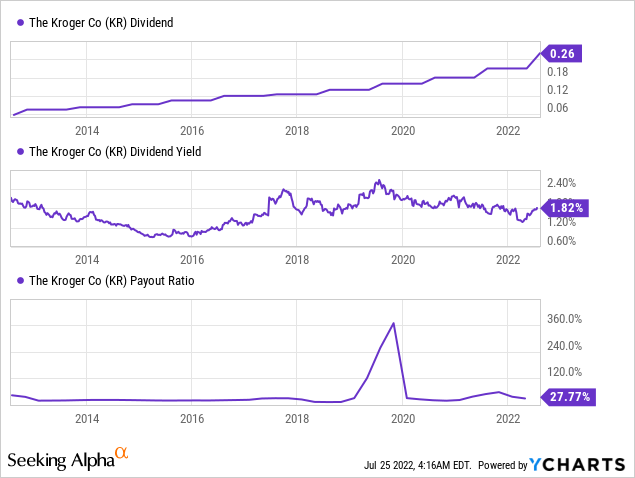

Kroger initiated the dividend 15 years ago, and since it did, it has increased the dividend annually. The company is paying a 2.25% following the latest 24% dividend increase. The company pays less than 30% of its earnings in dividends. Therefore, the dividend seems safe and is unlikely to be cut. Investors should expect the company to continue to increase it as it prioritizes returning capital to shareholders.

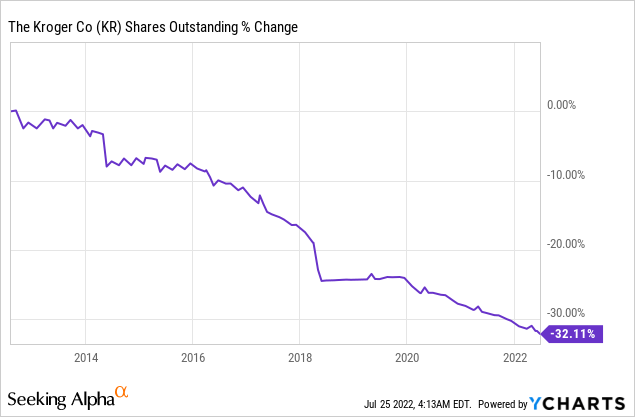

In addition to dividends, Kroger is also returning capital to investors using buybacks. Buybacks are a great way to return capital when companies are growing. It is an effective way to supplement the EPS growth by lowering the number of outstanding shares. In the last decade, Kroger has repurchased almost one-third, which increased the EPS by close to 50%. Buybacks are highly efficient when shares are trading for a low valuation.

Valuation

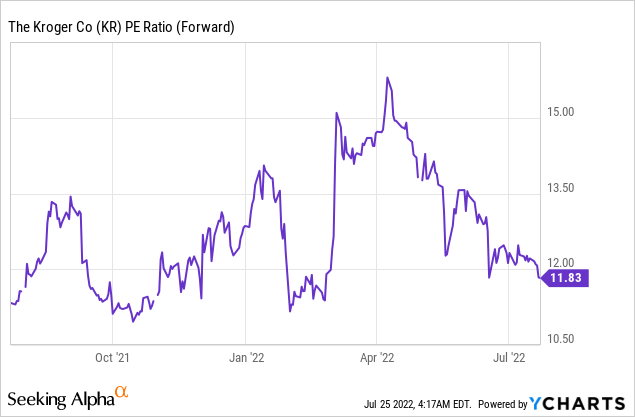

The company’s P/E (price to earnings) ratio is standing at 11.83 when taking into account the forecasted EPS for 2022. It is significantly lower than the P/E we saw just several months ago when the ratio peaked at 15. The current ratio is around the average ratio we saw last year. Therefore, considering the company’s growth, I believe it is fairly valued.

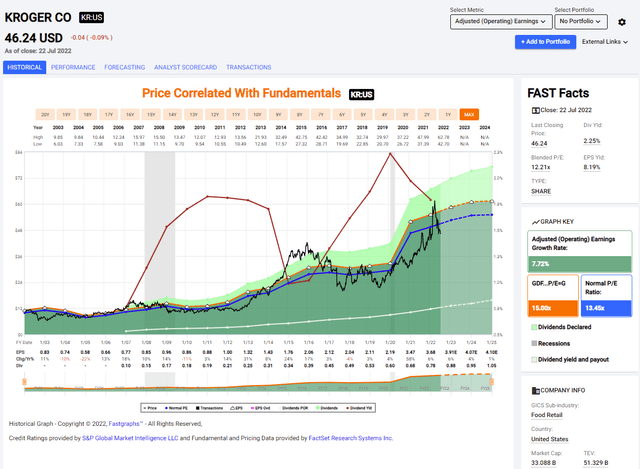

The graph below from F.A.S.T. Graphs also implies that Kroger is reasonably valued. The company’s average P/E ratio over the last two decades was 13.45. The current P/E ratio is lower than the forecasted growth rate. The average growth rate in the previous 20 years was 7.7%, roughly half of the current forecast. The harsher environment affects the growth rate. Future EPS growth acceleration may lead to multiple expansions.

F.A.S.T. Graphs

To conclude, Kroger is a trustworthy company that is growing steadily. The company enjoys top and bottom line growth, increasing dividends, and buybacks. The company is trading for what I believe to be a fair valuation, and investors can get an investment combining solid fundamentals and a reasonable valuation.

Opportunities

Margin expansion is the first opportunity for Kroger. Retailers work on razor-thin margins, and the struggle is to increase them. Kroger plans to improve the product mix by offering more of its private label. It also plans to continue to cut costs and maintain a lean operation as much as possible. Last, it is leveraging its database by using its customers’ data to help partners market to them directly.

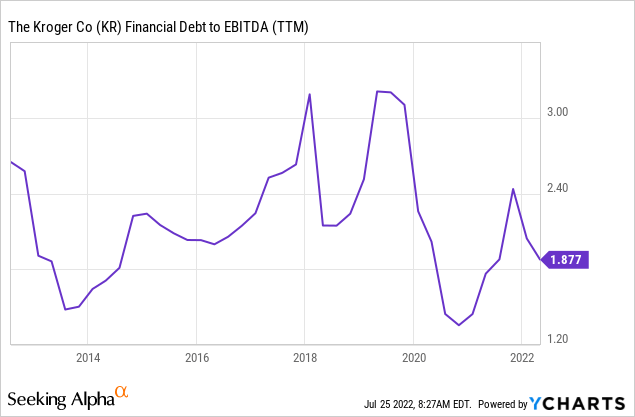

The balance sheet strength is another growth opportunity. The company has deleveraged its balance sheet over the last five years. This balance sheet can now support future growth using M&A. It can acquire competitors in areas where it has less or no presence. This strategy will shorten its path to expansion and allow for faster top and bottom line growth.

Digital and omnichannel capabilities are crucial. As consumers have more disposable income, they are not focused solely on price and require a positive purchasing experience. Kroger is investing in its digital business to attract new clients. In addition, it will allow the company to reach new markets easier and offer a better experience, which will allow for higher margins.

Risks

Inflation is a significant risk for retailers as they are primarily resellers of products. They suffer from increasing labor costs and the increase in prices of goods. For example, Kroger is not as large as Walmart, and its bargaining power with suppliers is lower. Therefore, the company will have to increase prices, making it harder to increase the market share.

Moreover, the company is operating in a very competitive business environment. It competes with companies like Walmart and Target, which enjoy better bargaining power with suppliers and larger scale, which allows them to save money on their operations. The competition will make it harder to increase prices, and it will also make it harder to expand and gain new markets.

Taking into account inflation, the harsh competitive environment is affecting the growth rate. The forecasted growth rate is slow, and while it is not a business risk, it is a risk for investors who may achieve higher total returns investing in the index. The company has grown faster in the past, and it has room to expand in the U.S, yet the current environment will make it hard to grow in the medium term.

Conclusions

Kroger is a good company with a long track record of effective execution. It enjoys strong fundamentals with solid growth of the top and bottom line. It pays a reliable dividend and lowers the share count constantly. The company is fairly valued at the moment and has several growth opportunities for the future and what I believe to be limited risks.

Kroger, in my opinion, is a buy for dividend growth investors who seek reliable income from a well-known retailer. However, investors should not expect that in the long term, the company will beat the S&P 500. Kroger is a “slow-mover,” and it fits a specific type of investor who seeks a growing reliable income.

Be the first to comment