Khanchit Khirisutchalual

Inflation is here to stay. It will probably cool, but we will not return quickly to the 2% FED-target. It’s a smart idea to invest in a diversified and actively managed real return ETF like the SPDR SSGA Multi-Asset Real Return ETF (NYSEARCA:RLY). Diversifying lowers the risks and the active management is helpful because not all inflation hedging investments are working as expected given their historical inflation betas. Commodities and energy stocks are performing nicely, but TIPS and REITs are not. RLY is currently overweight commodities and energy stocks and underweight TIPS and REITs. Nice!

Inflation here to stay?

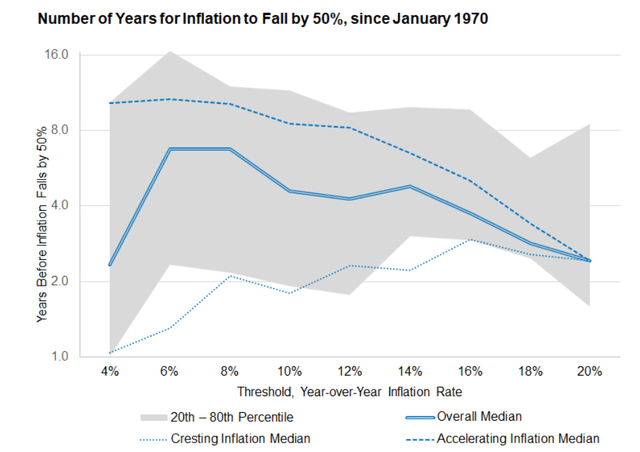

Research Affiliates recently investigated how quickly inflation returns back to an acceptable level once it crossed certain thresholds. They make a difference between cresting inflation and accelerating inflation. Cresting inflation crosses the 4% level, but doesn’t reach the 6% inflation level. Accelerating inflation does cross the 6% level. The historical record is like this:

If inflation is cresting, inflation levels revert by half in about a year. If inflation is accelerating, 6% inflation reverts to 3% in a median of about seven years. Above 8%, reverting to 3% usually takes 6 to 20 years, with a median of over 10 years.

Figure 1: Years for inflation to fall by 50% (Research Affiliates)

Inflation hedges

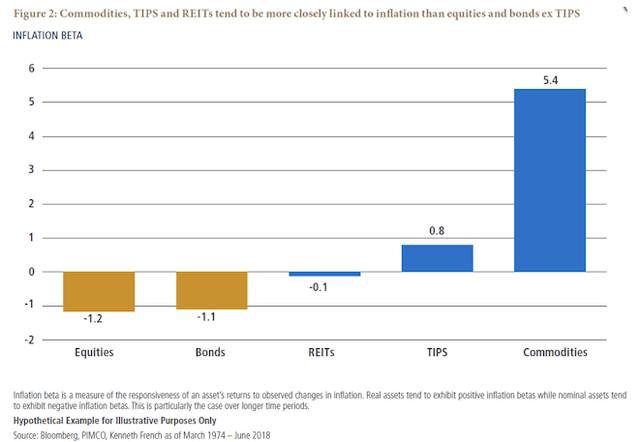

The best Inflation hedging asset classes are well-known: commodities TIPS, real estate.

Figure 2: Inflation Beta (PIMCO)

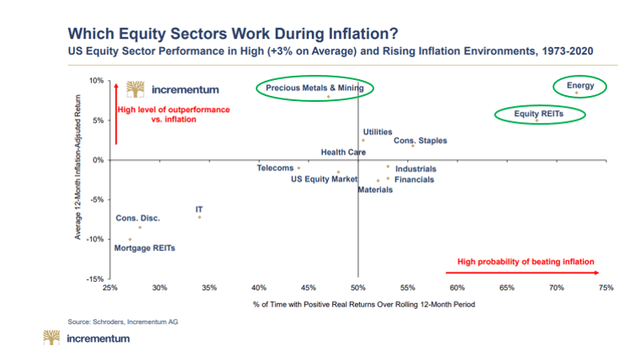

Also some certain equity sectors hedge against inflation: energy, REITs and Metals & Mining are the best performing equity sector in inflationary environments.

Figure 3: Equity sectors and inflation (Incrementum)

But, not all of them are “working” in the current inflation cycle!

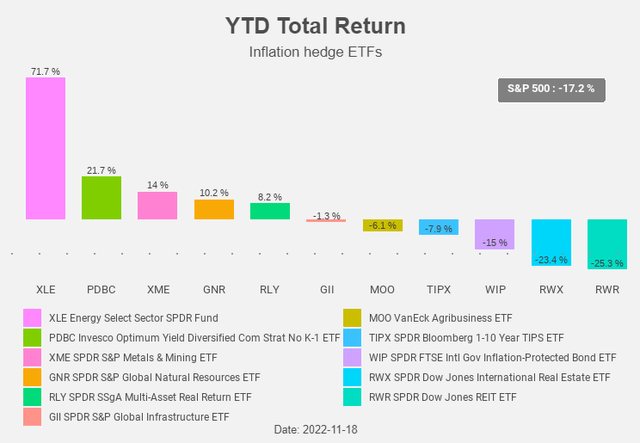

Figure 4: Total return chart (Yahoo! Finance, Author)

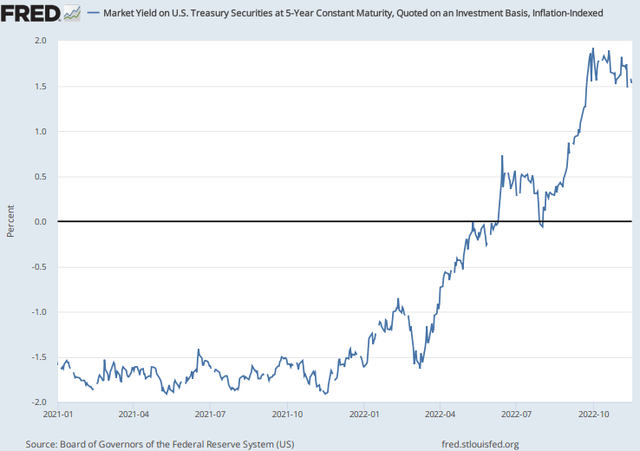

Commodities, energy and infrastructure stocks do perform as expected, but the same cannot be said of TIPS and REITs. For TIPS this doesn’t come as a surprise given the rise in real yields.

Figure 5: Real yields (FRED)

We do not expect those yields to rise much further and one cannot deny that the current yield is more attractive than e.g. one year ago (when you were guaranteed of a negative real yield).

RLY

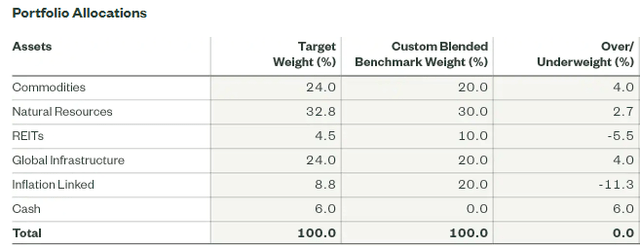

RLY is an actively managed ETF that is currently overweight commodities, natural resources and infrastructure. Natural resources contains the sectors agriculture, energy, and metals & mining. RLY is underweight the inflation hedges that aren’t working: TIPS and real estate.

We like this active management approach and the positions the fund managers take.

We’ve written before positively about inflation hedging investments like (energy) commodities ( here and here), energy infrastructure and oil services stocks.

We are less outspoken positive about real estate, but we see opportunities brewing in real estate once the FED ends it rate hikes.

San Francisco Federal Reserve President Mary Daly said this week that pausing rate hikes is not currently on the table and that the Fed funds rate could end up in the 4.75%-5.25% range (versus a current rate of 3.75%-4.00%). This would imply an end to the rate hikes in February or March next year.

Figure 6: Portfolio Allocations (SSGA)

RLY is also overweight cash.

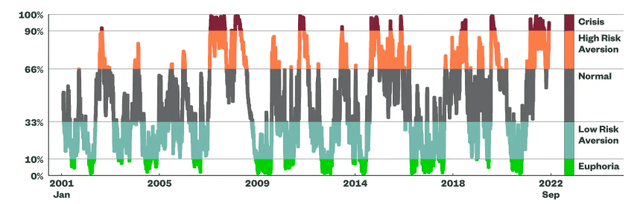

RLY uses a proprietary risk sentiment indicator (the Market Regime Indicator). The indicator employs a quantitative framework and forward-looking market indicators, including equity- and currency-implied volatility, as well as credit spreads, to identify the current market risk environment. The indicator is pointing to a high risk aversion and that’s why the fund became more defensive and built up a cash position.

Figure 7: Market Regime Indicator (SSGA)

RLY is a fund-of fund with two benchmarks. The primary benchmark is Bloomberg U.S. Government Inflation-Linked Bond Index and the secondary benchmark is DBIQ Optimum Yield Diversified Commodity Index Excess Return. Despite the fact that the primary benchmark is an inflation linked bonds benchmark, TIPS are only 20% of the custom blended benchmark weight.

RLY invests in the ETFs that you can see in Figure 4. The biggest investments are:

- the SPDR S&P Global Natural Resources ETF (GNR) with a weight of 25%,

- the SPDR S&P Global Infrastructure ETF (GII) with a weight of 24%, and

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) with a weight of 23%.

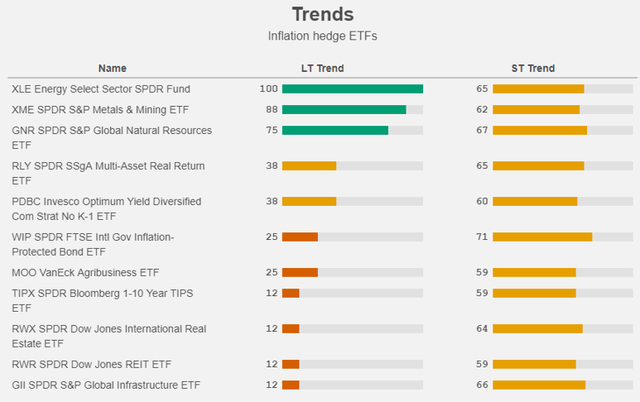

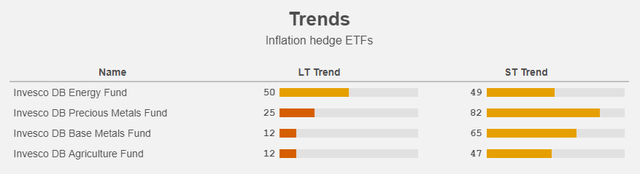

Let’s take a look at the long term trends of the funds in which RLY invests. As one could expect from a diversified ETF the trend of RLY is an average of the underlying funds and is in neutral territory. Funds that are in a clear uptrend, in a downtrend and in neutral territory are each more or less one third of the fund. Especially GII, the second biggest position in the fund, is a drag on the overall trend of RLY. GII invests in the transportation, utilities, and energy infrastructure sub-industries.

Figure 8: Trend (Yahoo! Finance, Author)

We remain positive on the energy commodities because they will remain supported by the current under-investment. Despite the transition to renewable energy the world needs oil & gas for years to come.

Figure 9: Trend (Yahoo! Finance, Author)

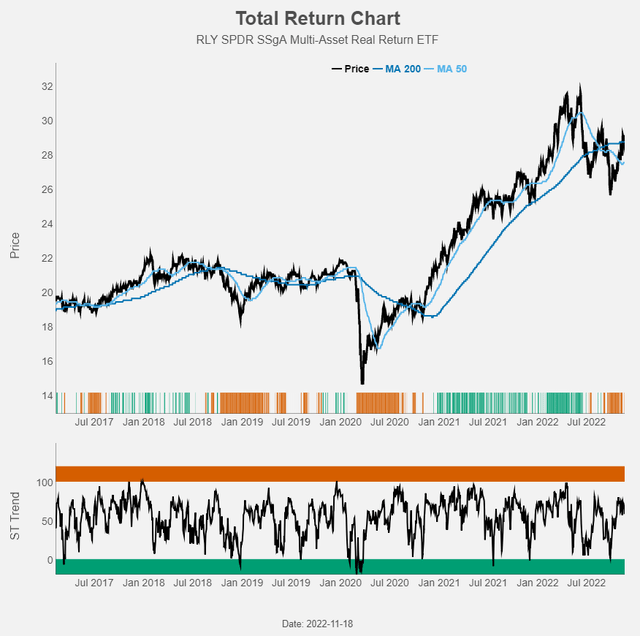

Figure 10: Total return chart (Yahoo! Finance, Author)

Dividend policy

Dividends from net investment income, if any, are generally declared and paid quarterly by RLY. At the end of last year RLY received a big dividend from PDBC which resulted in a nice dividend for RLY shareholders. While we cannot exclude that RLY would receive more juicy dividends from its underlying funds, you shouldn’t buy RLY for the high yield, but for the high expected total return.

What could go wrong?

The main thing that could go wrong is a hard global recession that would crush inflation numbers and even lead to deflation. This would reduce global energy demand and have a negative impact on energy prices. We cannot exclude such a scenario but it’s not our most probable scenario. The end of rate hikes is in sight, China could re-open and the war in Ukraine could move to a diplomatic solution. All three could support global growth.

Conclusion

It’s always a good idea to invest in a diversified way in an interesting theme. In a diversified portfolio some investments do better than others and this asks for an active management.

RLY offers all of that: a diversified and active approach to an interesting theme. We believe inflation hedging is indeed appealing because inflation is here to stay. The energy-related part of the portfolio is performing well. Real estate is not, but when the FED stops hiking rates they might stage a comeback. Inflation linked bonds suffer(ed) from rising real yields. On the one hand we do not expect those yields to rise much further and on the other hand is the current yield more attractive than e.g. one year ago.

Inflation is here to stay and RLY offers a one stop shop for an investor looking for inflation beating returns: buy!

Be the first to comment