Chip Somodevilla

Legendary billionaire investor Warren Buffett – CEO of Berkshire Hathaway (BRK.A) (BRK.B) – has been aggressively accumulating shares in energy giant Occidental Petroleum (OXY), leading some to speculative that he may buy the entire company at some point.

Just this past week, Mr. Buffett disclosed the purchase of an additional 12 million OXY shares, bringing his stake to a total of 175 million shares, or ~18.6% of the company. Not only is Berkshire OXY’s largest individual shareholder, but it also holds options to upsize its stake to roughly 28% of the company. In the first quarter alone, Berkshire purchased about $7 billion worth of the stock, showing just how high Warren Buffett’s conviction is in the future of energy.

Mr. Buffett’s bullishness on energy seems to directly contradict some analysis which suggests immense downside for energy as a result of an increasingly expected recession destroying demand. For example, Norbert Rücker – Head Economics and Next Generation Research, Julius Baer – recently predicted that energy prices will experience an accelerated decline in the event of economic deterioration, stating:

The sentiment cycle has likely turned earlier than expected and could continue to pressure prices going forward. We see fundamentals unchanged. With Russian oil still flowing, the shale business expanding and demand stagnant, oil prices should eventually drop into the single digits…Should the economic cycle unexpectedly soften more meaningfully, the fundamentals would change more markedly, putting even greater pressure on oil prices.

With oil prices still hovering near $100 a barrel, a decline to the single digits would imply downside of over 90% for oil prices, which could prove devastating to the industry.

That said, we share Mr. Buffett’s bullishness on the sector because:

- energy prices remain elevated relative to recent history

- some experts think that we could see oil prices at over $200 a barrel in the event that the G7 decides to try to cap Russian prices.

- sector valuations remain very cheap relative to history and the broader market.

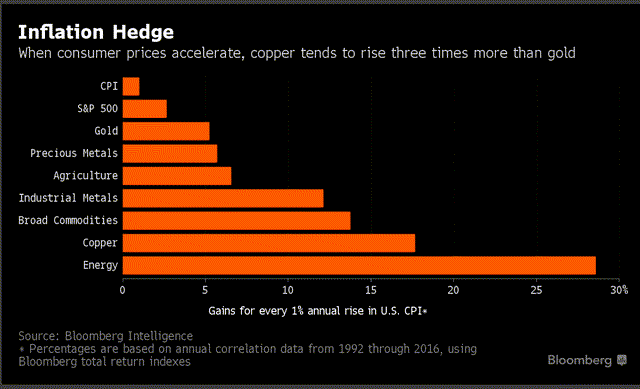

- energy is a proven outperformer during periods of high inflation:

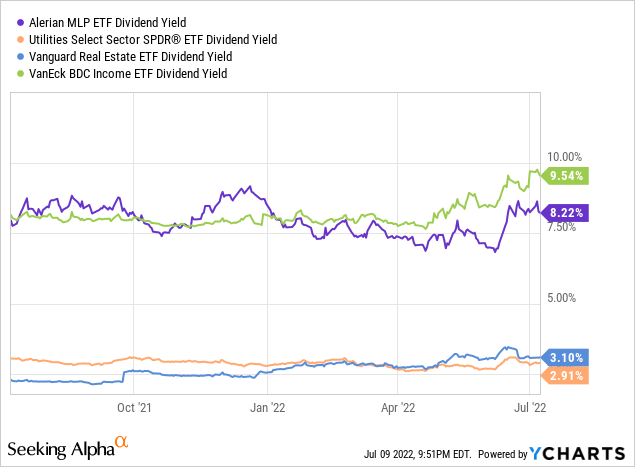

While high quality energy companies like BP (BP), Exxon Mobil (XOM), Chevron (CVX), and OXY will likely prove to be good investments over time, we are particularly bullish on the midstream sector (AMLP) right now. The reason for this is because even if the short-term bear thesis for energy plays out, midstream business cash flows are quite resistant to gyrations in commodity prices. Furthermore, their balance sheets are generally stronger than they have ever been and they are almost all gushing free cash flow. This is translating into some of the highest and safest yields available anywhere in the market today. As the chart below shows, midstream businesses on average are offering yields that are nearly triple what is offered by other more defensive high yielding business models such as REITs (VNQ) and utilities (XLU). The only sector that is yielding more than midstream at the moment is BDCs (BIZD), but these are much riskier yields with much tighter dividend coverage and a far weaker performance profile during recessions.

As a result, we are buying high yielding, investment grade midstream businesses hand-over-fist right now as we prepare to weather a recession and beyond while generating high single digit current yields that will likely grow at attractive rates for years to come.

Top Midstream Picks

While we think investors can do fine by simply buying the sector with positions in either one of the Global X ETFS (MLPA)(MLPX), we think investors can achieve even more attractive risk-adjusted returns by investing in the following stocks:

Energy Transfer (ET) is one of the largest and best diversified midstream businesses with exposure to all 15 major U.S. production basins and significant cash flow coming from five different business segments. On top of that, it has a booming NGL export business that is one of the largest in the world and only continues to grow.

The company has made enormous progress over the past year and a half towards deleveraging its balance sheet and has begun to aggressively grow its distribution, with a projected annualized payout of $0.80 (~8% current yield) that management has repeatedly stated it plans to raise by over 50% in the coming years to a $1.22 target level. This would imply a yield on current cost of over 12.2%.

With a solid investment grade balance sheet, one of the cheapest valuations in the entire sector on both EV/EBITDA and P/DCF ratios, and a distribution coverage ratio of well over 2x, ET offers extremely attractive risk-adjusted income and income growth potential that should weather just about any macro environment.

Enterprise Products Partners (EPD) is probably the best blue chip MLP out there with a BBB+ credit rating, one of the lowest leverage ratios in the sector, enormous liquidity, and a very well laddered debt maturity calendar. It also offers an attractive 7.6% current yield, has hiked its distribution twice already this year, boasts a coverage ratio of over 1.7x, and is investing aggressively in very attractive growth projects.

With 24 years of distribution growth under its belt, a track record of generating superior returns on invested capital and unitholder total returns, and an insider team that owns ~1/3 of the partnership’s equity and continues to buy more, it is hard to see how investors would lose with this investment over the long term.

While both ET and EPD issue K1 tax forms which often render them unsuitable for retirement accounts, provide an inconvenience for some investors come tax time, and also can result in massive withholding taxes for some non-U.S. investors, there are also attractive opportunities in the C-Corp space.

Kinder Morgan (KMI) and Enbridge (ENB) both issue 1099 tax forms, boast solid investment grade balance sheets, offer high yields (though not quite as impressive as ET’s and EPD’s), and have very impressive asset portfolios with some of the largest crude oil and natural gas transportation capacity in North America that boast utility-like safety. Both of these businesses also have solid growth potential and should remain vital cogs of North America’s energy infrastructure for decades to come.

Investor Takeaway

Despite some analysis that implies energy prices are about to experience an epic crash, Mr. Buffett is buying energy companies hand-over-fist which further strengthens our own conviction in the sector. That said, we are adding an additional layer of safety to our energy investments by concentrating on investment grade businesses in the midstream sector, giving us further insulation against commodity price volatility.

To hear more about our view on the energy sector and our top picks in the midstream space, please check out my recent interview on Seeking Alpha’s Weekend Bite below:

We are very bullish on midstream as our investments provide us with stable cash flows and high income yields that should flow into our brokerage count at an increasingly high level for many years to come.

Be the first to comment