PrathanChorruangsak/iStock via Getty Images

Being a landlord can be very rewarding…

Let’s say, you buy a property for $100,000. Rent it out at $800 per month. You have $200 per month of expenses. And you finance the property with 50% equity and 50% debt at a 5% interest rate.

That’s an 8.4% return on equity based on the cash flow alone.

But then there is also appreciation. Assuming your property gains 3% per year, that would bring your total return to 14.4%.

Of course, this is a simplified example, and you can play with the numbers to reach different results, but this is more or less what publicly listed REITs (VNQ) have achieved. To give you an example, Realty Income (O), the net lease giant, has earned 15.2% annual returns for its shareholders since going public in 1994:

Realty Income historic returns (Realty Income)

And being a landlord has paid off even more handsomely in the years following a market sell-off.

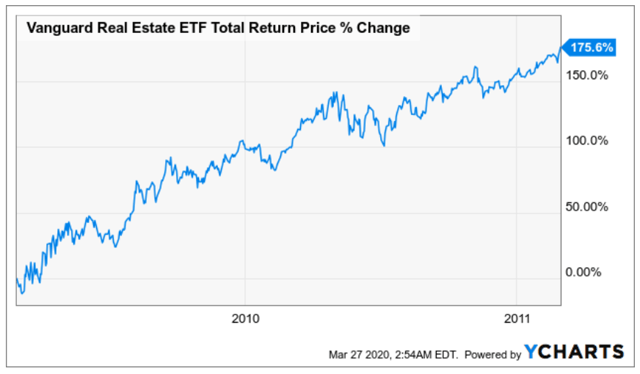

Consider that REITs nearly tripled in value in the two years following the great financial crisis…

REITs nearly triple in value post-financial crisis (YCHARTS)

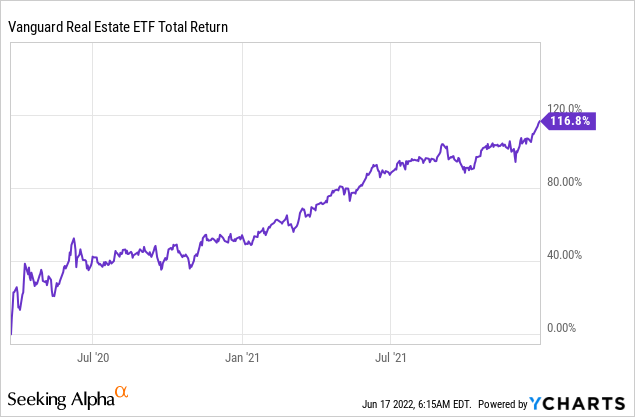

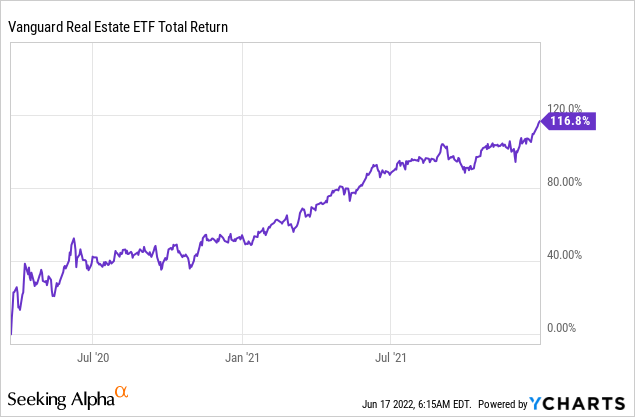

… And they also doubled investors’ money in the year following the initial pandemic crash:

This shows you that the price you pay has a massive impact on the profitability of a real estate investment. The best time to buy REITs is when they become undervalued following a market sell-off.

This brings us to today:

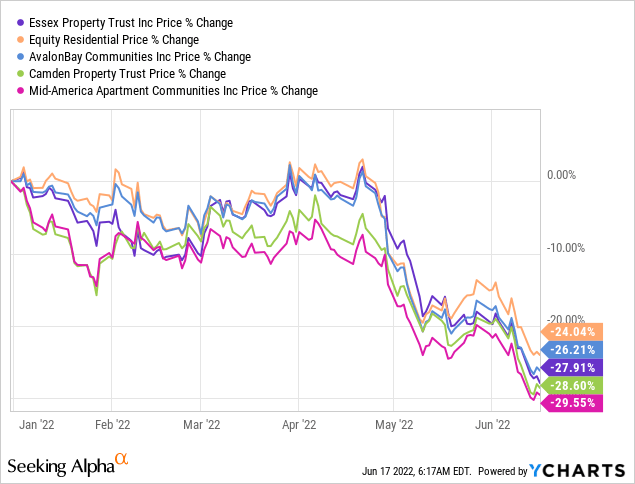

I am currently accumulating more shares of my favorite apartment REITs because to my mind, they provide some of the best risk-to-reward in today’s environment:

- They offer inflation-protection.

- They also offer recession-resilience.

- And yet, they are now steeply discounted.

Most apartment REITs (ESS; EQR; AVB; CPT; MAA) have dropped by ~25-30% in 2022, and that’s despite rapid rent growth and more cap rate compression.

As a result, premiums to net asset value (‘NAV’) have now turned into steep discounts, which is a rare occurrence for such a desirable property sector.

In fact, the discounts to NAV are now the largest in years for the apartment REIT sector, which makes little sense when you consider that occupancy rates are today near their highest, the pool of renters is only growing larger as interest rates continue to rise, and the growth in demand far outpaces the growth in new supply of apartment communities.

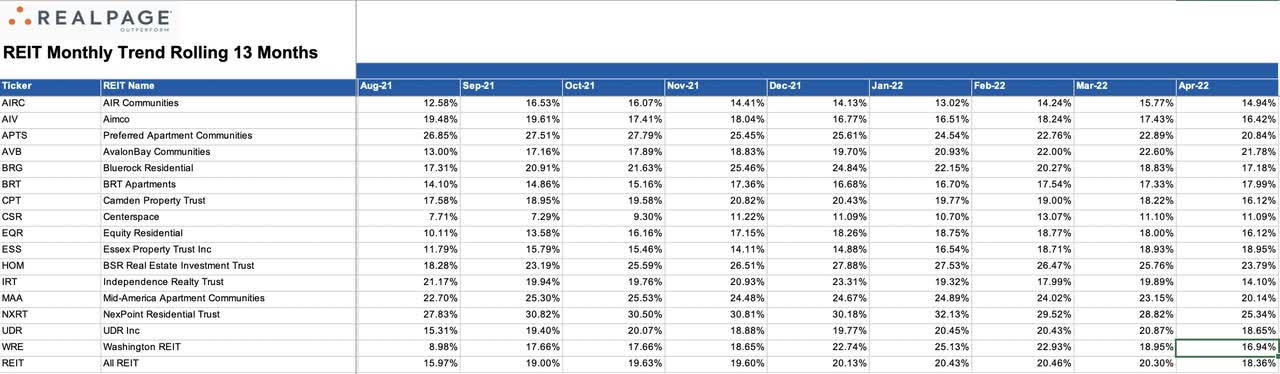

With that in mind, it is not surprising that rents are growing so rapidly. There are a number of apartment REITs that are currently hiking rents by 15-20%. That’s the fastest growth in over a decade!

Apartment rents are rising rapidly (RealPage)

I expect many of these apartment REITs to deliver greater than 15% annual total returns in the coming years. Their fundamentals are strong and yet, they are now steeply discounted. That’s exactly when you want to be a landlord.

In what follows, I highlight some of our recent purchases. Just for reference, we have three portfolios at High Yield Landlord (Core, Retirement and International) and we attempt to outperform by only investing in the most undervalued apartment REITs.

Below, we highlight one transaction for each portfolio:

Core Portfolio

BSR REIT (OTCPK:BSRTF / HOM.U): This is our largest apartment REIT investment. We think that it is particularly attractive because it owns mainly affordable apartment communities in Texan cities that enjoy rapid rent growth prospects. We started buying it at $11 per share exactly one year ago. It then rose all the way to $22 per share, and recently, dropped back down to $14.5. Even after the recent drop, our investment is up over 30% in just one year, which may lead some of you to think “how can it still be undervalued”? And that’s a fair question. I myself have a hard time buying things that are up so much in a short amount of time.

But the reality is that the company’s fair value has risen even faster than its share price. The NAV per share is up 66% and the FFO per share is up 75% year-over-year. As a result, the company is now priced at a ~35% discount to NAV and just around 20x FFO, which is unusually cheap for a REIT that’s performing so well. We believe that it is only a question of time before it returns to $22, which is where it was just a few months ago. Its NAV per share is already at $22 and by the end of the year, it could well be closer to $25 as it keeps hiking rents across its portfolio. Rents on new leases were hiked by 17.4% in the first quarter of this year!

If the public REIT market fails to reprice BSR, we would not be surprised if one of the big private equity players like Blackstone (BX) attempted to buy out the entire company. While we wait for the upside, we earn a monthly 3.5% dividend yield that’s set to be hiked again later this year. The payout ratio is low at 63% and the board just hiked the dividend by 4% in February.

Texan apartment community (BSR REIT)

Retirement Portfolio

Camden Property Trust (CPT): Last month, we added more capital to AvalonBay (AVB), and today, we are adding a bit more to CPT. Both are considered to be blue-chip apartment REITs with large-scale, A-rated balance sheets, strong track records, and attractive growth prospects.

The main difference between CPT and AVB is that CPT’s assets enjoy better organic growth prospects because they are mainly located in strong sunbelt markets. In that sense, CPT could be compared to BSR, but it is much larger, better diversified, and has a better balance sheet.

Naturally, the discount is not quite as steep, but even CPT is now priced at a 25% discount to NAV, which is rather unusual for an apartment REIT of this quality. Don’t expect huge immediate upside, but there is a clear path to double-digit annual total returns, and this is very attractive coming from one of the safest REITs you can buy.

It pays a 2.6% yield and it is expected to grow its FFO per share by ~10% in 2022. Offered at a discount, we are buyers and just upgraded it from a “Hold” to a “Buy” rating.

Sunbelt apartment community (Camden Property Trust)

International Portfolio

Boardwalk REIT (OTCPK:BOWFF / BEI.UN): We recently posted an update on the Canadian apartment REIT, and nothing major has changed since then, other than that its share price has dropped by nearly 20%.

Despite the sell-off, the company’s NAV per share has continued to rise, and as a result, it is now priced at a 35% discount to NAV, and as we noted in our recent update, we believe that this NAV is calculated quite conservatively and set for further growth. They use a 4.4% cap rate for their NAV estimate, which is conservative in today’s market.

Based on its cash flow, BEI.UN is also priced at one of the lowest multiples in the apartment sector at just 13x FFO. We expect 50% upside and while you wait, you earn a monthly 2.6% dividend yield. The dividend is not high, but this is because the payout ratio is just 35%. BEI.UN intentionally retains most of its cash flow to reinvest in growth and this has the advantage of optimizing the tax efficiency of your investment.

Canadian apartment REIT (Boardwalk REIT)

Bottom Line

Billionaire Andrew Carnegie famously said that 90% of millionaires got their wealth by investing in real estate.

And that’s not surprising when consider that real estate is a big-ticket investment that typically employs leverage and results in high returns.

Unless you are a successful entrepreneur, it is real estate that’s likely to generate the most wealth for the majority of people.

And REITs are a great way to invest in real estate at a steep discount to fair value following the recent sell-off. The last time REITs were so cheap was early into the pandemic, and it only took slightly over one year for them to double in value as they recovered:

Today, a number of REITs are priced for similar high returns as they recover to where they traded just a few months ago.

If you missed the covid-19 crash, this is your second chance to get rich owning real estate.

Be the first to comment