JohnFScott

Top Level

Starbucks (NASDAQ:SBUX) is expected to announce Q4 and Full-Year Earnings after the close on Thursday, November 3rd, 2022. In this article I will present the results of a newly developed model to predict risk and return so that you have actionable information on what to expect after the call.

Competitive Advantage

To understand competitive advantage, we need to understand how the company makes money. Apart from retail stores on seemingly every corner of America, Starbucks operates as a roaster, marketer, and retailer of specialty coffee worldwide. It operates through three segments: North America, International, and Channel Development. The company also licenses its trademarks through licensed stores, grocery, and foodservice accounts. The company offers its products under the Starbucks, Teavana, Seattle’s Best Coffee, Evolution Fresh, Ethos, Starbucks Reserve, and Princi brands. As of October 3, 2021, it operated 16,826 company-operated and licensed stores in North America; and 17,007 company-operated and licensed stores internationally.

Starbucks enduring competitive advantage (MOAT) relies heavily on delighting customers since product improvement can only happen as a roaster. They can also improve economic position by eliminating unnecessary costs, but people don’t go to Starbucks for cheaper coffee. The moat is therefore measured by how much people are buying, and how much they are willing to pay to buy it. This moat is easily measured by revenue.

Starbucks Revenue Growth: Then and Now

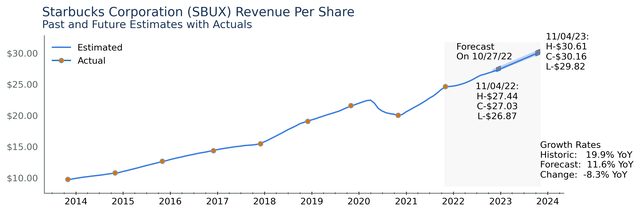

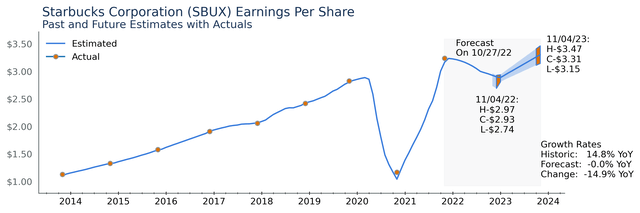

The next two charts show the last 8 years of earnings and revenue as well as forecasts for the next 2 years from 11 sell-side analysts reporting from major brokerage houses.

Although the chart looks good at first sight, constant growth should visibly curve up exponentially because of compounding returns. The trend for Starbucks is linear showing a slowdown in growth rate. The revenue forecasts show that revenues are projected to grow on a 11.7% trend over the next two years. This is down 8.2% from Starbucks’ historical growth trend of 19.9%. The company took a hit to revenue from COVID in 2020 and is still working to return to previous growth rates. I can’t tell you if this is the start of a new normal or a temporary situation that once resolved will result in a more competitive company. I do know that revenue is critical for a company like Starbucks and that we need to pay attention to revenue as a gauge of long-term economic potential.

2022 revenue estimates are so tight you can barely see the range on the chart. The estimates are centered around $27.03 per share with the entire range fitting between $26.87 and $27.44. I would expect any announcement outside this range to impact short term price momentum. A high side beat will be an indicator that Starbucks is recovering sales volume faster than expected and may return to pre-COVID growth rates. A low side miss will likely place minor downward pressure on share prices.

Authors Image from Financial Modeling Prep Data

Starbucks Earnings Expectations

For this earnings call earnings are expected to come in between $2.74 and $2.97 per share with a most likely result of $2.93. More importantly earnings are projected to be essentially flat over the next two years when contrasted to a long-term historic growth rate of 14.8%. This forecast decrease in earnings growth is a result of multiple causes. Semi-successful unionization efforts in 2022, food price inflation from the Russian invasion of Ukraine, and additional coffee bean price inflation from poor growing conditions in South America are all impacting costs.

It should be noted that the earnings shown here are Pro forma, or ‘street’ earnings. GAAP earnings have been found to be less reliable when predicting intrinsic value due to accounting rule changes and sometimes the absurdity of the rules themselves.

Authors Image from Financial Modeling Prep Data

Analyst Sentiment

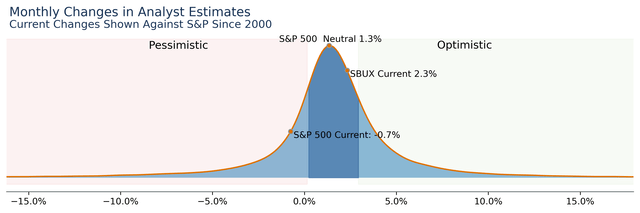

Starbucks seems poised to deliver results within expectations. Analysts were pessimistic after the previous quarter results; however, they have returned to a more neutral stance in the last 30 days.

Analyst estimates for earnings and revenue generate the above charts. However, all humans are prone to bias based on their incentive structure. The below chart summarizes analyst behavior for all stocks in the S&P across the last 2 decades. The neutral point shows analysts tend to raise estimates by 1.3% monthly and are currently pessimistic on the S&P having decreased estimates by 0.7%. Starbucks shows somewhat positive sentiment at 2.3% increase over the past month.

Recent analyst changes for Starbucks point to meeting or slightly beating estimates, but this should be tempered by the pessimistic outlook for the market. I would expect only a huge expectation beat to move the share price in a significant way.

Authors Image from Financial Modeling Prep Data

Resulting Risk Forecast

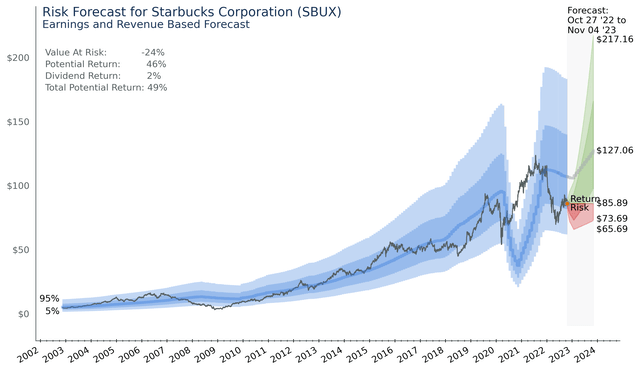

All the above data gets fed into a series of machine learning algorithms to create a forecast of price risk. The chart below probably needs some explanation. The blue bands represent the predicted intrinsic value of the company with the actual price data shown against the prediction. The forecast portion shows how the price of $85.89 at the time of forecast relates to the intrinsic value.

For Starbucks this results in a value at risk of 23% from a price prediction low of $65.69. Potential return is forecasted to be 41.4% based on a central intrinsic value of $127.06. Combined with a 2.2% dividend the total potential return becomes 43.6%. I don’t put much value in the upper end of the forecast. It seems unlikely that prices would reach that level in the next year.

A word of caution: The chart only shows the range the stock trades in 90% of the time. The more extreme cases can go well above or well below the bands shown on the chart. It also only represents known risks. New information, like a big miss on revenue will require an updated price risk assessment.

Authors Image from Financial Modeling Prep Data

Conclusion

Earnings results are going to have some uncertainty due to war, inflation, and supply shortages. Still, all these issues are almost certainly short-term adversity that tends to make a good company better. They are also ‘known unknowns ‘and tend to already be priced into stocks. Starbucks’ customers aren’t exactly cost conscious either, so longer term costs can get passed on and earnings are likely to return regardless of costs.

If revenue growth stays on trend Starbucks moat is intact. There is some uncertainty here, so even a long-term investor would be wise to focus on the upcoming results. For those with shorter time horizons: Next quarter the price trend is likely to be set by how much revenue results meet, beat, or miss expectations.

Be the first to comment