TU IS

Red Violet, Inc. (NASDAQ:RDVT) enjoys a market that may grow at a CAGR of close to 22.85% globally. I believe that RDVT’s EBITDA margin will most likely increase as more customers learn about RDVT’s machine learning capabilities. Keep in mind that more data sets analyzed in the long run will enhance the company’s machine learning processes. I do see risks from lack of innovation and competition, however the current fair price remains somewhat undervalued.

Red Violet

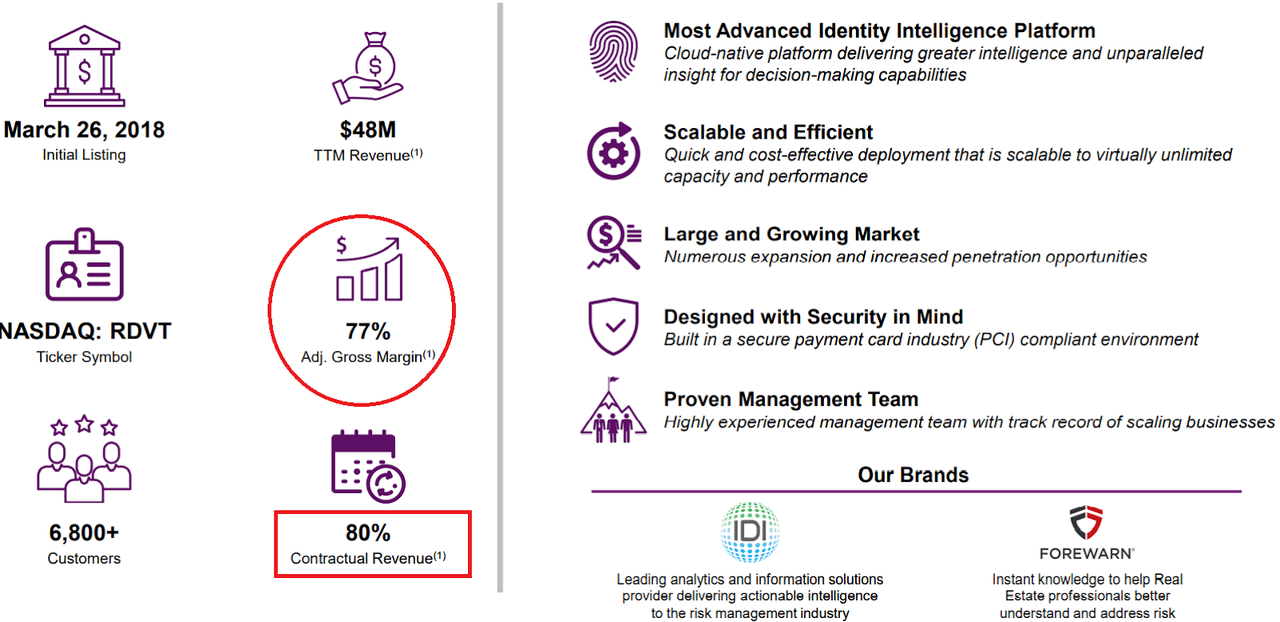

Incorporated in Delaware, Red Violet, Inc. offers proprietary technologies and analytical capabilities to deliver identity intelligence. Among many other distinctions, Red Violet notes to have the most advanced identity intel platform in the market.

With that about the technology, I decided to assess the company’s financials once I got to know that 80% of the company’s revenue is contractual. Besides, the fact that the adjusted gross margin is close to 77% is also worth noting. Some of these features were reported in a recent presentation.

Source: RDVT – Company Overview – August 2022

Growing Revenue And Adjusted EBITDA Margin Of 24% In The Six Months Ended June 30, 2022

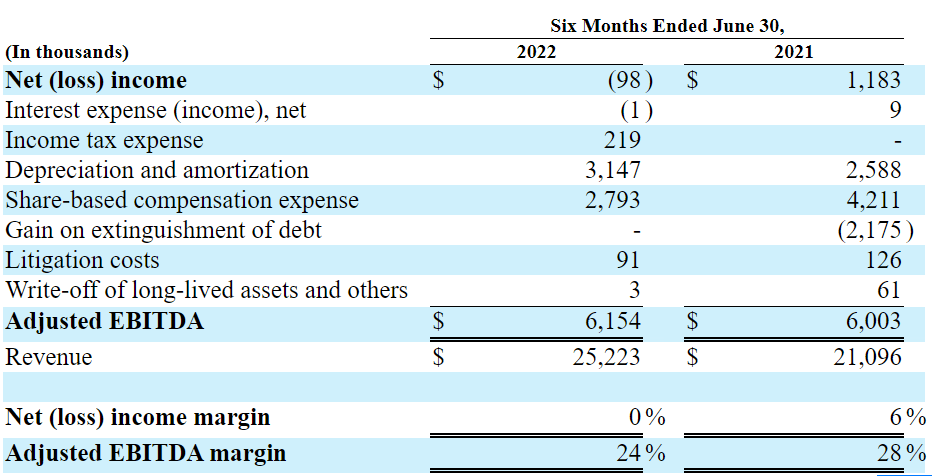

I believe that the numbers reported in the last six months could be better, but there are many reasons for optimism. In the last six months ending June 30, 2022, we saw a net income loss, along with an adjusted EBITDA margin of 24% and revenue of $25 million, which was a bit higher than that in the same period in 2021. Depreciation and amortization was worth $3.147 million. Finally, share based compensation expense obtained was $2.793 million, which does not seem small. With all this being said, I believe that Red Violet would most likely generate interest if the adjusted EBITDA continues to trend higher.

Source: 10-Q

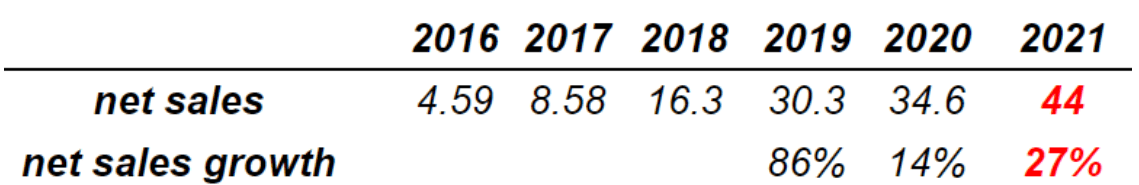

In 2021, a net sales of $44 million was obtained, with a sales growth of 27%. Let’s also note that sales growth, in 2020, was equal to 14%, and it stood at 86% in 2019. Red Violet reported sales growth not only in 2022. In the past, management reported similar or even more sales growth.

Source: SA

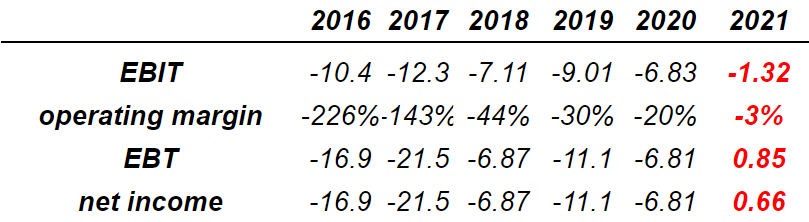

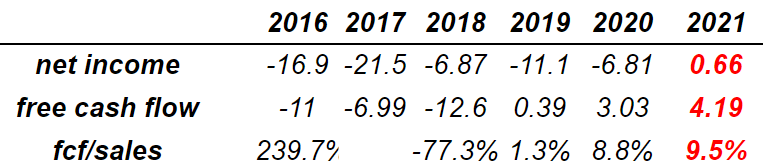

With regards to the most recent net income, I believe that there is room for optimism. 2021 provided us with the following information. With an EBIT of -$1.32 million, EBT was $0.85 million with a net income of $0.66 million. In 2021, the company reported positive net income for the first time in the last five years.

Source: SA

With that about the income statement, investors will likely appreciate the cash flow statement. With a free cash flow of $4.19 million, Red Violet reported an FCF/sales ratio of close to 9%. Further increase in free cash flow will likely lead to an increase in Red Violet’s fair valuation.

Source: SA

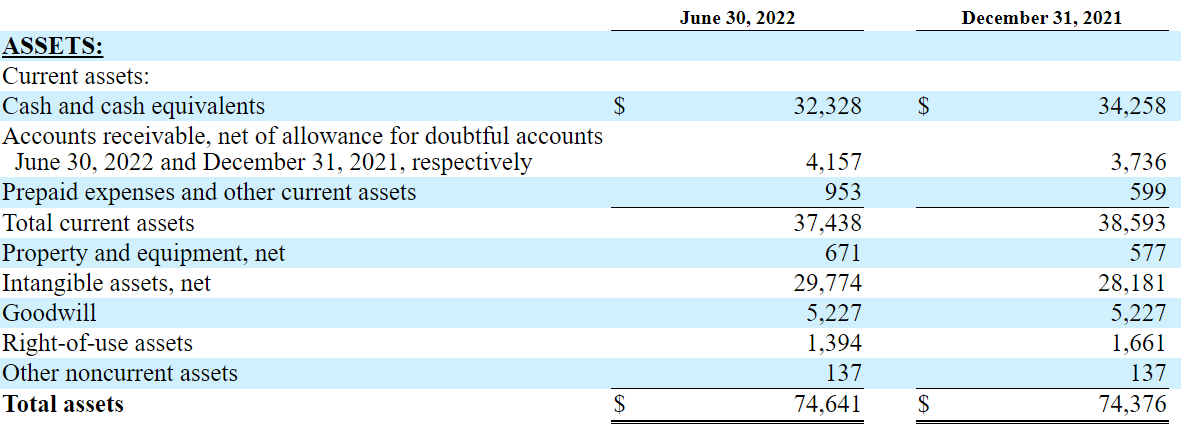

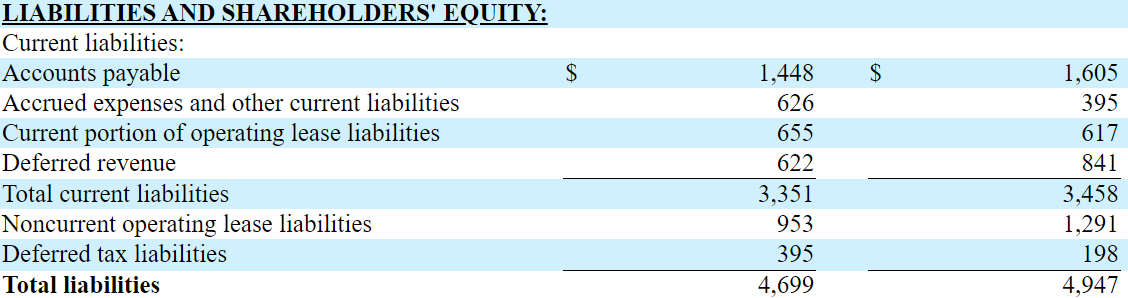

Solid Balance Sheet With Almost No Liabilities

As of June 30, 2022, Red Violet reported a cash and cash equivalents of $32 million, in addition to accounts receivable, net of allowance for doubtful accounts of $4 million. Finally, with total current assets worth $37 million and positive FCF, I believe that the company has sufficient liquidity to finance its operations.

Intangible assets were worth $29 million with goodwill worth $5 million. The right-of-use assets were reported to be worth $1.394 million along with noncurrent assets of $137 million. The total assets were equal to $76 million, which resulted in a solid balance sheet with an asset/liability ratio of 14x.

Source: 10-Q

Turning to liabilities for 2022, accounts payable were $1.448 million, together with accrued expenses and other current liabilities of $0.626 million. The current portion of operating lease liabilities obtained was only $0.655 million, with deferred revenue of $0.622 million and total current liabilities of $3.3 million. Finally, with total noncurrent operating lease liabilities of $0.953 million and deferred tax liability of $0.395 million, the company noted total liabilities of only $4.69 million.

Source: 10-Q

Conservative Case Scenario

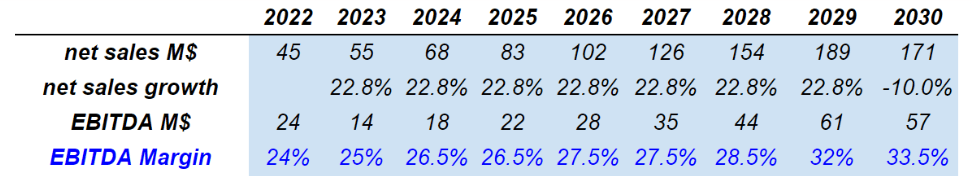

Under my best case scenario, I assumed that Red Violet will likely grow as much as the global fraud detection and prevention market, close to 22%.

The global fraud detection and prevention market size is rising at a CAGR of 22.8% during the forecast period 2022 to 2029.

I also believe that Red Violet will likely improve its insights and machine learning capabilities as more data is assessed. If clients appreciate the new capabilities, revenue growth will likely grow more than expected.

As the digital transformation accelerates, the data generated therefrom increases rapidly. Derived semantic insight increases exponentially with each new data asset, creating compounded additional value that can be used by supervised and unsupervised machine learning algorithms. Source: 10-k

I also assumed that Red Violet’s technology will benefit significantly from its scalability. In this regard, let’s note that the company’s platform is fully built in the cloud, which makes it more reliable than that of clients. The following words from the annual report are in my view what investors need to have a look at to understand the company’s business potential:

Unlike legacy technologies, our platform was built in the cloud from the ground up. Due to its cloud-native construct, CORE demonstrates increased speed and scalability as compared to legacy constructs.

As competitors invest millions of dollars transitioning platforms from dated infrastructures to primarily hybrid-cloud environments, we are advancing and expanding our cloud-native technology and functionality to meet customer need, as customers increasingly rely on the speed, reliability, security, scalability and efficiencies that only the cloud delivers.

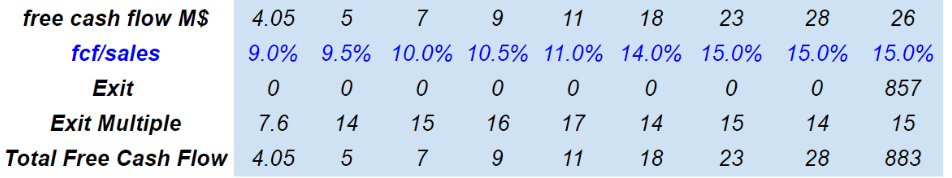

Under sales growth of 22.8%, EBITDA margin close to 25%-33.5%, and 2030 FCF/Sales of 15%, I obtained FCF close to $4-$28 million and 2030 EBITDA of $57 million.

Bersit’s DCF Model Bersit’s DCF Model

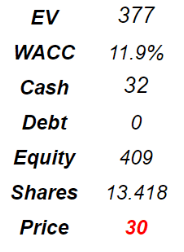

Also, with an exit multiple of 15x and a discount of close to 11.5%, the implied equity valuation is close to $410 million, and the fair valuation would be close to $30 per share.

Bersit’s DCF Model

Risks And Sales Growth Close To 14% Would Lead To A Valuation Of Only $9 Per Share

If we assume the estimates in North America, I would say that sales growth will likely stay at around 14%. Keep in mind that according to experts, the risk analytics market would grow at 14.7% until 2026:

The risk analytics market is projected to grow to $64.7 billion by 2026, representing a CAGR of 14.7% from 2021 through 2026, with North America estimated to hold the largest market share in the risk analytics market. Source: Risk Analytics Market marketresearch.com

In my opinion, it is quite likely that Red Violet’s platform comes with minor errors or security vulnerabilities that management may need to disclose. If customer’s businesses suffer significant damages, the reputation of Red Violet could deteriorate. As a result, sales growth may decline, or signing new contracts with clients may be more expensive. In sum, I would say that the company’s EBITDA margin and FCF margin would most likely decline.

Any errors or security vulnerabilities discovered in our products after commercial release could result in loss of revenue or delay in revenue recognition, or loss of customers, any of which could adversely affect our business and results of operations. In addition, we could face claims for product liability or breach of personal information. Source: 10-k

Red Violet may launch products that clients don’t need, or technological innovation could not be effective. As a result, I would say that competitors would perhaps report larger sales growth than Red Violet. In sum, I believe that the company’s free cash flow would be lower than expected.

We cannot assure you that we will be able to identify, develop, manufacture, market or support new or enhanced products and services successfully in a timely manner. Further, we or our competitors may introduce new products or services or product enhancements that shorten the life cycle of existing products or services or cause existing products or services to become obsolete. Source: 10-k

Finally, I would certainly expect malicious attacks from hackers or other types of actors. If clients can’t use the company’s systems, or Red Violet suffers data leaks, I believe that some customers would leave the company. The results would include decreases in the FCF/Sales ratio.

Despite our physical security, implementation of technical controls and contractual precautions to identify, detect and prevent the unauthorized access to and alteration and disclosure of our data, we cannot assure you that systems that access our services and databases will not be compromised or disrupted, whether as a result of criminal conduct, DDoS attacks or other advanced persistent attacks by malicious actors, including hackers, nation states and criminals. Source: 10-k

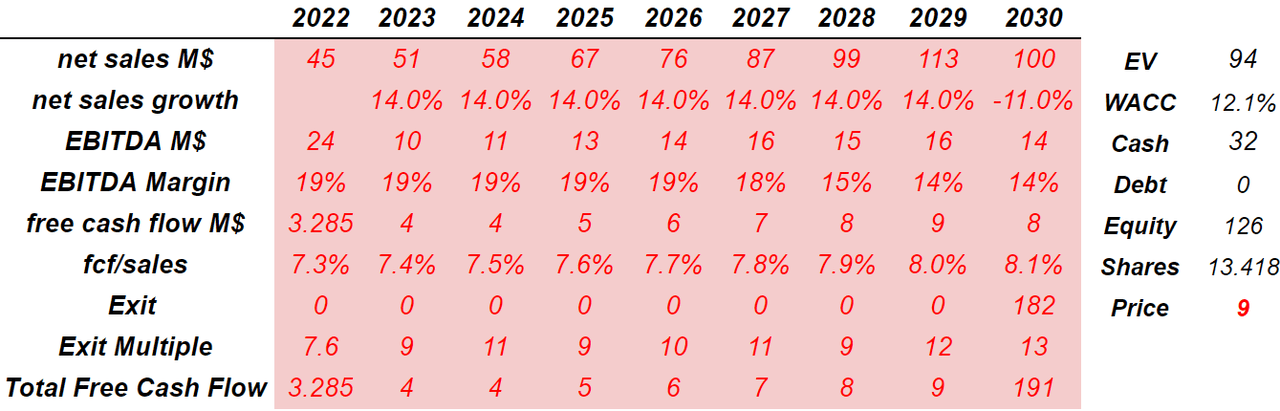

If we assume sales growth of 14%, an ultra conservative EBITDA margin around 19%-14%, and a FCF/Sales margin of 7%-8%, FCF would stand at around $3-$9 million. If we also use a discount of 12.1% and an exit multiple of 13x 2030 EBITDA, the implied equity valuation would be close to $126 million. Finally, the stock price would be around $9 per share.

Bersit’s DCF Model

Conclusion

Red Violet operates in a market that could be growing globally at a CAGR of more than 22%, and I would expect the company’s EBITDA margin to expand. In my view, with more data sets, Red Violet’s machine learning capabilities will likely increase, which may accelerate customer retention. I obviously see risks from lack of innovation and competition. However, under my several case scenarios, I obtained results indicating certain undervaluation in the stock.

Be the first to comment