Seremin/iStock Editorial via Getty Images

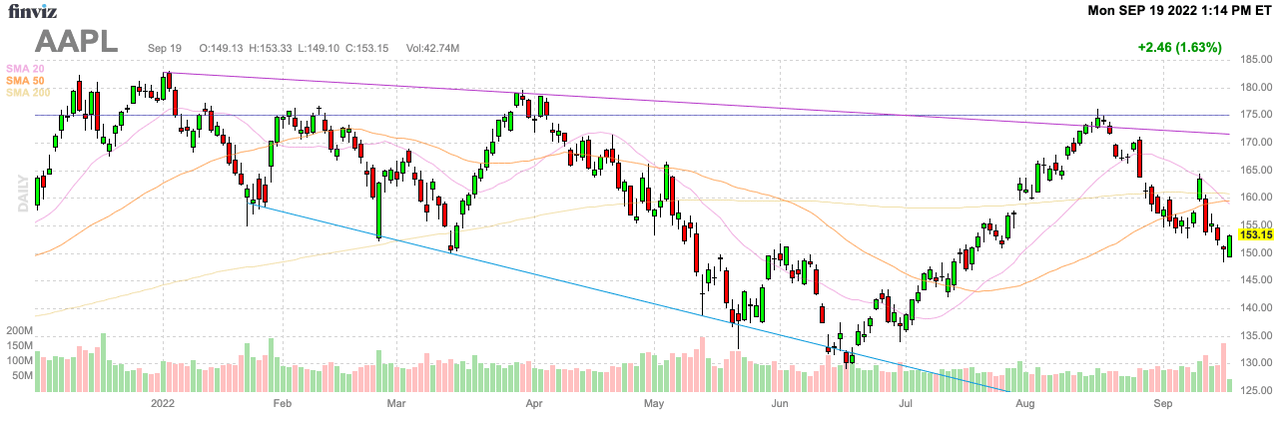

As usual, Apple (NASDAQ:AAPL) is down substantially from the nearly $175 highs just a month ago after their annual iPhone launch event hyped up investor interest. The tech giant failed to impress without the launch of a mixed reality device to compete with Meta Platforms (META). My investment thesis remains Bearish on the stock with another failed break of strong resistance at the recent highs.

FinViz

Mixed iPhone 14 Demand Message

Fresh off incorrectly predicting a price hike for the iPhone 14 models, especially the Pro models, influential analyst Ming-Chi Kuo now claims a production shift towards the iPhone Pro models. Only 12 days after the Far Out event that launched the new iPhone, Apple would have completely misdiagnosed the demand for each model to already shift production.

Apple would definitely benefit from a consumer buying the higher-priced Pro models due to pricing differences. The big question is whether consumers are actually buying the higher-priced items, with the economy potentially in a recession and definitely facing higher inflation.

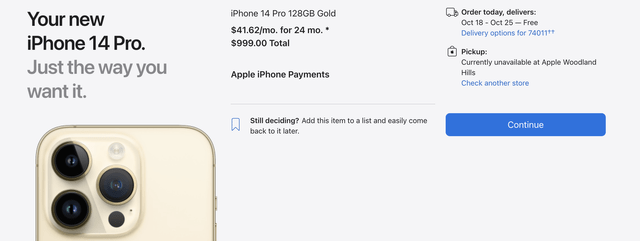

The actual starting price breakdown for the various iPhone 14 versions is as follows:

- iPhone 14 – $799

- iPhone 14 Plus: $899

- iPhone 14 Pro: $999

- iPhone 14 Pro Max: $1099

Data appears to suggest consumers are buying the iPhone 14 Pro models due to limited value on the 14 Plus. The 14 Pro only costs $100 more than the Plus. Forbes even argues for buying a refurbished iPhone 13 Pro Max at a discount to the iPhone 14 Plus.

The data doesn’t really question whether consumers are shifting into the Pro versions, but it does question the volumes. A consumer wanting a large-screen smartphone might pass on upgrading for another year when the best option starts at $1,000 for the base version.

Other reviews, actually suggest consumers should buy a new iPhone 13 for just $699 reducing the money paid to Apple this cycle. The iPhone 14 models may technically push higher average selling prices higher due to the shift in the models purchased and the elimination of the mini, but the consumer has every reason to reach down for a cheaper option.

The whole key to the launch of the iPhone 12 was the 5G chip. All of the other upgrades in the iPhone 13 and now 14 models are minor improvements that consumers can take or leave without much indigestion. Though, a consumer doesn’t want a new phone without a 5G chip that would leave the smartphone vastly behind the network speed capabilities over the next couple of years. Very few consumers actually care about a better camera, processor or an emergency SOS feature.

The latest news of a camera defect in the iPhone 14 Pro Max could hit volumes in the short term. The Guardian has reported owners seeing the camera fail when using popular apps like Instagram and TikTok.

Outside of an unexpected lingering issue, Apple will no doubt solve any camera-related issue in a relatively short time. The tech giant won’t see any long-term sales impact, but this camera issue could impact sales for the holiday period, with consumers trying to shift purchases towards the Pro models.

What Investors Always Miss

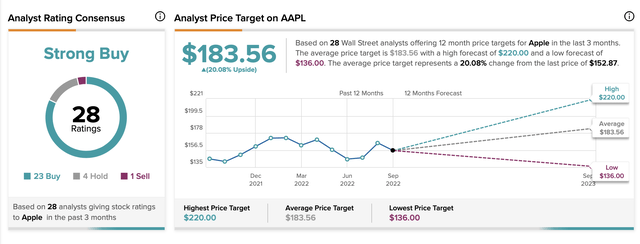

Investors need to understand that analysts are uniformly bullish on Apple and these factors are included in earnings estimates. The analyst community has 23 Buy ratings on the stock and only 1 Sell rating.

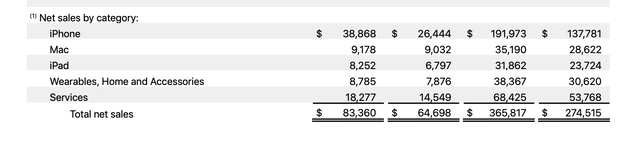

Wedbush analyst Dan Ives has iPhone 14 demand matching or slightly exceeding the iPhone 13 sales at ~220 million annually. As discussed above, the only way for Apple to boost sales at all is via higher ASPs from a shift to higher priced models, with iPhone 14 prices identical in the U.S. to the 13 model and volumes starting at the same level.

With a $100 higher ASP, Apple could boost FY23 sales by a lofty $22 billion. This best-case scenario would only boost iPhone sales by 10% from the FY22 level that should approach $210 billion after reaching $191 billion in FY21.

Ironically, analysts forecast total FY23 sales rising 5%, or just $19 billion. A more reasonable $50 ASP boost comfortably falls into these sales targets without the need for analysts to raise financial targets.

Dani Ives even promotes a scenario where Apple fails to meet iPhone 14 Pro demand due to the price points and reviews pushing people towards the higher-end models. Apple could easily see the higher ASP and fail to meet sales targets due to a lack of crucial supplies.

The current iPhone 14 Pro delivery dates are out at least a month now based on options selected. The iPhone 14 Plus will arrive much quicker.

The data suggests a disconnect with iPhone model-related demand, not any extra demand for the iPhone 14. Either way, investors should understand Apple is highly unlikely to soar past the consensus estimates of an analyst group over 80% bullish on the stock, despite the tech giant trading at 23x FY23 estimates after Apple has fallen $20 from the recent highs.

Takeaway

The key investor takeaway is that the iPhone 14 launch event wasn’t very pivotal at all. Apple only appears set to grow revenues via pushing consumers into higher price point models by not providing the compelling technology upgrades to the non-Pro models.

Investors need to understand that a lot of the expected ASP increases are already built into analyst estimates for 5% revenue growth in FY23. The stock shouldn’t trade at a multiple far in excess of the sales growth rate.

Be the first to comment