metamorworks/iStock via Getty Images

Brookfield Infrastructure Partners’ (NYSE:BIPC) geographically diversified portfolio of in-demand assets, predictable cash flow, sustainably growing dividend, and acumen management team make this stock a compounding machine worth buying today and holding for the long term.

An In-Demand, Diversified Portfolio

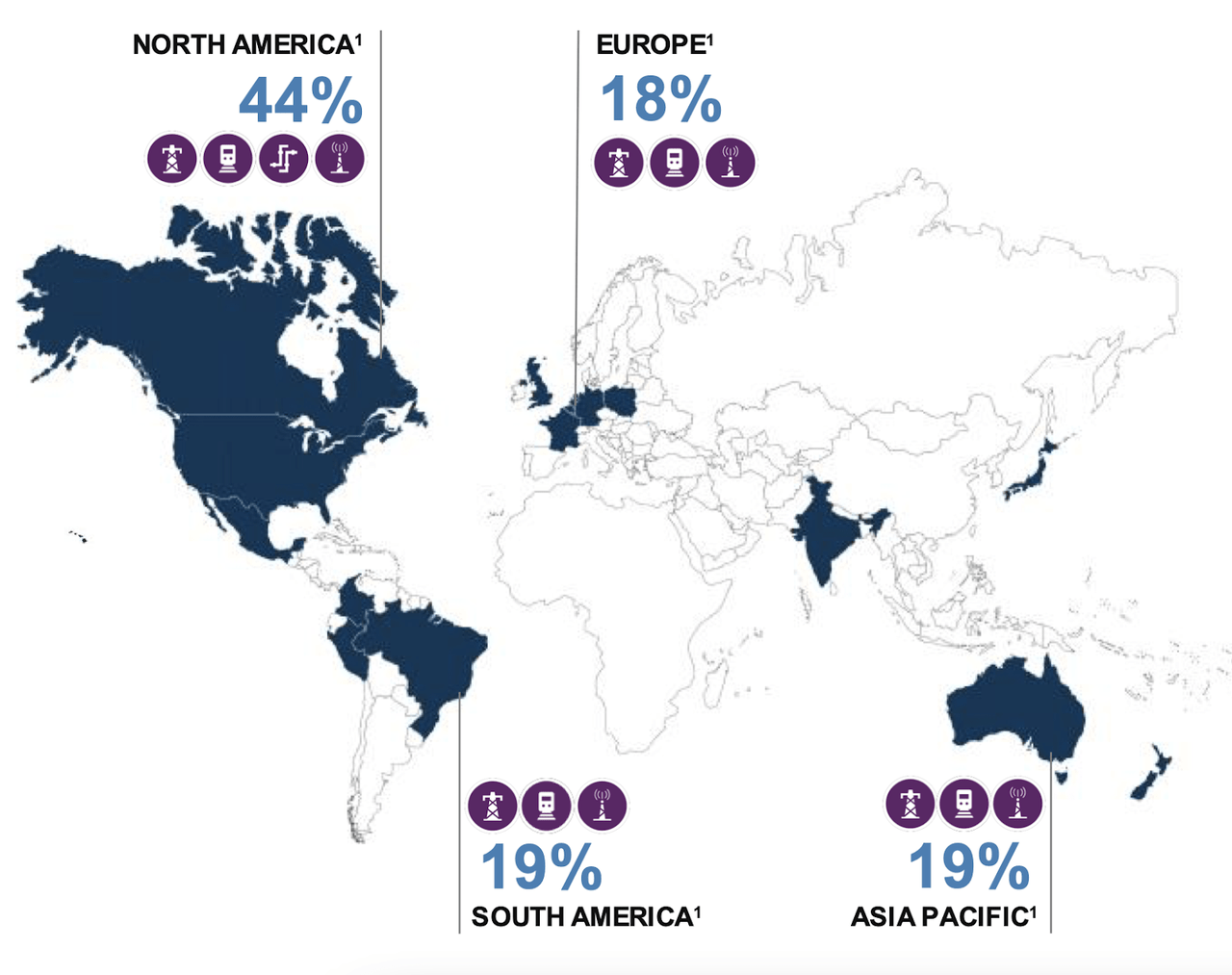

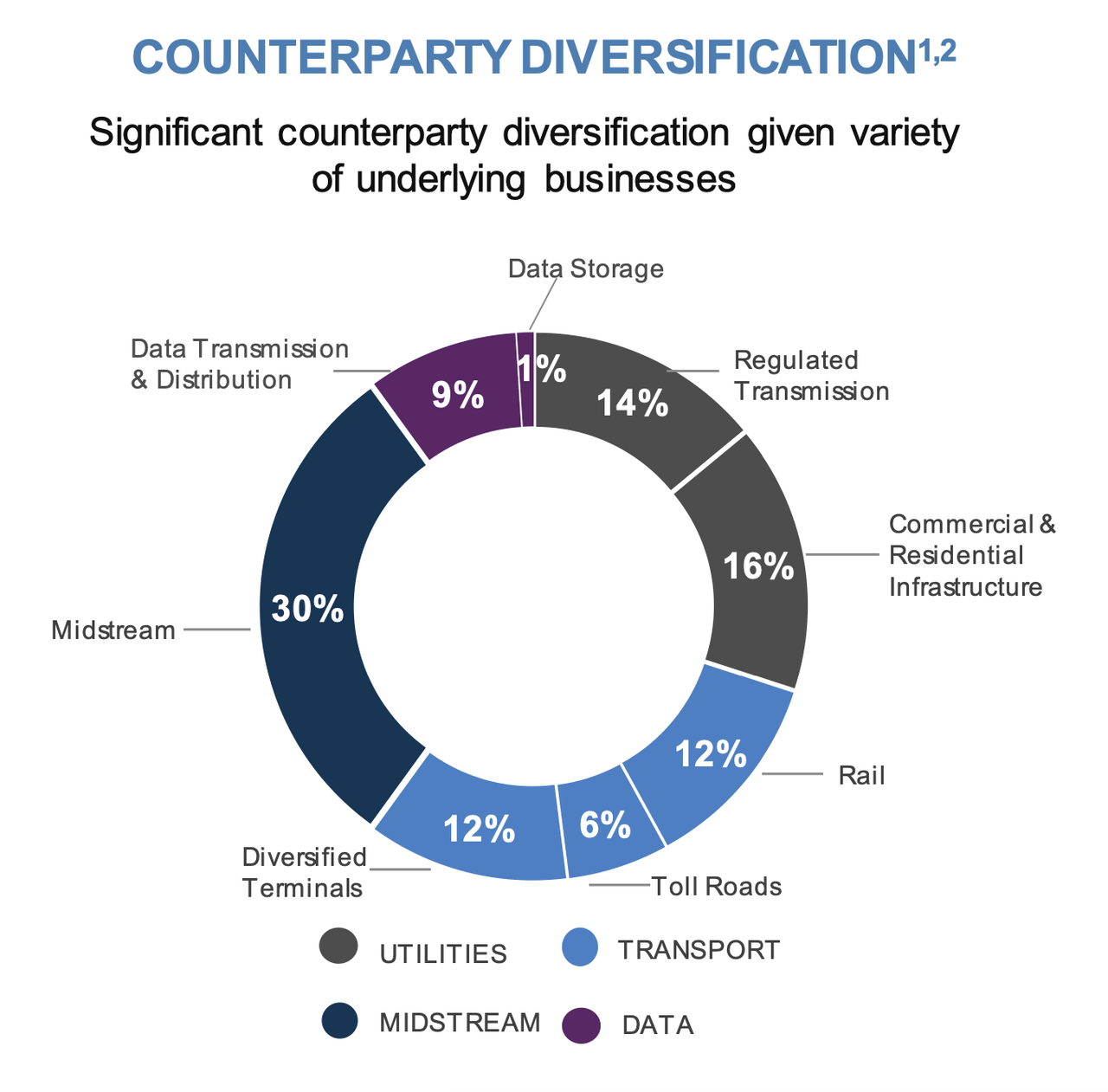

Brookfield Infrastructure owns high-quality, long-life assets from 5 Continents, including North America, South America, Europe, Asia, and Australia. Their portfolio consists of essential products and services categories such as utilities, transport, midstream, and data. These capital-intensive infrastructure assets provide a moat for the business due to a very high cost of competitive entry. In addition, their assets are often regulated monopolies such as a water treatment facility. In light of the current geopolitical conflict, it is important to note that none of BIP’s infrastructure assets are present in Russia or Ukraine.

Brookfield Infrastructure Investor Day

Utilities

Their impressive utilities business, which expands across 9 countries and 5 continents, includes 5,300 kilometers of transmission lines, 16,200 kilometers of natural gas pipelines, and 1.9 million residential energy customers. In the recent investor day presentation, management identified an additional $900 million in investment opportunities for the company’s utilities business. This is expected to result in the regulated transmission utilities segment growing earnings before interest, taxes, depreciation, and amortization (EBITDA) at a 9% compound annual growth rate from 2021 to 2026. This steady growth has me excited.

Transport

Talking about global supply chain issues is like beating a dead drum. Everyone has been discussing this topic for more than two years now. That being said, Brookfield Infrastructure is poised to take advantage of continued global logistical challenges. They see plenty of opportunity ahead as current transportation infrastructure assets will require new capital and investment to de-bottleneck their networks. BIP has $950 million in planned investments for the transport segment, which should help the company grow transport EBITDA 12% to 15% over the next five years. BIP’s current transport segment is already massive and consists of 32,300 km of rail operations, 13 terminals, 2 export facilities, and 3,800 KM of toll roads.

Midstream

The midstream segment was BIP’s best performer this quarter with 34.2% funds from operation (FFO) growth. Their midstream sector includes 15,000 km of transmission pipelines, natural gas and liquid natural gas storage and processing plants, and over 10,000 km of gas pipelines.

Investors should not be worried about Brookfield’s midstream segment. As ESG concerns increase in the investing world, available capital for the midstream industry may become more scarce while, at the same time, the midstream industry will need additional capital more than ever to transition to a net zero model. This is where Brookfield comes in. They are primed to take advantage of both the current midstream industry and the future midstream transition. As regulation increases, new development projects are delayed like the Keystone Pipeline and the Dakota Access Pipeline, and public sentiment towards fossil fuel pipelines sours, the value of BIP’s established midstream infrastructure will increase.

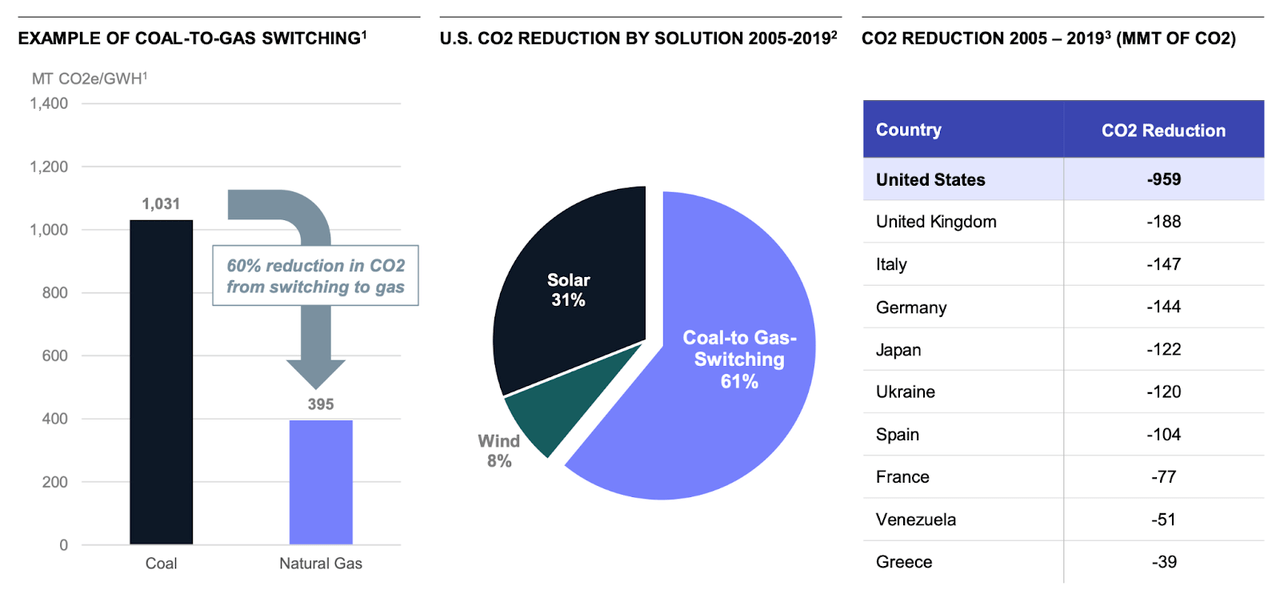

Furthermore, natural gas, although a fossil fuel, plays an essential role in global decarbonization efforts. After all, it already accounted for a majority of the United States’ reduction in fossil fuel emissions.

Goldman Sachs Asset Management

Data

BIP’s data segment has me the most excited. Currently, their data segment only makes up 10% of their asset portfolio. However, I believe it will grow over time to eventually equal the utility, transport, or midstream categories. In the most recent investor day presentation Chief Investment Officer, Sikander Rashid, stated EBITA from the data infrastructure sector will increase five fold to $100 Million by 2025. Their 50/50 joint venture with Digital Reality Trust (DLR), the biggest data center REIT in the world, is accelerating this push. They are creating institutional quality data centers and data infrastructure in India. This will be a massive value add for long term BIP investors. Afterall, India is the world’s 5th largest economy in terms of GDP. And their data needs are rapidly expanding. In fact, the data center industry in India is expected to grow at a 34% CAGR over the next few years. What’s more, the Indian government has recently pledged $1 Billion towards investing in this industry.

BIP’s keen management team certainly knows where to find lucrative opportunities. They believe the world is entering a 100 year data infrastructure upgrade investment cycle. Brookfield infrastructure Partners is definitely positioning themselves to capitalize on this trend.

Brookfield Infrastructure

Predictable Inflation Resistant Cash Flow

In addition to BIP’s geographically diversified suite of in-demand assets, their predictable, stable cash flow makes them highly investable. Most of their decades long contracts have clauses that elevate rates to adjust for inflation. In fact, 70% of their contracts are indexed to inflation. Furthermore, 90% of their debt is fixed rate so, in this inflationary environment, the value of their debt depreciates relative to their assets’ inflation adjusted, appreciating, cashflows. In 2021, BIP’s management team made the crucial decision to insulate the business from rising rates by conducting $9 Billion in refinancings, extended the average duration of their debt by approximately 5 years. They now have an average debt term of 8 years.

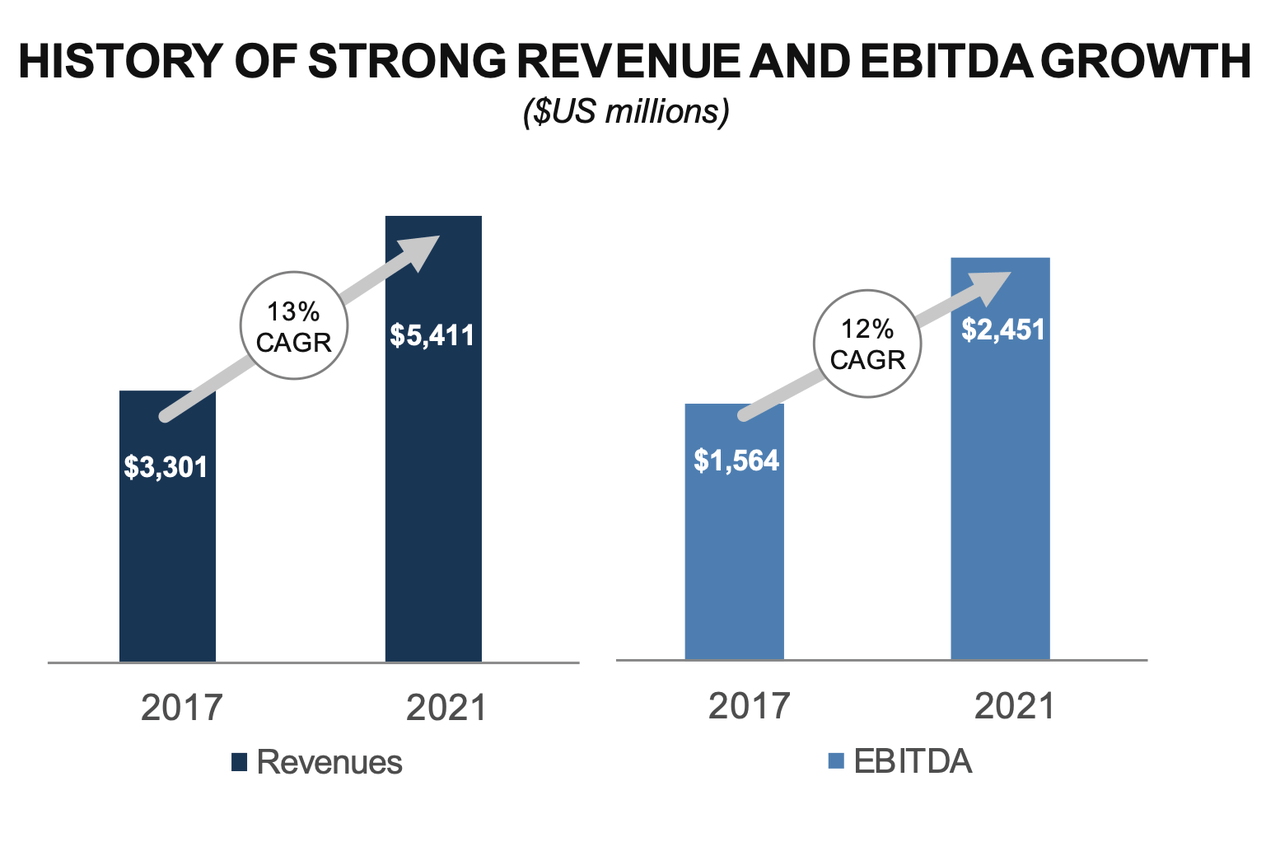

BIP has a strong history of revenue, EBITA, and dividend growth. In the most recent quarter, they beat expectations on revenue and funds from operation (FFO) with growth of 26% and 14.4%, respectively.

Revenue and EBITA Growth (BIP Corporate Profile)

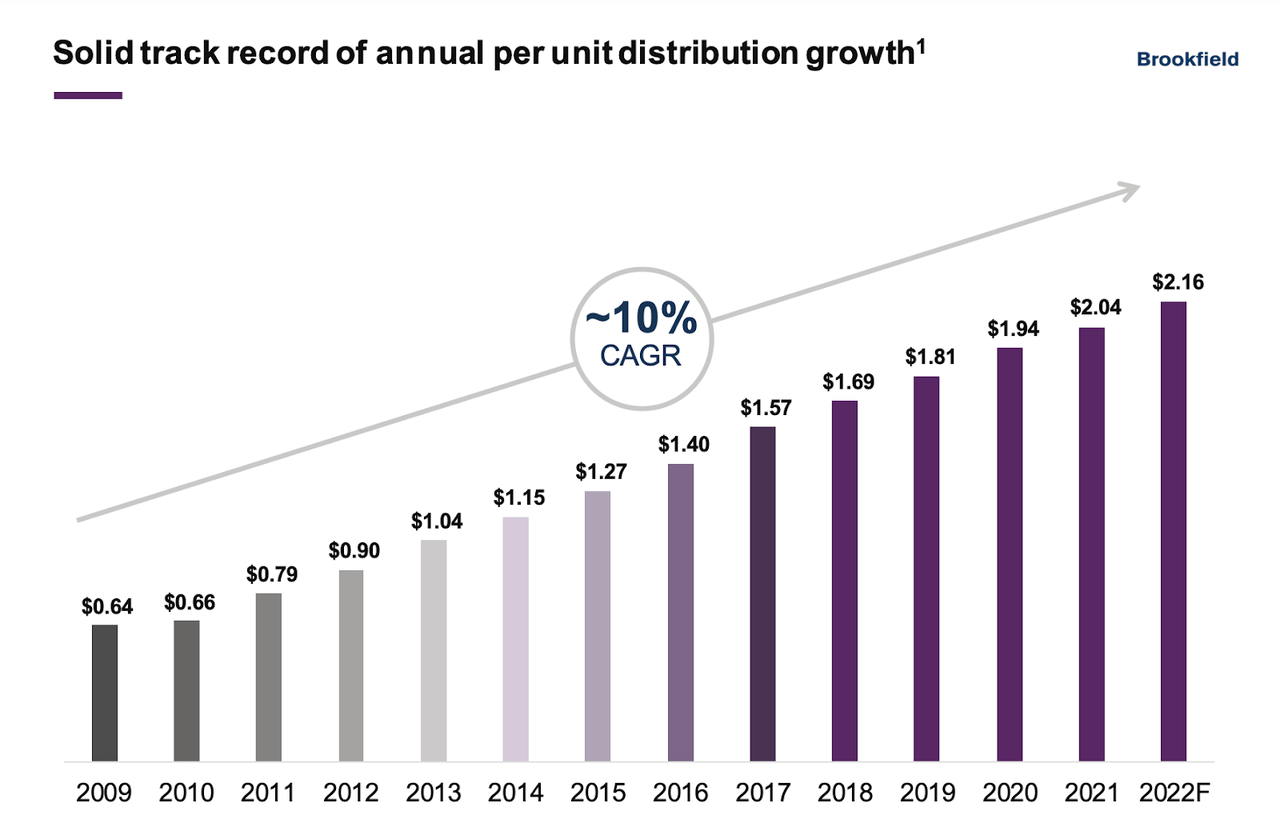

Brookfield Infrastructure’s current dividend yield is around 3.5% and management is guiding for distribution growth of 6-9% over the next few years.

Distribution/Dividend Growth (BIP Corporate Profile)

Demographic Tailwinds

Demand for Brookfield Infrastructure Partners’ assets is poised to capture value from the growth of the global middle class which will increase from 1.7 Billion in 2021 to 5.5 Billion by 2030. This larger middle class will require access to more data, transportation and utilities infrastructure. Management has deployed 50% more capital this year than their historical average, increasing future growth prospects. In addition, management projects a 50% increase in their capital backlog over the next 2-3 years from a 2015-2020 yearly average of $2 Billion to $3 Billion.

Growth Through Asset Recycling

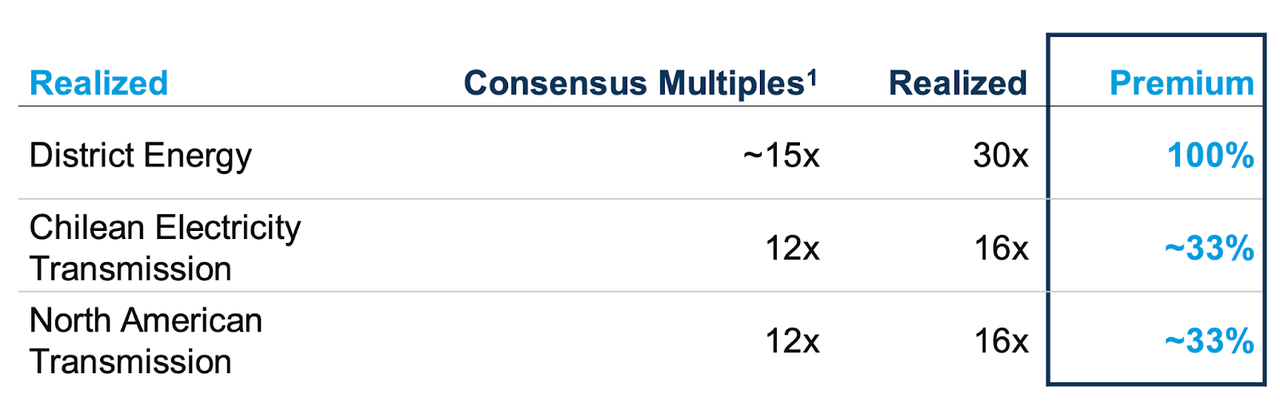

BIP’s management are experts in what they call asset recycling. They buy assets at a lower multiple, manage them well, achieve a payback on their capital and a desired FFO, and sell them at a higher multiple in the future when their target FFO is no longer viable.

When looking to buy an infrastructure platform, BIP looks for an attractive entry point, quick payback period, robust cash yield, conservative capital structure, a large scale transaction, customer quality and credit strength. For example, In 2021 they sold district energy, which was only generating 5% in funds from operation (FFO) and used those proceeds to buy Inter Pipeline, which will generate 13% FFO. Management sought out Inter Pipeline because 80% of Inter Pipeline’s EBITA is under contract with a remaining lifetime of 12 years. This will give them a payback on their capital of only 8 years. Any capital gained after 8 years is icing on the cake.

The recent sale of their Enwave geothermal facility also demonstrates the success of their capital recycling program. They bought the asset in 2012 and sold it in 2021. By improving the business through their platform development approach, they received a 6x multiple on invested capital by acquiring and bolting on adjacent and complimentary businesses, assembling a top tier management team that specializes in integration and optimization, and leveraging Brookfield’s leading real estate portfolio. CFO David Krant stated they typically create exit valuations that are 25-50% higher than what is implicit in BIPs market cap. That is on top of proceeds from sales of assets that already paid for themselves.

BIP Investor Day

A Sharp Management Team

BIP’s management team has decades of experience owning and operating infrastructure assets. Brookfield Infrastructure is part of an elite group of companies including Brookfield Renewable and Brookfield Asset Management (BAM). The CEO of Brookfield Infrastructure, Sam Pollock, has been with the Brookfield family since 1994. Before his role as CEO, Mr. Pollock acted as Brookfield Asset Management’s Chief Investment Officer. Brookfield Infrastructure’s association with Brookfield Asset Management is priceless. With an $83 Billion market cap, BAM is the biggest alternative asset manager in the world. They can feed unique, lucrative opportunities to BIP that no other infrastructure companies in the $4 Billion market cap range would have access to.

BIP Versus BIPC

Brookfield Infrastructure Corporation and Brookfield Infrastructure Partners are economically equivalent stakes of the business and have the same dividend or distribution on a dollar basis. BIPC typically trades at a slight premium to BIP resulting in small difference between their percentage dividend yield. Their current yields are 3.82% and 3.35%, respectively.

BIPC/BIP Ratio (Trading View)

BIPC trades at a premium to BIP because it has a broader investment base. The corporate shares can be held in IRAs, indexes, and pension funds without the tax complications of a master limited partnership (MLP). BIPC is a corporation that issues a 1099 while BIP is a partnership that issues a K-1. Within an IRA, MLP income of over $1,000 annually is taxable as it is considered unrelated business taxable income. A company that issues MLP shares, like BIP, does not pay corporate income tax but instead distributes income to its partners or unitholders. That makes it subject to immediate taxes, unlike most other investments that you might hold in an IRA.

To avoid the potentially complicated tax headache of the limited partnership, I recommend paying the small premium to buy shares of BIPC rather than units of BIP. Plus, it is currently only trading at a 13% premium which is in the historically average range, much lower than the 47% premium it traded at in December 2020.

Concerns

BIP’s dividend payout ratio, which shows the proportion of earnings a company pays its shareholders in the form of dividends, is very high at 142.76%. A payout ratio of over 100% indicates that a company is paying more in dividends than it can support in earnings. Many would view this as unsustainable. I would like to see BIP’s payout ratio come down to well under 100%. However, because BIP regularly acquires and sells massive assets, their earnings are often very lumpy quarter to quarter. But because they have steadily and sustainably increased their dividend, earnings, and FFO over the long term, I am willing to look past their high payout ratio for now.

Conclusion

BIP’s geographically diversified suite of in-demand, low risk assets with inflation adjusted revenues, a steadily increasing dividend, a highly experienced management team, and a proven capital recycling program will likely create long-term value for Brookfield Infrastructure investors.

Be the first to comment