felixmizioznikov/iStock via Getty Images

REIT Rankings: Manufactured Housing

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on September 27th.

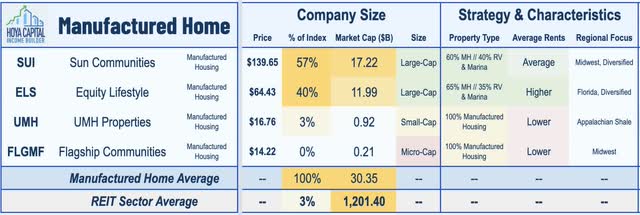

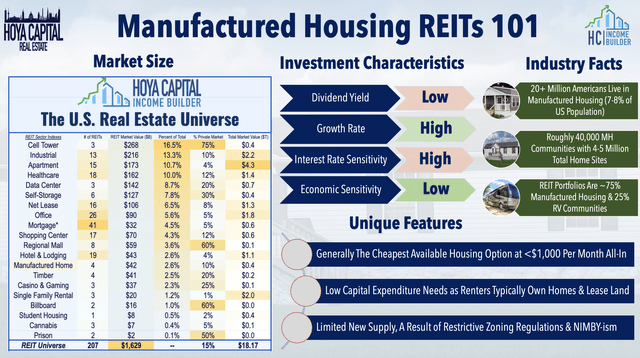

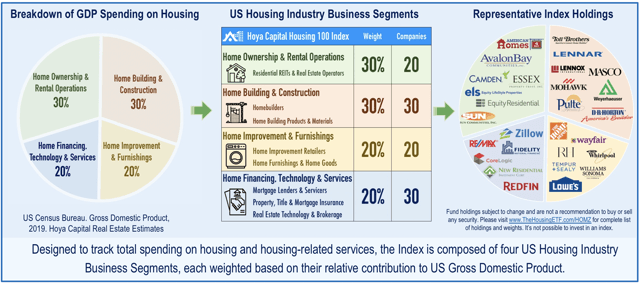

Manufactured Housing REITs (“MH REITs”) have emerged over the past decade from relative obscurity into several of the largest and most well-run publicly-traded property owners in the world, but have uncharacteristically struggled this year amid a historic surge in interest rates and, more recently, from the expected impacts of Hurricane Ian on the critical Florida market. Within the Hoya Capital Manufactured Housing Index, we track the three U.S.-listed MH REITs, which account for roughly $30B in market value: Equity Lifestyle (ELS), Sun Communities (SUI), and UMH Properties (UMH). We also track small-cap Flagship Communities (OTCPK:FLGMF), which trades on the Toronto Stock exchange but owns MH communities in the U.S. Midwest.

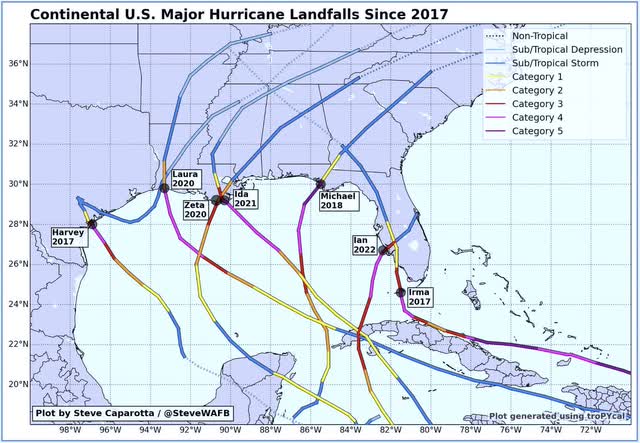

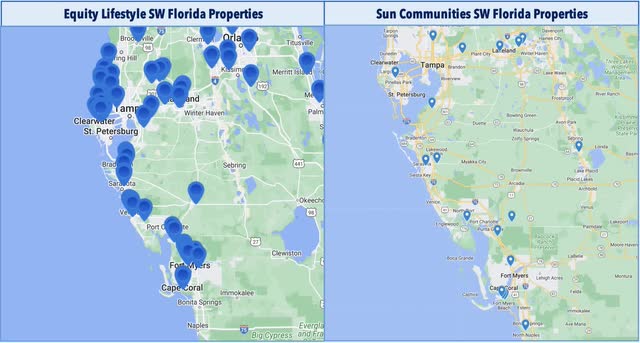

With Hurricane Ian making landfall as a destructive Category 4 storm on the Southwest Florida coast on Wednesday, this report examines the expected impact on manufactured housing REITs. The storm took a similar path to initial landfall as Hurricane Charly in 2004 and Hurricane Irma in 2017 – which at the time was the most intense hurricane to strike the continental United States since Katrina in 2005 – but early indications are that the impacts of Ian are likely to be more significant due to its more-northerly landfall which resulted in substantial storm surge effects in the Fort Myers and Port Charlotte areas. The two largest manufactured housing REITs – Equity Lifestyle and Sun Communities – each own several dozen communities that were directly impacted by the storm – several of which have clearly sustained significant damage based on news reports that have featured nearby MH communities.

Sun Communities owns 129 total communities in Florida – accounting for roughly 25% of its total revenues – while Equity Lifestyle owns 135 properties – roughly 40% of its total rental revenue. For Irma, SUI reported total damages of $32M – reduced to $8M net after insurance recoveries – which represented roughly 1% of its annual FFO. Equity Lifestyle reported damages of $13M in total – reduced to $4M after recoveries – which represented a <1% hit to its annual FFO. Critically, MH REITs typically own only the land under the sites and not the manufactured homes themselves. That said – SUI and ELS do offer limited rentals of REIT-owned houses which comprise roughly 2% of ELS’s total sites and 6% of SUI’s total sites.

While there is a higher potential for lost revenues from destroyed homes from Ian, revenue losses were muted from Irma and were isolated to limited lost transient RV revenues. Of note, however, ELS and SUI have both invested heavily in marina facilities over the past several years – which have not yet seen any major hurricanes under their ownership – and given the more destructive storm surge compared to Irma – we could very well see more significant damages incurred from Ian even if the MH communities manage to escape with relatively minor damages.

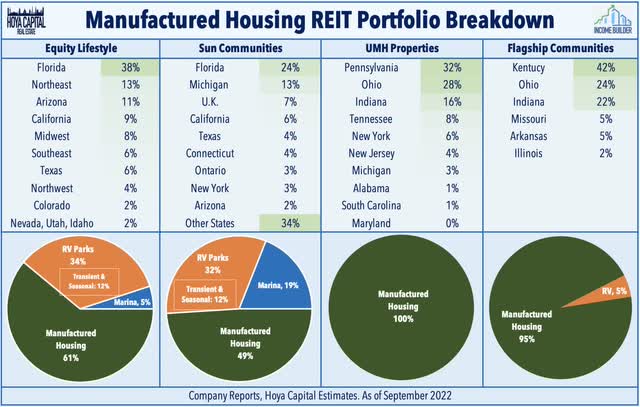

Manufactured housing REITs have historically been viewed as one of the most “recession-resistant” property sectors given the countercyclical demand trends of manufactured housing demand, which is generally the cheapest housing option available in the United States. SUI and ELS have both made a push into more pro-cyclical analogous asset classes – RVs and marinas – that have offset some of these effects – perhaps at the expense of higher risk related to major storm events – but all of these sub-sectors benefit from a similar fundamental backdrop of limited supply and relatively high barriers to entry. RV parks now comprise roughly a third of assets for ELS and SUI, while marinas comprise 5% and 19%, respectively. UMH and newly-listed FLGMF focus exclusively on traditional manufactured housing communities.

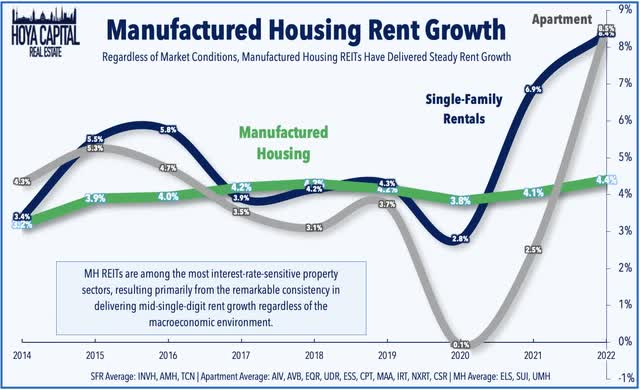

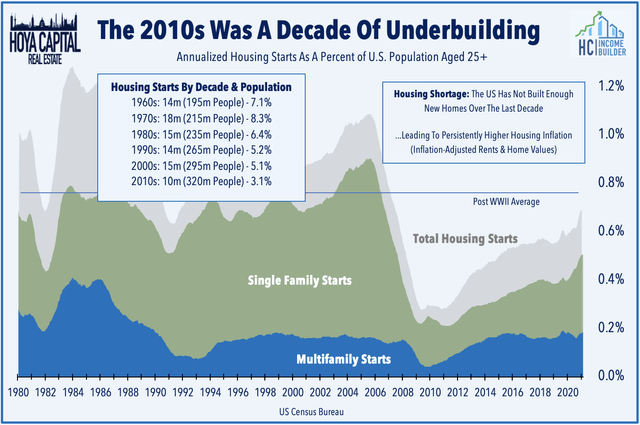

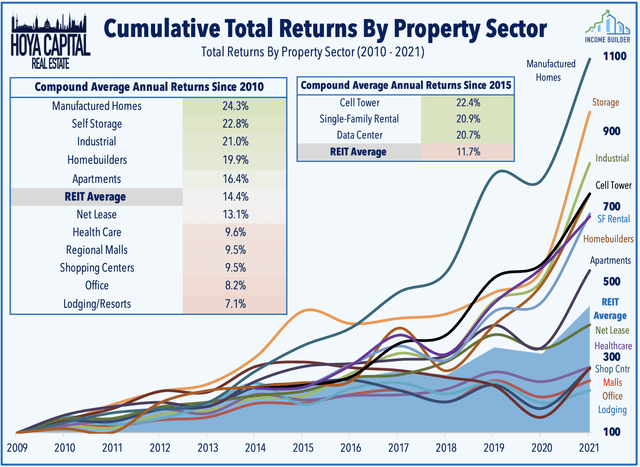

Beneficiaries of the intensifying affordable housing shortage across the United States resulting from a decade of underbuilding manufactured housing REITs have been the single-best performing REIT sector since the start of 2010 with average annual total returns of nearly 25%, but have uncharacteristically lagged in early 2022. Counterintuitively, despite the historical double-digit annual returns, MH REITs are still among the most interest-rate-sensitive property sectors, resulting primarily from the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment. As noted above, we believe that MH REIT rent growth will surprise to the upside over the next twelve months given its the more-direct linkage with the CPI Index than other residential REIT sectors.

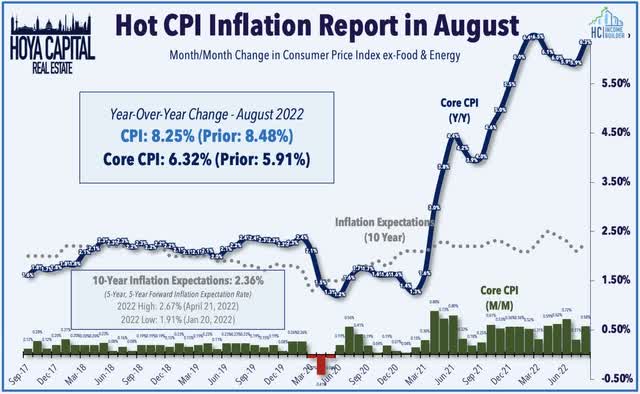

This CPI-linkage comes in two forms – indirectly through the wage effects driven by Social Security Cost of Living Adjustments (“COLA”) and directly through the explicit CPI-linkage on longer-term MH ground leases. As the most affordable housing option in most regions and with a generally older resident base, a significant share of renters are in retirement age and receiving social security income or other inflation-linked transfers. Social Security benefits received a 5.9% cost-of-living adjustment for 2022 – the highest increase in about 40 years – and will increase further in 2023. The Social Security Administration is expected to announce the COLA increase on Oct. 13 and is calculated using the CPI-W index for the third quarter – averaging the year-over-year increase in July, August, and September – which likely end up in the 8.5% to 9.0% range once the September data is released in early October. As a result, we believe MH REITs will achieve their strongest rent growth on record in 2023 irrespective of broader macroeconomic weakness.

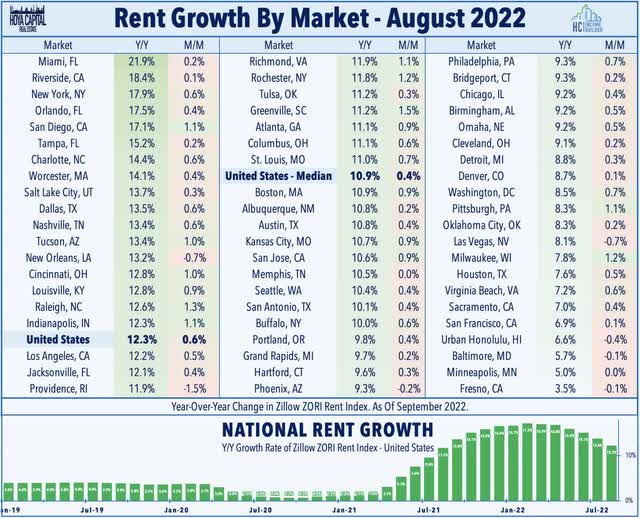

While the majority of leases are determined by market rate adjustments on an annual basis, a direct CPI linkage affects approximately 10% of MH sites owned by ELS and SUI – primarily those in Florida and California due to state rent control statutes. The multi-decade highs on the CPI Index can effectively “unlock” embedded rent growth on below-market leases that were capped under the previous economic regime of low inflation and begin to “catch-up” with market rents which continue to rise by double-digit annual rates across the nation per the latest Zillow (Z) report. While MH renters are unlikely to see double-digit rent hikes in the foreseeable future, we do expect rent growth to meaningfully accelerate and significantly exceed analyst forecasts.

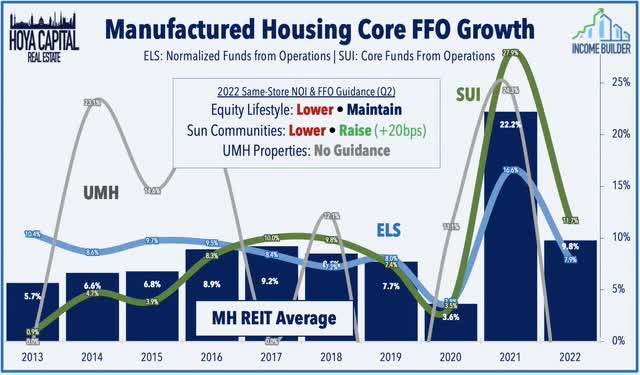

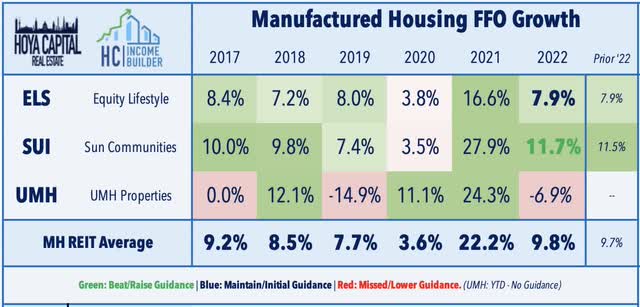

Growth in funds from operations (“FFO”) – the earnings per share “equivalent” for REITs – is driven by the combination of same-store “organic” growth and by external growth through acquisitions and new development. Manufactured housing REITs delivered incredible FFO growth of 22% in 2021, which was significantly above their earlier estimates and was the strongest year of FFO growth on record for all three of these REITs. As discussed in our REIT Earnings Recap, the outlook for 2022 calls for average FFO growth of nearly 10%. We believe that Hurricane Ian’s impacts will result in a 1-2% FFO hit for this year, but still believe that these REITs will meet the full-year target as the upside rental rate effects will offset the downside storm-related impacts.

Following a rare “miss” from Equity LifeStyle in the first week of Q2 earnings season driven by a gas-price-driven slowdown in transient RV demand, Sun Communities reported stronger results, raising the midpoint of its Core FFO outlook based on its newly-reported constant-currency convention – which it began reporting following the acquisition of Park Holidays in the UK. SUI expects FFO growth of 11.7% this year following growth of nearly 30% in 2021 and yet still trades near its “cheapest” level in nearly a decade. ELS, meanwhile, maintained its full-year FFO guidance but did reduce their NOI growth target by 70 basis points, citing moderating growth expectations from transient RV demand, but the recent stabilization in gas prices should help to relieve some of the pressure. While both ELS and SUI have been working to convert their transient RV sites into annual sites, transient and/or seasonal sites still represent roughly 12% of revenues for both companies.

Manufactured Housing Fundamentals

Roughly one-in-twelve Americans live in a factory-built manufactured home, and shipments of these units represent roughly 10% of housing starts in a typical year. MH REITs comprise 2% of the “Core” REIT ETFs and also represent 4% of the Hoya Capital US Housing Index, the benchmark that tracks the performance of the US housing industry. These REITs generally own communities in the higher tiers of the quality spectrum and are more “retiree-oriented” than the average MH community. Often misunderstood by investors, manufactured homes are generally not “mobile” (except for recreational vehicles “RVs”) as about 80% of MH units remain where they were initially installed, and newer units are generally built to higher-quality standards than commonly believed.

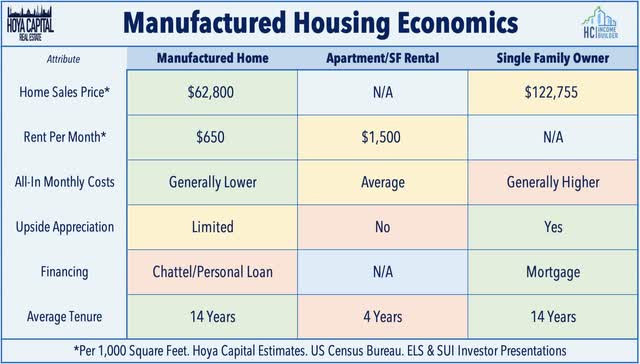

For residents, the economics of MH takes on the qualities of both renter and homeowner. Residents generally own their home but lease the land underneath it, paying an average of $70k for a new 1,500-square foot prefabricated home. The average monthly lease to set their home on a site and hook up to utilities in MH or RV community can range from $300 to $1,000 per month. By foregoing the investment in the land, however, property appreciation is generally minimal, and as a result, MH homeowners in land-lease communities generally cannot finance MH or RV purchases with traditional mortgages, and as with RVs, owners must finance the acquisition with a personal property (chattel) loan at a higher interest rate.

Earlier this year, Harvard University’s JCHS published its annual “State of the Nation’s Housing.” Researchers noted that “the supply of existing homes for sale has never been tighter,” as soaring home prices and rents have been fueled by “the combination of robust demand and limited supply.” JCHS concluded that “the pandemic is partially to blame for such tight conditions, but the biggest reason behind the constraints on supply is the underproduction of new homes since the mid-2000s.” The report noted that “supply constraints are nearly universal,” but particularly in the affordable housing segments. A separate report by the NAR estimated that the underproduction of new housing units relative to household formation totals 6.8 million units.

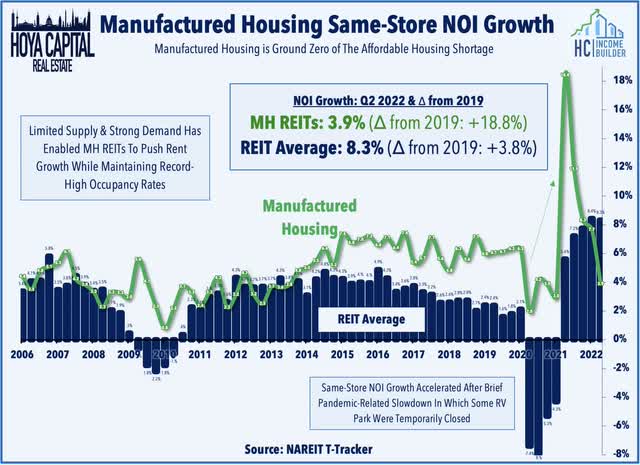

MH REITs have been the “canary in the coal mine” of the intensifying housing shortage for the past decade, continuing to produce sector-leading NOI and FFO growth and, as a result, have outperformed the Equity REIT Index in each of the past nine years – the longest streak of consecutive outperformance ever within the REIT sector. Driven by strong performance in their RV segment and occupancy increase in their core manufactured housing parks, the three major MH REITs – ELS, SUI, and UMH – delivered same-store NOI growth of 10% for full-year 2021 and these REITs are expecting NOI growth of roughly 6% at 2022 at the midpoint of their updated financial outlook.

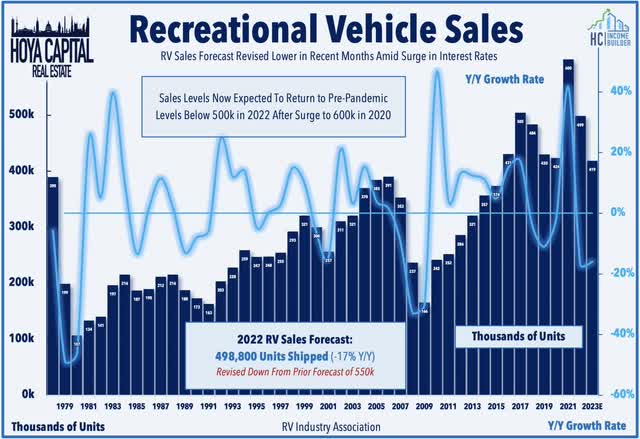

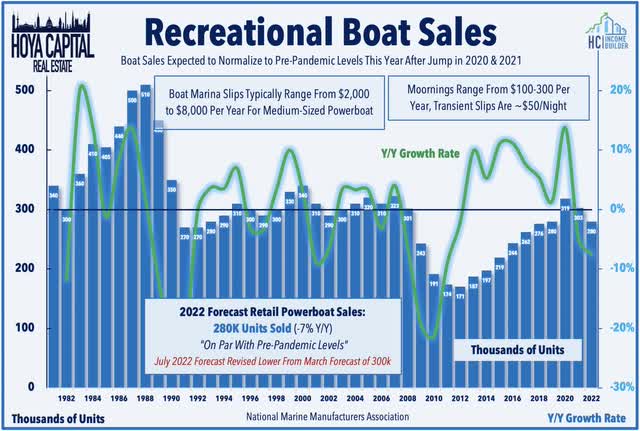

As noted, MH REITs have historically been one of the most interest-rate-sensitive REIT sectors – a function of their historically counter-cyclical fundamentals and the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment. The diversification into RV parks and boat marinas – which have a more economically sensitive demand and cash flow profile – have provided a pro-cyclical counterbalance that should neutralize some of the potential headwinds from rising rates and inflation. While sales levels are expected to return to pre-pandemic levels this year, the RV Industry Association reported that RV sales set record-highs in 2021 despite facing similar supply chain issues as traditional homebuilders, demand that helped power a 6% rise in “same-community” RV rents in 2021.

Recreational boat sales also accelerated significantly during the pandemic despite ultra-lean inventory levels. The recreational boating industry – which includes MarineMax (HZO), Malibu Boats (MBUU), MasterCraft Boat (MCFT), and Brunswick Corporation (BC) – delivered very strong earnings results in 2021 despite the ongoing supply chain constraints. With SUI’s major investment in Safe Harbor Marinas, these MH REITs are now the two largest owners of marinas in the country. Institutional-quality marinas – of which there are roughly 500 across the U.S. – offer substantial operating parallels to the company’s RV business. ELS now owns 23 marinas comprising 6,800 slips while SUI owns 41,275 slips across 114 marinas.

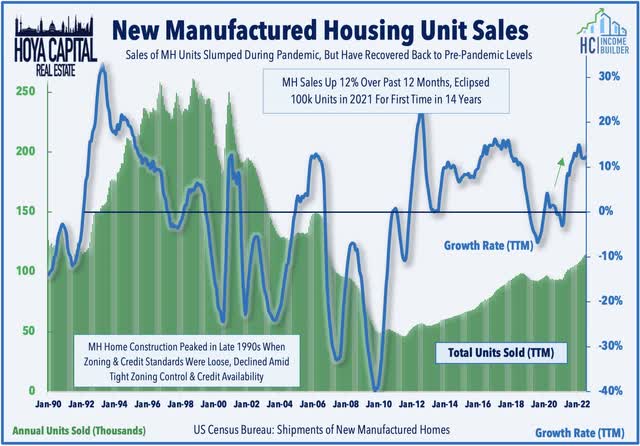

Sales of new manufactured housing units have also exhibited a strong acceleration over the last year, eclipsing 100k units in a twelve-month period for the first time in 14 years, driven largely by site expansions of existing MH REIT parks. MH sales peaked in the late 1990s when zoning and credit standards were loose, but declined sharply beginning in the early 2000s during the pre-GFC housing boom as demand shifted to site-built homes. MH units are typically the most affordable non-subsidized housing option in most markets and the manufactured housing resident base is incredibly “sticky”, as the average MH owner stays in a community for 14 years, far higher than the 3-5 year average for other rental units.

MH REIT Stock Price Performance

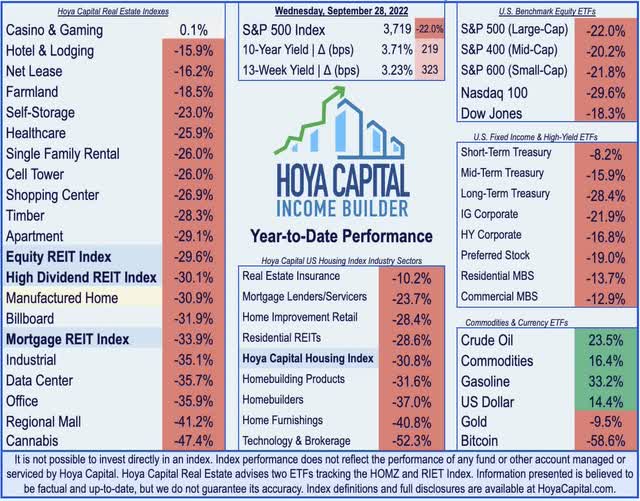

MH REITs edged out the Equity REIT Index in 2021 with total returns of 42% to push their incredible streak of nine straight years of outperformance. Pressured by rising interest rates and the growth-to-value rotation within the REIT sector, however, MH REITs had uncharacteristically underperformed for much of 2022, but have been among the best-performing REIT sectors over the past month amid a rotation back into “essential” and defensive property sectors. The Hoya Capital Manufactured Housing REIT Index is lower by 30.9% this year, slightly lagging the 29.6% decline from the cap-weighted Vanguard Real Estate ETF (VNQ) and the 22.0% decline from the S&P 500 (SPY).

The non-REIT players in the manufactured housing and RV industry have also been under pressure this year following a robust 2021. After leading the gains last year, MH builders Skyline Champion (SKY) and Cavco Industries (CVCO) are each off by roughly 30% while RV retailer Camping World (CWH) is also lower by more than 40%. RV manufacturers including Thor Industries (THO) and Winnebago Industries (WGO) have seen similar declines of 30-35% so far in 2022, as have RV and marine parts dealers Patrick Industries (PATK) and LCI Industries (NYSE:LCII).

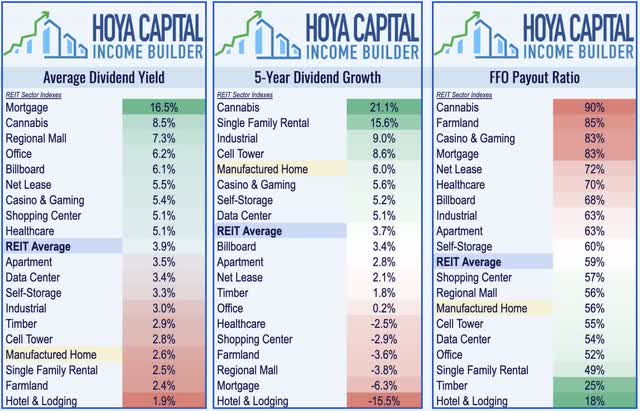

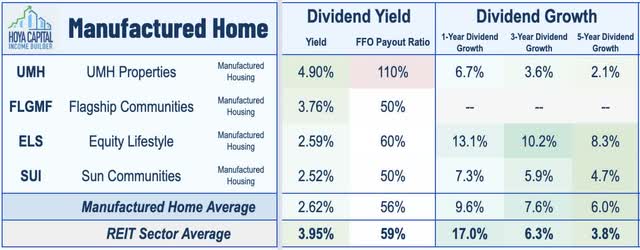

Manufactured Housing REIT Dividend Yields

Manufactured Housing REITs pay an average dividend yield of 2.6%, ranking towards the bottom of the REIT sector and below the market-cap-weighted average of 3.9%. MH REITs, however, have delivered one of the strongest rates of dividend growth over the last five years. ELS and SUI are two of only a dozen REITs that raised their dividends in 2020, 2021, and again in 2022. MH REITs pay out just 55% of their available cash flow, implying strong potential for future dividend growth and more free cash flow to fund external growth.

Among the three larger MH REITs, UMH pays the highest dividend yield in the sector at 4.90% but went nearly two decades with zero dividend growth before finally raising its distribution for the first time since 2008 last year. Equity LifeStyle pays a dividend yield of 2.59%, while Sun Communities pays a dividend yield of 2.52%. ELS has delivered average annual dividend growth of 8.3% over the last five years, among the best in the REIT sector, while SUI has taken a more growth-oriented approach with a lower payout ratio.

The Bull & Bear Thesis For MH REITs

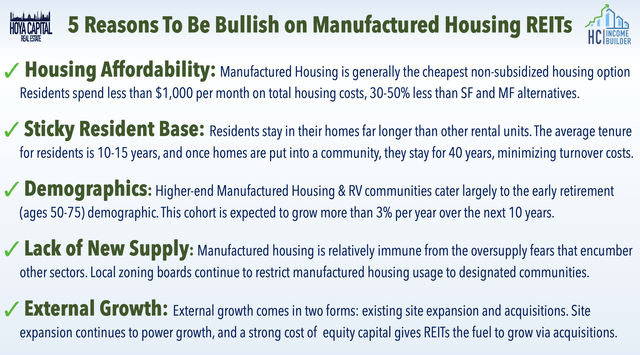

Below, we outline five reasons that investors are bullish on MH REITs.

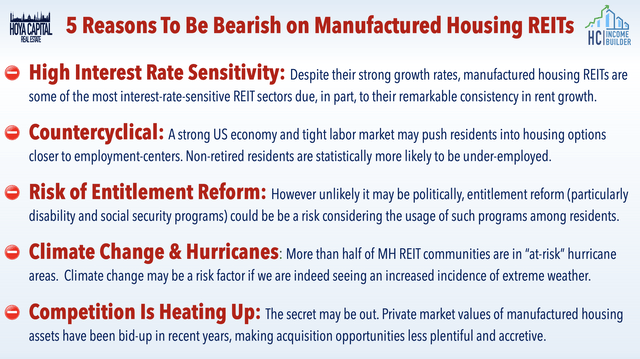

Below, we outline five reasons that investors are bearish on MH REITs.

Takeaways: High-Conviction Positive Outlook

While we’ll get more clarity over the impacts of Hurricane Ian over the next few days, we believe that these REITs will still meet the full-year FFO target as the upside rental rate effects will offset the downside storm-related impacts. We continue to expect MH REITs will leverage the record-setting cost-of-living adjustment (COLA) adjustments which should result in a roughly 9% rise in benefits to a significant percentage of MH REITs’ resident base. MH REITs have remarkably delivered nine consecutive years of outperformance compared to the broader REIT Index, benefiting from strong operational execution, significant supply constraints, demographic tailwinds, and high barriers to entry, and when all is said and done this year we expect MH REITs to extend their streak to a tenth-straight year of outperformance.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment