smodj

RCI Hospitality (NASDAQ:RICK) is the only publicly listed company that specializes in the ownership and management of strip clubs:

Strip club owned by RCI Hospitality (RCI Hospitality)

I have previously highlighted RICK as my largest non-REIT investment, but never included it in our Core Portfolio at High Yield Landlord because it only pays a 0.4% dividend yield, which is too low for our yield-oriented strategy.

But recently, the company announced that it would buy back ~5% of its capitalization, which is essentially just another way to return capital to shareholders. As such, the adjusted yield is now ~5.4%. The CEO has noted that they buy $100k of shares every day on autopilot, and will keep doing so as long as their share price remains below $65, which represents a 10% FCF yield. Today, the share price is $49, and earlier this year, the share price was briefly above $90.

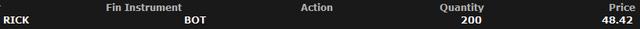

I have been accumulating more shares in my company’s account, and recently, we also added it as a position to our Core Portfolio.

High Yield Landlord purchase of RICK (Interactive Brokers)

Why Am I So Bullish On RCI Hospitality?

I encourage you to read our full investment thesis to understand why I like it so much, but here’s the thesis in 10 bullet points:

- Deeply Discounted Valuation: The company is currently generating about $6.5 per share of free cash flow per share, pricing it at 7.4x. If you adjust for their recent club acquisitions, the ongoing buybacks, the opening of new Bombshells locations, and the impact of Covid, the largest shareholder of the company, Adam Wyden, estimates that the free cash flow per share is around $10 per share, pricing the company at 4.8x its free cash flow. The management has a clear capital allocation policy that prioritizes buybacks whenever their free cash flow yield exceeds 10%, and therefore, they are today buying back shares at the moment.

- Moated Assets: Strip clubs are moated assets that enjoy high barrier to entry because it is almost impossible to open new ones. They require licenses that are extremely difficult to obtain, and no one wants a new strip club in their backyard. As a result, the existing clubs are sort of grandfathered in and enjoy a quasi-monopoly in their local market. Moreover, RICK targets only the highest quality strip clubs that are thriving. A good example would be Tootsie’s in Miami, which is the largest strip club in the world, or Rick’s Cabaret in Manhattan. While the profitability of these clubs will vary over time, it is likely to remain strong and grow in the long run since everyone wants to party, but the supply of such places is strictly limited. Therefore, I believe that the earnings quality of the business is superior to that of restaurant chains like BJ’s (BJRI), Olive Garden, Texas Roadhouse (TXRH) and Cheesecake Factory (CAKE).

- Extremely Lucrative Roll-up Play: Despite being moated assets, strip clubs sell for low multiples of 3-5x adj. EBITDA, allowing RICK to target 25-33% cash-on-cash returns on its new club acquisitions. The reason why the multiples are so low is simply that there are no natural buyers for these assets. If you run a public company, you probably don’t want to buy these as it would hurt your ESG ratings. If you are a private equity fund, you probably have at least some limited partners that don’t want you to buy strip clubs. If you are a rich local entrepreneur, your wife (or husband) probably does not want to buy the local strip club… And even if you could, the expertise that’s needed to run a successful strip club is highly specialized as you need to be able to sniff things like drug dealing, prostitution, racketeering, etc. Most investors don’t want that headache and as a result, there are only a few potential buyers and RICK is the only one with access to public capital and a great reputation for closing deals with large cash or liquid stock components.

- Access to Public Capital: As noted previously, RICK is the only acquirer of strip clubs with access to the public equity markets. That’s a huge advantage because it greatly accelerates the growth story. RICK can take its own stock and sell it to buy strip clubs at huge positive spreads. In the REIT world, you would be happy with a 200-300 basis point spread over your cost of capital, but RICK commonly gets a multiple of that. Just earlier this year, it was priced at 10x FCF, which coupled with debt put its cost of capital at ~8%, and it can buy clubs targeting a 25-33% cash-on-cash return. The spreads are massive and RICK has a large pipeline of potential club acquisitions. Today, it owns around 50 of them, and it bought 13 of them this year alone. RICK has identified at least 500 clubs that it could target for acquisition in the USA.

- Seller-Financing: Because RICK is the preferred buyer of strip clubs and there are only a few competing buyers, RICK enjoys strong bargaining power with potential sellers, and it is able to negotiate attractive terms beyond the price itself. As an example, it will often only give a small cash component as part of the deal and structure a large portion of the sale price as seller-financing with 6-8% interest rates. The sellers like it because it allows them to unlock the value of their clubs, get out of the operations, and still earn a return on their club while deferring some of the taxes. And for RICK, this is great because it boosts its returns on equity even further and allows it to grow even faster if it has to put less cash to buy these assets.

- Owns The Real Estate: RICK owns nearly all of its real estate, which provides a hedge against inflation and also some additional margin of safety. The value of this real estate is significant and growing since a lot of it is in growing markets in Texas and Florida where people are moving. As an example, Tootsie’s is over 75,000 square feet of space.

- Clear Capital Allocation Policy: RICK is strictly focused on the growth of its free cash flow on a “per share” basis. The management always reminds this in every conference call and in its investor presentation. Their policy is to buy back shares whenever their free cash flow yield exceeds 10%, and they only target new acquisitions if there is a significant spread.

- Eventual Bombshells Spin-Off: RICK also owns a military-themed sports bar restaurant concept called Bombshells. It works particularly well in markets like Texas. Today, they have 11 locations, and they expect to at least double that in the coming 2-3 years. The returns on capital invested are even stronger than those of strip clubs, and they are now starting to franchise as well, generating fees and royalties. Today, Bombshells already generates 30% of RICK’s revenue and eventually, RICK could potentially spin off Bombshells into a separate entity to unlock its value for shareholders. It has been speculated that Bombshells alone could be worth RICK’s entire market cap.

- Skin In The Game: The insider ownership is nearly 8% and most of that is owned by the CEO who keeps buying the dips to this day. He has publicly noted that he has ~95% of his net worth invested in the stock and has no plan on selling. On the contrary, he keeps buying more and more.

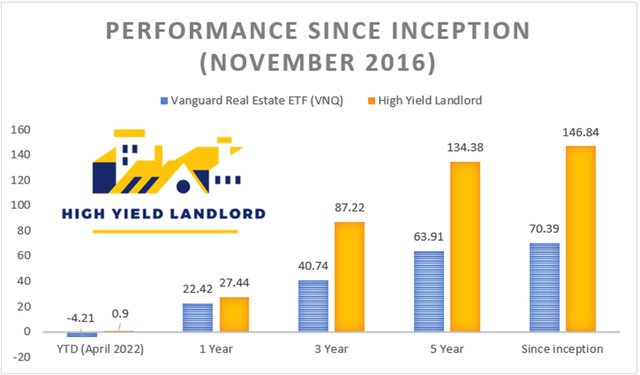

- Rapid Growth At A Very Low Price: The attractiveness of an investment is mainly the function of its valuation, risk, and growth. RICK is priced dirt cheap, it owns moated assets, and it has rapid growth prospects ahead of it. Ever since the company implemented its capital allocation policy in 2016, it has been growing free cash flow per share by 16% annually even including the pandemic, and it can keep doing so for a long time to come. Yet, the company is priced at a 14% free cash flow yield, which is dirt cheap for a company that’s growing at this pace. Its valuation multiple could double, and it still wouldn’t be expensive. Do I know what its share price will be one year from now? I have no clue, and a recession could of course temporarily hurt its business (although strip clubs enjoy some resilience to recessions). But do I think that RICK will trade a lot higher 5 years from now? I am very confident that it will, and that’s all that matters to me.

You can read our full investment thesis by clicking here. This is my largest position overall, and I will now start accumulating shares for our Core Portfolio as well.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Be the first to comment