Sundry Photography

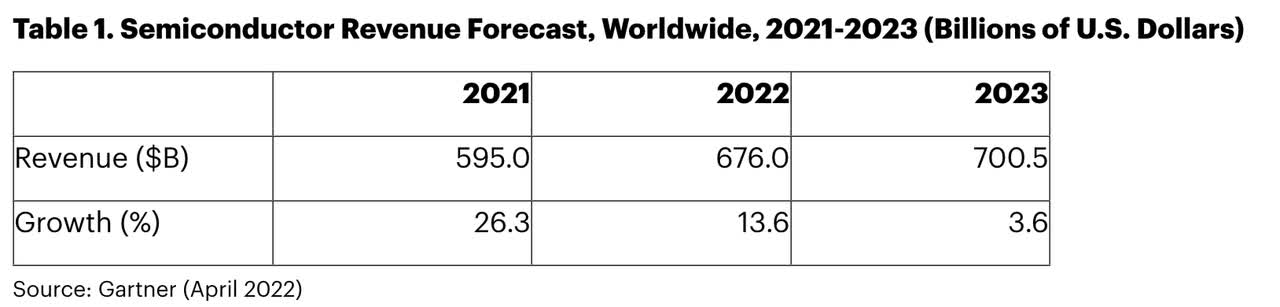

We are bullish on Lam Research Corporation (NASDAQ:LRCX). Our buy thesis is based on our belief that the company plays a pivotal role in the semiconductor manufacturing chain. We believe the semiconductor manufacturing industry will grow exponentially in the long term because it is in the business of etching and deposition, which is essential for manufacturing semiconductor chips. Gartner forecasts worldwide semiconductor revenue to grow by 13.6% in 2022. We believe increased demand for semiconductors will lead to increased demand for the front-end equipment LRCX provides. The following graph shows the semiconductor revenue forecasts.

Gartner

We believe the stock is in a downward draft in the near term because of weakening consumer spending. We think the stock pullback creates a good entry point to buy into semiconductor equipment suppliers at a lower price. We believe the risk of weakening consumer spending is already factored into the stock now and believe the downside is limited from here.

LRCX is in the green zone because WFE spending is strong in the long term

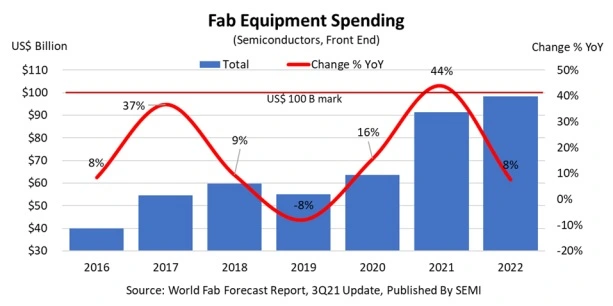

LRCX is a wafer fabrication equipment (WFE) company. The equipment LRCX manufactures is essential for producing end-user chips. The necessity of WFE in manufacturing semiconductors makes us optimistic about the stock’s long-term outlook. WFE spending correlates with semiconductor spending. The WFE spending is expected to drop in the near term due to weakening consumer demand. However, we believe this weakness is priced into LRCX stock. The following graph shows the growth trajectory of WFE spending.

SEMI

WFE spending is also growing exponentially within the memory sector. The memory sector achieved $38B in spending in 2022, according to EE Times Asia. The bulk of LRCX’s revenue comes from its memory segment. We recognized that weakening consumer spending will likely cause CAPEX cuts in the memory sector in the near term. Nevertheless, we are not too concerned about this negatively impacting LRCX because we believe most of the CAPEX cut expectations in the memory sector have been priced into the stock.

Global WFE TAMs have been climbing

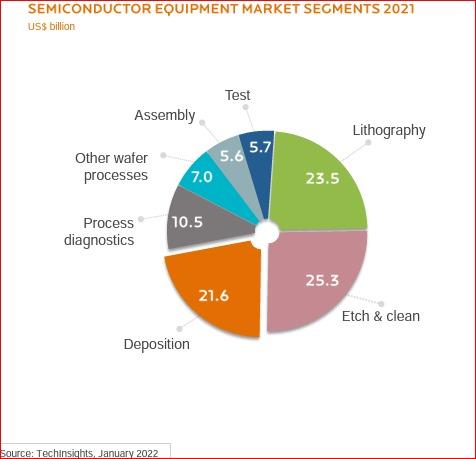

We are optimistic about the LRCX business because it works in the business of etching and deposition. Etch and Deposition processes are used in more than 500 steps to make a semiconductor chip. The global TAM for etching and deposition has been increasing over the past few years. Etching TAM was $25.3B in 2021, while only $18.2B in 2020. The same goes for deposition. Deposition TAM was $15.8B in 2020 and grew to $21.6B in 2021. Etching and deposition TAMs are on the rise. In turn, we believe LRCX, a primarily etch and deposition company, is well-positioned within the industry to ride the wave up. We are buy-rated on LRCX now because we think the stock is near the bottom and provides an attractive risk-reward. The following graph shows the semiconductor equipment market segments.

TechInsights

NAND exposure is a double-edged sword

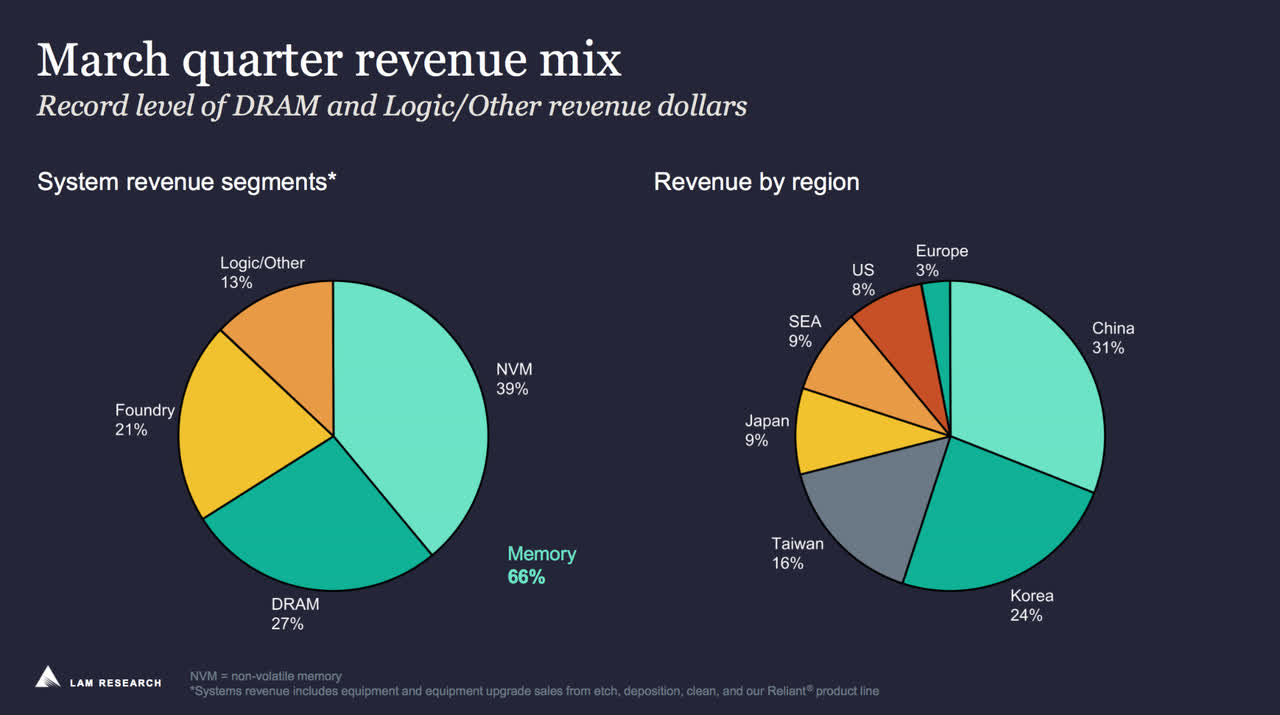

Most of LRCX’s business comes from its memory segment, with NAND and DRAM making up 66% of revenue. LRCX is particularly exposed to NAND at 39% of revenue during the last quarter. The company benefited from the industry’s transition from 2D NAND to 3D NAND. In layman’s terms, the company spearheaded the transition from one-story level NAND to sky-scrapper NAND. The following graph shows LRCX’s revenue per segment.

Lam Research

Despite LRCX’s NAND revenue dropping compared to previous quarters, we are still bullish on the stock. In the September quarter of 2021, NAND made up 45% of the company’s revenue and only 39% in the last quarter. We attribute the drop from 45% to 39% to weakening consumer spending. NAND is used primarily in PCs and smartphones. PC and smartphone shipments are projected to decline. Gartner forecasts worldwide PC shipments to decline 9.5% in 2022. IDC also forecasts smartphone shipments to decline by 3.5% to 1.31 billion units in 2022. Nevertheless, we are not worried about LRCX’s exposure to weakening consumer spending. We believe the demand pullback is priced into the stock.

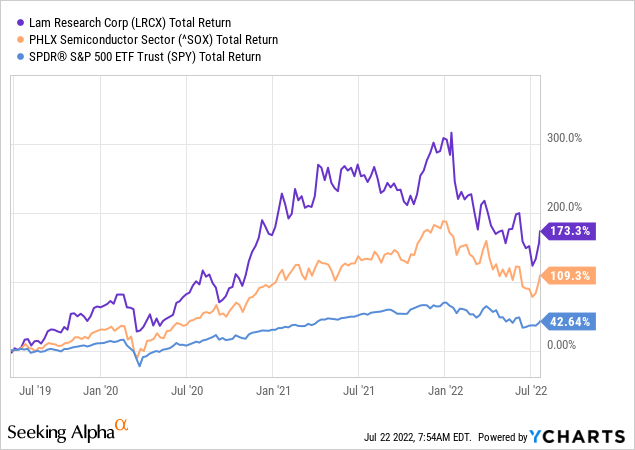

Stock performance

LRCX has had an impressive run over the past five years. The stock rocketed 95% since the pandemic began. The stock grew around 173% over the past five years. LRCX stock peaked at $732 and is now trading at about $472, near its 52-week low of $376. We recommend investors buy the stock on weakness. The stock is currently in a downward draft due to market volatility and supply chain issues in the semiconductor industry. YTD, the stock is down 34%. We believe the downward draft is more or less done. We believe the stock is close to bottoming and will likely go up from here.

The following graphs outline LRCX stock performance.

YCharts

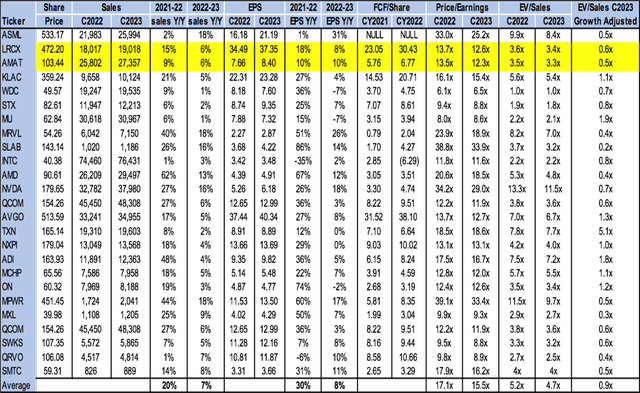

Valuation

LRCX is trading at around $472 and is reasonably priced compared to its peers. On the P/E basis, LRCX is trading at 12.6x C2023 EPS of $37.35 compared to the group average of 15.5x. The stock is trading at 3.4x EV/C2023 sales versus the peer group average of 4.7x. Adjusted for growth, LRCX is trading at 0.6x C2023, compared to the group average of 0.9x. The following chart illustrates the semiconductor peer group valuation.

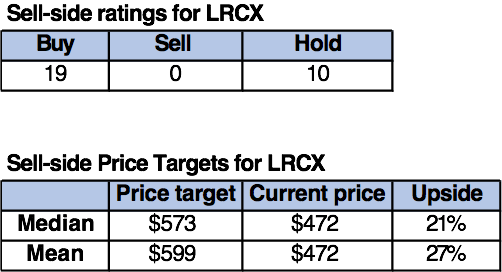

Word on Wall Street

Market consensus on LRCX is a buy. Of the 29 analysts covering the stock, 19 are buy-rated, and ten are hold-rated. Analyst optimism is reflected in the upside presented by the sell-side price targets. LRCX is currently trading at around $472. The sell-side median price target is $573, and the mean is $599, for an upside of 21-27%. The following chart indicates LRCX sell-side ratings and price targets:

Techstockpros

What to do with the stock

We are bullish on the LRCX. We believe the company is a primary WFE supplier, and now is the time to buy in because the stock is close to bottoming. LRCX is well-positioned within the memory business to grow in the long run. We believe the stock is an attractive buy for long-term investors.

Be the first to comment