Kwarkot/iStock via Getty Images

We monitor dividend announcements for stocks in Dividend Radar, a spreadsheet of stocks with dividend streaks of five years or more. Readers are invited to download the spreadsheet for free. The Dividend Radar spreadsheet separates stocks into three categories: Champions (with increase streaks of 25+ years), Contenders (10-24 years), and Challengers (5-9 years).

In the last week, five companies in Dividend Radar declared dividend increases, including two of the stocks I own. Note, there were no dividend cuts or suspensions announced for Dividend Radar stocks during this period.

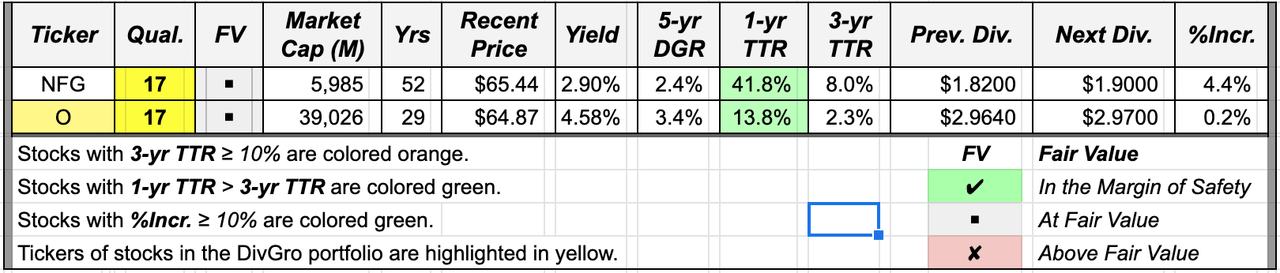

The following table provides a summary of the dividend increases. The table is sorted into sections for Champions, Contenders, and Challengers, and then by the percentage increase, (%Incr). Dividends are annualized and in US$, unless otherwise indicated. Yield is the new dividend yield for a recent price and Yrs are years of consecutive dividend increases.

The following dividend increase data are sorted alphabetically by ticker.

Company descriptions are the author’s summary of company descriptions sourced from FINVIZ.

Great Southern Bancorp (GSBC)

GSBC operates as a bank holding company for Great Southern Bank that offers a range of financial services in the United States. The company provides various deposit, loan, and insurance products. The company has operations in Missouri, Iowa, Minnesota, Kansas, Nebraska, Oklahoma, and Arkansas. GSBC was founded in 1923 and is headquartered in Springfield, Missouri.

- On Jun 15, GSBC declared a quarterly dividend of 40¢ per share.

- This is an increase of 11.11% from the prior dividend of 36¢.

- Payable Jul 12, to shareholders of record on Jun 27; ex-div: Jun 24.

National Fuel Gas (NFG)

Founded in 1902 and based in Williamsville, New York, NFG is engaged in the production, gathering, transportation, distribution, and marketing of natural gas. It also develops and produces oil reserves, primarily in California. As of September 30, 2020, NFG owned approximately 95,000 acres of timber property and managed an additional 2,500 acres of timber cutting rights.

- On Jun 15, NFG declared a quarterly dividend of 47.5¢ per share.

- This is an increase of 4.40% from the prior dividend of 45.5¢.

- Payable Jul 15, to shareholders of record on Jun 30; ex-div: Jun 29.

Realty Income (O)

Known as The Monthly Dividend Company®, O is an equity REIT that invests in commercial real estate markets in the United States and internationally. The company earns income from more than 5,000 properties under long-term lease agreements with commercial tenants. O was founded in 1969 and is headquartered in San Diego, California.

- On Jun 14, O declared a monthly dividend of 24.75¢ per share.

- This is an increase of 0.20% from the prior dividend of 24.7¢.

- Payable Jul 15, to shareholders of record on Jul 1; ex-div: Jul 30.

W. P. Carey (WPC)

With an enterprise value of approximately $17 billion, WPC ranks among the largest diversified net lease REITs. The company invests in high-quality, single-tenant industrial, warehouse, office, and retail properties subject to long-term leases with built-in rent escalators. Its properties are located primarily in the U.S. and Northern and Western Europe

- On Jun 16, WPC declared a quarterly dividend of $1.0590 per share.

- This is an increase of 0.19% from the prior dividend of $1.0570.

- Payable Jul 15, to shareholders of record on Jun 30; ex-div: Jun 29.

Investar (ISTR)

Founded in 2006, ISTR operates as the bank holding company for Investar Bank, providing a range of commercial banking products for individuals and small to medium-sized businesses in South Louisiana. The company offers various deposit and loan products, as well as cash management and other financial services. ISTR is headquartered in Baton Rouge, Louisiana.

- On Jun 16, ISTR declared a quarterly dividend of 9¢ per share.

- This is an increase of 0.00% from the prior dividend of 9¢.

- Payable Jul 29, to shareholders of record on Jun 30; ex-div: Jun 29.

Please note that we’re not recommending any of these stocks. Readers should do their own research on these companies before buying shares.

Dividend Cuts and Suspensions

Following requests from readers, we’ve added this section to our weekly article series. Please note that we’re only covering dividend cuts and suspensions announced by companies in Dividend Radar’s spreadsheet. There were no dividend cuts or suspensions announced for stocks in Dividend Radar during this period.

An Interesting Candidate

This section highlights one of the stocks that announced a dividend increase. We provide a quality assessment and present performance, earnings, and valuation charts.

Our objective is to identify high-quality dividend growth [DG] stocks trading at reasonable valuations. That’s tough, though, as high-quality DG stocks often trade at premium valuations. If we can’t find a worthy candidate, we’ll suggest a stock to add to your watchlist and a suitable target price.

To start, we use DVK Quality Snapshots to do a quick quality assessment, screening our list of DG stocks based on quality scores. Below are two stocks with quality scores of 17 each:

Created by the authors from data in Dividend Radar

Let’s look at Dividend Champion Realty Income in this article. The stock yields 4.58% at $64.87 per share and has a modest 5-year dividend growth rate [DGR] of 3.4%.

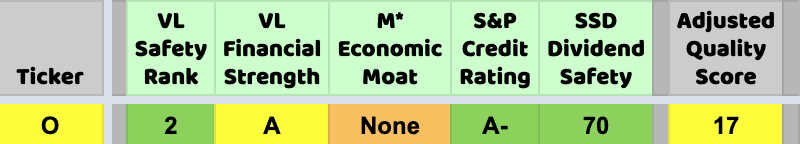

Realty Income is rated Decent (quality score: 15-18):

Created by the author from a personal spreadsheet

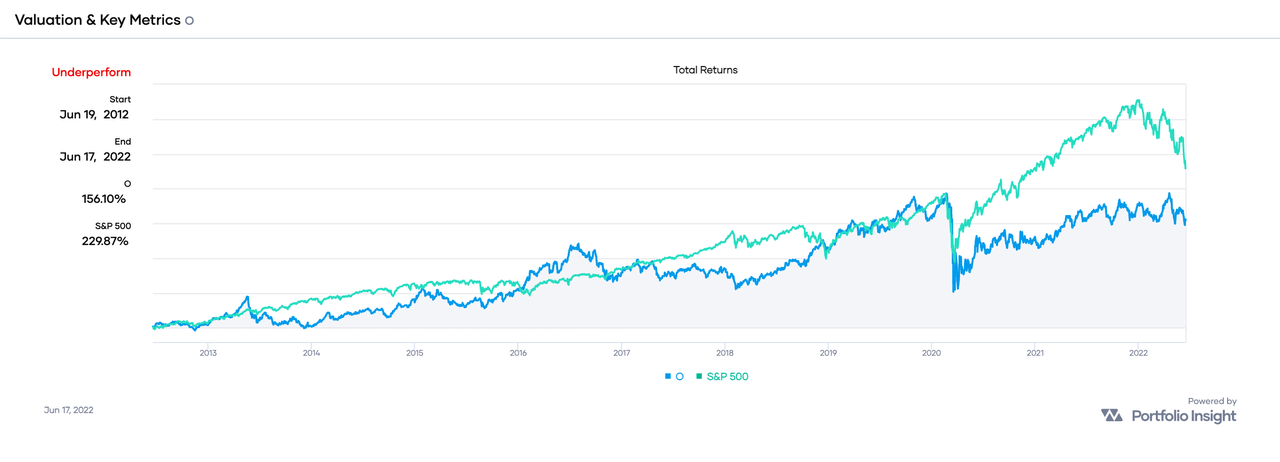

Over the past ten years, Realty Income underperformed the SPDR S&P 500 ETF (SPY), an ETF designed to track the 500 companies in the S&P 500 index:

Portfolio-Insight.com

Over this time frame, Realty Income delivered total returns of 156% versus SPY’s 230%, a margin of 0.68-to-1.

However, if we extend the period of comparison to the past twenty years, Realty Income easily outperformed SPY, with total returns of 963% versus SPY’s 418%, a margin of 2.30-to-1.

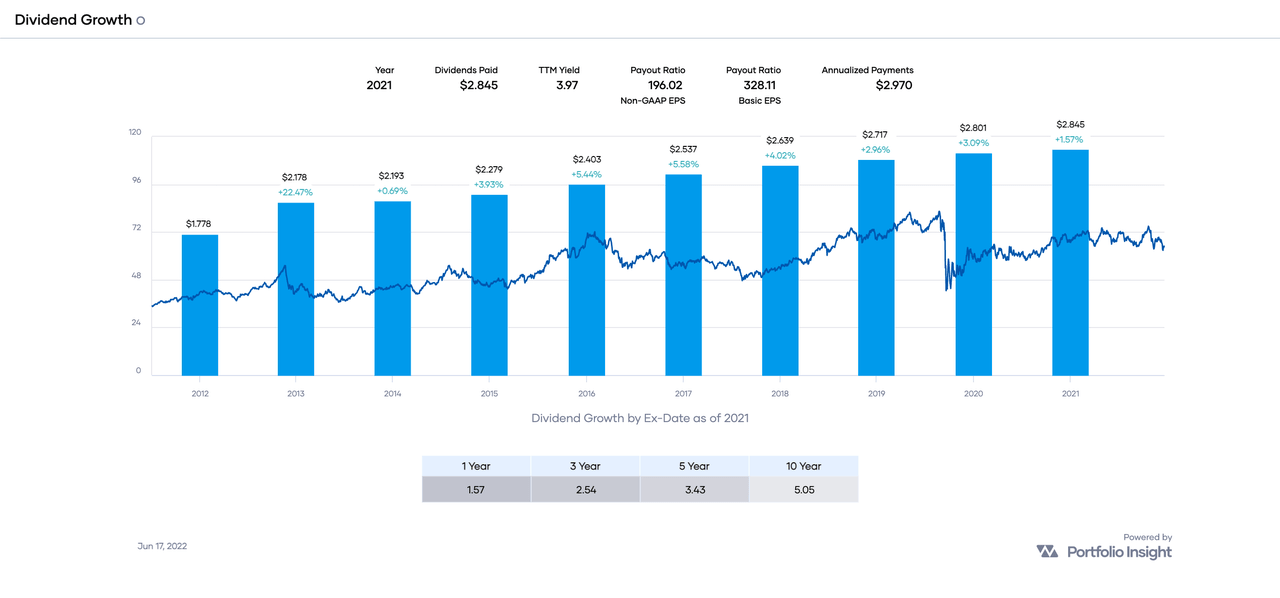

Realty Income’s dividend growth history is a model of consistency, though the dividend growth rate [DGR] is modest:

Portfolio-Insight.com

Moreover, the DGR is decelerating, as can be seen by dividing the 5-year DGR by the 10-year DGR: 3.43 ÷ 5.05 = 0.68. A ratio below 1.00 means the DGR is decelerating.

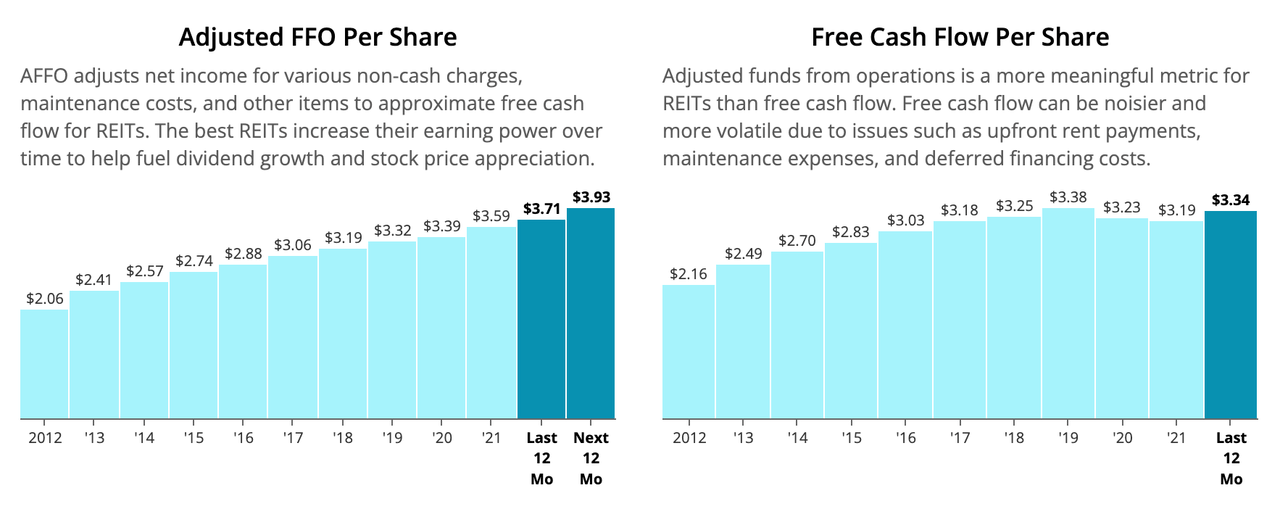

Realty Income’s adjusted funds from operations [AFFO] are growing nicely, too:

Simply Safe Dividends

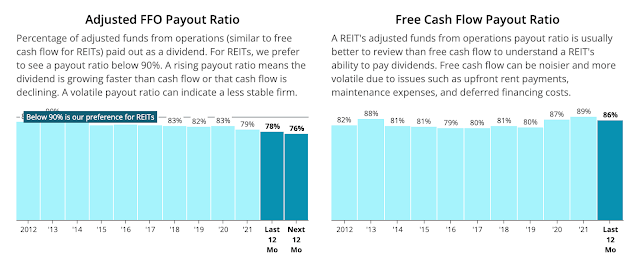

At 78%, Realty Income’s AFFO payout ratio is “low for REITs,” according to Simply Safe Dividends:

Simply Safe Dividends

Realty Income has plenty of room to continue paying and growing its dividend for the foreseeable future. Simply Safe Dividends considers Realty Income’s dividend Safe, with a Dividend Safety Score of 70.

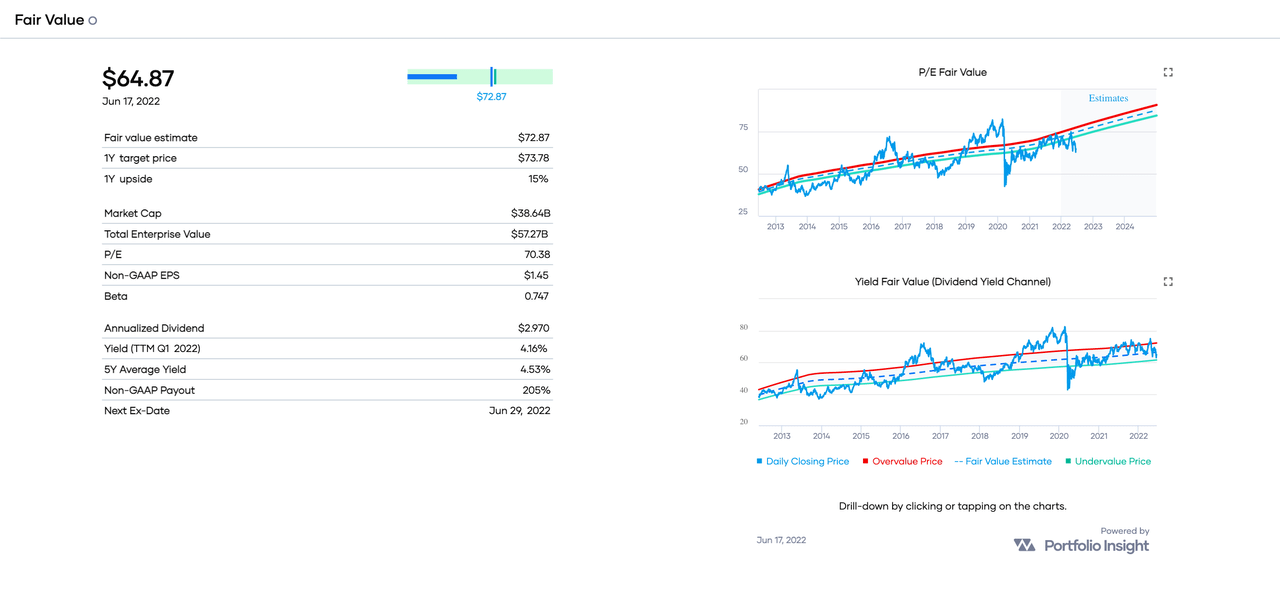

Next, let’s now consider Realty Income’s valuation.

Portfolio-Insight.com

A quick way to estimate fair value is by dividing the stock’s annualized dividend ($2.97) by its 5-year average yield (4.53%). This results in a fair value [FV] estimate of $66. Given Realty Income’s current price of $64.87, the stock is trading at a slight discount to its past dividend yield history.

For reference, CFRA’s FV is $61, Finbox.com’s FV is $62, Portfolio Insight’s FV is $73, and Morningstar’s FV is $76. The average of these fair value estimates is $68, also indicating that Realty Income may be trading at a discounted valuation.

My own FV estimate of Realty Income is $68, so I believe the stock is trading at a discount of about 4.6%.

Here are the most recent Seeking Alpha articles covering Realty Income:

- Hold: REITs Under Rising Rates: XLRE And Realty Income In Focus, by Sensor Unlimited

- Buy: Realty Income Corp.: A Great REIT To Consider, by Daniel Jones

- Buy: Is Realty Income Stock A Buy, Sell, Or Hold After Recent Earnings?, by Julian Lin

Conclusion

Realty Income is an Investment Grade DG stock rated Decent. For stocks rated Decent, I require a discounted valuation of 10% relative to my fair value estimate. Therefore, my Buy Below price for Realty Income is $61.

Please note that I’m not recommending Realty Income or any of the stocks listed in this article. Readers should do their own research on these companies before buying shares.

Thanks for reading, and happy investing!

Be the first to comment