AerialPerspective Works

Investment Thesis

The global renewable energy market was valued at $881.7 billion in 2020 and is predicted to grow at an 8.4% CAGR to $1,977.6 billion by 2030. This is a fast-growing sector, thus it’s interesting for investors to analyze it and understand if there is a buying opportunity at a moment. In this article, I have looked at past and recent valuations in order to understand where we are in the cycle. All in all, I believe that valuations are stretched. Clean energy stocks had a fantastic 2020 and 2021 and investors rushed into the sector to take advantage of that, pushing multiples higher in the process. However, rising rates and lower liquidity are important risks at this point for high multiple stocks. Past cycles have shown how brutal drawdowns can be when valuations are so high in this sector. As a result, I believe we are nowhere near the bottom, and the risk-reward tradeoff of going long clean energy stocks is unattractive at the moment.

Strategy Details

The First Trust NASDAQ Clean Edge Green Energy Index ETF (NASDAQ:QCLN) tracks the investment results of the NASDAQ Clean Edge Green Energy Index. The strategy invests in manufacturers, developers, distributors, and installers of innovative clean-energy technologies.

If you want to learn more about the strategy, please click here.

Portfolio Composition

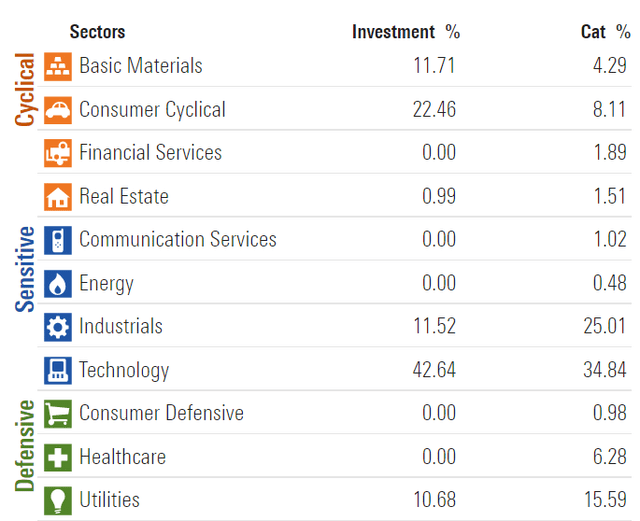

The index invests ~43% of total assets in Tech stocks, followed by Consumer Cyclicals (22%) and Basic Materials (~12%). The largest three categories have a combined allocation of approximately 76.8%.

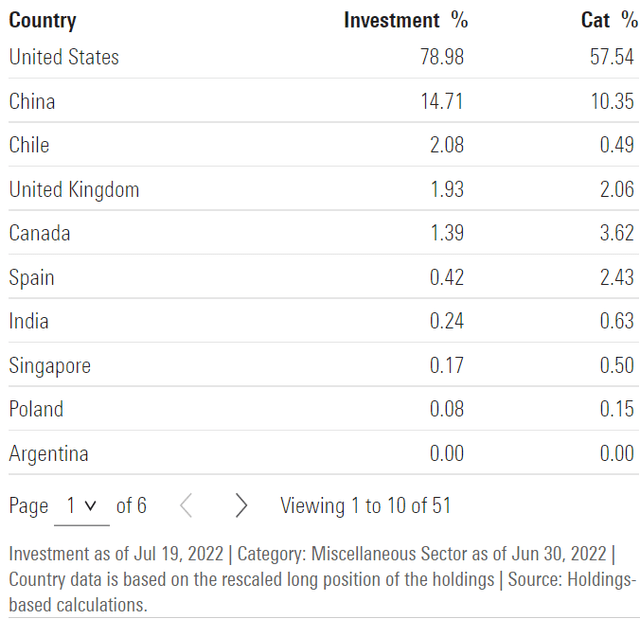

In terms of geographical allocation, the U.S. accounts for ~79%, followed by China (~15%) and Chile (~2%).

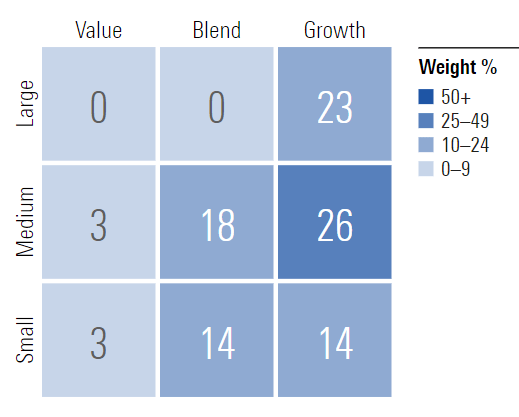

~26% of the portfolio is invested in mid-cap growth equities, characterized as mid-sized companies where growth characteristics predominate. Mid-cap issuers are generally defined as companies with a market capitalization between $2 billion and $8 billion. The second-largest allocation is large-cap growth stocks, which account for 23% of the portfolio.

Morningstar

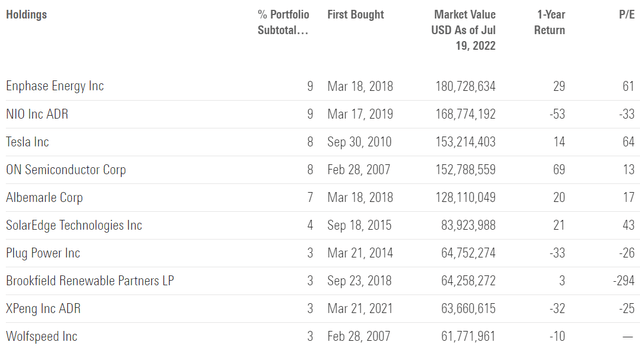

QCLN is currently invested in 65 different stocks. The top 10 holdings account for ~58% of the portfolio, with no single stock weighting more than 9%. The fund manages a concentrated portfolio. Before investing in such a portfolio, investors must feel comfortable with the asset allocation, since concentration might reduce some of the benefits of investing in ETFs and increase volatility. It’s also important to mention that QCLN is slightly more concentrated than some of its peers, such as the iShares S&P Global Clean Energy Index ETF (ICLN) which has a ~49% allocation to the top 10 holdings.

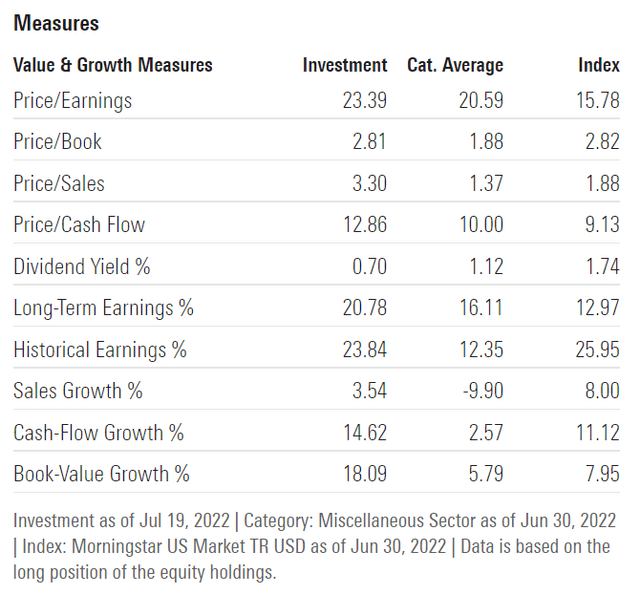

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, QCLN trades at ~3x book value and ~23x earnings. For comparison, ICLN trades at ~2x book value and ~28x earnings. While cheaper than ICLN, QCLN is expensive from an absolute perspective in my opinion. Given the fact that the industry is expected to grow at a 10% CAGR, the fund has a PEG ratio of 2.3 which is high in a rising rate environment.

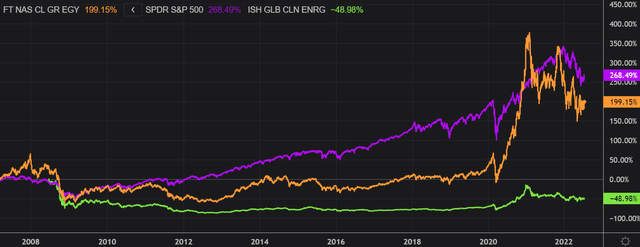

Furthermore, I believe it’s critical for investors to have some historical context on how clean energy strategies have performed in previous cycles. As we can see, investors’ interest in this area is not new, and there have been several instances where they have driven prices to extremes. During the GFC, clean energy considerably underperformed the market. The same happened a few years later, when QCLN plunged ~55% from 2011 to 2013. While some analysts might argue that this time is different given the regulatory push to switch to cleaner sources of energy, I believe that higher rates and lower liquidity make valuations extremely important.

Is This ETF Right for Me?

The worldwide renewable energy industry was worth $881.7 billion in 2020 and is expected to reach $1,977.6 billion by 2030, expanding at an 8.4% CAGR during that period. Based on the push in the Western world to switch from fossil to clean energy sources, I believe QCLN is suitable for growth investors who are looking for fast-growing industries and can weather a higher level of volatility.

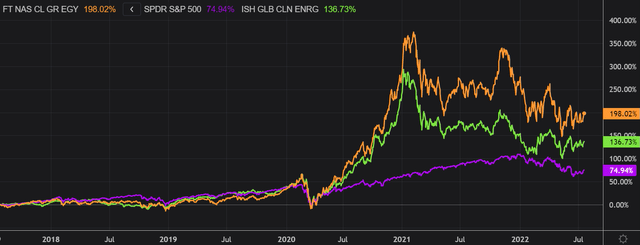

I have compared QCLN’s price performance below against the SPDR S&P 500 Trust ETF (SPY) and ICLN over the last 5 years to assess which was a better investment. Over that period, QCLN outperformed the market by more than 123 percentage points which is remarkable. ICLN came second, at ~61 percentage points lower than QCLN.

To put QCLN’s returns into perspective, a $100 investment in this fund 5 years ago would now be worth $298. This represents a compound annual growth rate of ~24.4%, which is an excellent absolute return.

However, if we take a step back and look at returns since the fund’s inception, it’s interesting to note that the S&P 500 outperformed clean energy strategies. I think this shows just how hard it is to beat the market over a very long period. On top of that, we are now in a new liquidity regime that looks very different from the last 2 years. A tighter monetary policy isn’t likely to benefit high multiple stocks. For this reason, I believe the risk-reward tradeoff of going long QCLN is unattractive at the moment.

Key Takeaways

While it’s undeniable that this is a fast-growing sector, enthusiastic investors have pushed valuations of clean energy stocks to unsustainable levels over the long term. Clean energy companies generated spectacular returns in 2020 and 2021, but investors need to be aware that these were outliers. Higher interest rates and reduced liquidity are significant risks for high multiple stocks today. Previous cycles have demonstrated how painful drawdowns can be when valuations in this industry are so high. As a result, I believe we are far from the bottom, and the risk-reward tradeoff of investing in QCLN is unattractive.

Be the first to comment