jetcityimage

Investment Thesis

Angi (NASDAQ:ANGI) has had mixed performance over the past few years. The company’s positioning makes it more resilient to economic headwinds in the housing market. But I think that Angi lacks the operating leverage to increase its profitability. For this reason, I’m avoiding the stock at the current time.

Angi’s Positioning in the Housing Market

It has been five years since IAC (IAC) arranged the merger between Angie’s List and HomeAdvisor. The holding company still owns 85% of Angi’s shares and controls 98% of its voting power.

Angi has been experiencing solid growth over the past five years. The company grew its top line to $1.8 billion at a 23% CAGR. It continued to report positive total revenue growth in July and August. This is a sign of strength as other parts of the economy have pulled back.

Management believes that the company is less cyclical than the broader housing market. The idea is that contractors will become more dependent on them as demand cools. Management discussed this dynamic on their last earnings call.

But as the macro environment slows down, whether it’s because home ownership or home transactions slow down a little bit, and Home Services slow down a little bit, it’s really important that we maintain our share of the overall home service requests. But a moderate slowdown in Home Services is actually really good for the demand for our pros using our product. And we’ve seen that. So we’ve already seen that in the last couple of months, where our pros are more engaged, they’re active for match more. So that means they’re turning their leads on more, their willingness to pay per lead has gone up. And overall, we think that moderation in demand is a very positive thing for the largest part of our business.

The housing market is cooling fast. Angi’s positioning may help the company’s top line hold up as this happens. I think management may be understating the effect of a potential decline in volume. But overall, the company is likely going to be more resilient than the housing market.

I think that Angi has decent positioning as a home services marketplace. But I have some issues with the company’s fundamentals.

First, the company has high marketing expenses. Last year, sales and marketing totaled over half of the company’s revenue. This expense has roughly tracked revenue growth over the past five years. Because of this, I suspect that a lot of these costs are direct targeted advertising. There is an individual cost associated with every job acquired through platforms like Google (GOOG) or Meta (META). This is fine, but I don’t think it scales well. Simple revenue growth won’t decrease these costs as a percentage of revenue.

A Breakdown of Angi’s Services Segment

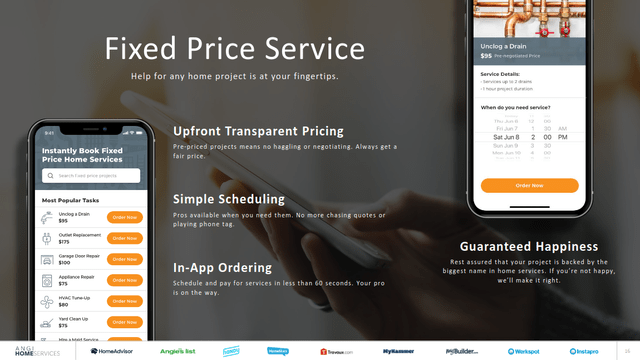

Most of Angi’s growth comes from its Angi Services segment. This represents the company’s prepackaged service offerings. The company sells a service at a fixed price. Then it finds a contractor to perform the service for less than that price.

Angi 2020 Investor Presentation

This has been Angi’s fastest-growing service since its launch in late 2019. The segment grew 120% last year and reported triple-digit growth in the last two quarters. But this business has structurally lower margins than Angi’s other segments.

In 2018, the company’s gross margins were north of 95%. After launching Angi Services, the company’s gross margins have declined to about 75%. I can try to estimate the margins of Angi Services by calculating the difference between the company’s cost of revenues and the previous margins of Angi’s other segments. I’ll make the assumption that the gross margin for Angi’s Ads and Leads segment has remained at 95%. Using these inputs, I can estimate a gross margin for Angi Services of around 25% to 30%. This is still before adding in sales and marketing costs. I think that this topline growth may be misleading. Revenue from this segment is worth less than revenue from the company’s higher-margin businesses.

In addition, we’re seeing Angi’s topline growth decline across segments. The company’s owner reported that Angi Services revenue growth was only 14% year over year in August. This was down from 107% in the second quarter.

There’s a lot of competition, too. Sites like Yelp (YELP) and Thumbtack compete with Angi’s core business. I think these competitors will limit Angi’s pricing power in the future. We’re already seeing evidence of this with the company’s roofing business. The segment is a new acquisition of Angi Services. It took a major hit in the last month of the quarter because of Angi’s pricing. Management discussed this on their last earnings call.

The only thing I’d add with respect to services, monthly trends is it’s — it was a stark hit in to growth in July from Roofing. As Oisin said before, Roofing did about $9 million of revenue in July, it had been averaging $14 million a month across Q2. And that is not in our mind macro. That’s not due to any decline in demand. We just got ahead of ourselves in aggressiveness on price and some other operational challenges that Oisin and team are focused on and really that the focus on price started in early June. So a bit of an own goal there.

Management says that it may take multiple quarters to recover from this “own goal.” I think this is evidence that the company may not have enough pricing power to generate high margins.

This is my key concern with Angi’s fundamentals. Most of the company’s costs increase proportionately with the business’s revenue. This is especially true for the segment that is driving most of the company’s top-line growth. I don’t think the company has a lot of levers to pull on that can suddenly increase its operating margins.

High Valuation and Still Burning Cash

Even after an 80% drop, Angi is still trading at an elevated valuation. The company is valued at an EV/S of 0.9 times. Its enterprise value to adjusted EBITDA is 53 times. This might seem reasonable for a growth technology company. But I don’t think Angi will ever be able to achieve the high margins of other ecommerce marketplaces. The company is simply too reliant on high sales and marketing expenses.

Angi has returned to unprofitability. The business lost cash from its core operations in three of the last four quarters. It’s been over a year since the company generated positive free cash flow.

The business has reasonable liquidity. At the current run rate, it would take over three years for Angi to run out of cash on hand. The business has half a billion dollars in debt, but it is low interest and not due until 2028.

Final Verdict

At first glance, Angi seems like an interesting play on the home services market. It’s less vulnerable to broader economic headwinds. But I think that the company will continue to have profitability issues. Its highest growth segment is further reducing the business’s margins. I don’t think that Angi has the bargaining power to increase its advertising prices or decrease its advertising costs. For these reasons, I recommend avoiding the stock.

Be the first to comment