lechatnoir

Lamar Advertising Company (NASDAQ:LAMR) is a specialty real estate investment trust (“REIT”) that focuses on leasing out billboards for the copy of companies’ advertising. They have over 100k billboards including digital billboards in key high traffic areas in the U.S. and a little in Canada. Adjusted funds from operations (“AFFO”) is rising, as are the dividends, and the leases locked in are pretty long-term. Pricing is ahead of inflation, and things look good. But the contracts are short term. If spending ceased, it would become a problem immediately for Lamar.

Notes on LAMR

The first thing to consider about LAMR is that its contracts are rather short term, on average 4 months. While some extend up to a year, many are just a couple of weeks long. The assets are short in duration, and if the market gully were to become deeper, with feedback loops into consumer confidence declines, we could see more definite declines in consumer spending that would create problems for Lamar rather immediately. Unlike other REITs, they would not be able to rely on long contracts to guarantee a certain amount of income.

On the flip side, it also means they can rollover contracts with higher pricing. They’ve been doing this, and this has pushed revenue growth up 10% in Q2 as well as AFFO and the dividend. This is same-unit revenue increase, so adjusted for acquisition and newbuild effects. They are guiding towards mid single-digit sales growth onwards and low single-digit input inflation coming primarily from labor and the cost of concessions. They have no problem outpacing inflation, in fact, inflation benefits them.

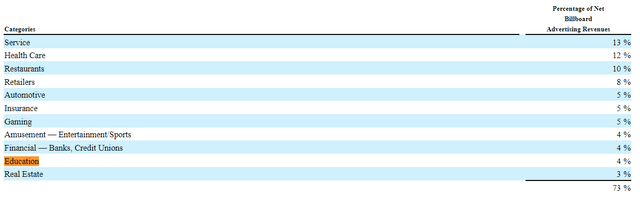

In terms of industry exposure, this is where spending is currently coming from clients, which should represent a somewhat normalized wallet share. Some were impacted heavily by COVID-19, especially the out-of-home related businesses, but overall performance across markets are ahead of pre-COVID levels. Especially strong are amusement and sports, which is up almost 50%, as well as services, which was up an impressive 20%. Retail also continues to perform strongly up 18%. Education was up 21% and gaming 12%. Political ads are up 82% but it’s a marginal category. The goods boom has been kind to Lamar in other words, as all the categories have performed well.

Our concern with the wallet share across industries is primarily in automotive exposures and retail exposures which could both suffer on declines in consumer confidence. Restaurants are also a discretionary expenditure that could suffer, and the 10% they represent in the chart above is likely below the pre-COVID normal. The exposure is not irrelevant to more discretionary categories, and a downturn would affect their markets quite meaningfully.

Conclusions

While there are some industry-level risks, there are also some silver linings that are coming from declines in digital advertising. Ad agencies are guiding towards some deceleration in the latter half of the year, especially as major streaming companies and other internet companies that have received the COVID-19 boon see some mean reversion. Indeed, even Lamar expects some deceleration as velocity slows with some larger national accounts, therefore guiding single digit for the FY. Moreover, with Apple’s (AAPL) new privacy protocols, the efficiency of digital mobile marketing has been affected, and that could work in the favor of traditional mediums of advertising which have never relied on pinpoint marketing accuracy and data science.

So, while total spend could decline, further perhaps with worsening macro outlook which is levitating for now over sentiment and headlines, Lamar and its peers may see a growth in share. At least for now, there’s nothing to worry about on the macro side. As said on the Q2 2022 earnings call:

One of the overwhelming comments was that local remains really strong. And that our renewal activity and rate discussions are likewise very strong.

Sean Reilly, LAMR CEO

Still, we are a little concerned. Dividend yields are a pretty good reflection of the earnings yields, and that lies at a little above 5%. With some actual risks on occupancy, we feel this is might be a little low. High dividend increases seem unlikely for the next year cycle or so, and reference rates are coming up above 3% now. Perhaps compensation for the risk is insufficient. Overall, LAMR delivered a strong quarter, but we don’t see definitive resilience.

Be the first to comment