Marko Geber

Lemonade (NYSE:LMND) is an Insurtech company that aims to disrupt the incumbent insurance industry, which has been dominated by a few humongous billion-dollar players for decades.

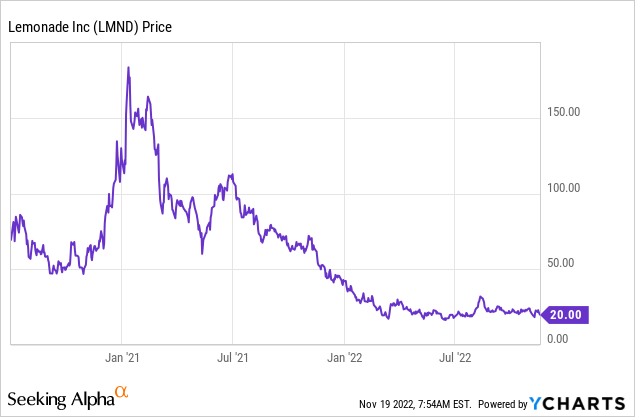

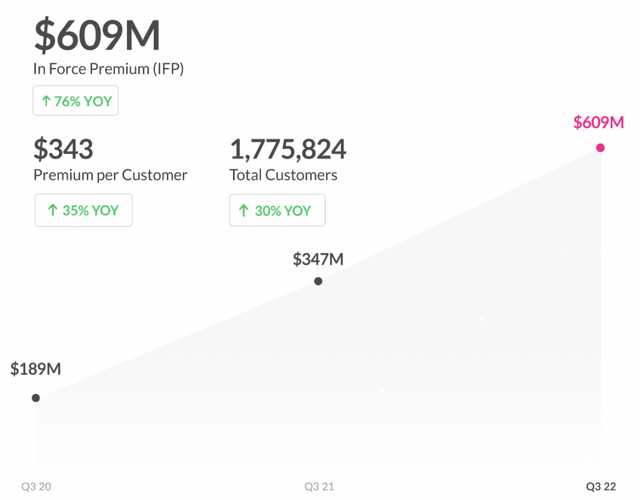

The company was founded in 2015 by Daniel Schreiber and Shai Wininger (who was the Co-Founder) of Fiverr and had its fanfare IPO in April 2021. The story was simple, “delight customers” with a rapid AI-powered experience, grow fast, and disrupt the huge market. So far the business has been growing fast with revenue increasing by 10 times since 2017. In the third quarter of 2022, the strong results continued as the company’s Inforce Premium (which you can think of as “annual recurring revenue”) increased by 76%. Despite these factors, the company’s stock price has plummeted by 87% since its highs in April 2021, which has been mainly driven by the macroeconomic environment and loss ratio spikes driven by extreme weather events. In this post, I’m going to break down Lemonade’s market opportunity, business model, financials and valuation. This post also includes extracts from an Interview I did with Lemonade’s Chief Financial Officer [CFO] Tim Bixby, let’s dive in.

Huge Market Opportunity

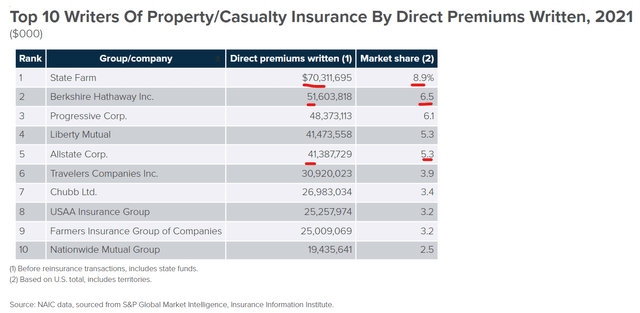

To give you an idea of the sheer size of the incumbent insurance industry, let’s dive into a few of the biggest players. State Farm is the largest auto insurer in the U.S and a giant in the property/casualty insurance market. The company was founded in 1922, has ~58,000 employees, and wrote ~$70 billion in premiums in 2021. Lemonade by comparison has ~1,000 employees and ~$600 million in inforce premium figures for Q3 (which isn’t an exact comparison) but you get the idea, this is David vs Goliath. Then if we go down the list below you see Warren Buffett’s Berkshire Hathaway ($51.6 billion in premiums), Progressive Corp ($48 billion), Liberty Mutual ($41.5 billion) etc. Keep in mind this is just one category, the Property/Casualty market, this doesn’t include auto insurance, life insurance, and all the other categories. The point is the insurance market is gigantic and is primed for disruption.

Largest Insurance companies (1)

AI Business Model

Lemonade plans to disrupt the gigantic insurance market through its Tech-powered solution which aims to “delight customers” with its fast and low-cost service. For example, the company famously claimed to be 5 times cheaper than an incumbent insurer and save customers “80% within 90 seconds”. In my interview with the CFO of Lemonade Tim Bixby, on my YouTube channel Motivation 2 Invest. I asked if it was possible to get a full policy so fast and he confirmed that “almost 100% of the time” a full policy can be achieved in a “matter of minutes”. The reason Lemonade can accomplish this, is it doesn’t use an army of human agents as you have at incumbent insurance companies.

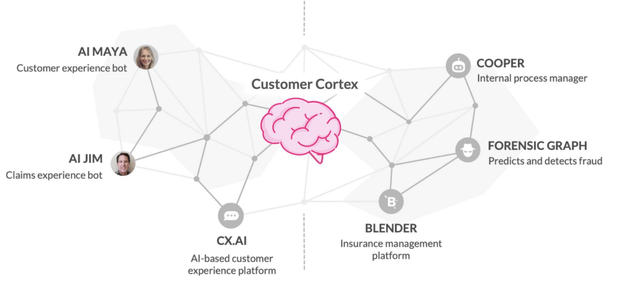

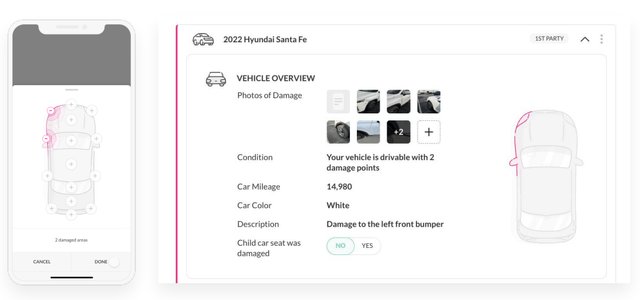

Lemonade uses Artificial Intelligence [AI] powered chatbots to take the input information, assess risk and underwrite policies. In Lemonade’s investor day presentation (November 2022), the company showcased its various AI bots as a “neural net” image. “AI MAYA” is the customer experience Bot that takes inputs from users. Then when a customer wishes to make a claim, they speak to “AI JIM” the claims experience bot. Its AI Jim bot takes what is called a first notice of loss (FNOL) for 98% of claims, and manages ~45% of the process end to end, with “greater accuracy than humans”, according to Lemonade.

Behind the scenes, there is an internal process manager bot (COOPER) and even Forensics Graph to help predict fraud. Its Fraud detection algorithms have so far flagged over $100 million in fraudulent claims and has detected doctored documents in $12 million worth of claims.

Lemonade AI Bots (Investor Day Presentation November 2022)

Lemonade also now uses a platform called “Watchtower” to track wildfires and extreme weather in a region. This then automates the “halting” of marketing and initiates a delayed start date for new policies. I believe the use of this platform is in response to the extreme Texas Winter Storm Uri (February 2021) which caused a massive amount of payouts to be filed with Lemonade after huge damage hit the region. Although payouts are a part of the insurance game, monitoring risk and exposure is essential for profitability.

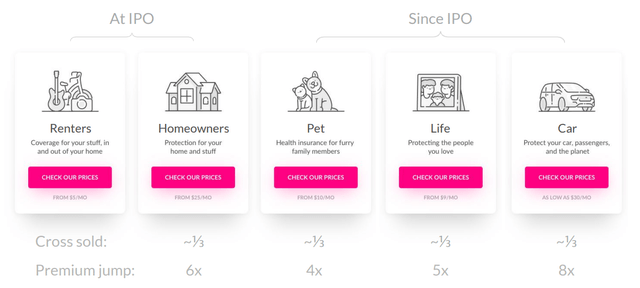

Lemonade started with Renters Insurance but has since expanded to Home, Car, Life, and even Pet Insurance. On the Motivation 2 Invest YouTube Channel, I asked Tim Bixby, Lemonade CFO, why they have jumped into many categories. He revealed some interesting insights about the industry.

“The renters market was unloved by the industry, because it was difficult to make money, due to the low premium” – Lemonade CFO Tim Bixby

Lemonade’s competitive advantage was its “lower cost structure” which enabled it to enter the market at a lower price than incumbents as they have many overheads. Renter’s insurance is then seen as a “gateway policy” to larger markets with greater premiums. Lemonade’s strategy is to “grow with its customer” throughout their entire lifecycle. For example, a young “Gen Z” will likely start renting before buying a home, a car, a pet, and then finally life insurance as they raise a family etc. I personally think this model is genius and makes a lot of sense, as upsells become more natural.

Insurance Types (Lemonade Insurance Types)

Third Quarter Financials

Lemonade generated solid financial results for the third quarter of 2022. In Force Premium which you can think of as Annual Recurring revenue increased by a rapid 76% year over to $609 million, which beat management’s prior guidance of between $595 million and $600 million. Revenue increased by 107% year over year to $74 million. This was driven by an increase in Gross Earned Premium (increased by 71% year over year) and a reduction in premium ceded to reinsurers.

Total Customers were 1.78 million and has increased by a solid 35% year over year. When Lemonade first had its IPO it was focusing more customer growth but management has since pivoted its strategy to focus more on growing the share of wallet of the consumer through upsells and cross-sells. For example, Lemonade reported Premium Per Customer of $343 million which increased by a rapid 35% year over year.

Lemonade (Q3 Earnings date)

Its growth in Premium Per Customer was primarily increased as a result of the Metromile Acquisition, in the second quarter of 2022. Lemonade paid ~$145 million in stock for the Auto insurance company which had $155 million in cash and $110 million in car premiums. This personally seemed like a fantastic deal for Lemonade and I had to ask Lemonade CFO Tim Bixby how they got such a great deal, here is his response.

“Timing is everything…we started speaking to Metromile about one year ago”

“We created a ratio on the value of Metromiles stock vs our stock then when the market corrected…that ratio was still intact”. – Lemonade CFO Tim Bixby.

Metromile is an auto insurance company that pioneered the usage of telematics to track “good” and “bad” drivers. The power of this tracking enables customers to adjust their driving habits to save money on their insurance policy. Metromile has 100,000 customers and has racked up 500 million miles of driving data. Therefore Lemonade saw this as a valuable part of the acquisition. In addition, a barrier to growth in the insurance industry is state-by-state regulation and approval. The acquisition of Metromile has helped to accelerate the number of states Lemonade’s auto insurance product was in from 3 states to 10 states.

Lemonade Car Insurance (Investor Day Presentation November 2022)

I queried Lemonade’s CFO Tim Bixby about the challenges Metromile was facing and possible reasons the company wanted to sell. Metromile had faced “challenges with customer acquisition” and the small size of the company made it hard for them to “right size” and “get loss ratios in the right place”. Therefore as Lemonade has developed a cost-effective customer acquisition strategy, bringing the companies together made a lot of sense.

Big Data Advantage and LTV Model

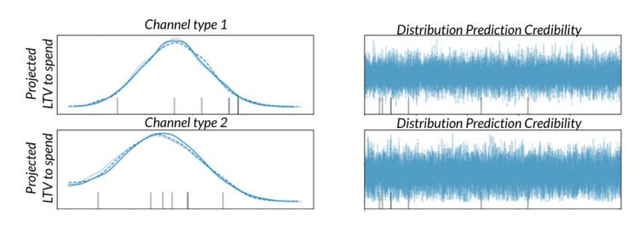

For those interested in Digital Marketing and Localization Marketing, you will love this next section. Lemonade has an LTV to CAC (lifetime value to Cost of Customer Acquisition) ratio of 3.15X. According to many Venture Capitalists, an LTV to CAC ratio greater than three is ideal for sustainable growth as it means the company is growing profitably.

Lemonade has developed a state-of-the-art Lifetime Value Model to help predict customer churn. As 100% of Lemonade’s customers are digitally enabled the company has an advantage over incumbent insurance companies which have many customers signing up via an agent. Lemonade collects ~1,800 data points on each customer which helps to increase the accuracy of the model. As more data is collected, the model accuracy is improved and it can be used on the customer acquisition side to acquire customers which are likely to be more profitable longer term. These LTV models govern 86% of Lemonade’s marketing spend and is a key competitive advantage for the company.

LTV Model Lemonade (Investor Presentation November 2022)

Pet Partnerships

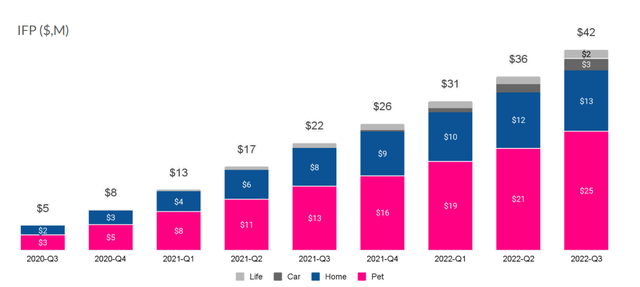

Approximately 80 Million households in the U.S have pets but just 2.5% have Pet Insurance, therefore there is a significant market opportunity. Pet Insurance (pink bars on chart below) makes up ~58% of cross-sells. In addition, this absolute cross-sell premium for pets has increase by 92% year over year to $25 million.

Cross Sells (Investor Presentation November 2022)

As a side note, I personally see the love people have for their pets and often they are considered part of the family. “Pandemic pets” was a secular trend that exploded in 2020, as people sought the unconditional love only a pet can offer.

A couple of months back I asked Lemonade CFO Tim Bixby about a “partnership strategy” as in my eyes this made sense given its competitor Root had partnered with Carvana for auto insurance. After which it was great to see Lemonade scored a pet insurance partnership with Pet e-commerce giant Chewy, a company with 20 million customers and a $17 billion market capitalization. In Spring 2023, Chewy (CHWY) will start to sell Lemonade Pet insurance policies as part of its CarePlus Pet health program. The beautiful thing about this partnership is Chewy’s revenue share will be paid out entirely in lemonade stock, which should help to reduce the cash burn for lemonade and increase profitability. Lemonade believes this could become one of the primary growth channels in the future.

UK Expansion

Lemonade is currently available in the U.S.A, Germany, Netherlands, and France. In my interview with CFO Tim Bixby, I asked about expansion opportunities in the U.K. Recorded a couple of months back the company had “no formal announcements” but as of the third quarter, Lemonade has announced to be launching in the U.K, which is the largest insurance market in Europe.

Loss Ratio Trends

The “Loss Ratio” is a common metric used in the insurance industry to calculate the profitability of a company’s endeavor. It is calculated by taking the Losses incurred in Claims plus adjustment expenses divided by premiums earned for the period. Generally, lower is better and a “good” insurance company has a loss ratio of between 40% and 60%, although it depends upon the policy type.

Loss Ratio Formula (Wall Street Mojo)

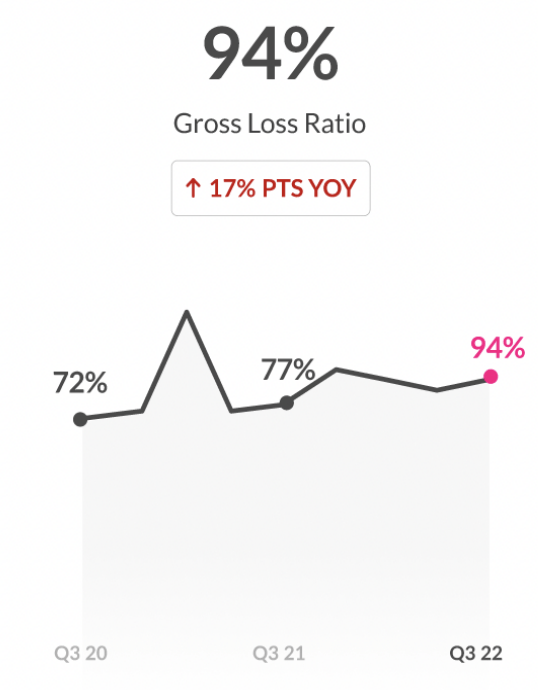

Lemonade is in the early stages of scale and thus has a fairly high gross loss ratio was 94% for Q3,22 which is up from 77% in Q3 2021 and 86% in Q2 2022.

The loss ratio had previously been coming down but this spike was caused by the Metromile deal (which was expected) and Hurricane Ian which added several points of increase to this ratio. Management believes these are short term factors and the loss ratio will be on an “overarching downward trend” with “occasional bumps”.

With that said, we do anticipate the overarching downward trend to continue in the coming quarters, notwithstanding the “occasional bumps”.

Gross Loss Ratio (Q3,22 Report)

The Insurance industry is notoriously challenging to make profitable as anything can happen in the world, including black swan events. Even the genius Warren Buffett struggled to make Berkshire Hathaway’s insurance segment consistently profitable until he hired Indian-born Ajit Jain, who Buffett praises for turning that part of the business around. For example, in a Book on Warren Buffett called the “Snowball”, Buffett is alleged to have forecasted a potential terrorist attack and didn’t take on as much insurance risk for the twin towers prior to the attack. Despite this exceptional forecast, Berkshires subsidiaries still took a $1.5 billion hit to earnings, which represents the challenges in the industry.

Operating Expenses

Lemonade reported Operating Expenses of $110 million in the third quarter of 2022, which increased by 33% year over year. This was mainly driven by headcount expenses, legal fees and as partially offset by lower sales and marketing expenses.

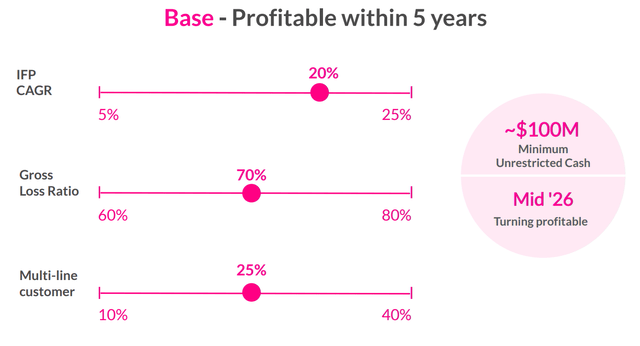

Lemonade generated earnings per share of negative $1.37, which missed analyst estimates slightly by $0.01. The company insists it is on a “path to profitability” and aims to be profitable within 5 years in its base case scenario. This forecasted a 20% compounded annual growth rate in In-force premium and a 70% gross loss ratio. I personally believe these estimates to be very conservative and I believe Lemonade can surpass this.

Base Case Profitability (Q3 earnings date)

The company has a solid balance sheet ~$225 million in cash and total debt of $36.6 million which is manageable.

Advanced Valuation

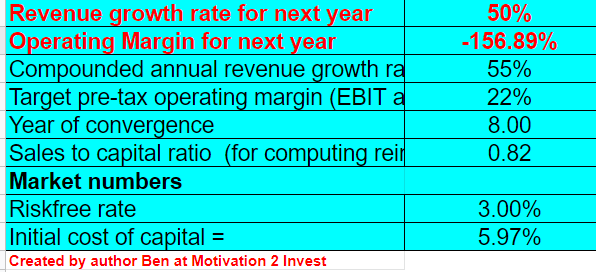

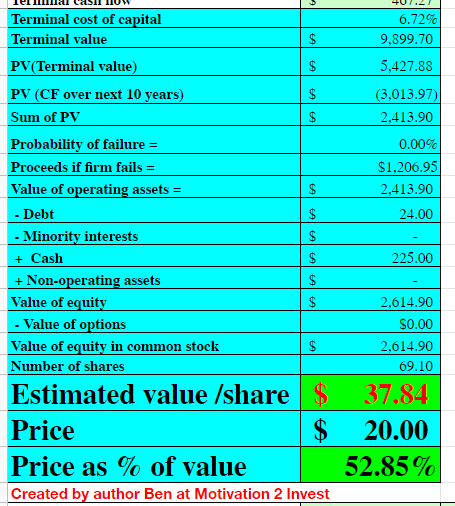

In order to value Lemonade I have plugged its latest financials into my discounted cash flow valuation model. I have forecasted a conservative 50% revenue growth for next year, which is approximately half of the prior year’s growth rate. In addition, I have forecasted 55% revenue over the next 2 to 5 years. I am expecting a slight dip in growth rate as the comparison metric increases and we enter a recessionary environment.

Lemonade stock valuation (created by author Ben at Motivation 2 Invest)

I am also forecasting the business to increase its pretax operating margin to 22% over the next 8 years. This assumes the company would reach profitability in 5 years (As per the base case scenario). Then I forecast the business will surpass this with multiple cross-sells across categories, greater scale and a lower loss ratio.

Lemonade stock valuation 2 (created by author Ben at Motivation 2 Invest)

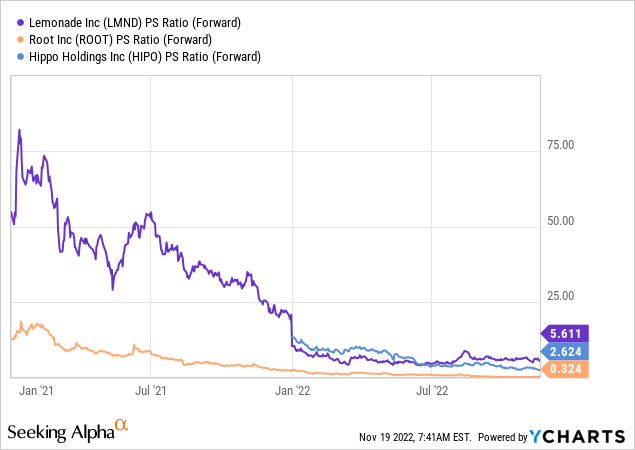

Given these factors I get a fair value of $37.84 per share, the stock is trading at $20 per share and the time of writing and thus is ~47% undervalued. Lemonade is also trading at a forward price-to-sales ratio = 5.6, which is cheaper than historic levels of over 50, which is astonishing. As a comparison, Auto insurtech Root (ROOT) has a PS ratio = 0.324 and home insurtech Hippo (HIPO) has a PS ratio = 2.6. Both of these stocks trade cheaper, but they are single category focused for the most part and are struggling with profitability.

Risks

Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. When consumers are having input costs squeezed I imagine fraudulent insurance claims may increase, as people look for extra ways to try and make money. In addition, many growth stocks have seen their valuation multiples compressed which means a higher cost of capital for companies. Other risks include extreme weather conditions such as Hurricanes and winter storms which have impacted lemonade’s loss ratio in the past. Lemonade’s strategy is to focus on more of a “miles per gallon” strategy and less on a “mile per hour” strategy as it aims to preserve cash and focus on profitability.

Final Thoughts

Lemonade is a tremendous company that is disrupting the incumbent insurance industry. The company is really offering insurance at a faster speed, a better price, and with a heart thanks to its charitable giveback scheme which I haven’t discussed in this post. Management is very skilled, transparent, and great at communicating with investors, which is also another positive. The stock is undervalued intrinsically and relative to historic multiples and it thus could be a great long-term investment.

Be the first to comment